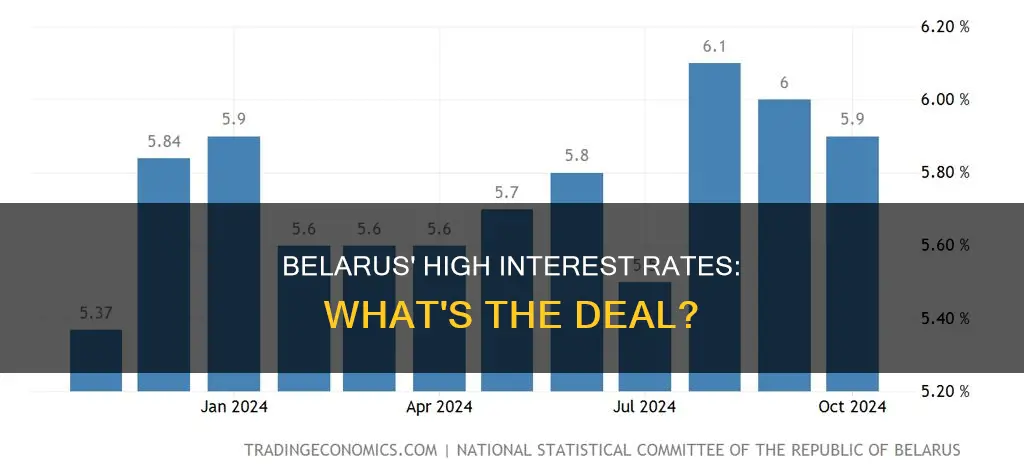

Belarus's interest rates have historically been high, with the refinancing rate ending 2022 at 12.00%, compared to the Eastern European average of 8.40%. Belarus's cash rate (policy rate: month end: refinancing rate) was set at 9.50% per annum in July 2024, and the country's interest rates have been as high as 480.00% per annum in the past. Belarus's deposit interest rate was reported at 4.852% per annum in 2023, down from 8.421% in 2022, and the lending interest rate was 9.962% per annum in 2023, down from 12.716% in 2022. These high interest rates have a significant impact on the country's economy and financial landscape.

What You'll Learn

Belarus's refinancing rate

The refinancing rate in Belarus ended 2022 at 12.00%, up from 9.25% at the end of 2021 and down from 23.50% a decade earlier. In July 2024, the refinancing rate was set at 9.50% per annum. The refinancing rate is the rate of the National Bank of the Republic of Belarus, which is a basic instrument for regulating interest rate levels in the money market and setting interest rates on liquidity provision operations for banks.

The refinancing rate in Belarus has fluctuated over time, reaching an all-time high of 480.00% per annum in January 1995 and a record low of 7.75% in March 2021. The average refinancing rate in Eastern Europe was 8.40% at the end of 2022, lower than the rate in Belarus.

FocusEconomics collects Belarusian interest rate projections from a panel of analysts at leading forecast institutions. These projections are then validated by a team of economists and data analysts to provide a Consensus Forecast for the next ten years.

Belarus Visa: Easy or Difficult to Get?

You may want to see also

The role of the National Bank of the Republic of Belarus

The National Bank of the Republic of Belarus is the central bank and state agency of Belarus. It is an independent entity, accountable only to the President of the Republic of Belarus. The Head of State approves the Statute of the National Bank and appoints the Bank's chairman and board members with the Parliament's consent.

The National Bank's primary objectives include maintaining price stability, ensuring the stability of the Belarusian banking system, and securing the safe and efficient functioning of the payment system. It is responsible for developing and implementing the country's monetary policy, regulating credit and leasing activities, managing money circulation, and carrying out currency regulation and foreign exchange control. The bank also lends resources to banks, issues money and securities, and manages the country's gold and foreign currency reserves in consultation with the President.

Additionally, the National Bank is responsible for banking supervision, licensing banking activities, carrying out financial stability monitoring, and organizing and supervising the payment system's functioning. It also has a role in promoting financial inclusion and financial literacy among the population. The bank maintains various economic and financial statistics, including banking, monetary, financial market, balance of payments, and international investment position statistics.

The history of the National Bank of the Republic of Belarus dates back to 1922 when it was established as the "Belarusian Republican Bank" under the direction of the State Bank of the USSR. The bank underwent reorganizations in 1959 and 1987 and took on its current form in 1990 after Belarus declared independence from the Soviet Union. The independence of the Belarusian banking system and the National Bank was established with the adoption of laws on banking in December 1990, which came into force on January 1, 1991.

