The economies of Bahrain and Kerala are vastly different in scale, but they share some commonalities. Both have historically relied heavily on a few primary sectors, with Bahrain's economy dominated by oil and gas, and Kerala's economy traditionally centred around agriculture. However, both regions have made efforts to diversify their economies and reduce dependence on a single industry. Bahrain has successfully developed its banking and tourism sectors, while Kerala has transitioned to a service-based economy, with a strong focus on information technology and tourism. Despite their differences, both Bahrain and Kerala have shown economic resilience and a commitment to adapting their economic strategies to meet changing global demands.

| Characteristics | Values |

|---|---|

| GDP | Kerala: $115 billion (2022-23) Bahrain: $43.27 billion (2022) |

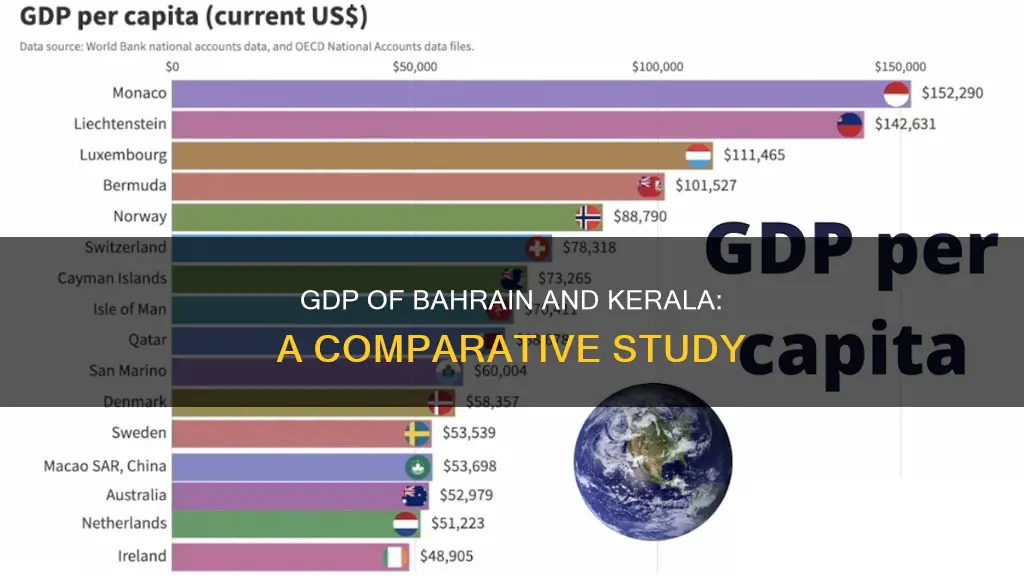

| GDP per capita | Kerala: $3,195 (2022-23) Bahrain: $26,009 (2022) |

| Primary Sectors | Kerala: Services, Agriculture Bahrain: Services, Oil and Gas |

| Population | Kerala: 35.7 million (2023) Bahrain: 1.7 million (2022) |

| Area | Kerala: 38,863 km2 Bahrain: 765 km2 |

| Dependency on Remittances | Both Kerala and Bahrain have significant portions of their populations working abroad and rely on remittances as a major source of income. |

| Tourism | Both places have a strong focus on developing their tourism industries, with Kerala known for its backwaters, houseboats, and cultural attractions, and Bahrain for its historical sites and modern attractions. |

| Fisheries | Fishing and fish processing are important economic activities in both regions. |

| Similar GDP Growth Rates | In recent years, both Kerala and Bahrain have experienced similar GDP growth rates, with Kerala's GDP growing at 9.6% in 2022-23 and Bahrain's GDP growing at 9.2% in 2022. |

What You'll Learn

- Both economies are heavily reliant on the service sector

- Tourism is a significant contributor to the GDP of both Bahrain and Kerala

- High debt is a concern for both economies

- Remittances are a notable source of income for both regions

- The financial services industry is a key driver of growth in both Bahrain and Kerala

Both economies are heavily reliant on the service sector

The economies of Bahrain and Kerala are markedly different in scale and context, but they do share a heavy reliance on the service sector. Bahrain's economy is heavily dependent on oil and gas, but it has also invested significantly in banking and tourism. The country has a robust banking sector and is a regional financial and business centre, with a successful finance industry. Bahrain's banking and financial services sector has benefited from the regional boom driven by demand for oil, with petroleum accounting for 60% of export receipts.

