Value Added Tax (VAT) was introduced in Bahrain on 1 January 2019, with a standard rate of 10% applied from 1 January 2022. All businesses registered for VAT in Bahrain must file for their VAT return on specific periods as prescribed by the National Bureau for Revenue (NBR). The NBR is the government entity responsible for implementing and collecting VAT in Bahrain. This paragraph aims to provide an overview of the process of filing VAT returns in Bahrain, including the required steps, deadlines, and potential penalties for non-compliance.

| Characteristics | Values |

|---|---|

| VAT Return Form | Electronic form |

| Submission | Online |

| Website | National Bureau for Revenue (NBR) |

| Website Address | https://www.nbr.gov.bh/ |

| Submission Deadline | Last calendar day of the following month |

| VAT Rate | 10% |

| VAT Registration Threshold | BHD 37,500 |

| VAT Registration | Mandatory for businesses with annual supplies > BHD 5,000,000 |

| VAT Return Frequency | Monthly or quarterly |

| VAT Return Details | VAT on sales and VAT on purchases |

| VAT on Sales | Standard-rated sales, sales to taxpayers in other GCC states, sales subject to domestic reverse charge mechanism, zero-rated domestic sales, exports, exempt sales |

| VAT on Purchases | Standard-rated domestic purchases, imports subject to VAT, purchases subject to domestic reverse charge mechanism, purchases from non-registered suppliers, zero-rated/exempt purchases |

What You'll Learn

VAT on sales

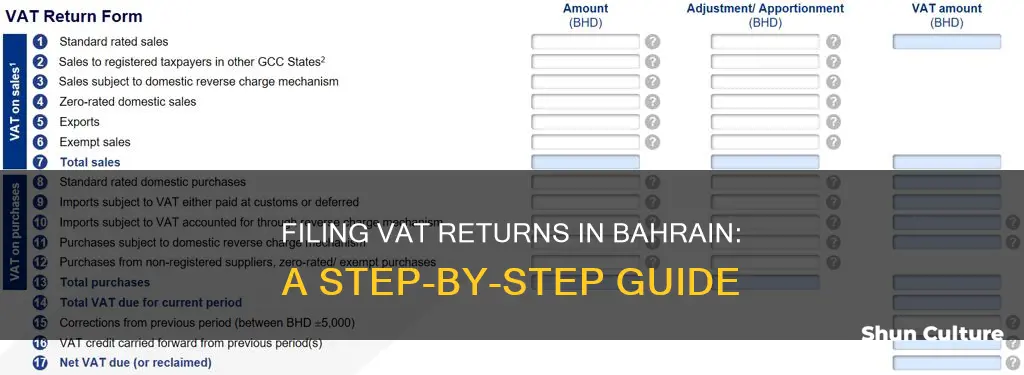

The VAT Return form is divided into two main sections: 'VAT on sales' and 'VAT on purchases'. The former is further divided into seven sub-sections, which are detailed as follows:

- Standard-rated sales: This section requires you to report the total amount of standard-rated goods and services (attracting 5% VAT) sold during the current period in Bahrain. The value considered here is excluding VAT and should be reported in the column 'Amount (BHD)'. The VAT collected on these supplies needs to be reported in a separate column, 'VAT amount (BHD)'. If there are any adjustments of similar sales made in the previous reporting periods, they can also be reported under this section.

- Sales to registered taxpayers in other GCC states: The total amount of sales to GCC states and all adjustments to sales to registered customers in GCC states will be treated as exports until the integrated GCC customs system is live. Thus, for now, this field will be "display only" and not editable.

- Sales subject to domestic reverse charge mechanism: All sales made under the Domestic reverse charge mechanism should be reported here.

- Zero-rated domestic sales: Report the total value of all goods and services sold during the current period that are zero-rated in Bahrain.

- Exports: Declare the value of taxable (standard-rated and zero-rated) and exempt supplies made during the current period to countries outside Bahrain.

- Exempt sales: Report the value of exempt supplies made during the tax period here.

- Total sales: The aggregated value of supplies declared above will be automatically calculated.

In addition to the above, it is important to note that Bahrain imposes a zero-rated tax on certain categories, including basic food items, education, health, construction of new buildings, local transportation, and oil and gas. Certain supplies related to real estate and financial services are VAT-exempt.

Exploring the Distance: India to Bahrain

You may want to see also

VAT on purchases

The 'VAT on Purchases' section of the VAT Return form is where you need to detail any purchases and recoverable input VAT. This section has five sub-sections:

- Standard-rated domestic purchases: Declare the value of purchases on which you can recover input tax and the amount of recoverable input tax in the VAT return period.

- Imports subject to VAT either paid at customs or deferred: Declare the value of imports on which VAT is paid at customs or deferred.

- Imports subject to VAT accounted for the reverse charge mechanism: Declare the value of services imported and accounted for on the reverse charge mechanism, along with the recoverable input tax.

- Purchases subject to domestic reverse charge mechanism: Declare all purchases made under the domestic reverse charge mechanism, along with recoverable input VAT.

- Purchases from non-registered suppliers, zero-rated/exempt purchases: Declare the total amount of goods and services purchased during the current period that were either zero-rated and purchased in Bahrain, zero-rated and imported from outside Bahrain, purchased from a non-registered supplier, or exempt and either bought in Bahrain or imported from outside Bahrain.

The total value of goods and services purchased during the tax period will then be auto-calculated.

