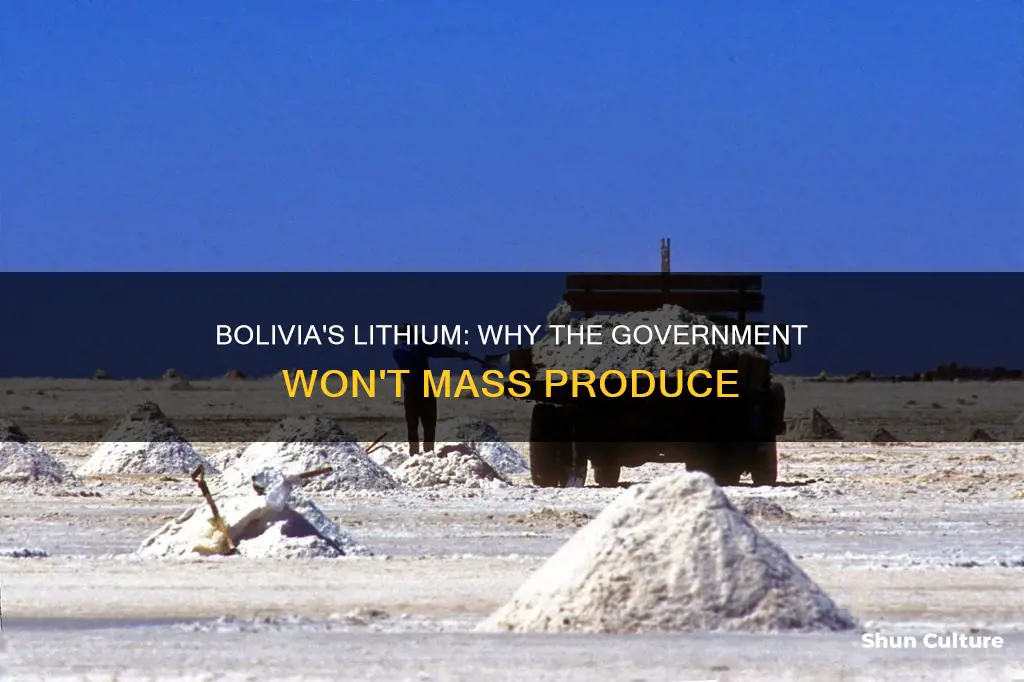

Bolivia is home to the world's largest lithium deposits, but its production has not yet reached commercial viability. The country has faced challenges in developing its lithium industry, including capacity and financial constraints, as well as opposition from local communities concerned about the environmental impact of lithium extraction. There are also technical challenges unique to Bolivia that make lithium extraction more difficult and costly compared to its neighbouring countries. As a result, Bolivia has struggled to attract foreign investment and develop a thriving lithium industry.

| Characteristics | Values |

|---|---|

| Reason for developing lithium industry | To become a global leader in lithium production, developing new lithium batteries and related products |

| Lithium reserves | 21 million tons |

| Government's aim | To supply nearly half of the global demand and set up an electric vehicle production hub |

| Concerns | Environmental impact, water scarcity, exploitation of natural resources, profit-sharing, lack of transparency, mismanagement of freshwater |

| Foreign investment | China, Russia, Germany |

| Domestic investment | State-owned Yacimientos de Litio Bolivianos (YLB) |

| Local communities' concerns | Lack of benefit from lithium development, negative impact on traditional livelihoods (tourism, salt market, agriculture), environmental degradation |

| Water usage | 500,000 gallons of water per ton of lithium |

| Production issues | Untested equipment, operational challenges, lack of qualified human resources, technology and infrastructure |

What You'll Learn

Lack of infrastructure, personnel, and technology

Bolivia has the largest lithium resources in the world, but it has not been able to produce lithium on a commercial scale. This is due to a variety of factors, including a lack of infrastructure, personnel, and technology.

Firstly, in terms of infrastructure, Bolivia's salt flats, where the lithium is located, have lower concentrations of lithium than those in Chile and Argentina. This means that more investment is needed to extract the same amount of lithium, and the process takes longer, increasing the cost of production. Additionally, Bolivia's salt flats have a very high concentration of magnesium, which current technology requires miners to remove using lime, further adding to the cost of extraction. The country also faces challenges due to its poor infrastructure compared to its neighbors, making operations more expensive.

Secondly, there is a lack of qualified human resources and technology in the industry. The lithium industry requires specialized knowledge and equipment for extraction and processing. Bolivia has struggled to attract foreign investment and develop the necessary infrastructure due to concerns about the government's handling of the industry, unstable political relations, and protests from local communities.

