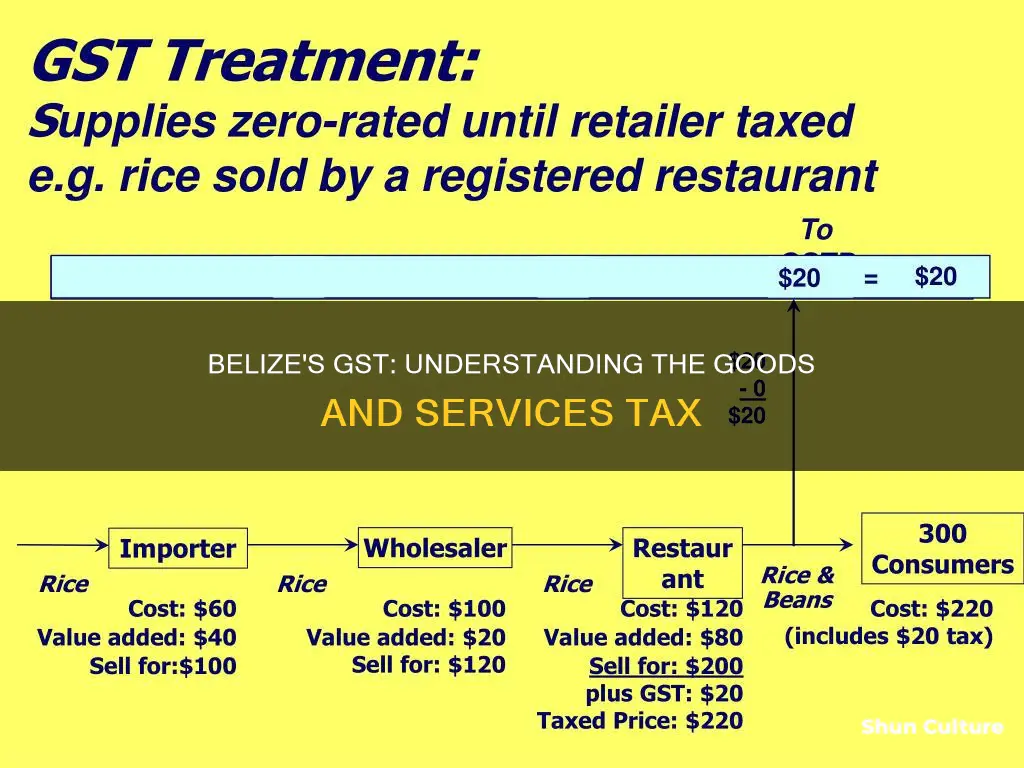

Belize's General Sales Tax (GST) is a 12.5% consumption tax that has been applied to most goods and services in the country since 2010. It is a tax return proposed by the Belize government for enterprises operating within the country. The Department of General Sales Tax is the government body that administers the GST. The main objectives of the GST are to collect revenues, register agents, and audit the agents' accounts to ensure the safety of income and business.

| Characteristics | Values |

|---|---|

| Type of Tax | Consumption tax |

| Applicable On | Supply of goods and services |

| Current Rate | 12.5% |

| Zero-Rated Goods | Staple food items (rice, beans, corn, fresh meat, flour, sugar, eggs, bread, tortilla) |

| Exempt Goods and Services | Water, school fees, house rent, insurance, medicine, hotel rooms |

| Applicable On | Internet data service, government contracts, Business Processing Outsourcing companies |

| Registration Criteria | Annual turnover of $75,000 or more |

| Registration Criteria (for new businesses) | Average monthly value of taxable supplies of $6,250 or more in the first 12 months |

What You'll Learn

Who needs to pay GST?

The General Sales Tax (GST) in Belize is a consumption tax levied on the supply of goods and services in Belize. It has been set at 12.5% since 2010 and is applicable to all commodities. However, there are certain exemptions and zero-rated goods.

Businesses that need to pay GST are those that make sales or have a gross revenue of $75,000 or more annually. Additionally, if a business has been operating for less than 12 months and the average monthly value of taxable supplies was $6,250 or more, they are also required to register for and pay GST.

GST is applicable to goods and services provided within Belize, including internet data services, government contracts, and Business Processing Outsourcing companies. It is also levied on imported products, in addition to other tariffs and taxes such as Import Duties, Cost, Insurance, Freight (CIF Value), and Environmental Tax.

On the other hand, certain staple food items such as rice, beans, flour, sugar, and other locally produced fresh fruits and vegetables are subject to a 0% GST rate. Water, school fees, house rent, insurance, medicine, and hotel rooms are exempt from GST altogether.

It is important to note that GST returns and payments are typically due on a monthly basis, and businesses must submit their Sales and Purchases ledgers when submitting their GST returns. This includes providing information such as their Tax Identification Number (TIN), business address, phone number, and the relevant tax period.

Belize's Economic Engine: Exploring the Country's Key Industries

You may want to see also

Exempt goods and services

The General Sales Tax (GST) in Belize is a consumption tax levied on the supply of goods and services in the country. It has been set at 12.5% since 2010 and is applicable to all commodities. However, certain goods and services are exempt from GST. These exemptions are crucial for businesses to understand when operating in Belize.

Water is exempt from GST in Belize. This means that businesses providing water-related services or selling water products do not need to charge GST to their customers. This exemption ensures that access to this essential resource remains affordable for all.

School fees are also exempt from GST. Educational institutions and related services are not required to include GST in their fee structures. This exemption supports the importance of education and ensures that schools and other educational entities can operate without the additional burden of GST.

