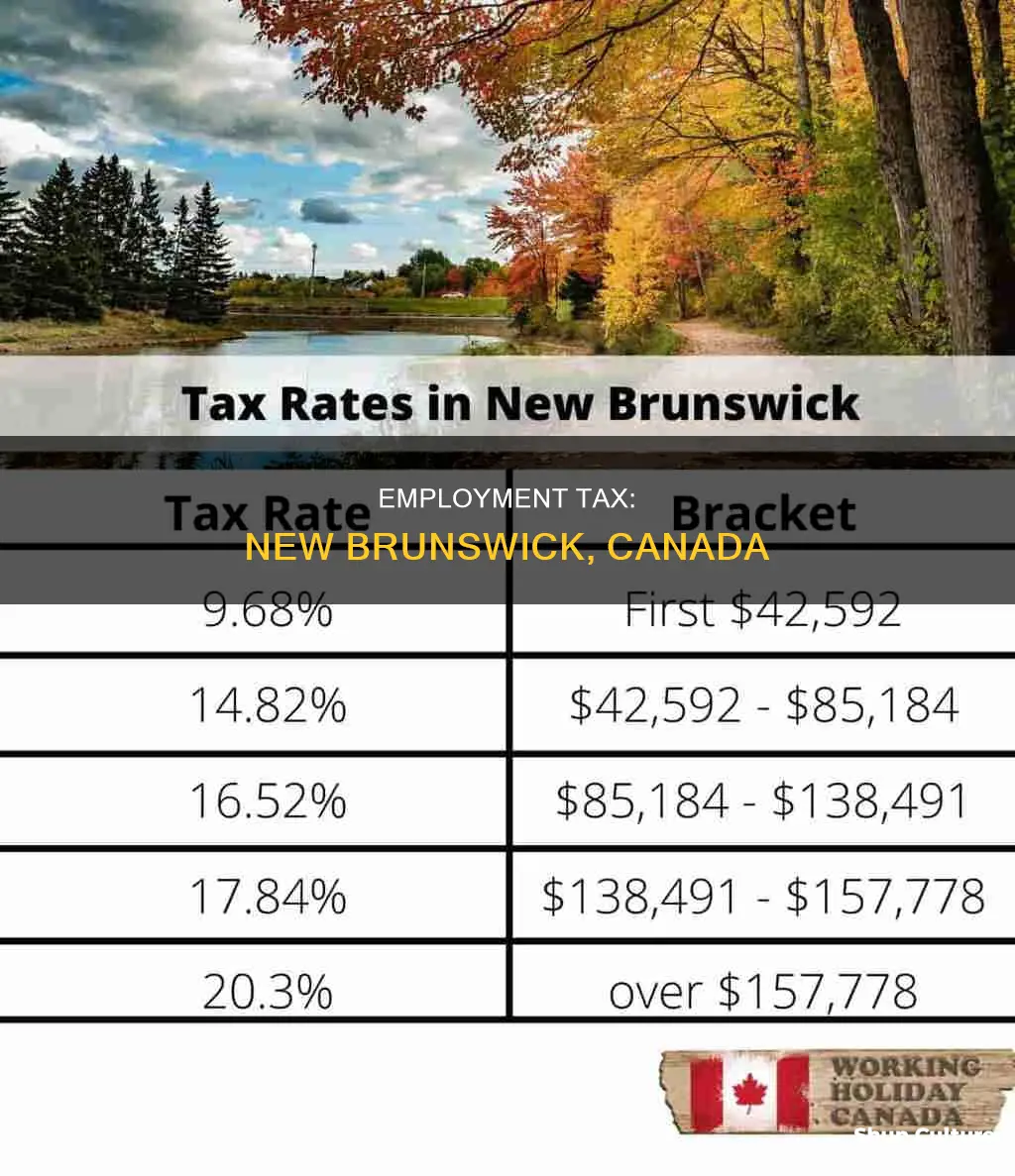

Employment tax in New Brunswick, Canada, is calculated based on an individual's taxable income, which includes income from employment, self-employment, tips, commissions, and investments. The tax rates in New Brunswick range from 9.4% to 19.5% of income, with the federal and provincial tax rates combined ranging from 24.4% to 52.5%. The amount of tax deducted from an employee's paycheque will depend on their income level and the corresponding tax bracket. New Brunswick also offers various tax credits and deductions, such as the NB Child Tax Benefit, NB Harmonized Sales Tax Credit, and NB Low-Income Tax Reduction, which can reduce the overall tax burden for residents.

