New Brunswick's personal income tax is collected by the federal government through the Canada Revenue Agency (CRA). The province uses a progressive tax structure, with four tax brackets that increase each year based on inflation. The tax rate charged in New Brunswick on the first $47,715 of taxable income is 9.40%. A higher rate of 14% is charged on the next $47,716, followed by a 16% rate on the next $81,325, and a 19.5% rate on income over $176,756. The CRA advises taxpayers to keep tax records and supporting documents for at least six years.

What You'll Learn

Provincial corporation tax

New Brunswick's corporation tax is levied at two rates: a lower rate of 2.5% and a higher rate of 14%. The lower rate applies to the first $500,000 of income, while the higher rate applies to all income beyond that. This is a dual tax rate system, and New Brunswick small businesses are eligible for the lower rate regardless of the amount of passive income they earn.

The province's corporate tax system is designed to support businesses of all sizes, with the lower rate benefiting smaller enterprises and start-ups, while the higher rate applies to larger, more established companies. The tax structure is progressive, meaning that as a company's income increases, it will pay a higher proportion of tax. This system is intended to be fair and equitable, ensuring that smaller businesses are not burdened with excessive taxes that could hinder their growth and development.

The specific tax rates and brackets for corporation tax in New Brunswick are determined by the provincial government and may be subject to change over time. It is important for businesses to stay informed about any updates to the tax laws and regulations to ensure compliance and effective financial planning.

When calculating corporate taxes in New Brunswick, businesses can utilise Schedule 366, the New Brunswick Corporation Tax Calculation. This tool helps entities compute their tax liability before applying any credits or deductions. Additionally, businesses can take advantage of various tax credits offered by the province, such as the Research and Development Tax Credit and the Small Business Investor Tax Credit. These credits can help reduce the overall tax burden and encourage economic growth and investment in New Brunswick.

The province's corporate tax structure is designed to be straightforward and efficient, enabling businesses to understand and meet their tax obligations with ease. By offering competitive tax rates and incentives, New Brunswick aims to foster a business-friendly environment that attracts new enterprises and supports the expansion of existing ones.

Safety in Numbers: Examining the Security of North Brunswick

You may want to see also

Personal income tax

New Brunswick's personal income tax is collected by the federal government through the Canada Revenue Agency (CRA). The personal income tax rates and bracket structure are applied to federally-defined New Brunswick taxable income.

New Brunswick uses a progressive tax structure with four tax brackets. The tax brackets increase each year, based on inflation. This means that you may be taxed at different rates depending on the amount of income you have earned in any given year.

The federal basic personal amount (BPA) for the 2023 tax year is $15,000, while the New Brunswick BPA amount is $12,458. This is the allowable amount of income that you can earn before you must start paying taxes.

New Brunswick's tax system is similar to other Canadian provinces, with many of the provincial taxes and credits complementing similar credits at the federal level. However, there are some unique credits for residents of New Brunswick, such as the Low-Income Tax Reduction and the Seniors' Home Renovation Tax Credit.

