The Kingdom of Bahrain introduced the Value Added Tax (VAT) law in 2019, with a standard rate of 5% on goods and services purchased and sold by businesses. In 2022, this rate was revised to 10%. Businesses registered under Bahrain VAT are responsible for collecting VAT on the supply of taxable goods or services, which should then be paid to the Nation Bureau for Taxation (NBT). To calculate VAT in Bahrain, the product or service price is multiplied by the VAT rate. This amount can be calculated manually or using an online calculator.

| Characteristics | Values |

|---|---|

| VAT rate | 10% |

| VAT-eligible goods | All goods and services purchased and sold by businesses |

| VAT-implementing authority | National Bureau of Revenue (NBR) |

| VAT registration threshold | BHD 37,700 |

| VAT payment due date | Last day of the month following the end of the tax period |

| VAT payment formula | Output VAT – Input VAT |

| Late payment penalty | 1% additional penalty per month of delayed payment |

| Late filing penalty | Submission penalty |

| Incorrect returns penalty | 2.5% to 5% of the net tax amount, minimum BHD 500, maximum BHD 10,000 |

| Non-registration penalty | BHD 10,000 |

What You'll Learn

How to calculate output and input VAT

VAT, or Value Added Tax, is an indirect tax charged on goods and services purchased and sold by businesses. In Bahrain, VAT was introduced on January 1, 2019, with a standard rate of 5%. This rate was revised to 10% on January 1, 2022.

Output VAT is the tax collected on the sale of goods or services. For example, if a business sells goods worth BHD 100,000 with an additional 5% tax, the output VAT is BHD 5,000.

Input VAT is the tax paid on the purchase of goods or services. For instance, if a business purchases goods worth BHD 50,000 with an additional 5% tax, the input VAT is BHD 2,500.

How to Calculate VAT Payment:

To calculate the VAT payment, use the following formula:

VAT Payment = Output VAT – Input VAT

First, calculate the total output VAT collected during the tax period and the total input VAT that you are eligible to recover. Once you have these values, apply the formula. If the output VAT is greater than the input VAT, the difference is the VAT payable to the government. If the output VAT is less than the input VAT, the result is refundable, and there is no VAT payable.

For example, let's consider a business with an output VAT of BHD 300,000 and an input VAT of BHD 200,000. Using the formula, we subtract the input VAT from the output VAT:

BHD 300,000 – BHD 200,000 = BHD 100,000

Therefore, the VAT payable to the government is BHD 100,000.

VAT Calculators:

Online VAT calculators are available for Bahrain, which can help you perform quick and detailed VAT calculations. These calculators allow you to calculate VAT for multiple items, product/service descriptions, and provide a running total. You can also use these calculators to determine the taxable value and the VAT amount, ensuring accurate VAT compliance for your business.

US-Bahrain Relations: Hosting the US Fifth Fleet

You may want to see also

VAT registration in Bahrain

Mandatory Registration

Any taxable persons in Bahrain with a turnover exceeding or expected to exceed BHD 5 million annually are legally required to register for VAT. The deadline for registration in this case was the 20th of December 2018.

Additionally, the following thresholds apply:

- Any taxable persons with turnover exceeding or expected to exceed BHD 500,000 and BHD 5,000,000 annually are required to register for VAT by the 20th of June 2019.

- Any taxable persons with turnover exceeding or expected to exceed BHD 37,500 and BHD 500,000 annually are required to register by the 20th of December 2019.

Voluntary Registration

Voluntary registration is also an option for any taxable persons with over BHD 18,750 in annual supplies.

Non-Resident Registration

Non-residents without a fixed place of business or establishment in Bahrain are required to register for VAT within 30 days of their first taxable supply to non-taxable persons in the country. They can apply directly to the National Bureau for Taxation (NBT) or appoint a Tax Representative. The NBT may request documentation to prove that the registration requirements are met.

Registration Process

To register for VAT in Bahrain, the taxable entity must first create an NBT profile on the NBT website. Once the profile is approved, they will receive login details to access the registration form. The registration form can be completed and submitted online, and the VAT certificate will be available on the taxpayer's NBT profile once approved.

The following information is required for the registration:

- Taxpayer details (legal name, legal form, address, contact details, VAT eligibility date, etc.)

- Commercial registration details (CR Number, CR date, subsidiary details, sector, etc.)

- Financial information (annual value of supplies, expenses, imports, and exports)

- Registrant details (name, identification number, date of birth, job title, etc.)

- Documentation (commercial registration certificate, customs registration certificate, audited financial statements, copy of registrant ID, etc.)