Bahrain's Banking Scene: A Comprehensive Overview

You may want to see also

Submission of the VAT Return Form

To submit the VAT Return Form, the taxpayer must log in to the National Bureau for Revenue (NBR) portal with their registered tax credentials. The NBR is the government entity responsible for implementing and collecting VAT in Bahrain.

The electronic VAT Return Form can be accessed by clicking on the "VAT returns" tab after logging in. This will open a list of all returns, both submitted and not submitted. The taxpayer must then read the instructions and check the boxes before checking their VAT details, such as their TIN number, name, and address.

The next step is to fill out the VAT form, providing details in the relevant boxes. This includes details of sales, output VAT, and any adjustments, as well as details of purchases and recoverable input VAT. The details must be categorised as follows:

VAT on sales:

- Standard-rated sales

- Sales to registered taxpayers in other GCC states

- Sales subject to domestic reverse charge mechanism

- Zero-rated domestic sales

VAT on purchases:

- Standard-rated domestic purchases

- Imports subject to VAT, either paid at customs or deferred

- Imports subject to VAT accounted for the reverse charge mechanism

- Purchases subject to domestic reverse charge mechanism

- Purchases from non-registered suppliers, zero-rated/exempt purchases

After filling out the form, the taxpayer can submit the VAT Return. The NBR will send a notification of acknowledgment via email and SMS, and the official detailed receipt can be accessed on the taxpayer's portal account.

It is important to note that VAT returns must be filed on time and as prescribed by the NBR, even if there is no VAT to pay or reclaim. The time period for filing the VAT Return is until the last calendar day of the following month mentioned in the VAT Return Filing period.

Best Places to Buy Birthday Cakes in Bahrain

You may want to see also

VAT return filing period and deadlines

The filing period and deadlines for VAT returns in Bahrain depend on the annual turnovers of businesses. The timeline can be semi-annual, quarterly, or monthly, depending on the business's turnover.

Businesses with an annual turnover of over 5,000,000 BHD (or 3 million BHD, according to another source) must file their VAT returns at the end of the month following the tax period. For example, for the tax period of January 1, 2019, to January 31, 2019, the deadline to file the VAT return is February 28, 2019. From 2020 onwards, these businesses must file their VAT returns on a monthly basis.

On the other hand, businesses with an annual turnover below 5,000,000 BHD (or 3 million BHD) file their VAT returns on a quarterly basis. For the first quarter of 2019 (January 1 to March 31), the deadline to file the VAT return is April 30, 2019. For subsequent quarters, the deadline is the last day of the month following the end of the tax period. From 2020 onwards, these businesses must continue to file their VAT returns on a quarterly basis.

It is important to note that the National Bureau for Revenue (NBR) has the authority to change the tax periods for specific registered taxpayers, and they will be notified of any changes in advance.

Bahrain's Masseuses: Sex Workers or Legitimate Massage Therapists?

You may want to see also

How to file your VAT Return

A VAT Return is a calculation of how much VAT a business must pay to the Tax Authority or be reimbursed by them. The taxpayer collects VAT on behalf of the Tax Authority (in Bahrain, this is the NBR) and claims back the VAT paid on their taxable purchases.

To file your VAT Return in Bahrain, you must submit an electronic VAT Return Form via the National Bureau for Revenue (NBR) website. Here are the steps you need to take:

- Register with the NBR Electronically: Before you can file your VAT Return, you must register with the NBR electronically.

- Log in to the NBR Portal: Visit the official NBR portal at https://www.nbr.gov.bh/ and log in with your username and password.

- Access the VAT Returns Tab: Once you are logged in, click on the "VAT returns" tab. This will show you a list of all your returns, including those that have been submitted and those that are yet to be filed.

- Read the Instructions and Check Your VAT Details: Before filling in the form, read the instructions carefully and check your VAT details, including your TIN number, name, address, and other information.

- Fill in the VAT Form: Provide the required details in the relevant boxes. If you use accounting software, you may be able to automatically populate these details. Remember to attach any relevant invoices.

- Submit the VAT Form: After filling in the form, check the declaration box and submit your VAT Return. The NBR will send a notification of acknowledgment via email and SMS. You can also access the official detailed receipt in PDF format on your taxpayer portal account with the NBR.

Important Considerations:

- Deadlines: It is important to submit your VAT Return by the specified deadline to avoid penalties. The filing deadline is usually the last calendar day of the following month in your VAT Return filing period.

- Amendments: If you need to make any corrections to your VAT Return Form due to errors, you can do so within 30 business days of becoming aware of the error, as long as the NBR has not started supervision and inspection procedures.

- VAT Accounting Software: It is highly recommended to use VAT accounting software to help you accurately account for your VAT transactions and generate VAT Returns in the prescribed format.

The Mystery of the Missing Bahraini: An Enigmatic Disappearance

You may want to see also

Frequently asked questions

You need to submit an electronic VAT Return Form via the National Bureau for Revenue (NBR) website. You will need to provide details of transactions related to taxable sales and purchases.

The deadline for filing a VAT return is the last calendar day of the month following the end of your tax period. For example, if your tax period is 1st January to 31st January, your VAT return is due by 28th February.

To access the VAT Return Form, you need to log in to the NBR portal with your registered tax credentials.

The VAT Return Form is divided into two main sections: 'VAT on Sales' and 'VAT on Purchases'. 'VAT on Sales' includes details such as standard-rated sales, sales to registered taxpayers in other GCC states, and zero-rated domestic sales. 'VAT on Purchases' covers standard-rated domestic purchases, imports subject to VAT, and purchases from non-registered suppliers.