What You'll Learn

Marginal tax rates

For 2023, the New Brunswick tax rate on the first $47,715 of taxable income is 9.4%. A 14% rate is charged on income between $47,715 and $95,431. A 16% rate is applied to income between $95,431 and $176,756. Above this, the rate is 19.5%.

The combined federal and provincial tax rate in New Brunswick ranges from 24.4% to 52.5%. The federal income tax rates in 2023 range from 15% to 33%.

The marginal tax rates for 2024 have been increased by an indexation factor of 1.047 (4.7%). For example, the marginal tax rate for income between $47,715 and $53,359 in 2023 will be for income between $49,958 and $55,867 in 2024.

Lineup Stress for the Stress Factory

You may want to see also

Federal and provincial tax brackets

New Brunswick uses a progressive tax structure with four tax brackets that increase each year based on inflation. The tax brackets for the 2023 tax year are as follows:

- On the first $47,715 of taxable income, a 9.40% tax rate is applied

- On the next $47,716, a 14.00% tax rate is charged

- On the following $81,325, a 16.00% tax rate is applied

- On income over $176,756, a 19.50% tax rate is charged

The federal tax brackets for the 2023 tax year are as follows:

- Over $47,715 up to $53,359

- Over $53,359 up to $95,431

- Over $95,431 up to $106,717

- Over $106,717 up to $165,430

- Over $165,430 up to $176,756

- Over $176,756 up to $235,675

It's important to note that the tax rates and brackets may vary slightly from year to year due to factors such as inflation and changes in government policies. Additionally, there are various tax credits and deductions available to residents of New Brunswick, such as the Low-Income Tax Reduction and the Seniors' Home Renovation Tax Credit, which can help reduce the amount of tax payable.

The Mystery of Scott Brunswick: Fact or Fiction?

You may want to see also

Payroll tax deductions

In Canada, payroll tax deductions depend on the province or territory of employment. In the province of New Brunswick, the federal and provincial tax rates and income thresholds for 2024 are as follows:

Federal Tax Deductions

The federal indexing factor for 2024 is 4.7%. The federal tax rates and income thresholds are:

- 15% on the first $51,719 of taxable income.

- 20.5% on the next $51,720 (on taxable income between $51,719 and $103,438).

- 26% on the next $60,565 (on taxable income between $103,438 and $164,003).

- 29% on the next $66,047 (on taxable income between $164,003 and $230,050).

- 33% for taxable income over $230,050.

Provincial Tax Deductions

The indexing factor for New Brunswick for 2024 is also 4.7%. The New Brunswick tax rates and income thresholds for 2024 are:

- 9.4% on the first $47,715 of taxable income.

- 14% on the next $47,716 (on taxable income between $47,715 and $95,431).

- 16% on the next $81,325 (on taxable income between $95,431 and $176,756).

- 19.5% for taxable income over $176,756.

The amount of tax an employer deducts from an employee's paycheque varies based on where they fall inside the federal and New Brunswick tax brackets. The amount of income tax deducted from a paycheque appears in Box 22 of the employee's T4 slip.

In addition to federal and provincial income tax, other payroll deductions include Canada Pension Plan (CPP) contributions and Employment Insurance (EI) premiums. CPP contributions are based on an employee's pensionable earnings, while EI premiums are based on their insurable earnings. Both CPP and EI have annual maximum contribution and premium amounts, respectively, after which deductions stop for the remainder of the year.

