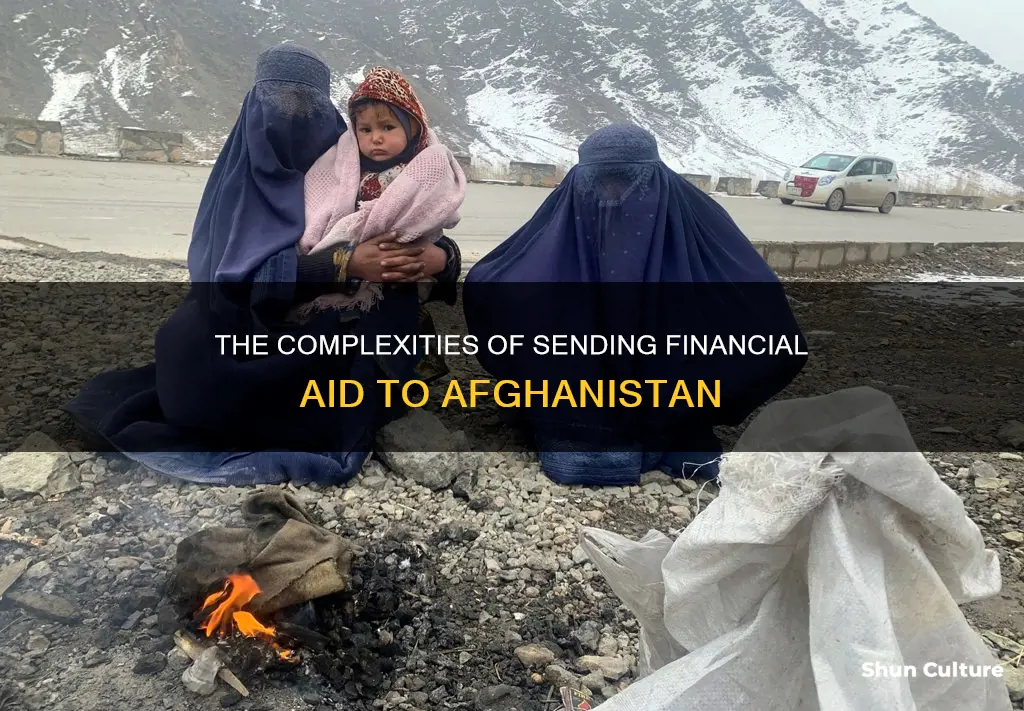

Sending money to Afghanistan has become increasingly difficult since the Taliban's rise to power in 2021. The country has become disconnected from financial systems worldwide, and customers who wish to send money to Afghanistan often face obstacles, delays, and refusals. Many money transfer companies, including Western Union and MoneyGram, have suspended their services in the country due to security concerns. However, some companies, such as Western Union and MoneyGram, have since resumed their operations in Afghanistan, offering fee-free transfers for a limited time. The ability to send money into the country remains uncertain, with outbound services currently suspended.

| Characteristics | Values |

|---|---|

| Recommended Providers | Western Union, MoneyGram, Wise |

| Average Cost of Online Money Transfer | 7.6% of the amount sent |

| Cheapest Provider | Western Union |

| Average Cost of Cheapest Provider | 7.6% of the amount sent |

| Average Cost of Most Expensive Provider | 7.6% of the amount sent |

| Average Fastest Transfer Time | Minutes |

| Country's Official Currency | Afghan Afghani (AFN) |

What You'll Learn

Western Union and MoneyGram suspended services to Afghanistan

Western Union and MoneyGram, two of the world's largest money transfer firms, suspended their services in Afghanistan following the Taliban's takeover of Kabul in August 2021. The companies cited security concerns and the deteriorating situation in the country as the reasons for the suspension. This move cut off a vital channel of financial support for many Afghans, especially those relying on remittances from overseas.

Western Union stated that it recognised the importance of its services for customers trying to support their loved ones in Afghanistan. The company committed to resuming operations as soon as conditions permitted. MoneyGram also acknowledged the impact of its decision, stating that the suspension was not made lightly.

The suspension of services by Western Union and MoneyGram had significant implications for the Afghan economy and the livelihoods of its citizens. Remittances from Afghans living abroad are crucial for the country's economy, amounting to nearly $789 million in 2020, according to the World Bank. This influx of funds from migrant workers is a key lifeline, helping Afghanistan's economy withstand years of conflict and instability.

In early September 2021, Western Union and MoneyGram announced the resumption of their money transfer services to Afghanistan. This decision came after banks in the country reopened, allowing the money transfer firms to dispense and collect funds. The companies also received assurances from their banking partners about the availability of sufficient cash to facilitate transactions.

To support those affected by the situation, Western Union offered a two-week period of $0 transfer fees for all money transfers into Afghanistan. MoneyGram also offered $0 fees for online transfers to help customers save money when sending funds for emergency essentials, medical bills, and other necessities.

The Unconquerable Conflict: Afghanistan's Enduring War

You may want to see also

Western Union and MoneyGram resumed services to Afghanistan

Western Union and MoneyGram have resumed their money transfer services to Afghanistan. The companies suspended their services in Afghanistan after the Taliban captured Kabul in August 2021.

The reopening of banks in Afghanistan, along with a push by the US government to allow humanitarian activity to continue, gave the companies the confidence to resume their services. In a statement, MoneyGram said:

> We recognize that remittances play a pivotal role in the livelihood and daily needs of the Afghan people.

