Indemnity in Bahrain is a form of protection or compensation that is the right of every employee when their service is ended or terminated. It is calculated based on the employee's tenure, final basic pay, and other factors such as social insurance and allowances. The calculation of indemnity in Bahrain can be complex, with different formulas and considerations depending on the specific circumstances of the employee's contract, type of termination, and other factors.

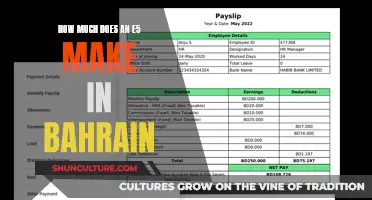

| Characteristics | Values |

|---|---|

| What | Indemnity Calculation Bahrain |

| Who | Foreign employees in the private sector, not covered by social insurance law |

| When | At the end of an employee's service term |

| Amount | Varies depending on tenure and basic salary. For the first three years, the indemnity is 4.2% of the basic monthly salary. After three years, it rises to 8.4%. |

| Payment | Paid as a lump sum |

| Calculation | Based on the most recent basic monthly salary |

| Changes | Since 1st March 2024, employers pay a monthly amount to the Government of Bahrain, which employees receive directly from the government at the appropriate time. |

What You'll Learn

Indemnity calculation for employees working on a daily basis

Indemnity in Bahrain is paid to employees at the end of their service term with an organisation. It is calculated based on their tenure in the firm and their final basic pay. The indemnity amount acts as compensation in the case of unfair termination.

According to Article 47 of Bahrain Labour Law, the End of Service Indemnity (EOSI) or gratuity is calculated based on the last basic monthly salary, including any social gratuity or allowance. For employees who work on a daily basis and are paid by the day, EOSI is calculated based on the average wage of the last three months.

- Determine the employee's daily wage: Calculate the average daily wage by dividing their total earnings over the last three months by the number of days worked in that period.

- Calculate the total indemnity amount: Multiply the daily wage by the number of days the employee has worked for the company.

- Pro-rata adjustments: If the employee has worked for a fraction of a year, adjust the total indemnity amount accordingly.

- Add any additional allowances: In some cases, companies may include basic allowances and social allowances in the EOSI calculation.

- Payment process: Since March 2024, employers in Bahrain pay a monthly amount to the Government, who then pay the employee upon request.

It is important to note that EOSI calculations may vary slightly between companies, and it is always recommended to consult with the HR department or a legal professional for specific cases.

Bahrain's Exchange Rate: USD to Dinar Conversion

You may want to see also

Indemnity calculation for employees on indefinite contracts

Indemnity in Bahrain is paid to employees at the end of their service with an organisation. It is calculated based on tenure and includes factors such as the final basic pay. It is also dependent on specific terms outlined in the Bahrain Labour Law.

Recent Changes to Indemnity Calculation in Bahrain

Since 1st March 2024, employers are required to pay a monthly amount to the Government of Bahrain, following fixed percentage rates. Employees will then receive this amount directly from the Government when appropriate. This change means that employers are no longer involved in the final settlement transaction.

Who Receives Indemnity in Bahrain?

The beneficiaries of indemnity in Bahrain are foreign employees in the private sector who are not covered by the Social Insurance Law and have completed at least one year of service.

Calculation Procedure

The calculation of indemnity is based on the employee's most recent basic pay and is calculated on a pro rata basis. For the first three years, employees receive half a month's basic pay, and from the start of the fourth year onwards, they are entitled to a full month's basic pay.

Sample Calculation

For an employee with a basic salary of 500 BD, who worked for five years before their contract was terminated, the indemnity calculation would be as follows:

- First-year indemnity = half-month salary (BD 250)

- Second-year indemnity = half-month salary (BD 250)

- Third-year indemnity = half-month salary (BD 250)

- Fourth-year indemnity = full-month salary (BD 500)

- Fifth-year indemnity = full-month salary (BD 500)

- Total Indemnity to be paid = BD 1750

Important Considerations

It is important to note that the calculation may vary depending on the company and specific circumstances. Additionally, any period of unpaid leave taken by the employee should be excluded when determining the service period, reducing the total years of service.

Exploring Bahrain's Coastal Beauty: Are There Sandy Beaches?

You may want to see also

Indemnity calculation for employees on definite contracts

Indemnity in Bahrain is a special benefit that employers must provide to employees at the end of their service term. It is calculated based on specific terms outlined by Bahrain Labour Law. The calculation depends on the employee's tenure in the firm, their final basic pay, and exclusion from concepts like social insurance.

Who Receives Indemnity?

Only foreign nationals employed in Bahrain are eligible for indemnity payments. To receive indemnity, one must be a foreign employee with at least one year of service, working full-time, part-time, or on a contract, and without Social Insurance coverage. Additionally, the employee must have completed their tenure. In the event of an employee's death, a preferred nominee can receive the payment.

