New Brunswick's personal income tax is collected by the federal government through the Canada Revenue Agency. The tax rate varies depending on your income, with higher incomes falling into higher tax brackets and thus attracting higher taxes. The tax rate on the first $47,715 of your income is 9.4%, then 14% on the next $47,716, 16% on the next $81,325, and 19.5% on income over $176,756. The basic personal amount for 2024 in New Brunswick is $13,044, which is the amount you are not required to pay any tax on. So, if we take away the basic personal amount from $16,000, we get $2,956. This means that the tax on $16,000 in New Brunswick would be $283.76 (9.4% of $2,956) leaving you with $15,716.24.

| Characteristics | Values |

|---|---|

| Tax on $16,000 income | $1,504 - $1,532 |

| Tax rate | 9.4% - 9.68% |

| Basic personal amount | $12,458 - $13,044 |

| Marginal tax rate | 40.6% |

| Average tax rate | 30.2% |

What You'll Learn

Marginal tax rates range from 9.4% to 19.5%

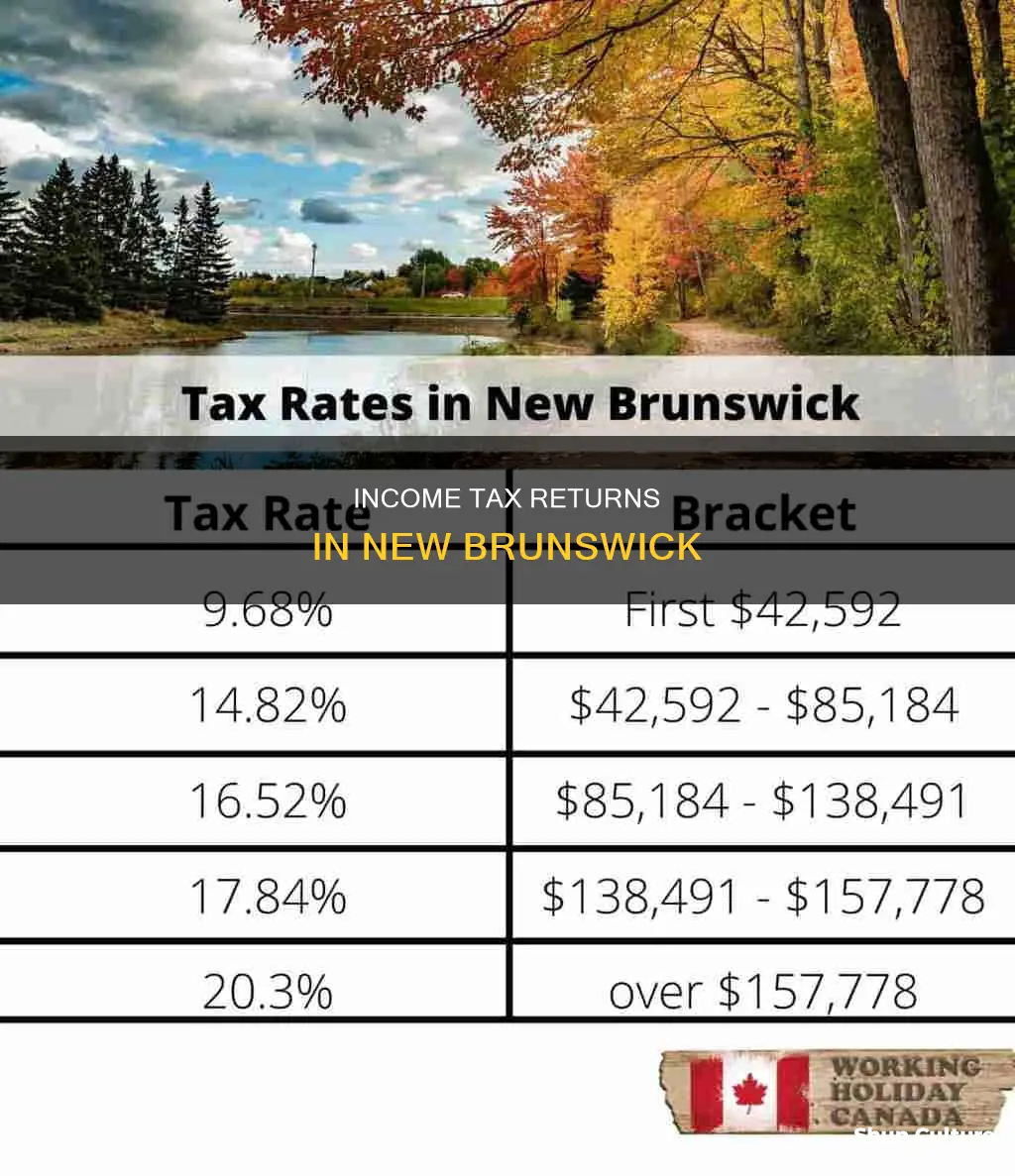

Marginal tax rates in New Brunswick range from 9.4% to 19.5% of income. This means that the amount of tax you pay depends on your income level, with higher incomes being taxed at a higher rate. Marginal tax rates are progressive, so as your income increases, so does the tax rate applied to that income.