Despite this, Bahrain has recognised the need to diversify its economy away from oil, and has expanded into other sectors such as banking, heavy industries, retail, and tourism. The country has a strong regulatory framework for its financial industry, and its urgency in embracing economic liberalisation has contributed to its success. Bahrain's economy is also supported by its successful tourism industry, with the country being a popular destination, particularly for Gulf countries' residents.

Similarly, Kerala's economy has gradually shifted from an agrarian economy to a service-based one. The tertiary sector, which includes hospitality, tourism, medical services, information technology, transportation, and education, contributes around 65% of the state's revenue. Kerala's economy is based on a social democratic welfare state, and it has the second-lowest poverty rate in India. The state has a strong focus on human resource development, investing a large proportion of its revenue in education and healthcare.

Kerala's economy is also heavily reliant on remittances from its large emigrant population, with around 1.6 million Keralites working overseas, mainly in the Gulf countries. The state has a highly educated population, with a literacy rate of 93.9% compared to the national average of 74%. This has contributed to the success of its service sector, particularly in information technology, education, and medical services.

Both Bahrain and Kerala have recognised the importance of diversifying their economies and investing in the service sector to drive economic growth and development.

Exploring Bahrain: Its Unique Culture and Rich History

You may want to see also

Tourism is a significant contributor to the GDP of both Bahrain and Kerala

In 2024, Bahrain unveiled a new tourism strategy, aiming to attract 14.1 million tourists by 2026 and increase the contribution of the tourism sector to its GDP to 11.4%. Bahrain's strategic location in the Persian Gulf makes it an attractive destination for long weekends and recreational activities for people from other Gulf countries. The Bahrain Tourism and Exhibitions Authority (BTEA) organises, promotes and manage events, conventions and exhibitions related to art, culture, business, entertainment and sports to attract tourists.

Kerala, a state in India, is recognised internationally as a tourist destination. Tourism is a principal contributor to the state's economy, accounting for about 10% of its Gross State Domestic Product. In 2015, the total revenue generated from tourism in Kerala was 26,689.63 crores, with a compound annual growth rate (CAGR) of 11.33% over the previous decade. Kerala's varied geographical features, including its beaches, historical sites, heritage, culture, forests and environmental resources, have made it one of the most sought-after destinations in Asia.

Tourism in Kerala creates employment, generates income, and promotes traditional industries. It is estimated that the tourism sector has generated over 14 lakh jobs in Kerala, with the total number of jobs created directly and indirectly by the sector between 2009 and 2012 accounting for 23.52% of the state's total employment. Foreign exchange earnings from tourism in Kerala have also been steadily increasing over the years, except for a decline during the global financial crisis in 2009.

LGBT Safety in Bahrain: A Complex Reality

You may want to see also

High debt is a concern for both economies

While the economies of Bahrain and Kerala differ in many ways, one common concern they share is their high debt. Both Bahrain and Kerala have economies that are vulnerable to high debt levels, which can impact their long-term growth and stability.

For Bahrain, a small island country near the western shores of the Persian Gulf, debt vulnerability is a significant issue. The country has a favourable investment climate and a successful finance industry, but its economy is heavily dependent on oil and gas, as well as foreign workers. While Bahrain has diversified its economy to some extent, investing in banking, heavy industries, retail, and tourism, it still relies heavily on oil revenues. In 2017, lower world energy prices generated a sizeable budget deficit of about 10% of GDP. The country's debt-to-GDP ratio is a concern, and it has at times received budgetary support from neighbouring countries like Saudi Arabia, Kuwait, and the United Arab Emirates.

Kerala, a state in India, also faces challenges due to its high debt burden. In the 2019-2020 fiscal year, Kerala's debt was estimated at 35.53% of its Gross State Product (GSP). The state's debt liability increased by 14.4% from 2013-2014 to 2014-2015, with its liability as a percentage of GSDP reaching 31.4%, higher than the target set by the Kerala Fiscal Responsibility Act. Kerala's economy is based on a social democratic welfare state model, and it spends a large proportion of its revenue on human resource development, including education and healthcare. While Kerala has the second-lowest poverty rate in India, its high debt levels are a concern for the state's long-term economic health.

The implications of high debt for both Bahrain and Kerala are significant. Debt vulnerability can lead to increased borrowing costs, limiting the ability of these economies to invest in growth-promoting initiatives. It can also make them more susceptible to economic shocks and fluctuations in commodity prices, impacting their ability to service their debts. Additionally, high debt levels can constrain government spending on critical areas like infrastructure, social services, and economic development, hindering their ability to respond effectively to economic downturns or crises.

