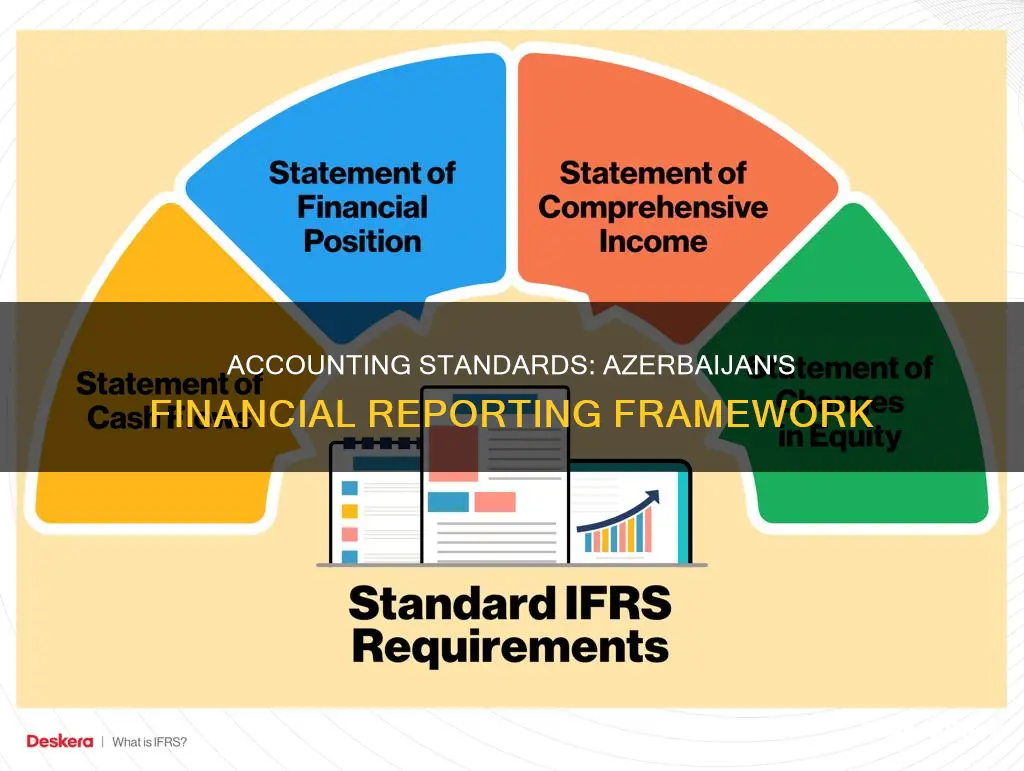

Azerbaijan's accounting standards are based on the norms set by the International Accounting Standards Board (IASB). The country's financial reporting framework is regulated by the Law of the Republic of Azerbaijan on Accounting, which came into force in 2018. This law stipulates the applicable accounting standards and financial reporting requirements for various entities, including public interest entities (PIEs), large, medium, and small enterprises. The Ministry of Finance of the Republic of Azerbaijan is responsible for enacting these financial reporting standards and translating them into mandatory application. The country's accounting structure includes the balance sheet, the profit and loss account, and the notes to the accounts.

| Characteristics | Values |

|---|---|

| Country | Azerbaijan |

| Accounting Law | The Republic of Azerbaijan Accounting Law came into force in 2004 and was amended in 2018. |

| Accounting Framework | The Ministry of Finance of the Republic of Azerbaijan is responsible for enacting the financial reporting standards. |

| Accounting Standards | The Azerbaijani accounting norms respect the norms by the International Accounting Standards Board. |

| Accounting Bodies | The Chamber of Auditors of Azerbaijan Republic, Association of Accountants of the Republic of Azerbaijan |

| Accounting Regulation Bodies | Ministry of Finance of the Republic of Azerbaijan |

| Mandatory IFRS Adoption | Credit organisations, insurance companies, non-state (private) social funds, entities with securities traded on the stock exchange, and commercial organisations exceeding specific thresholds. |

| Optional IFRS Adoption | Any commercial organisation (other than a very small one) that has one or more subsidiaries. |

| Mandatory Audit | Companies with foreign capital, private limited companies, and companies with an annual turnover of more than 2.5 billion AZM or asset value of more than 5 billion AZM. |

| Accounting Year | 1st of January to 31st of December |

What You'll Learn

The Republic of Azerbaijan Accounting Law

The Republic of Azerbaijan has a comprehensive set of laws and regulations governing financial accounting and reporting, known as the Republic of Azerbaijan Accounting Law. This legal framework aims to ensure accurate and transparent financial practices in the country. Here is an overview of the key components of the Republic of Azerbaijan Accounting Law:

Regulatory Bodies and Standards

The Ministry of Finance of the Republic of Azerbaijan is the primary regulatory body responsible for enacting financial reporting standards in the country. The country's accounting norms are aligned with the standards set by the International Accounting Standards Board (IASB). The International Financial Reporting Standards (IFRS) are adopted in their entirety for specific entities, including credit organisations, insurance companies, and non-state private social funds.