Finally, the Bolivian government's restrictive policies have also hindered the development of the lithium industry. Law 928, which established the state-owned Yacimientos de Litio Bolivianos (YLB), mandates that only the state can extract and process lithium, with limited private sector and foreign participation allowed in the industrialization phase. This has restricted the involvement of private companies with the necessary expertise and technology, resulting in a waste of time and resources.

In conclusion, Bolivia's lack of infrastructure, personnel, and technology in the lithium industry has hindered its ability to mass-produce lithium. The country needs to address these issues through reengineering the industry, fostering partnerships, and creating favorable policies to attract investment and expertise.

Checked Baggage Rules for AA Flights to Bolivia

You may want to see also

Environmental concerns

The environmental concerns surrounding lithium mining in Bolivia are significant, with potential impacts on water supply, land use, and local ecosystems. The country's salt flats, where lithium is found, are located in some of the driest places on Earth, making them vulnerable to climate change. With Bolivia already facing food insecurity, droughts, and floods, there are concerns that mining and processing lithium could further jeopardize food security through its excessive carbon emissions, water use, and land use.

The most common lithium mining technique, brine extraction, requires excessive land and water use. In Chile, for example, it takes 500,000 gallons of water to produce one ton of lithium. This has led to concerns about water scarcity and contamination in local communities, as well as potential harm to wildlife populations.

Bolivia's lithium deposits have a high concentration of magnesium, which adds to the cost and complexity of extraction. Current technology requires the use of lime to remove magnesium salts, further increasing the environmental impact.

There are also worries about the potential impact on local ecosystems and the Indigenous communities that steward them. Lithium extraction can deplete and contaminate freshwater sources, affecting both wildlife and the livelihoods of residents who rely on tourism and salt mining.

Local communities near the Uyuni salt flat are particularly concerned about the environmental impact of lithium mining, as they depend on the salt flat for their economic livelihood. They fear that brine operations could contaminate the salt flat, driving away tourists and making it difficult to support the local population due to water shortages.

Some residents have expressed a willingness to accept lithium development as long as they can benefit from it. However, they want to ensure that lithium production does not destroy the salt flat or exploit the limited water resources in the desert environment.

Direct lithium extraction (DLE) is being explored as a more environmentally friendly alternative to traditional brine extraction. DLE can preserve over 98% of the water supply used for extraction, making it a more sustainable option for water-scarce areas. However, this technology is still being studied and is not yet widely available.

Overall, there are significant environmental concerns surrounding large-scale lithium mining in Bolivia, particularly regarding water scarcity, land degradation, and the potential impact on local ecosystems and communities.

Bolivia's Political Landscape: Parties and Their Promises

You may want to see also

Water scarcity

Lithium extraction and processing require substantial amounts of water. Approximately 500,000 gallons of water are needed to produce one ton of lithium through brine extraction and treatment. This high water consumption can put a strain on local water supplies, especially in arid regions.

In Bolivia, the Uyuni salt flat, located in the department of Potosí, is at the center of the lithium industry. This region already faces water scarcity issues, and the influx of lithium operations could further deplete and contaminate freshwater resources.

Local communities and activists have expressed concerns about the potential impact of lithium production on their water supply. They worry that the rapid growth of the industry could lead to mismanagement of water resources and environmental degradation. There is also a lack of transparency regarding water usage by lithium facilities, with residents calling for increased disclosure of information.

To address these concerns, local leaders are drafting environmental protection standards and regulations for the lithium industry. They are demanding information on water requirements, expecting the implementation of water treatment plants, and seeking to ensure that waste removal processes are adequate.

Exploring Bolivia's Population: Trends and Insights

You may want to see also

Community opposition

There has been significant opposition to mining in Bolivia, especially from communities in mineral-rich Potosí. Bolivia has a well-organized and active civil society that has toppled presidents and blocked private mining developments.

The Potosí region is where most of Bolivia's lithium is located. However, residents of Potosí are suspicious of the government's handling of the lithium industry. In the past, the government has signed contracts with foreign companies on terms that are unfavourable to the region and the country. For example, the contract with the German company ACI Systems (ACISA) was financially disadvantageous for YLB (Yacimientos de Litio Bolivianos), involved no transfer of technology, and offered no royalties for Potosí.

In 2019, protests erupted in Potosí over unsatisfactory royalties for local communities. Protesters blocked roads and threw explosives at authorities. This eventually led to the resignation of Evo Morales as president.

