The City of Brunswick, Ohio, levies a mandatory income tax on all residents aged 18 and over, regardless of their income. The Brunswick income tax rate is 2.0% and is based on taxable income and business net profits. In addition to income tax, Brunswick also imposes a sales tax of 6.75%, which includes 5.75% Ohio state sales tax and 1% Medina County sales tax. The deadline for filing City of Brunswick taxes is usually April 15, and payments can be made via check, money order, or online using Visa, MasterCard, Discover, or electronic check.

| Characteristics | Values |

|---|---|

| Income tax payment | Requires new PIN |

| Income tax rate | 2.0% |

| Tax credit | 1.0% |

| Filing deadline | 15 April 2024 |

| Sales tax rate | 6.75% |

What You'll Learn

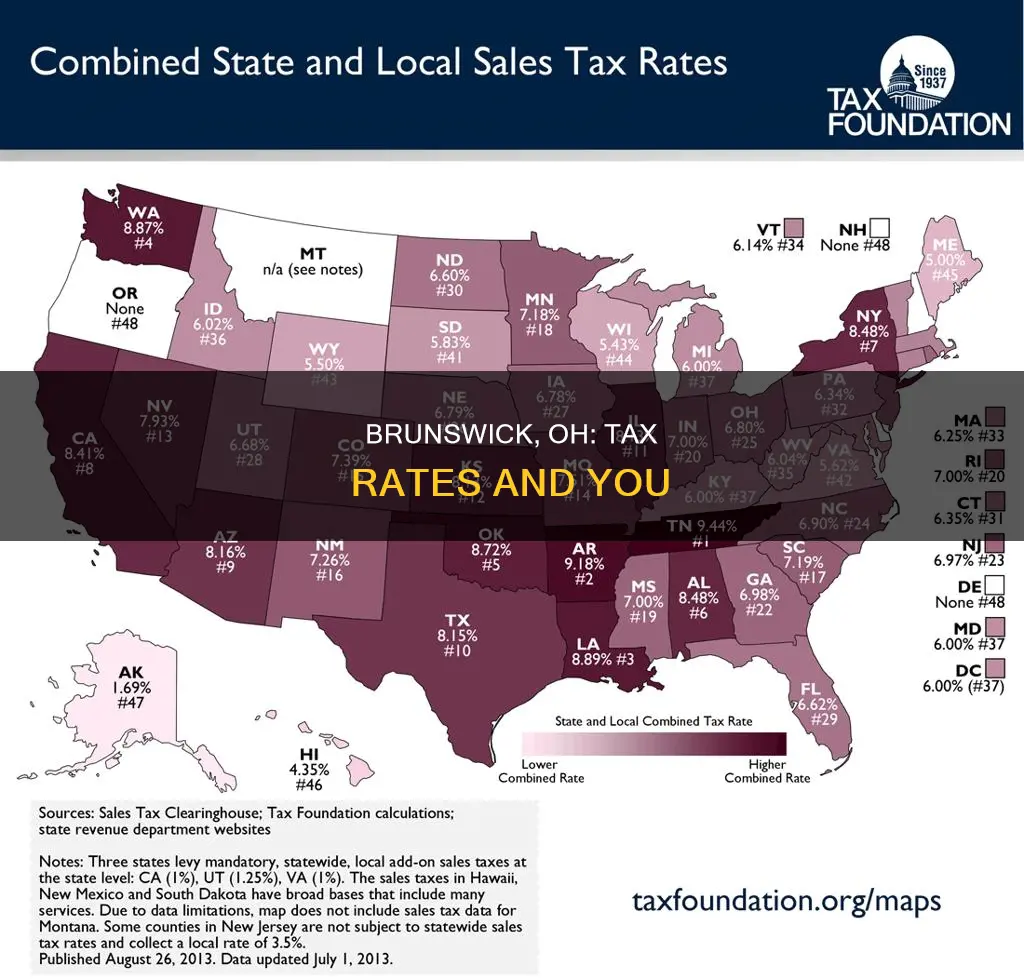

Sales tax rate in Brunswick, Ohio

The sales tax rate in Brunswick, Ohio, is 6.75%, consisting of 5.75% Ohio state sales tax and 1% Medina County sales tax. This rate has been consistent since at least December 2020.

In addition to sales tax, Brunswick residents who are 18 or older are required to file a tax return, regardless of income. Those who own a business and/or rental property must also file a return. The only exception is for those who have submitted proof of retirement to the Tax Department and have no other taxable income.

The City of Brunswick's income tax rate is 2.0%, based on taxable income and business net profits. This rate was increased from 1.85% effective January 1, 2018.