Addressing the issue of high debt is crucial for both Bahrain and Kerala. It requires a combination of strategies, including fiscal discipline, economic diversification, and efficient debt management. By reducing their debt vulnerability, these economies can enhance their long-term growth prospects, improve their creditworthiness, and ensure a more stable and resilient future.

Exploring the Capital City Southwest of Bahrain

You may want to see also

Remittances are a notable source of income for both regions

Remittances are a notable source of income for both Bahrain and Kerala, with money sent home by migrants playing an important role in the economies of both regions. In Bahrain, remittances sent out of the country are a significant proportion of its GDP, while in Kerala, remittances received from migrants contribute a large share of the state's income.

Remittances from Bahrain

Bahrain's economy is heavily dependent on oil and gas, with petroleum accounting for 60% of export receipts, 70% of government revenues, and 11% of GDP. However, remittances sent out of the country by expatriates are also a notable feature of Bahrain's economy. Bahrain is one of the top remittance-sending countries in the world, with remittances sent out of the country equal to 12% of its GDP. The main destination for these remittances is other countries in the Gulf region, with India, Egypt, Pakistan, and the Philippines also receiving significant amounts. The expatriate population in Bahrain is large, comprising about 50.4% of the total population, and these foreign workers send a large portion of their income back to their home countries.

Remittances to Kerala

Kerala has a long history of emigration, particularly to the Gulf countries, and remittances from these migrants are a significant source of income for the state. In 2008, remittances to Kerala totalled Rs. 43,288 crores, which had a substantial impact on the state's economy and the living conditions of its citizens. This amount was nearly a third (31%) of Kerala's NSDP and was more than 5 times the finance Kerala received from the central government. Remittances contributed to an increase in the per capita income of the state, with the figure rising from Rs. 41,814 to Rs. 54,664 when remittances were included.

The impact of remittances is seen in household consumption, saving, and investment, as well as the quality of houses and the possession of modern consumer durables. Remittances have also played a role in enhancing the quality of life in Kerala, contributing to improvements in education and health, as well as the reduction of poverty and unemployment. However, it is worth noting that Kerala's remittance-dependent economy may be vulnerable to external shocks, such as the coronavirus pandemic, which has resulted in job losses for many Keralite migrants in Gulf countries.

Exploring Bahrain's Neighbors and Their Proximity

You may want to see also

The financial services industry is a key driver of growth in both Bahrain and Kerala

Bahrain has been recognised as a leader in Islamic finance and banking, offering deep levels of industry expertise to FinTech companies and banking institutions. The country is also home to the MENA region's leading FinTech hub, Bahrain FinTech Bay, which provides a dedicated coworking space, innovation labs, and advisory services. Bahrain's flexible markets and strong technology infrastructure have also played a crucial role in the growth of its financial services industry.

On the other hand, Kerala's financial services industry is also a vital contributor to the state's economy. The Kerala Financial Corporation (KFC), established in 1953, plays a significant role in boosting industrial growth in the state by strengthening the MSME industrial sector. KFC has sanctioned loans to around 65,000 enterprises to date and is recognised as one of the best-performing state financial institutions in India.

Kerala's financial services industry also benefits from the overall growth of India's financial sector, which includes commercial banks, insurance companies, non-banking financial companies, and other financial entities. The Indian government has introduced several reforms to liberalise, regulate, and enhance the industry, making it one of the world's most vibrant capital markets. The total first-year premium of life insurance companies in India reached US$32.04 billion in FY23, while the non-life insurance sector premiums reached Rs. 1.87 lakh crore (US$22.5 billion) in the same period.

In summary, both Bahrain and Kerala have thriving financial services industries that contribute significantly to their respective economies. Bahrain's industry is built on a strong foundation of Islamic banking and FinTech innovations, while Kerala benefits from a diverse range of financial services and the overall growth of India's financial sector.

Bahrain's Problem Areas: Understanding the Kingdom's Challenges

You may want to see also

Frequently asked questions

The nominal Gross Domestic Product (GDP) of Bahrain was $44,390,820,479 (USD) as of 2022.

Kerala's annual gross state product (GSP) was US$131.98 billion in 2020-2021.

Both Bahrain and Kerala have experienced economic growth and diversification. Bahrain's GDP grew by 2.45% in 2023, with a focus on the non-oil sector, while Kerala achieved a 6.6% growth rate in 2022-23, showcasing positive economic trends.