Belarus and Morocco: A Tale of Two Countries

You may want to see also

Belarus's interest rates compared to other countries

Belarus's refinancing rate, which is its policy rate, was 9.50% per annum in July 2024. This is lower than the rate in the previous month of June, which was 9.75%. Belarus's refinancing rate has decreased over the past decade, from 23.50% in 2014 to 12.00% at the end of 2022. In March 2021, the refinancing rate reached a record low of 7.75% per annum.

The country's interest rates are set by the National Bank of the Republic of Belarus. Belarus's interest rates are higher than the average in Eastern Europe, which was 8.40% at the end of 2022.

For example, in Switzerland, the annual GDP interest rate is currently lower than Belarus's. Meanwhile, Belarus's interest rates are lower than those in countries such as the Philippines, which recently reduced its interest rate to 3.50%.

First Class Mail: International Service in Belarus?

You may want to see also

The impact of interest rates on Belarus's economy

Interest rates in Belarus have historically been high, reaching an all-time high of 480% in 1995. More recently, the refinancing rate was 12% at the end of 2022, down from 23.5% a decade earlier and 9.5% in July 2024. These high-interest rates have had a significant impact on the country's economy.

One of the main effects of high-interest rates is the encouragement of savings deposits in commercial banks. This is because the deposit interest rate, which is the rate paid by commercial banks for demand, time, or savings deposits, is also relatively high in Belarus. In 2023, the deposit interest rate was 4.852% per annum, down from 8.421% in 2022. This decrease in interest rates can help revitalise the economy and increase exports, as it encourages lending and investment, making it cheaper for businesses to borrow money to fund their operations.

High-interest rates can also have a stabilising effect on a country's currency. In Belarus, the exchange rate against the US dollar averaged 2.97 (USD/BYN) in June 2023. A strong currency can help to control inflation, which has been a concern in Belarus, with an inflation rate of 5.8% in June 2024, the highest in five months. High-interest rates can also attract foreign investment, as investors seek higher returns, which can further strengthen the currency.

However, high-interest rates can also have negative effects on an economy. They can make borrowing more expensive for businesses and consumers, slowing economic growth. Additionally, high lending rates can increase the risk of default on loans, leading to higher levels of non-performing loans in the banking sector. Belarus's banks reported non-performing loans as a percentage of total gross loans, although the specific figure is not available.

Overall, interest rates have had a complex and varied impact on Belarus's economy, influencing savings, investment, inflation, and the value of its currency. The effects of interest rate changes can be unpredictable, and so the National Bank of the Republic of Belarus must carefully consider the potential consequences of any adjustments.

Belarus Ruble: Floating or Fixed?

You may want to see also

Historical data and trends of Belarus's interest rates

Belarus's refinancing rate has fluctuated over the years, ending 2022 at 12.00%, up from 9.25% in 2021, and significantly down from 23.50% a decade earlier in 2012. This data indicates a general downward trend in the refinancing rate over the past decade.

Deposit interest rates in Belarus have also varied, with an annual average of 14.333% from 1993 to 2023. In 2023, the deposit interest rate was reported at 4.852% per annum, a decrease from 8.421% in 2022. The highest rate was recorded in 1995 at 100.817% per annum, while the lowest was in 2023 at 4.852% per annum.

Lending interest rates have shown similar volatility, with an annual average of 17.496% from 1992 to 2023. The rate was 9.962% per annum in 2023, down from 12.716% in 2022. The highest lending interest rate was observed in 1995 at 175.000% per annum, while the lowest was in 2008 at 8.550% per annum.

Interest rate spreads, the difference between lending and deposit rates, have also fluctuated. In 2023, the spread was 5.110% per annum, up from 4.295% in 2022. The highest spread occurred in 1995 at 74.183% per annum, while the lowest was in 2012 at -2.808% per annum.

These historical trends demonstrate the variability of interest rates in Belarus, with some periods of high interest rates and others of more moderate levels. The data also highlights the significant decrease in interest rates from the mid-1990s to the 2020s, indicating a long-term downward trajectory.

Belarus' Historic Victory: Record-Breaking Football Match

You may want to see also

Frequently asked questions

Belarus' interest rate is not consistently high and has been decreasing over the years. In July 2024, the interest rate was 9.50% per annum, down from 12.00% at the end of 2022.

As of July 2024, the refinancing rate in Belarus is 9.50% per annum.

The refinancing rate in Belarus is higher than the average in Eastern Europe. For example, the average refinancing rate in Eastern Europe was 8.40% at the end of 2022, while Belarus' rate was 12.00%.