House rent is another area where GST is not applicable in Belize. Landlords and property management companies do not need to include GST when setting rental rates for their tenants. This exemption is significant for both tenants and landlords, as it helps keep housing costs more manageable.

Insurance services in Belize are also exempt from GST. Insurance providers do not add GST to the policies they offer, which can include health, life, property, and other types of insurance. This exemption helps keep insurance premiums more affordable for individuals and businesses alike.

Medicine and medical products are exempt from GST in Belize. Pharmaceutical companies, medical device manufacturers, and healthcare providers do not charge GST on their products and services. This exemption ensures that essential healthcare remains accessible and affordable for the population.

Hotel rooms are another category of exempt goods and services in Belize. Hotels and other accommodation providers do not include GST in their room rates. This exemption is beneficial for the tourism industry, as it attracts visitors from around the world and contributes significantly to the country's economy.

In addition to these exemptions, it is worth noting that certain staple food items, such as rice, beans, corn, fresh meat, flour, sugar, eggs, bread, and tortillas, are subject to a 0% GST rate. This means that while GST is applicable, the tax rate is minimal, ensuring that essential food items remain affordable for Belizean citizens.

Belize or Cancun: Unraveling the Safety Dynamics

You may want to see also

How to register for GST

In Belize, the General Sales Tax (GST) is a consumption tax levied on the supply of goods and services. It is important to register for GST if your business falls under the following criteria:

- Your annual turnover is $75,000 or more per annum.

- Your business has been operating for less than 12 months, and the average monthly value of taxable supplies was $6,250 or more.

- You are a promoter of public entertainment or a licensee/proprietor of places of public entertainment, even if your annual gross sales/receipts are less than $75,000.

Voluntary GST registration is also available for those who do not meet the required threshold. Before applying, one must determine if they are carrying on or intend to carry on a business and make or supply taxable goods and services.

To register for GST in Belize, follow these steps:

- Obtain an Application for Registration Form from any local Belize Tax Service (BTS) Office or download it from their website.

- Complete the necessary forms, including the relevant information such as your Tax Identification Number (TIN), business name, address, phone, and fax number.

- Submit the completed GST application form to the Department of General Sales Tax.

- Provide any additional information or documentation that may be requested by the department.

- Upon approval, you will receive a Certificate of Registration, which must be displayed publicly in each business location.

It is important to note that the registration is not for the business activity itself but for the person conducting those activities, whether they are a company, partnership, sole proprietor, trustee, or estate. The entire process can typically be done online or in person.

Belize's National Bird: The Toucan's Appeal

You may want to see also

Filing and payment deadlines

The General Sales Tax (GST) in Belize is typically due on a monthly basis. The exact deadlines may vary, so it is important to check with the Belize Tax Service or official sources for the most up-to-date information.

Businesses registered for GST must submit their returns and payments by 7:00 PM on the tax due date to avoid penalties and interest charges.

The GST return must be filed by all businesses registered for GST. Businesses with an annual turnover of $75,000 or more per annum are required to register for GST. Additionally, businesses that have been operating for less than 12 months and have an average monthly value of taxable supplies of $6,250 or more also need to register.

To register for GST, businesses can fill out the necessary forms provided by the Belize Tax Service, either online or in person.

When filing a GST return, businesses must submit their Sales and Purchases ledgers and provide the following information:

- Tax Identification Number (TIN)

- Name and business name

- Business address, phone number, and fax number

- Tax period indicating the month and year for which the return is being filed

- Due date of the return

- Declaration with the name, signature, position in the company, and date of filing

It is important to note that GST returns require proper books and records of business transactions, including books of account, credit and debit notes, stock-on-hand records, motor vehicle logbooks, system and program documentation, and any other documents that verify transactions or entries in the books of account.

Best Airport for Hopkins, Belize

You may want to see also

Benefits of filing GST

The General Sales Tax (GST) is a consumption tax levied on the supply of goods and services in Belize. It is applied to businesses with annual sales or gross revenue of $75,000 or more. The GST is typically chargeable on goods and services provided within Belize, with some exemptions and zero-rated supplies, such as financial services, medical products, and agricultural products like rice, flour, beans, and sugar.

There are several benefits to filing GST in Belize. Firstly, it allows businesses to claim tax credits for GST paid on business purchases. This means that the input tax on purchases will be covered under GST, and businesses can claim credits for the GST they have paid. Secondly, customers buying products or services will receive tax invoices for their purchases, which can only be issued by a person registered for GST services. These registered persons can then issue tax invoices to customers, allowing them to claim tax credits for their purchases.

Additionally, filing GST in Belize offers better feasibility of logistics and removes the cascading effects of unnecessary taxes. It is also simple and easy to implement. The GST will enable businesses to follow a uniform tax code, freeing them from government restrictions and contributing to the growth of the country's economy.

While there may be some challenges, such as increased operational costs and adapting to new tax laws, the benefits of filing GST in Belize include improved tax management, streamlined business operations, and enhanced opportunities for economic growth.

Belize's Small Business Definition: Understanding the Criteria

You may want to see also

Frequently asked questions

GST stands for General Sales Tax. It is a consumption tax levied on the supply of goods and services in Belize. It has been set at 12.5% since 2010.

Staple food items such as rice, beans, corn, fresh meat, flour, sugar, eggs, bread, and tortillas are subject to a 0% GST rate. Water, school fees, house rent, insurance, medicine, and hotel rooms are considered exempt from GST.

You must register for GST if your annual turnover is $75,000 or more. You can register by completing the necessary forms provided by the Belize Tax Service, either online or in person.