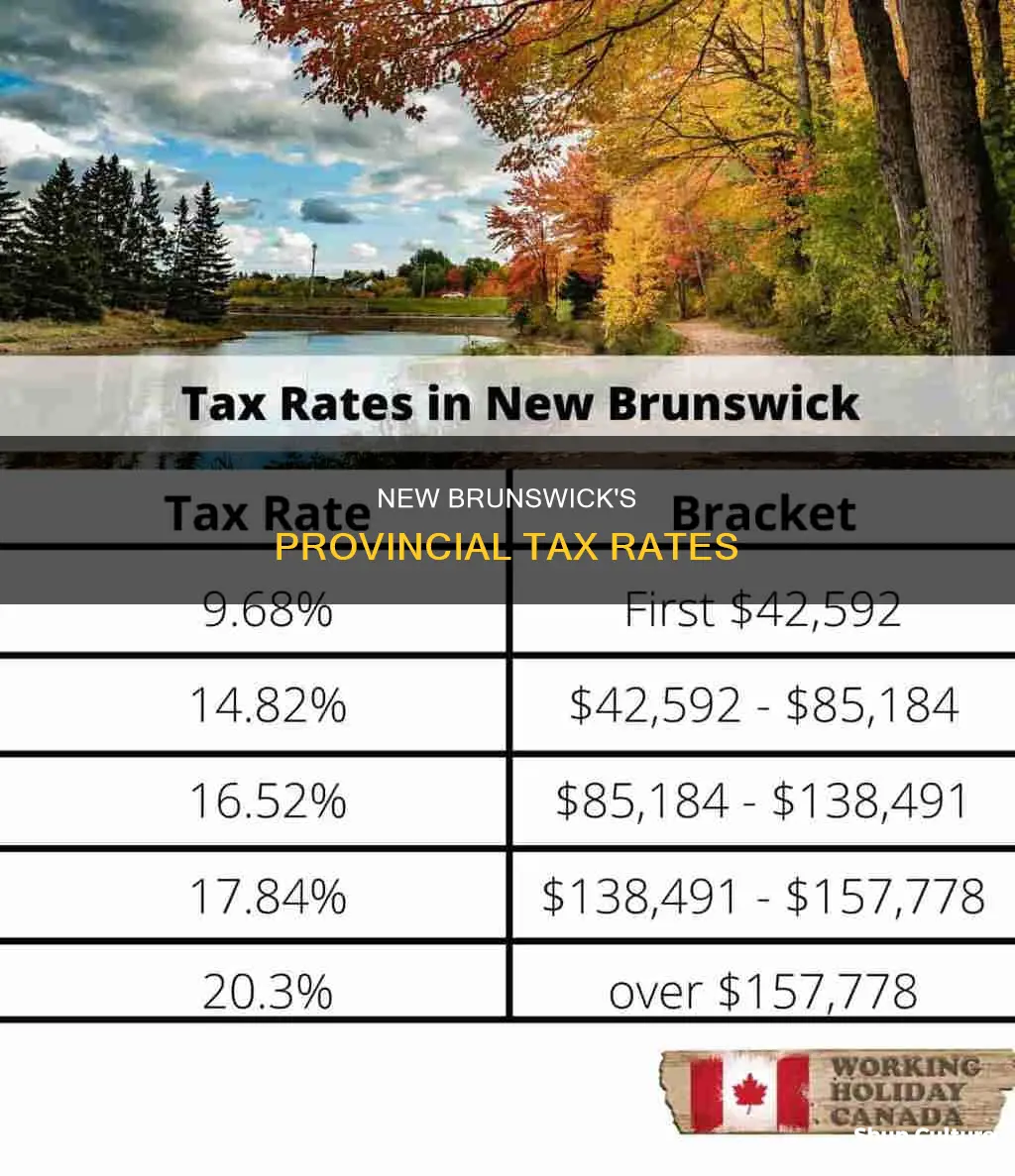

- 9.68% on the first $40,492

- 9.68% on the first $41,059

- 9.68% on the first $41,675

- 9.68% on the first $42,592

- 9.68% on the first $43,401

- 9.4% on the first $43,835

- 9.4% on the first $44,887

- 9.4% on the first $47,715

- 9.4% on the first $49,958

- 14.82% on $40,492 to $80,985

- 14.82% on $41,059 to $82,119

- 14.82% on $41,675 to $83,351

- 14.82% on $42,592 to $85,184

- 14.82% on $43,401 to $86,803

- 14.82% on $43,835 to $87,671

- 14.82% on $44,887 to $89,775

- 14% on $47,715 to $95,431

- 14% on $49,958 to $99,916

- 16.52% on $80,985 to $131,664

- 16.52% on $82,119 to $133,507

- 16.52% on $83,351 to $135,510

- 16.52% on $85,184 to $138,491

- 16.52% on $86,803 to $141,122

- 16.52% on $87,671 to $142,534

- 16.52% on $89,775 to $145,955

- 16% on $95,431 to $176,756

- 16% on $99,916 to $185,064

- 17.84% on $131,664 to $150,000

- 17.84% on $133,507 to $152,100

- 17.84% on $135,510 to $154,382

- 17.84% on $138,491 to $157,778

- 17.84% on $141,122 to $160,776

- 17.84% on $142,534 to $162,383

- 17.84% on $145,955 to $166,280

- 20.3% over $160,776

- 20.3% over $166,280

Kids in Brunswick CSD: How Many?