Applicability of IFRS

Publication Requirements

Annual accounts must be prepared in the Azeri language and the local currency, known as the manat. However, companies operating under a Production Sharing Agreement (PSA) are exempt from this requirement, and most of these companies opt to use IFRS norms.

Audit Requirements

Audit is mandatory for companies with foreign capital, private limited companies, and companies exceeding specific turnover or asset value thresholds. The Law on Audit of 1994, as amended in 2004, establishes the Chamber of Auditors of Azerbaijan Republic as the entity responsible for maintaining the register of auditors and audit firms, implementing a quality assurance system, and overseeing the certification and professional development of auditors.

Professional Qualifications

To qualify as an auditor in Azerbaijan, individuals must possess a university degree in a relevant field such as accounting, finance, economics, or law. They must also have practical experience and successfully pass a certification program and professional examinations administered by the Chamber of Auditors of Azerbaijan Republic.

Recent Amendments

Exploring East Azerbaijan's Expansive Land: Size in Kilometers

You may want to see also

International Financial Reporting Standards (IFRS)

IFRS is a globally recognised accounting language, with companies in over 140 jurisdictions required to use them when reporting on their financial health. The standards are designed to provide a consistent way of describing a company's financial performance and position, making it easier for investors to compare financial statements across international boundaries.

IFRS is particularly relevant for publicly listed companies, and it is now used by more than 100 countries, including the European Union, and over two-thirds of the G20. In Azerbaijan, IFRS is adopted in its entirety for use by credit organisations, insurance companies, non-state (private) social funds, entities with securities traded on the stock exchange, and commercial organisations that meet specific thresholds concerning revenue, number, and total balance sheet. Additionally, any commercial organisation with subsidiaries must prepare consolidated financial statements in accordance with IFRS.

The Republic of Azerbaijan Accounting Law of 2004 states that any modifications to these standards can only be made by the IASB and that such modifications come into effect when officially adopted by the IASB.

Exploring Azerbaijan's Commitment to Refugees

You may want to see also

Auditing requirements

Azerbaijan's auditing requirements are governed by the Law on Audit of 1994, amended in 2004, which defines audit and audit activities, specifies the entities subject to mandatory audit requirements, and establishes the Chamber of Auditors of the Azerbaijan Republic (CAAR) as the professional organisation for auditors. The CAAR is responsible for maintaining the register of auditors and audit firms, implementing a quality assurance review system, delivering continuing professional development programs, conducting professional examinations for auditor certification, and monitoring compliance with the Code of Ethics.

Under the Law on Audit, audits are mandatory for business entities that are required to publish their financial statements. This includes public interest entities (PIEs) such as credit institutions, insurance companies, investment funds, listed companies, and commercial entities with specific characteristics. The financial year in Azerbaijan runs from 1 January to 31 December, and annual accounts should be in Azeri and the local currency (manat), except for companies operating under a Production Sharing Agreement (PSA), which are exempt from these requirements.

To qualify as an auditor in Azerbaijan, individuals must possess a university degree in a relevant field such as accounting, finance, economics, or law, have at least three years of practical experience, and successfully pass a certification program and professional examinations administered by the CAAR. Additionally, to practice as an auditor, registration with the CAAR, inclusion in their register of auditors, and fulfilment of continuous professional development (CPD) requirements are mandatory.

The CAAR conducts quality assurance (QA) reviews of all auditors, with inspections carried out at least once every three years. The results of these inspections are published annually, and any disciplinary actions are managed by the Ethics, Disputes, and Disciplinary Committee.

The CAAR has translated and adopted international standards, such as the 2016-2017 Handbook of International Quality Control, Auditing, Review, Other Assurance, and Related Services Pronouncements. They also offer educational programs, seminars, and training on auditing standards to enhance members' understanding and implementation.