The marginal tax rate of 9.4% is applied to the first $47,715 of taxable income. This is the lowest tax bracket in New Brunswick. If your income is below this threshold, your marginal tax rate will be 9.4%. For example, if you are in this tax bracket and receive a $1,000 bonus, you will be taxed at 9.4%, meaning you will pay $94 in tax and your net income will increase by $906.

The marginal tax rate then increases to 14% on the next $47,716 of income (up to $95,431). This means that any income between $47,716 and $95,431 will be taxed at 14%. For example, if your taxable income is $50,000, the first $47,715 will be taxed at 9.4% and the remaining $2,285 will be taxed at 14%.

The marginal tax rate continues to increase as income levels rise. The next marginal tax rate is 16% on income between $95,431 and $176,756. Finally, the highest marginal tax rate in New Brunswick is 19.5% on income over $176,756.

It is important to note that these marginal tax rates are for the province of New Brunswick and do not include federal income tax rates, which are typically higher. The combined federal and provincial tax rates in New Brunswick range from 24.4% to 52.5%. Additionally, tax credits and deductions may impact the amount of tax owed.

Renting in Fredericton: A Guide

You may want to see also

Federal income tax rates range from 15% to 33%

Federal income tax rates in Canada vary according to the total amount of income earned and how much of that income is taxable. Taxpayers in Canada pay income tax to the federal government as well as to the government of the province or territory in which they reside.

In 2023, federal income tax rates ranged from 15% to 33%. The 33% rate is what's known as the "top tax bracket". This is the rate that's applied to any income over $235,675.

The federal tax brackets for 2023 are as follows:

- 15% on the first $53,359 of taxable income

- 20.5% on the portion from $53,359 to $106,717

- 26% on the portion from $106,717 to $165,430

- 29% on the portion from $165,430 to $235,675

- 33% on the portion over $235,675

The federal tax brackets and personal tax credit amounts for 2024 were increased by an indexation factor of 1.047 (a 4.7% increase). The federal tax brackets for 2024 are as follows:

- Marginal tax rate of 15% on the first $55,867 of taxable income

- Marginal tax rate of 20.5% on the portion from $55,867 to $111,733

- Marginal tax rate of 26% on the portion from $111,733 to $173,205

- Marginal tax rate of 29% on the portion from $173,205 to $246,752

- Marginal tax rate of 33% on the portion over $246,752

In New Brunswick, the tax rates range from 9.4% to 19.5% of income. The combined federal and provincial tax rate is between 24.4% and 52.5%. The amount of tax deducted from your paycheck depends on your total taxable income and the New Brunswick tax rates for the year. For example, if your taxable income is less than $47,715, your New Brunswick tax rate will be 9.4%.

Woodland Park MD: Distance from East Brunswick NJ

You may want to see also

Basic personal amount for 2024 is $13,044

The Basic Personal Amount (BPA) is a non-refundable tax credit that reduces the amount of tax you have to pay. The BPA for New Brunswick in 2024 is $13,044. This means that you don't have to pay any provincial income tax on the first $13,044 of your taxable income. The BPA is important because it helps ensure that low-income individuals and families don't bear too high a burden relative to their income.

The BPA is one of many tax credits available to residents of New Brunswick, including the New Brunswick Low-Income Tax Reduction, the New Brunswick Child Tax Benefit, and the New Brunswick Working Income Supplement. These credits can help reduce the amount of tax owed and provide support to those who need it most.

The New Brunswick personal income tax system has multiple tax brackets, with higher rates applied to higher levels of income. For 2024, the tax rates range from 9.4% to 19.5% of income. The BPA plays a crucial role in this system by ensuring that individuals and families with lower incomes are taxed at lower rates or not taxed at all.

The BPA is also indexed to inflation, which means that it is adjusted annually to reflect changes in the cost of living. This helps maintain the purchasing power of individuals and ensures that the tax system remains fair and equitable over time.