It is important to note that sales tax rates can change and may be impacted by various factors, so it is always advisable to consult official sources and local government tax offices for the most up-to-date and accurate information.

Rutgers New Brunswick: Application Strategies

You may want to see also

Income tax payment

The City of Brunswick has an income tax rate of 2.0% as of January 1, 2018, which is based on taxable income and business net profits. Brunswick also offers a tax credit of 1% for residents who have paid municipal income taxes in other municipalities, which cannot exceed 1% of their taxed earnings.

Any person aged 18 or over who resides in the City of Brunswick is required to file a return, regardless of income. This also applies to anyone who owns a business and/or rental property. The only exception is for those who have submitted proof of retirement to the Tax Department and have no other taxable income.

The deadline for filing City of Brunswick taxes is April 15, or the Federal individual due date if April 15 falls on a weekend or holiday. Payments can be made via check or money order, made payable to the "City of Brunswick", and placed in the drop box in front of City Hall or mailed. Electronic payments are also accepted via Visa, MasterCard, Discover, or electronic check.

For tax year 2023, a penalty of $25 will be applied for failure to file on time, even if no tax is due. A late payment penalty of 15% of the unpaid tax will be charged if paid after the due date, with interest calculated at 5% per annum on the unpaid tax.

Where is Brunswick, Georgia?

You may want to see also

Property taxes

The City of Brunswick requires all individuals over the age of 18 who reside in the city or own a business or rental property to file a tax return, regardless of their income. The municipal income tax rate is 2.0%, and the tax credit is 1.0% for wages taxed and paid in another city. This means that residents who pay municipal income taxes to other municipalities can receive a credit of up to 1% of their taxed earnings.

The deadline for filing city taxes in Brunswick is generally April 15, unless this date falls on a weekend or holiday, in which case the deadline is extended to the Federal individual due date. The city offers various methods for filing and paying taxes, including online filing and payment through Visa, MasterCard, Discover, electronic check, or credit/debit card. Payments made through electronic check or at the time of electronic filing do not incur additional fees.

For those who need assistance with their taxes, the City of Brunswick provides resources such as tax forms, video tax assistance through the Google Meet app, and in-person help at the City Hall Tax Office during specific dates and times.

New Brunswick, NJ: A Short Hop from Chester

You may want to see also

Tax filing deadline

For federal tax returns, the deadline for filing is usually April 15, unless this falls on a weekend or holiday, in which case the deadline is pushed to the next business day. In 2024, the federal tax deadline is April 15.

For City of Brunswick taxes, the deadline is the same as the federal tax deadline of April 15, unless this falls on a weekend or holiday, in which case the deadline is pushed to the next business day. In 2023, the City of Brunswick tax deadline was April 15, 2024.

If you are unable to file your tax return by the deadline, you can request an extension. For federal taxes, you can request an automatic 6-month extension by filing Form 4868 by the original deadline. However, this is not an extension for payment, and you should pay any taxes owed by the original deadline to avoid penalties. For City of Brunswick taxes, if you file a federal extension, you will automatically receive a 6-month extension. You must forward a copy of the extension to the Brunswick Tax Department. Similar to federal taxes, this is not an extension for payment.

Clementon-Brunswick Distance Explored

You may want to see also

Tax payment methods

The City of Brunswick offers a variety of ways to pay your taxes. The deadline for filing your City of Brunswick 2023 taxes is April 15, 2024.

Online Payment Methods

You can file and pay your 2023 City of Brunswick income tax return online via Visa, MasterCard, Discover, or electronic check. You can also pay by credit or debit card, but you will need to pay a fee charged by the credit card processor.

In-Person Payment Methods

You can drop off your tax forms and payments at the drop box located in the City Hall parking lot. No appointment is necessary to make a cash or credit card payment at City Hall, but you must bring your applicable tax forms.

Mail Payment Methods

Payments can be made via check or money order made payable to "City of Brunswick" and mailed to:

> City of Brunswick Income Tax Department

> PO Box 0816

> Brunswick, OH 44212

Fredericton, New Brunswick: Size and Scope

You may want to see also

Frequently asked questions

The sales tax rate in Brunswick, Ohio is 6.75%.

The income tax rate in Brunswick, Ohio is 2%.

The deadline for filing your City of Brunswick taxes is April 15. If April 15 falls on a weekend or holiday, the deadline is pushed to the Federal individual due date.

Any person 18 years or older who resides in the City of Brunswick is required to file a return, regardless of income. Additionally, any person who owns a business and/or rental property.