Commonwealth and Azerbaijan: A Membership Mystery

You may want to see also

The Chamber of Auditors of Azerbaijan Republic

The Chamber of Auditors of the Republic of Azerbaijan is a government agency responsible for overseeing state finances. The Chamber of Auditors was established in 1996, in accordance with the Law on Audit of 1994, to regulate the audit profession. Membership is mandatory for auditors and audit firms. The Chamber is responsible for maintaining the register for auditors and audit firms, organising and implementing a quality assurance review system, delivering continuing professional development programs for auditors, and managing professional examinations for auditor certification.

The Chamber of Auditors also has the following duties: reviewing the draft budget and implementing the state budget, including extra-budgetary funds and expenditures; providing annual reports on the draft budget and the state budget; and implementing financial control over state property management, the utilisation of funds allocated to state programs, the appointment and use of grants and financial assistance, and the protection of the environment.

The Chamber of Auditors is also involved in the implementation of International Financial Reporting Standards (IFRS). While the adoption of corporate accounting standards is the responsibility of the Ministry of Finance, the Chamber of Auditors is a member of the Ministry's Advisory Board and is involved in discussions and legislation drafting to enhance the statutory framework for the profession. The Chamber of Auditors also offers a professional educational program for auditors and continuing professional development programs.

In addition to its role in the financial sector, the Chamber of Auditors has established bilateral cooperation with several supreme audit institutions worldwide, including the State Audit Office of Georgia, the Supreme Audit Court of the Islamic Republic of Iran, and the Turkish Court of Accounts.

The Chamber of Auditors is led by a Chairman, a Deputy Chairman, and a Head of Office. Membership in the Chamber is maintained through mandatory registration for auditors and audit firms, and the organisation is responsible for monitoring compliance with the Code of Ethics. The Chamber of Auditors also has the authority to establish an investigative and disciplinary mechanism for its members, with the stated objectives of ensuring transparency, compliance with ethical and quality control standards, and preventing unfair competition.

Russian Speakers in Azerbaijan: A Significant Number?

You may want to see also

National Professional Accountancy Organisations

Azerbaijan's accounting norms are in accordance with the International Accounting Standards Board (IASB). The Republic of Azerbaijan Accounting Law (2004) states that the International Financial Reporting Standards (IFRS) are to be used by credit organisations, insurance companies, non-state (private) social funds, entities with securities traded on the stock exchange, and commercial organisations exceeding specific thresholds concerning revenue, number and total balance sheet.

The Chamber of Auditors of the Azerbaijan Republic is the National Professional Accountancy Organisation in the country. The Chamber of Auditors is responsible for maintaining the register of auditors and audit firms, implementing a quality assurance review system, arranging and delivering the Continuing Professional Development (CPD) program for auditors, managing and conducting professional examinations for the certification of auditors, establishing and conducting an investigation and disciplinary system, and monitoring compliance with the Code of Ethics.

The Chamber of Auditors of Azerbaijan was established in accordance with the Law on Audit of 1994, which was amended in 2004. This law defines audit and audit activities, specifies the scope of entities subject to mandatory audit requirements, and establishes the Chamber of Auditors as the professional organisation for auditors. The law also outlines the requirements to become an auditor and details the rights, responsibilities, and liabilities of the auditor.

To qualify as an auditor in Azerbaijan, an individual must have a university degree in accounting, finance, economics, or law, have three or more years of practical experience, and successfully pass a certification program and professional examination administered by the Chamber of Auditors. In addition, to practice as an auditor, an individual must be a member of the Chamber of Auditors, be included in the register of auditors, and fulfill CPD requirements.

The Chamber of Auditors plays a crucial role in regulating the audit profession in Azerbaijan, and its standards and requirements are essential for ensuring the quality and compliance of financial reporting in the country.

Exploring Wealth: Azerbaijan vs Turkey

You may want to see also

Frequently asked questions

The Republic of Azerbaijan Accounting Law, which came into force in 2018, stipulates that public interest entities (PIEs) must use International Financial Reporting Standards (IFRS).

PIEs include credit institutions, insurance companies, investment funds, listed companies, non-state (private) social funds, commercial entities with one or more subsidiaries, and commercial enterprises exceeding two of the three thresholds: revenue, total balance sheet, and average number of employees.

Large entities must prepare their financial statements in accordance with IFRS for SMEs or may opt to apply full IFRS. Medium-sized entities must apply IFRS for SMEs. Small entities must maintain accounting records in accordance with the rules for micro and small businesses established by the Ministry of Finance or may also opt to apply IFRS for SMEs.

The financial year in Azerbaijan begins on the 1st of January and ends on the 31st of December of the same year.