Calculation Procedure

The indemnity calculation procedure in Bahrain has two cases.

Case 1: Complete Number of Years

For the first three years, the employee is entitled to half-month basic pay. From the start of the fourth year onwards, the employee is entitled to a full month's basic pay.

For example, if an employee works for a basic salary of 500 BD monthly and their contract is terminated after 5 years, the indemnity calculation would be as follows:

- First-year indemnity = half-month salary (BD 250)

- Second-year indemnity = half-month salary (BD 250)

- Third-year indemnity = half-month salary (BD 250)

- Fourth-year indemnity = full month salary (BD 500)

- Fifth-year indemnity = full month salary (BD 500)

- Total Indemnity to be paid = BD 1750

Case 2: Termination in the Middle of a Year

In this case, we first calculate the indemnity for the complete years, then calculate the indemnity for the remaining days.

For example, if an employee works for a basic salary of 380 BD monthly and their contract is terminated after 4 years, 3 months, and 11 days, the indemnity calculation would be as follows:

- First-year indemnity = half-month salary (BD 190)

- Second-year indemnity = half-month salary (BD 190)

- Third-year indemnity = half-month salary (BD 190)

- Fourth-year indemnity = full month salary (BD 380)

- Indemnity for remaining days = (380/365)X101 days = 105.150 BD

- Total amount payable = BD 1,055.150

New Rule for Bahrain Indemnity (as of March 1, 2024)

The recent update in the indemnity calculation process involves the employer paying a monthly amount to the Government of Bahrain following fixed percentage rates. Employees can then receive this amount directly from the government at the appropriate time. This change ensures employees receive their contributions directly and simplifies the final settlement process by removing the employer from the transaction.

Cinemas in Bahrain: Open for Business Again

You may want to see also

Gratuity as a lump sum payment

Gratuity, also known as a leaving indemnity or End of Service Benefit (ESB) in Bahrain, is a lump-sum payment made by the employer to the employee for their service. It is paid out to employees who meet certain contractual terms or have been unfairly dismissed.

According to Article 47 of Bahrain Labour Law, gratuity is calculated based on the employee's most recent basic monthly salary, including any social allowance. For employees who work on a daily salary, are paid per production, or receive a commission on each sale, gratuity will be calculated based on the average wage of the last three months.

Article 116 of Bahrain Labour Law states that employees who are not subject to the provisions of the Social Insurance Law are entitled to a leaving indemnity of half a month's wage for each of the first three years of employment and one month's wage for each subsequent year. For those who have worked a fraction of a year, the indemnity will be paid in proportion to the period spent in the employer's service.

The calculation of the leaving indemnity depends on the employee's tenure and final basic pay. It is beneficial for employees in the case of unfair termination and can act as compensation. It is also useful for employees in finding their next job or planning their future.

Since 1 March 2024, there have been changes to the way indemnity is calculated and paid out in Bahrain. Previously, the employer paid the indemnity amount to the employee at the time of termination. Now, the employer pays a monthly amount directly to the Government of Bahrain, following fixed percentage rates, and the employee receives the amount from the government when appropriate. This new system ensures employees receive their full entitlements and places Bahrain in line with global best practices.

Haven Tower Bahrain: A Sky-High Experience

You may want to see also

Eligibility criteria for indemnity in Bahrain

To be eligible for indemnity in Bahrain, you must meet the following criteria:

- Time of receiving indemnity: The most preferable time to receive indemnity payment is at the end of your service. However, you may also request the amount before your resignation.

- Length of service: You should have completed at least one year of service with your company.

- Employment type: You can be a full-time, part-time, or contract worker. However, you must be employed in the private sector.

- Citizenship: Indemnity is not available for citizens of Bahrain. It is specifically for foreign nationals employed in the country.

- Social Insurance Law: You should not be receiving benefits under the Social Insurance Law.

- Special cases: In case of death, a preferred nominee can receive the payment. You can also collaborate with your company for deferred indemnity payments.

It is important to note that trade unions or work councils have no involvement in the labour laws of Bahrain.

Discovering Bahrain's International Circuit: Location and Attractions

You may want to see also

Frequently asked questions

Indemnity in Bahrain is a special benefit scheme or protection provided to employees by their employers when their service is ended or terminated. It is paid as a lump sum at the end of an employee's tenure.

Foreign employees in the private sector who have completed at least one year of service and are not covered by the Social Insurance Law are eligible for indemnity.

Indemnity is calculated based on the employee's tenure and final basic pay. For the first three years, the indemnity is calculated as half a month's basic pay. After the third year, the employee is entitled to a full month's basic pay for each remaining year.

The preferable time to receive indemnity payment is at the end of an employee's service. However, it may also be requested before resignation.

The benefits include legal entitlement to receive indemnity, reward for service, assistance in securing long-term financial plans, flexibility in receiving payments after one year of service, and support as a retirement plan.