It's important to note that the BPA may change from year to year, and it's always a good idea to consult the most up-to-date information when filing your taxes. Additionally, tax laws and credits can be complex, and it's recommended to seek guidance from a qualified tax professional or the Canada Revenue Agency (CRA) to understand how these may apply to your specific situation.

MARC's Westbound Brunswick Line

You may want to see also

Low-Income Tax Reduction provides a non-refundable tax credit

The New Brunswick Low-Income Tax Reduction was introduced in 2001. It is a non-refundable tax credit that can be used to reduce the tax payable for eligible low-income families with dependent children.

The Low-Income Tax Reduction is one of New Brunswick's most popular tax credits and deductions. The province's personal income tax is collected by the federal government through the Canada Revenue Agency (CRA). The CRA also determines eligibility for the tax credits.

The CRA will use the information from your tax return to calculate the payments you are entitled to receive from the following programs:

- New Brunswick harmonized sales tax credit (NBHSTC)

- New Brunswick child tax benefit (NBCTB)

- New Brunswick working income supplement

- New Brunswick school supplement program

The CRA advises taxpayers to keep tax records and supporting documents for at least six years.

The tax rate in New Brunswick on the first $47,715 of taxable income is 9.4%. The province uses a progressive tax structure, with four tax brackets. The tax brackets increase each year based on inflation.

East Brunswick, NJ: Tag Your Fire Extinguisher

You may want to see also

Seniors' Home Renovation Tax Credit: Seniors 65+ can claim up to $10,000 in home improvements

If you are a senior citizen, you may be eligible for a tax credit when renovating your home. This credit is designed to help seniors make their homes safer and more accessible. Here is some information about the Seniors Home Renovation Tax Credit and how you can benefit from it.

Eligibility

To be eligible for the Seniors Home Renovation Tax Credit, you must be 65 years of age or older by the end of the year for which you are claiming the credit. Alternatively, if you live with a family member who is a senior, you can still qualify for this tax credit. It is worth noting that your income does not affect your eligibility—seniors and their family members at all income levels can benefit from this credit.

Claimable Improvements

When it comes to the types of improvements that are eligible for the tax credit, there are several options. These improvements typically involve making your home more accessible and functional. Here are some examples:

- Grab bars and reinforcements around the toilet, tub, and shower

- Handrails in corridors

- Wheelchair ramps, stair/wheelchair lifts, and elevators

- Walk-in bathtubs

- Wheel-in showers

- Widening passage doors

- Lowering existing counters or cupboards

- Installing adjustable counters or cupboards

- Light switches and electrical outlets in accessible locations

- Easy-to-operate door locks

- Lever handles on doors and taps instead of knobs

- Pull-out shelves under counters to enable work from a seated position

- Non-slip flooring

- Hand-held showers on adjustable rods or high-low mounting brackets

- Additional light fixtures

- Swing clear hinges on doors

- Relocating taps for easier access

- Motion-activated lighting

- Touch-and-release drawers and cupboards

Expenses and Credits

It is important to note that not all expenses related to the above improvements are claimable. The expenses that are eligible for the tax credit typically include materials, fixtures, plans, permits, and professional labour. It is always a good idea to keep your receipts and consult with an accountant to ensure you are claiming the correct expenses. The maximum amount of eligible expenses that can be claimed is $10,000.

Provincial Variations

The specifics of the Seniors Home Renovation Tax Credit may vary depending on the province in which you reside. For example, in Ontario, the tax credit is known as the Healthy Homes Renovation Tax Credit, and it is worth 15% of the eligible expenses claimed. In British Columbia, the maximum credit amount is $1,000 per tax year, calculated as 10% of the qualifying renovation expense. In Manitoba, seniors can receive a Green Energy Equipment Tax Credit for installing a new geothermal or solar heating system.

Disassembling Brunswick Table: Step-by-Step Guide

You may want to see also

Frequently asked questions

The tax rate in New Brunswick ranges from 9.4% to 19.5% of income. The federal and provincial tax rate combined is between 24.4% and 52.5%.

To calculate your net income, first, determine your taxable income by deducting any pre-tax contributions from your gross income. Then, withhold all applicable federal and provincial taxes, and deduct any post-tax contributions. The result is your net income.

The basic personal amount (BPA) is the threshold below which you do not have to pay any tax. In 2023, the BPA in New Brunswick was $12,458, and in 2024, it is $13,044.

The deadline for filing taxes in New Brunswick is April 30 for employed individuals and June 15 for self-employed individuals.