Brunei is a small yet wealthy state with a population of less than 500,000. The country's economy is almost entirely supported by exports of crude oil and natural gas, with revenues from the petroleum sector accounting for over half of its GDP. Brunei is the third-largest oil producer in Southeast Asia and the ninth-largest producer of liquefied natural gas in the world. The country's citizens benefit from a socialist society, with the Sultan's government paying for education, healthcare, and most other living expenses. Brunei's citizens have one of the highest per capita incomes in Asia, with a 2018 per-capita GDP (PPP) of $71,802.

| Characteristics | Values |

|---|---|

| Per capita GDP | High |

| Per capita income | One of the highest in Asia |

| Per capita income in 2018 | $71,802 |

| Mean wage in 2009 | $25.38 per man-hour |

| Unemployment rate in 1999 | 5.5% |

What You'll Learn

Brunei's economy is dependent on oil and gas exports

Brunei is a small but wealthy country with a population of less than 500,000. It has a socialist society and is often considered the closest any nation has come to a total welfare state. The Sultan's government pays for education, healthcare, and most other living expenses for its citizens. This is financed through Brunei's vast oil and natural gas wealth, which also gives the country one of the highest per capita incomes in Asia.

Brunei's economy is almost entirely dependent on the exploitation of its vast reserves of petroleum and natural gas. Crude oil and natural gas production account for 60% of GDP and more than 90% of exports. The country is the third-largest oil producer in Southeast Asia, averaging about 180,000 barrels per day. It is also the ninth-largest producer of liquefied natural gas in the world. The petroleum industry generates more than half of Brunei's GDP, although it employs a very small portion of the labour force.

The country's oil and gas revenues have allowed the state to provide its citizens with a high standard of living. However, this has also made the economy vulnerable to fluctuations in commodity prices. Brunei's leaders recognise the need to diversify the economy away from oil and gas, as these reserves are finite and subject to market fluctuations. They have made efforts to develop other sectors, such as agriculture, fisheries, tourism, and financial services.

Brunei has taken steps to attract foreign investment and encourage the development of local industries. The government provides tax breaks and other incentives for new enterprises, and actively promotes the development of Brunei Malays as leaders in industry and commerce. Despite these efforts, oil and gas continue to dominate the economy, along with government spending.

Brunei's non-petroleum industries include agriculture, forestry, fishing, and banking. The country has also invested in a world-class petrochemical hub, and a national halal branding scheme to promote its products in Muslim markets worldwide. While these initiatives have had limited success, Brunei's economy remains heavily reliant on oil and gas exports.

A Long-Haul Adventure: Brunei to Saudi Arabia

You may want to see also

Brunei citizens pay no taxes

Brunei is a small but wealthy country with a population of less than 500,000. It is often referred to as a welfare state, as the Sultan's government pays for education, healthcare, and most other living expenses of its citizens. The country's economy is supported almost entirely by exports of crude oil and natural gas, with revenues from the petroleum sector accounting for over half of its GDP. Brunei is the third-largest oil producer in Southeast Asia and the ninth-largest producer of liquefied natural gas in the world.

Despite its high standard of living, Brunei's economy is vulnerable to fluctuations in petroleum prices, and the country will likely face challenges when its oil reserves eventually run out. The government has made efforts to diversify the economy away from oil and gas, but with limited success.

While Brunei citizens enjoy many benefits such as free education and subsidised food and housing, there is no personal income tax in the country. This is made possible by the steady stream of revenue from oil and gas production, which also allows the government to provide various subsidies and welfare measures to its citizens.

In addition to no personal income tax, there are also no sales tax or value-added tax (VAT) in Brunei. However, citizens are required to contribute 5% of their salary to a state-managed provident fund, and properties under commercial use are subject to property tax. The country also imposes stamp duties on various documents and a 55% tax rate on income from petroleum operations.

The normal corporate income tax rate in Brunei is 10%, and new enterprises that meet certain criteria can receive pioneer status, exempting profits from income tax for up to five years. Brunei also offers tax incentives for small and medium-sized enterprises (SMEs) in certain industries, such as imported raw materials, machinery, and the food industry.

Christianity in Brunei: A Faith Under Pressure

You may want to see also

Brunei has a high standard of living

The Sultan's government pays for education, healthcare, and most other living expenses of its citizens. There is no personal income tax, and the government subsidises food and housing. Bruneians also benefit from interest-free or low-interest loans for purchasing homes, and cheap, government-organised trips to Saudi Arabia for the hajj.

The cost of living in Brunei is relatively low. It is, on average, 27% lower than in the United States, with rent prices 56% lower. A single person's estimated monthly costs, excluding rent, are 826.3$ (1,091.9S$).

However, the country's economy is vulnerable to fluctuations in the price of oil, and it is likely to face serious difficulties when its oil reserves begin to run out.

Exploring Brunei: A Wealth of Tourist Destinations

You may want to see also

Brunei's government subsidises living expenses

Brunei is a wealthy country with a socialist society that is arguably the closest any nation has gotten to a total welfare state. The Sultan's government pays for education, healthcare, and most other living expenses of its citizens. The government provides for all medical services and subsidises food and housing. Brunei's citizens enjoy free education, free healthcare, and interest-free loans for purchasing homes. The government also subsidises the cost of the Hajj pilgrimage.

The government's ability to provide these services is financed through Brunei's large oil and natural gas wealth. However, this has resulted in the country having a mono-economy, with oil and natural gas making up a full 99% of its exports. In recent years, the government has recognised the need to diversify the economy by developing other sectors, such as agriculture, fisheries, tourism, and financial services.

