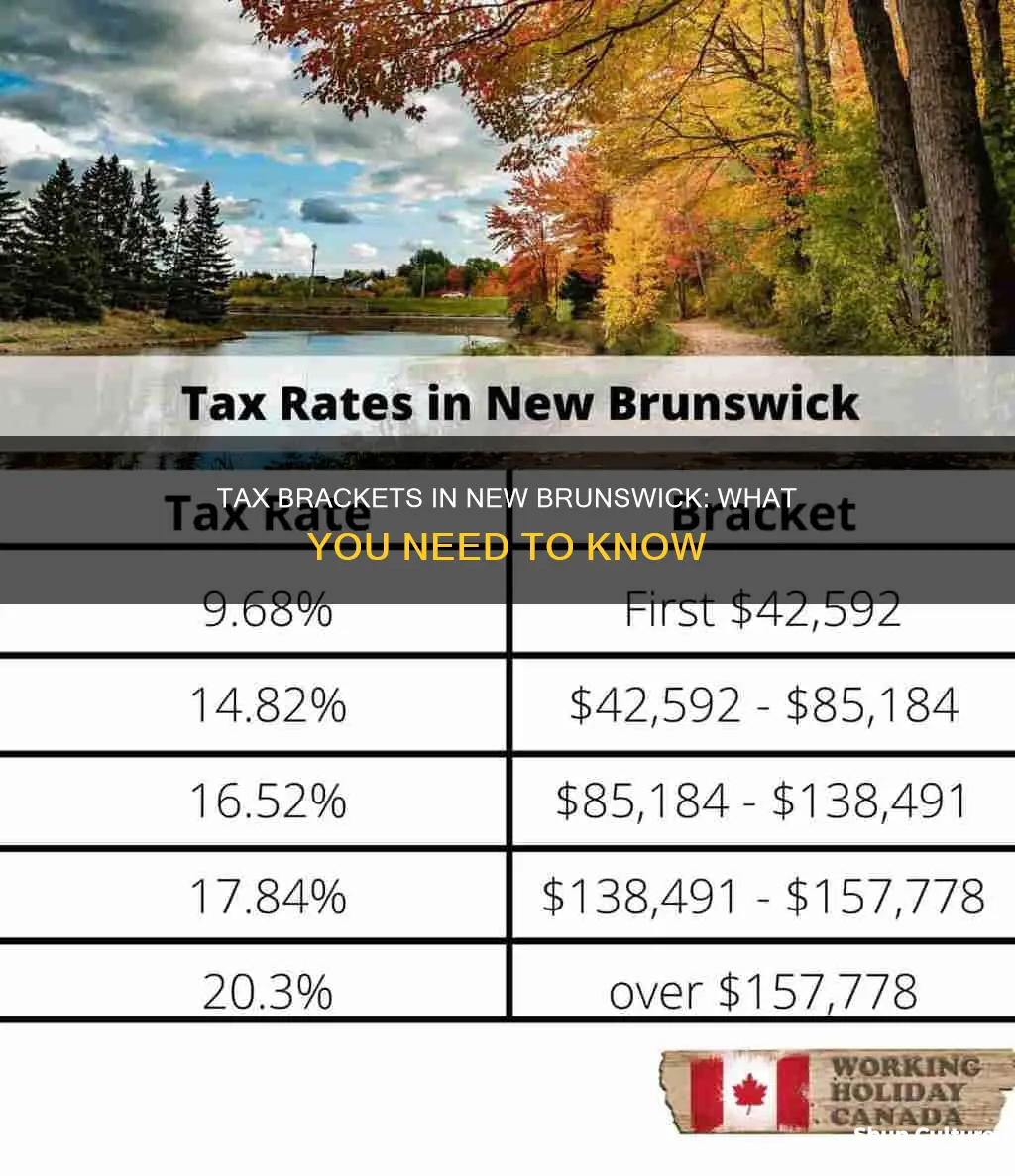

In Canada, the federal government sets the federal income tax rates for individuals, while each province and territory determines its own income tax rates. These provincial or territorial income tax rates apply in addition to federal income tax rates. In New Brunswick, the tax rates range from 9.4% to 19.5% of income, and the combined federal and provincial tax rate is between 24.4% and 52.5%. The marginal tax rate increases as income increases, meaning that those in higher tax brackets pay higher taxes on their income. New Brunswick also offers various tax credits and deductions, such as the NB child tax benefit, the NB harmonized sales tax credit, and the NB low-income tax reduction.

What You'll Learn

Federal income tax rates

The federal income tax rates in 2023 range from 15% to 33%. In 2024, the federal tax rates and income thresholds are as follows:

- Annual taxable income from $10,000 to $11,000: 15%

- Annual taxable income from $11,000 to $12,000: 20.5%

- Annual taxable income from $12,000 to $13,000: 24.4%

- Annual taxable income from $13,000 to $14,000: 26.04%

- Annual taxable income from $14,000 to $15,000: 27.52%

- Annual taxable income continues to increasing in this manner until reaching the highest income bracket

The federal income tax rates are set by the Government of Canada, and the provincial or territorial income tax rates are determined by each province or territory. These provincial or territorial tax rates are in addition to the federal income tax rates.

Fly to Rutgers: New Brunswick Edition

You may want to see also

Provincial income tax rates

In Canada, the federal government sets the federal income tax rates for individuals, and each province and territory determines its own income tax rates. Provincial or territorial income tax rates apply in addition to federal income tax rates.