Brunswick's Radical Bowling Purchase

You may want to see also

Tax credits and deductions

New Brunswick's personal income tax system is similar to that of other Canadian provinces. Many of the provincial tax credits and deductions for New Brunswick residents complement similar credits at the federal level, but there are some unique credits for New Brunswick residents.

New Brunswick's Provincial Tax Credits and Deductions:

- Low-Income Tax Reduction: A non-refundable tax credit for NB residents with low incomes, used to reduce provincial tax payable.

- Seniors' Home Renovation Tax Credit: A refundable tax credit for seniors aged 65+ in New Brunswick (or their family members) to help cover the cost of making their homes safer and more accessible. Residents can claim up to $10,000 worth of eligible home improvements and get 10% of the eligible expenses claimed.

- Basic Personal Amount: For the 2023 tax year, the New Brunswick basic personal amount (BPA) is $12,458. This is the allowable amount of income that can be earned before taxes must be paid.

- Child Tax Benefit: Eligible low-income families with dependent children may receive this benefit.

- Working Income Supplement: Eligible low-income families with dependent children may also receive this supplement, depending on their income level.

- Non-Refundable Tax Credits: These include the Spouse or Common Law Amount, Amount for Eligible Dependant, Amount for Infirm Dependents Age 18 or Older, Canada Pension Plan Contributions, Employment Insurance Premiums, Pension Income Amount, Disability Supplement Amount, Interest Paid on Student Loans, Tuition and Education Amounts, Amount Transferred from Spouse or Common Law Partner, Medical Expense Credit, Overseas Employment Tax Credit, NB Political Contribution Tax Credit, NB Labor-Sponsored Venture Capital Tax Credit, and NB Small Business Investor Tax Credit.

Federal Tax Credits and Deductions:

- Canada Workers Benefit

- RRSP, PRPP, and SPP Unused Contributions, Transfers, and HBP or LLP Activities

- Canada Pension Plan Contributions and Overpayment

- Donations and Gifts

- Federal Tuition, Education, and Textbook Amounts, and Canada Training Credit

- Multigenerational Home Renovation Tax Credit

- Employment Insurance Premiums on Self-Employment and Other Eligible Earnings

- FHSA Contributions, Transfers, and Activities

- Provincial Amounts Transferred from Your Spouse or Common-Law Partner

- New Brunswick Tuition and Education Amounts

Rutgers New Brunswick: Tuition Costs and More

You may want to see also

Tax deadlines

In Canada, the tax deadline for most residents is usually April 30. For the year 2022, the deadline was extended to May 1, 2023, as April 30 fell on a Sunday. Self-employed individuals have until June 15 to file their taxes, or the next business day if this falls on a weekend. For 2023, the self-employed tax deadline is June 17, 2024.

It is important to note that the above deadlines are for the federal tax return. Each province may have its own deadlines for provincial tax returns.

In New Brunswick, the tax deadline for employed individuals is April 30. Self-employed individuals have until June 15 to file their taxes.

Rochester to Fredericton: Miles Apart

You may want to see also

Frequently asked questions

Employment tax in New Brunswick, Canada, is calculated based on your taxable income. The tax rates in New Brunswick range from 9.4% to 19.5% of income, and the combined federal and provincial tax rate is between 24.4% and 52.5%.

To calculate your taxable income in New Brunswick, you need to find your gross income, which includes all types of income earned during the year, such as employment income, self-employment income, tips, commissions, and investments. If you are eligible for tax deductions, you can deduct them from your gross income to arrive at your taxable income.

Some common tax deductions and credits in New Brunswick include:

- NB Child Tax Benefit (NBCTB)

- NB Harmonized Sales Tax Credit (NBHSTC)

- NB Low-Income Tax Reduction

- NB Education and Tuition Tax Credits

- Basic Personal Amount

- Spouse or Common-Law Amount

- Amount for Eligible Dependants

- Amount for Infirm Dependants Age 18 or Older

- Canada Pension Plan Contributions

- Employment Insurance Premiums

- Pension Income Amount

- Disability Supplement Amount

- Interest Paid on Student Loans

- Tuition and Education Amounts