The country's dependence on a single commodity has made it vulnerable to market fluctuations. In addition, Brunei must rely on imports for nearly all its manufactured goods and most of its food. To address these issues, the government has implemented programs to stimulate local fisheries and develop the agricultural industry. By the early 21st century, Brunei had become self-sufficient in the production of poultry and eggs and was approaching self-sufficiency in vegetables.

While the government's subsidies provide many benefits to its citizens, some have argued that there is a lot of waste and that the subsidies could be implemented more efficiently. For example, it has been suggested that the government could save money by removing subsidies for non-essential goods and services, such as fuel for non-locals. This would also help to address the issue of subsidised goods being illegally exported. However, removing or reducing subsidies could have negative consequences, such as a decrease in tourism and an increase in crime by non-locals due to the higher cost of living.

Qantas' Flight Routes: Exploring Options to Brunei

You may want to see also

Brunei's economy is vulnerable to oil price fluctuations

Brunei is a small, wealthy country with a high per capita GDP. The economy is almost entirely supported by exports of crude oil and natural gas, with revenues from the petroleum sector accounting for over half of the GDP. Brunei is the third-largest oil producer in Southeast Asia, averaging about 180,000 barrels per day. It is also the ninth-largest producer of liquefied natural gas in the world.

While oil and gas revenues have allowed the state to provide its citizens with one of the highest per capita incomes in Asia, they have also made the country dependent on a single commodity that is subject to market fluctuations. The disappearance of a revenue surplus has made Brunei's economy more vulnerable to petroleum price fluctuations.

In the 1970s, Brunei invested sharply increasing revenues from petroleum exports and maintained government spending at a low and constant rate. This allowed the government to build its foreign reserves and invest them around the world to help provide for future generations. However, since 1986, petroleum revenues have decreased, and government spending has increased. The government has been running a budget deficit since 1988.

The Asian financial crisis in 1997 and 1998, coupled with fluctuations in the price of oil, have created uncertainty and instability in Brunei's economy. In recent years, GDP growth has been modest, and the country slipped into a mild recession in 1998 due to the collapse of Amedeo Development Corporation, Brunei's largest construction firm.

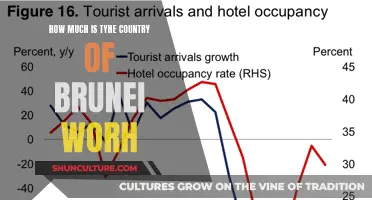

The government has implemented policies and initiatives to develop other sectors, such as agriculture, fisheries, tourism, and financial services. In early 2021, the government released a blueprint for achieving economic growth through diversification, with a focus on creating more meaningful and high-value employment opportunities. The non-oil and gas private sector has shown modest growth, but the government aims to enhance this by encouraging Bruneian-owned businesses to drive growth through collaboration and exploration of new market opportunities.

To reduce its vulnerability to oil price fluctuations, Brunei needs to continue its efforts to diversify the economy and develop new industries. While there is no proven strategy for economic diversification, it is crucial for the country to create a variety of internationally competitive industries, strengthen its economy against external shocks, and provide more high-value employment opportunities.

Wyndham Hotels in Brunei: Exploring the Empire's Reach

You may want to see also

Frequently asked questions

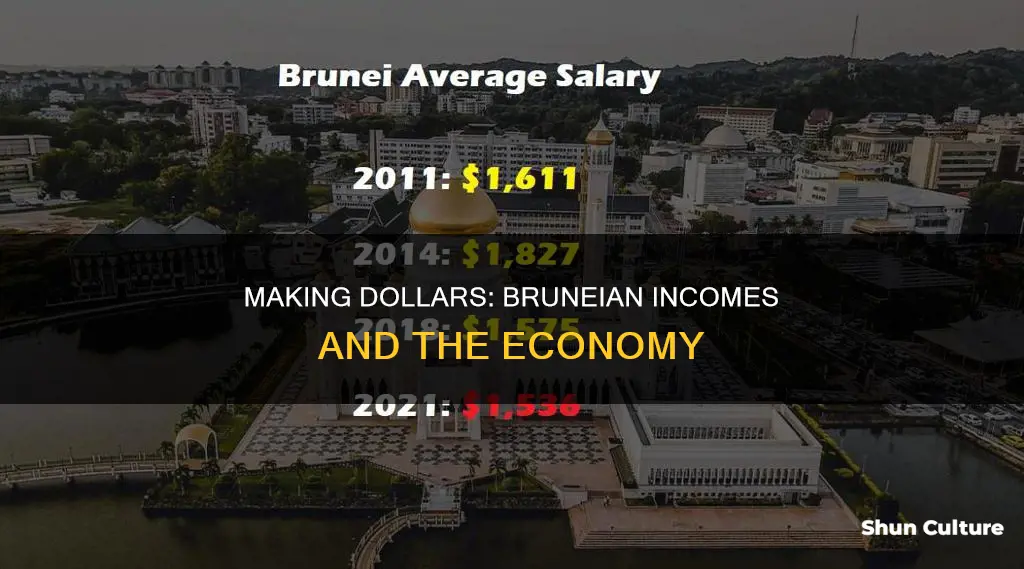

The average salary in Brunei is difficult to determine as it varies depending on numerous factors, including job type, qualifications, and industry. However, it is known that Brunei citizens enjoy a high standard of living, with the government providing for all medical services and subsidizing food and housing.

Brunei has one of the highest per capita incomes in Asia. In 2018, the per-capita GDP (PPP) in Brunei was $71,802, and the country ranked 43rd in the world on the Human Development Index.

Brunei does not have a minimum wage as it is not a concept that exists in the country.

Brunei citizens enjoy a tax-free income of up to $12,000 Brunei Dollars annually. Personal income tax is levied at a flat rate of 40% above this threshold, making it the country with the highest income tax rate in Asia.