Many residents living around the salt flats in the Potosí region have traditionally relied on tourism, the domestic salt market, and agriculture. They welcome the development of the lithium industry as long as they can benefit too. However, they are concerned about the environmental impact of lithium production, which involves complex chemical treatment. They want to ensure that lithium production does not destroy the salt flats or exploit the little water available in the desert environment.

Local leaders are busy writing up environmental protection standards as the government evaluates companies vying for partnerships. They want to know exactly how much water will be required for mining operations and expect there to be water treatment plants to prevent contamination from harming residents and local wildlife. They are also concerned about waste removal as lithium mining draws more people to the area.

Salt sellers in the town of Colchani, which sits on the edge of the Uyuni salt flat, are worried that if brine operations contaminate the salt flat, there won't be clean salt to sell. Tourists won't visit because the wildlife will be driven out. It will be too hard to support even the local population because of water shortages.

A History of Exploitation

Bolivia has a long history of exploitation of its natural resources by foreign interests, leaving many residents in poverty. There is a fear that the same will happen with lithium.

In the past, attempts to privatize the industry in the 1990s failed. Longtime President Evo Morales attempted to expand the government's role in the industry through a state-owned lithium company and to promote local production of batteries and electric vehicles, but these efforts were also unsuccessful.

A Need for Consultation

A thorough consultation process, in which the government and investors meet with local communities to discuss the parameters of development, is seen as the only reliable way to protect all the interests at stake in the region. This process is called "socialización" in Bolivia, and both critics and supporters are clamoring to influence how it is carried out.

Local communities want to be taken into account in terms of direct and indirect jobs and are also hoping for royalties, such as funds for building schools, roads, and other public infrastructure.

Bolivian Government: A Study in Corruption and its Impact

You may want to see also

Unreliable foreign investment

Bolivia's lithium industry has a history of unsuccessful attempts to attract foreign investment and develop thriving operations. The nationalization of lithium production in 2008 was met with criticism, as the country was perceived to lack the necessary technology and expertise. This move, along with years of stalled pilot programs and investment agreements, deterred foreign investors from partnering with the state-owned Yacimientos de Litio Bolivianos (YLB), which is the mandated entity for any company seeking to mine lithium in Bolivia.

One of the few companies that struck a deal with YLB, a German firm, withdrew from the country in 2019 amid protests over unsatisfactory royalty payments and environmental concerns. This incident underscores the unreliable nature of foreign investment in Bolivia's lithium industry, as community opposition and social unrest have influenced investors' decisions.

Moreover, the Bolivian government's partnerships with China and Russia to establish lithium extraction and processing facilities have sparked concerns in the United States. U.S. officials worry about the aggressive negotiation tactics of Chinese companies and the potential reinforcement of an extractive model that may not prioritize local development. However, the Bolivian government has dismissed these concerns, accusing the U.S. of "American imperialism" and attempting to "weaponize lithium to undermine democracies."

The window of opportunity to capitalize on surging lithium demand is narrowing, with China, the European Union, and the U.S. rapidly dominating the market. China already produces 79% of the world's lithium batteries and controls approximately 60% of the global extraction market. As a result, Bolivia faces an increasingly challenging landscape to compete with these established supply chains and production infrastructures.

In conclusion, unreliable foreign investment has been a significant hurdle for Bolivia in its pursuit of mass lithium production. The country's efforts have been hindered by a combination of factors, including community opposition, social unrest, and concerns over environmental and social impacts. Additionally, the complex dynamics with international investors, particularly the U.S., China, and Germany, have further complicated Bolivia's ability to attract and retain the necessary investments for large-scale lithium production.

Exploring Unique Cultural Treasures in Bolivia

You may want to see also

Frequently asked questions

Bolivia has the largest lithium deposits in the world, but it has not been able to produce lithium on a commercial scale. This is due to a combination of factors, including a lack of leadership, qualified human resources, technology, and infrastructure. There is also opposition to mining from local communities, particularly in mineral-rich Potosí, due to concerns about the environmental impact of lithium extraction and a history of unfavourable deals with foreign companies.

The Bolivian government has taken some steps to develop its lithium industry, such as hiring a leading advisory firm and launching a bidding round to invite private firms to test new technology. However, there are concerns that the government is not doing enough to address the environmental and social impacts of lithium extraction, and that it is not adequately consulting with local communities.

If the Bolivian government does not address these issues, it could miss out on the opportunity to capitalize on the surging global demand for lithium. There are also concerns that a lack of responsible management of the lithium industry could lead to negative environmental and social impacts, including water scarcity and contamination, and conflict with local communities.