You may want to see also

Marginal tax rate

In New Brunswick, the personal income tax is administered and collected by the federal government through the Canada Revenue Agency. The province uses a progressive tax structure with four tax brackets. The tax brackets increase each year, based on inflation. The tax brackets for the 2023 tax year are:

- On the first $47,715

- Over $47,715 up to $95,431

- Over $95,431 up to $176,756

- On the portion over $176,756

The marginal tax rate is different from the effective tax rate, which is the average rate paid on all income. The marginal tax rate is usually higher than the effective tax rate. This is because, in a progressive tax system, income is taxed at differing rates that rise as income increases to certain thresholds.

Getting New Brunswick PR: How Long?

You may want to see also

Payroll tax deductions

New Brunswick's personal income tax is collected by the federal government through the Canada Revenue Agency. The province uses a progressive tax structure, with four tax brackets that increase each year based on inflation.

The payroll tax deductions for New Brunswick include the Canada Pension Plan (CPP) and Employment Insurance (EI). The CPP contribution rate for employees and employers is 5.95%, with a maximum contribution of $3,867.50. EI premiums are set at 1.66% for employees and 1.66 x 1.4 = 2.32% for employers.

The province also offers various tax credits, such as the Low-Income Tax Reduction, which is a non-refundable tax credit that helps reduce the provincial tax payable for eligible low-income residents. The Seniors' Home Renovation Tax Credit is another example, where seniors aged 65 or older can receive a refundable tax credit of up to $10,000 for eligible home improvements.

Additionally, eligible low-income families with dependent children may also receive the New Brunswick Child Tax Benefit and the New Brunswick Working Income Supplement, depending on their income level.

For the 2024 tax year, the federal personal amounts for New Brunswick are as follows:

- Basic personal amount: $15,000

- Minimum basic personal amount: $12,458

The tax rates and income thresholds for New Brunswick in 2024 are:

- 4% on the first $44,887

- 4% on the first $47,715

- 4% on the first $49,958

14% on $47,715 to $95,431

14% on $49,958 to $99,916

16% on $95,431 to $176,756

16% on $99,916 to $185,064

- 84% on $176,756 to $185,064

- 3% over $185,064

The New Brunswick business limit for corporation tax is set at $500,000, with a lower tax rate of 2.5% and a higher rate of 14% for income above the limit.

New Brunswick's Electoral District

You may want to see also

Tax credits

New Brunswick's personal income tax is administered and collected by the federal government through the Canada Revenue Agency. The province's personal income tax rates and bracket structure are applied to federally-defined New Brunswick taxable income. Tax credit amounts are multiplied by the lowest New Brunswick personal income tax rate to calculate the provincial tax credits.

The New Brunswick Low-Income Tax Reduction was implemented in 2001. These amounts are used to reduce the tax payable. Eligible low-income families with dependent children may also receive the New Brunswick Child Tax Benefit and the New Brunswick Working Income Supplement, depending on their income level.

Tax filers may also qualify for other personal non-refundable tax credits provided by the Province of New Brunswick. Here is a list of non-refundable tax credits available to eligible tax filers:

- Basic Personal Amount

- Spouse or Common Law Amount

- Amount for Eligible Dependant

- Amount for Infirm Dependants Age 18 or Older

- Canada Pension Plan Contributions

- Employment Insurance Premiums

- Pension Income Amount

- Disability Supplement Amount

- Interest Paid on Student Loans

- Tuition and Education Amounts

- Amount Transferred from Spouse or Common Law Partner

- Medical Expense Credit

- Overseas Employment Tax Credit

- NB Low-Income Tax Reduction

- NB Political Contribution Tax Credit

- NB Labor-Sponsored Venture Capital Tax Credit

- NB Small Business Investor Tax Credit

For information on eligibility for these credits, contact the Canada Revenue Agency (CRA) or visit the CRA website.

New Brunswick also offers different tax credits for corporations, including the Research and Development Tax Credit and the Small Business Investor Tax Credit.

In addition, the province offers property tax relief programs such as the Residential Property Tax Credit, the Property Tax Allowance, and the Property Tax Deferral Program for Seniors.

GDL Transfer: Alberta to New Brunswick

You may want to see also

Frequently asked questions

The income tax rate in New Brunswick varies depending on the individual's taxable income. The tax rate on the first $47,715 of your income is 9.4%. A 14% tax rate is charged on income between $47,716 and $95,431. A 16% tax rate is applied to income between $95,431 and $176,756. Finally, a 19.5% tax rate is charged on income over $176,756.

The corporation income tax rate in New Brunswick has a lower band of 2.5% and a higher band of 14%.

New Brunswick does not currently have a provincial carbon tax rebate program.