In New Brunswick, the tax rates range from 9.4% to 19.5% of income, and the combined federal and provincial tax rate is between 24.4% and 52.5%. The marginal tax rate increases as income increases, meaning you pay higher taxes on the level of income that falls into a higher tax bracket.

| Income | Rate |

|---|---|

| $10,000 - $13,000 | 0.39% |

| $13,000 - $14,000 | 5.10% |

| $14,000 - $21,000 | 9.40% |

| $18,000 - $25,000 | 15.00% |

| $22,000 - $29,000 | 24.40% |

| $26,000 - $33,000 | 11.24% - 14.03% |

| $30,000 - $37,000 | 15.00% |

| $34,000 - $41,000 | 14.34% - 16.06% |

| $38,000 - $45,000 | 15.40% - 16.80% |

| $42,000 - $49,000 | 16.25% - 17.54% |

| $46,000 - $53,000 | 17.77% - 18.53% |

| $50,000 - $57,000 | 20.50% |

| $54,000 - $61,000 | 18.67% - 19.50% |

| $58,000 - $65,000 | 19.76% - 20.48% |

| $62,000 - $69,000 | 20.71% - 21.35% |

| $66,000 - $73,000 | 21.54% - 22.11% |

| $70,000 - $73,000 | 22.28% - 22.79% |

| $74,000 - $85,000 | 22.95% - 24.44% |

| $90,000 - $105,000 | 25.00% - 26.54% |

| $110,000 - $125,000 | 27.16% - 28.94% |

| $130,000 - $160,000 | 29.44% - 31.79% |

| $170,000 - $200,000 | 32.48% - 34.82% |

| $250,000 - $400,000 | 37.83% - 44.33% |

The above tax rates are marginal rates, which apply to each dollar of additional income. It's important to note that New Brunswick also has a basic personal amount of $12,458, which is the amount of income that is not subject to provincial tax.

MARC's Westbound Brunswick Line

You may want to see also

Marginal tax rates

For example, let's consider the marginal tax rates for New Brunswick in 2023:

- Income up to $47,715 is taxed at a marginal rate of 9.4%.

- Income between $47,715 and $53,359 is taxed at a marginal rate between 9.4% and 15%.

- The marginal tax rate continues to increase for higher income levels, with the top marginal rate being 19.5% for income above a certain threshold.

It's important to note that these marginal tax rates are in addition to federal income tax rates, which also vary based on income level. The combined federal and provincial tax rates in New Brunswick can range from 24.4% to 52.5%.

When filing taxes, individuals must consider both their marginal tax rate and their average tax rate, which is the percentage of their total income paid in taxes. The marginal tax rate helps individuals understand how much additional tax they will pay for each dollar of income earned within a specific tax bracket.

Additionally, it's worth mentioning that New Brunswick offers various tax credits and deductions, such as the NB child tax benefit, NB harmonized sales tax credit, and NB low-income tax reduction, which can reduce the amount of taxes owed. These credits and deductions can impact the overall tax liability for individuals in New Brunswick.

Zoning Exception: How to Get a Pass

You may want to see also

Payroll deductions

The amount of tax your employer deducts from your paycheque varies based on where you fall inside the federal and New Brunswick tax brackets. In 2023, federal income tax rates in Canada ranged from 15% to 33%, while New Brunswick income tax rates ranged from 9.4% to 19.5%. These rates are applied to your taxable income, which is your income after various deductions, credits, and exemptions.

In 2024, the federal indexing factor and the New Brunswick indexing factor were both 4.7%. This means that tax credits were adjusted accordingly, and employees will automatically receive the indexing change, regardless of whether they file a personal tax credits return form.

In addition to federal income tax rates, provincial or territorial income tax rates also apply. These vary across Canada, but the method of calculation is the same as for federal income tax.

When calculating payroll deductions, employers must take into account various components, including federal and provincial tax deductions, Canada Pension Plan (CPP) contributions, and Employment Insurance (EI) premiums. The Canada Revenue Agency provides guides and tables to help employers determine the correct payroll deductions for their employees.

The amount of income tax that was deducted from your paycheque appears in Box 22 of your T4 slip.

Severance Pay: New Brunswick's Law

You may want to see also

Sales tax rates

New Brunswick has a Harmonized Sales Tax (HST) which combines the federal Goods and Services Tax (GST) with the Provincial Sales Tax (PST). The HST is a value-added tax and is composed of the federal GST (5%) and a provincial component of 10%. The HST is applied to the same base of goods and services as the federal GST. This means the 15% HST is applied to all goods and services taxable under the federal Excise Tax Act.

The HST is administered by the federal government through the Canada Revenue Agency (CRA). Registrants (businesses or individuals registered to collect the HST on taxable sales) collect one sales tax and remit and report to one government agency.

Other provinces that have implemented the HST include Newfoundland and Labrador, Ontario, Prince Edward Island, and Nova Scotia.

Getting HST Number in New Brunswick

You may want to see also

Frequently asked questions

The tax rates in New Brunswick range from 9.4% to 19.5% of income. The combined federal and provincial tax rate is between 24.4% and 52.5%. New Brunswick's marginal tax rate increases as income increases, meaning you pay higher taxes on the level of income that falls into a higher tax bracket.

The tax bracket you fall into depends on your taxable income, which is your income after various deductions, credits, and exemptions have been applied. There are also various tax credits, deductions, and benefits available to reduce your total tax payable.

You can pay income taxes online through the CRA's My Payment online portal. You can also pay by setting up a pre-authorized debit agreement using CRA My Account or through a third-party service provider with credit card, e-transfer, or PayPal.