The Brunei dollar is pegged to the Singapore dollar due to the Currency Interchangeability Agreement (CIA) between the two countries. The agreement was established in 1967 to promote monetary cooperation and facilitate economic and trade relations. It allows the currencies of both countries to be exchanged at par and without charge, with the value of the two currencies always being equal. This arrangement provides stability to the Brunei dollar, removes exchange rate risks, and reduces the cost of doing business between the two countries, thereby easing tourism, trade, and investment.

| Characteristics | Values |

|---|---|

| Date of agreement | 12 June 1967 |

| Nature of agreement | Currency Interchangeability Agreement |

| Exchange rate | 1:1 |

| Purpose | Facilitate economic and trade relations |

| Original countries in agreement | Brunei, Malaysia, and Singapore |

| Current countries in agreement | Brunei and Singapore |

| Currencies' status in each country | Accepted as "customary tender" |

| Repatriation of currency | Yes |

| Monetary authorities | Brunei Darussalam Central Bank (BDCB) and Monetary Authority of Singapore (MAS) |

| Inflation in Brunei | 1.1% average over 1981-2023 |

| Trade between Singapore and Brunei | US$822 million in 2016 |

| Singapore's trade in services with Brunei | US$400 million in 2015 |

What You'll Learn

The Currency Interchangeability Agreement (CIA)

Under the CIA, the Brunei Darussalam Central Bank (BDCB) and Monetary Authority of Singapore (MAS) are obliged to accept and exchange each other's currencies at par and without charge. Banks in both countries also accept for deposit, from the public and businesses, currency issued by the other country at par and without charge. This means that the value of the Brunei dollar and the Singapore dollar is always equal.

The CIA removes exchange rate risks between the two countries, reducing the cost of doing business and facilitating trade and investment. It has also contributed to macroeconomic stability and low, stable inflation in Brunei Darussalam.

The agreement reflects the strong bilateral relationship between Brunei and Singapore and has stood the test of time, remaining intact through financial crises and structural changes to both economies.

Princess Hannah Hafizah: Her Age and Royal Life

You may want to see also

Monetary policy framework

The Brunei dollar (B$) has been the official currency of the Sultanate of Brunei since 1967. It is divided into 100 cents and is issued by the Brunei Darussalam Central Bank (BDCB).

The Currency Interchangeability Agreement (CIA) was established on 12 June 1967 between Brunei and Singapore to promote monetary cooperation and facilitate economic and trade relations. The agreement allows the currencies of both countries to be exchanged at par and without charge, meaning one Singapore dollar is equal to one Brunei dollar.

Under the CIA, the BDCB and Monetary Authority of Singapore (MAS) are obliged to accept and exchange each other's currencies. Banks in both countries also accept deposits of the other country's currency at par and without charge. This agreement removes exchange rate risks and reduces the cost of doing business between the two countries, thus easing tourism, trade, and investment.

The CIA provides a stable monetary policy framework for Brunei, as the Singapore dollar acts as an anchor for the Brunei dollar. Singapore's monetary policy directly influences monetary conditions in Brunei, contributing to macroeconomic stability and low inflation, which averaged 1.1% from 1981 to 2023.

The agreement has been mutually beneficial for both countries, strengthening their bilateral relationship and resulting in stronger trade and investment flows. It has remained intact despite economic challenges and changes in the global currency landscape.

A Guide to Ordering from Zalora Brunei

You may want to see also

Trade and investment

The pegged exchange rate between the Brunei dollar and the Singapore dollar has had a significant impact on trade and investment between the two countries. The Currency Interchangeability Agreement, signed in June 1967, allows for the free interchangeability of the two currencies at a 1:1 exchange rate. This agreement has facilitated trade and investment by removing exchange rate risks and reducing the cost of doing business between the two countries.

The stability of the Singapore dollar has helped to keep inflation in Brunei low and stable, averaging 1.1% between 1981 and 2023. This macroeconomic stability has provided a favourable environment for trade and investment. Additionally, the strong presence of the Brunei dollar in Singapore, as evidenced by the value of Brunei notes and coins deposited with the Monetary Authority of Singapore (MAS), indicates a strong bilateral trade relationship.

The agreement has resulted in stronger trade and investment flows between the two countries. Trade between Singapore and Brunei has grown significantly since the implementation of the agreement, with Singapore remaining one of Brunei's top 10 trading partners. Singapore's trade in services with Brunei has also expanded rapidly, increasing from US$76 million in 2000 to US$400 million in 2015.

The pegged exchange rate has also facilitated business between Bruneian and Singaporean firms. Many of Brunei's imports come through Singapore, and the ease of doing business with a shared currency has benefited both countries. Additionally, Brunei's heavy exports have increased the demand for the Singapore dollar, helping it appreciate in value.

The agreement has provided benefits to both countries in terms of trade and investment. The stability of the Singapore dollar has helped to anchor the Brunei dollar, providing confidence and stability for investors and businesses. The strong economic fundamentals of both countries, including their foreign reserve holdings, have supported the agreement and contributed to macroeconomic stability.