Western Union and MoneyGram are the world's largest money transfer firms, and their services are crucial for Afghans receiving financial support from family and friends overseas. However, some limitations remain. While inbound services have resumed, outbound services—sending money outside of Afghanistan—are still suspended. Additionally, money will be paid out only in select locations, mostly in Kabul, and in either US dollars or Afghanistan's currency, the afghani.

The Enduring Afghanistan War: Unraveling the Complexities of a Protracted Conflict

You may want to see also

The cheapest way to send money to Afghanistan

When looking for the cheapest way to send money to Afghanistan, it's important to consider the overall cost of your transfer. This includes transfer fees and exchange rates. While online money transfer providers typically offer better rates and cheaper fees than local banks, it's worth comparing the total cost of different providers to find the best option for you.

One of the cheapest ways to send money to Afghanistan is through an online provider such as Western Union, which was found to be the cheapest option in 99% of searches on Monito.com over the past three months. Western Union offers convenient and flexible options for sending money to Afghanistan, including online transfers, app transfers, and cash pickup at thousands of agent locations in the country. The average cost of online money transfers to Afghanistan with Western Union is 7.6% of the amount sent, although this can vary depending on the country you are sending from.

Another option for sending money to Afghanistan is Small World, a Financial Conduct Authority (FCA)-approved money transfer service. Small World offers great rates and low fees, with an easy-to-use platform that allows you to convert any major currency to Afghanis instantly. They also have a network of payment points across Afghanistan, ensuring convenient access to the funds you send.

To send money to Afghanistan, you will typically need to provide photo identification, such as a driver's license or passport, and your recipient's information, including their name and contact details. If you are sending money to an Afghan bank account, you will also need the account number, SWIFT or IBAN, and the recipient's bank branch address. It is also important to consider the safety of the transfer service, and to use a provider that is registered with a relevant industry regulator, such as the FCA in the United Kingdom.

The Many Names of Afghanistan's People: A Cultural Exploration

You may want to see also

The fastest way to send money to Afghanistan

Due to the Taliban's rise to power in Afghanistan, many money transfer companies, including Western Union and MoneyGram, have suspended their services to the country. However, some companies have since resumed their operations in Afghanistan. Here is a guide on the fastest way to send money to Afghanistan:

Western Union

Western Union is the world's largest money transfer firm, offering services in over 200 countries and territories. They resumed their money transfer services to Afghanistan in September 2021. Western Union offers online money transfers, as well as transfers through their app and agent locations. Their online transfers typically take less than 6 minutes to complete, and the funds are often available for pickup within minutes at their agent locations in Afghanistan. Western Union also provides tracking services for your money transfers.

MoneyGram

MoneyGram is another global remittance provider that resumed its services in Afghanistan in September 2021. They offer online money transfers, as well as transfers through their app and agent locations. MoneyGram's funds often arrive within minutes and are available for pickup at their locations across Afghanistan.

Small World

Small World is an FCA-approved money transfer service that offers fast transfer services. They have a network of payment points across Afghanistan, ensuring convenient access to the funds you send. Small World provides competitive exchange rates and low fees, and their payment process is simple and secure. You can send money through their website or mobile app.

It is important to note that due to the uncertain financial status of Afghanistan, there may be obstacles, delays, and refusals when attempting to send money into the country. Additionally, some limitations may apply to money transfer services, such as specific payout locations and currencies.

The Complex Withdrawal: Examining the Troop Pullout from Afghanistan

You may want to see also

The status of international remittances to Afghanistan

International remittances to Afghanistan have been significantly impacted by the country's political situation in recent years. The Taliban's rise to power and the subsequent withdrawal of US troops in 2021 led to a pause in international remittances to and from the country. This disruption has had a substantial effect on Afghans, both within the country and abroad, as financial assistance from overseas loved ones is a primary source of income for many.

In the aftermath of the Taliban's takeover, major money transfer companies, including Western Union and MoneyGram, suspended their services to Afghanistan. This decision was influenced by the deteriorating security situation and the need to comply with international sanctions against the Taliban and associated groups. The suspension of services caused difficulties for Afghans like Mustafa Barakzai, who relies on Western Union to send money to his family in Afghanistan to support their basic needs.

However, within a short period, both Western Union and MoneyGram resumed their money transfer operations to Afghanistan. Western Union announced the resumption of services on September 2, 2021, offering a two-week period of $0 transfer fees to encourage the flow of funds into the country. MoneyGram also waived online transfer fees temporarily to assist Afghans in accessing emergency funds.

While the resumption of services provided some relief, challenges remain. Outbound services from Afghanistan remain suspended, and payout locations are limited, mostly to Kabul. Additionally, the Afghan currency, the Afghani, has suffered due to long delays and suspensions in foreign currency exchange, causing its value to plummet.

As of October 2022, due to the uncertain financial status of Afghanistan, it was not advised to send money to the country. Customers intending to send money to Afghanistan continue to face obstacles, delays, and potential refusals. The situation is ever-evolving, and those seeking to send money are advised to stay updated with the latest developments and consult reliable sources for guidance.

A Nation's Gratitude: Honoring Our Iraq and Afghanistan Veterans

You may want to see also

Frequently asked questions

You can send money to Afghanistan through an online provider such as Western Union or MoneyGram.

The cost of sending money to Afghanistan depends on the provider and the amount you wish to send. Western Union, for example, allows you to send up to 8,000 NOK before they need to verify your identity, after which your send limit increases to 35,000 NOK.

Depending on the provider and delivery method, the money can be available for pickup in minutes.

Due to the current political situation in Afghanistan, the global consensus has been to pause international remittances in and out of the country. Customers who intend to send money to Afghanistan are likely to face obstacles, delays, and refusals. It is recommended that you check for updates on the financial situation before attempting to send money.