Prince Azim of Brunei: A Life Cut Short

You may want to see also

Economic and trade relations

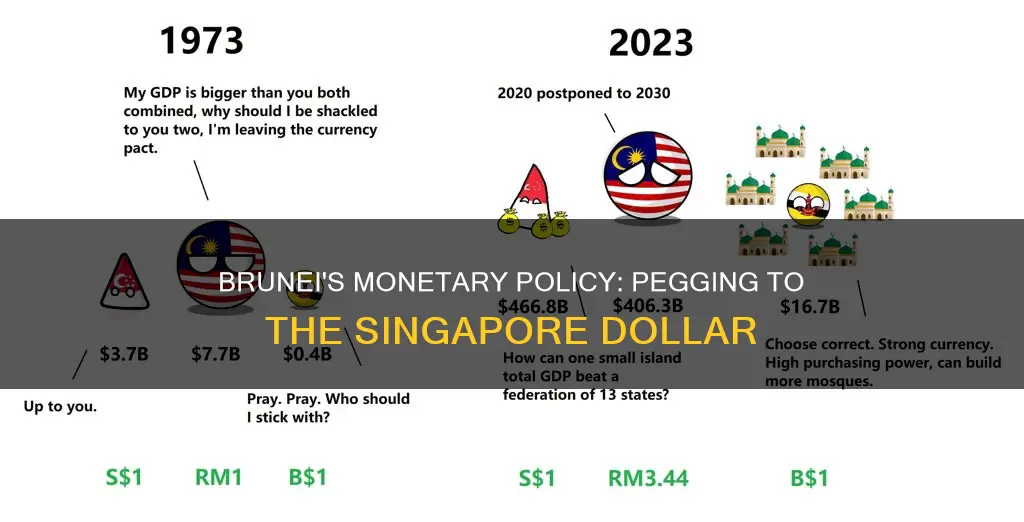

The close economic and trade relations between Brunei and Singapore are facilitated by the Currency Interchangeability Agreement, which allows the currencies of both countries to be used interchangeably in either country. This agreement has been in place since 1967, when it was initially a tripartite arrangement between Brunei, Malaysia, and Singapore. Malaysia opted out of the agreement in 1973, but Brunei and Singapore decided to continue with the arrangement.

The agreement removes exchange rate risks between the two countries and reduces the cost of doing business, thereby easing trade, investment, and tourism. It also ensures macroeconomic stability and low inflation in Brunei.

The two countries have strong trade and investment ties, with a significant amount of business being conducted between Bruneian and Singaporean firms. Brunei is a heavy exporting country, which increases the demand for the Singapore dollar and helps it appreciate. Brunei's stable currency, pegged to the Singapore dollar, is crucial given the country's dependence on oil and gas exports, which fluctuate with changes in prices.

In addition to the currency agreement, the two countries have signed several memoranda of understanding and cooperate extensively in defence, finance, trade, investment, tourism, health, aquaculture, and education.

Uncover the Hidden Gems of Bruneian Culture

You may want to see also

Inflation

The increase in inflation in Brunei can be attributed to a combination of demand and supply factors. On the supply side, the global supply chain disruption following the COVID-19 lockdowns and travel restrictions increased production and shipping costs worldwide. The impact of the pandemic and the Ukraine war on global commodity supplies also led to increases in the prices of key commodities, including agricultural products. In addition, reduced mobility and heightened health concerns during the pandemic caused disruptions in labour markets, particularly in Brunei, where foreign workers contributed to half of the private sector employment before the pandemic. On the demand side, the fiscal and monetary responses to COVID-19 may have increased domestic demand, putting upward pressure on inflation.

The inflation uptick in 2022 was driven by both supply and demand factors. Notably, demand pressure increased in 2022 when the economy reopened, with a release of pent-up demand from consumers who were unable to spend during the pandemic. This demand could, in some cases, temporarily outpace the ability of businesses to expand production, leading to increased price pressure, particularly in the domestic non-tradables sector.

The inflation decomposition using non-oil and gas (O&G) GDP data shows that supply factors explained about 38% of CPI inflation in 2022, while demand factors explained about 31%. Additionally, the uptick in inflation in 2021, during the lockdown period, was primarily driven by supply bottlenecks, with supply factors explaining about 45% of inflation, while demand factors explained about 7%.

The stability of the Brunei dollar is underpinned by the Currency Interchangeability Agreement (CIA) between Brunei and Singapore, which ensures that the value of the two currencies is always equal. This agreement removes exchange rate risks between the two countries, reducing the cost of doing business and easing trade, investment, and tourism.

Brunei's Political and Economic Strategies: Success or Failure?

You may want to see also

Frequently asked questions

The Brunei dollar is pegged to the Singapore dollar as part of the Currency Interchangeability Agreement, which was established in 1967 to promote monetary cooperation between the two countries.

The Currency Interchangeability Agreement (CIA) is a deal between Brunei and Singapore that allows their currencies to be exchanged at par and without charge.

The agreement removes exchange rate risks between the two countries and reduces the cost of doing business, which in turn eases tourism, trade, and investment. Trade between Singapore and Brunei has grown from under US$20 million in 1968 to US$822 million in 2016.

The agreement has helped keep inflation in Brunei low and stable, averaging 1.1% from 1981 to 2023.

One potential downside for Brunei is that it gives up some sovereign control over monetary policy. However, as a small country, the benefits of having a stable currency to peg to likely outweigh this drawback.