- Business activity of the company

- Previous 12 months' turnover and expenses figures

- Expected values of imports and exports

- Customs Identification Number

- Bank account details

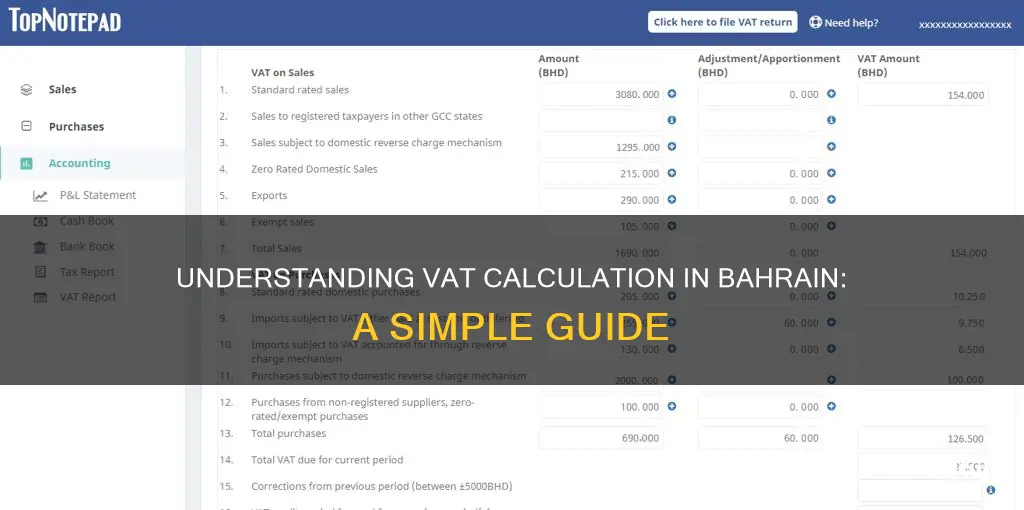

Calculating VAT

VAT in Bahrain can be calculated by multiplying the product or service price by the appropriate VAT rate. The formula for calculating VAT is:

VAT Payment = Output VAT – Input VAT

Output VAT refers to the tax collected on the sale of goods or services, while Input VAT refers to the tax paid on the purchase of goods or services.

Exploring Bahrain: A Traveler's Curiosity Unveiled

You may want to see also

Standard, zero, and nil VAT rates

The standard VAT rate in Bahrain is 5%, levied on all taxable supplies. This includes the supply of taxable goods or services. The VAT collected from customers should be paid by the supplier to the National Bureau for Taxation (NBT).

The VAT rate in Bahrain is classified into standard, zero, and nil rates. The standard rate of 5% will be levied on all supplies except those that are zero-rated or exempt from VAT. Businesses registered for VAT in Bahrain must charge and collect VAT at 5% on all taxable supplies.

Zero-rated supplies in Bahrain include exports of goods and services, local and international transportation of goods and passengers, basic foodstuffs, healthcare, education, and certain other goods and services. For zero-rated supplies, businesses must still charge VAT at 0%, meaning no VAT is added to the price paid by the customer.

Certain supplies are exempt from VAT in Bahrain, such as financial services, sale and lease of real estate, and bare land. These are subject to the conditions prescribed in the Bahrain VAT regulation. For exempt supplies, no VAT is charged, and no VAT is collected from the customer.

It is important for businesses to identify the type of supplies they are making and determine the VAT applicability to levy the correct VAT rate.

Using AT&T Services in Bahrain: What You Need to Know

You may want to see also

VAT returns and deadlines

VAT-registered businesses in Bahrain must submit a VAT return electronically to the National Bureau of Revenue (NBR) at the end of each VAT period. This involves submitting all the relevant data, including information on taxable supplies, input VAT (VAT paid on purchases), and output VAT (VAT charged on sales).

The deadline for submitting the VAT return is by the last day of the month following the end of the tax period. For example, for the tax period of Jan-Mar 2019, the VAT return along with the payment of VAT should be made by 30th April 2019. It is important to note that even if there are no transactions to report in a given tax period, a taxable person should still submit a nil return showing no output or input tax and subsequently no VAT payment.

VAT returns should be submitted quarterly. If a business fails to submit its VAT return on time, it may result in penalties. The NBR has the right to impose fines for late submission, incorrect data submission, and non-registration. To avoid penalties, businesses must ensure that they keep accurate records of VAT transactions, such as invoices, receipts, and credit notes.

The NBR has imposed a late filing penalty, which can be avoided by submitting VAT returns before the deadline. Additionally, there is a penalty for incorrect returns, where a company will be fined 2.5% to 5% of the net tax amount, with a minimum of 500 BHD and a maximum of 10,000 BHD. This can be avoided by ensuring that all transactions are recorded correctly and by reviewing the VAT return before filing.

Bangladeshi Population in Bahrain: A Comprehensive Overview

You may want to see also

VAT compliance and penalties

Registration:

Businesses with an annual turnover above BHD 37,700 are mandatorily required to register for VAT. This is the compulsory VAT registration threshold. Businesses with a turnover between BHD 18,850 and BHD 37,000 can choose to register voluntarily. Non-resident businesses have no threshold and must register before their first supply.

Invoices:

VAT invoices must be issued within 15 days of the month following the supply of taxable goods or services. Invoices must contain specific information, including the date, invoice number, supplier's tax ID, names and addresses of the supplier and customer, description and quantity of goods supplied, VAT rate applied, and gross, VAT, and net values of the supply.

Returns and Payments:

Registered taxpayers must submit periodic returns and pay any VAT due by the last working day of the month following the reporting period. The due date for VAT payments coincides with the submission of the VAT return. Even if there are no transactions in a given tax period, a nil return must be submitted.

Penalties:

The National Bureau for Taxation (NBT) has approved administrative penalties for non-compliance with VAT laws. These include fines for late registration, delayed VAT returns or payments, submitting false information, and various other violations. For example, failing to register within 60 days of the deadline can result in a fine of up to BHD 10,000. Submitting false information on imports or supplies can lead to a fine of 2.5-5% of the unpaid tax amount per month.

Additionally, specific offences are considered tax evasion and carry more severe penalties, including imprisonment. These include failing to register within 60 days, delayed VAT return or payment exceeding 60 days, fraudulent recovery of input tax, submitting forged documents, and failing to issue tax invoices.

To avoid penalties, businesses must stay informed about VAT compliance requirements and ensure timely and accurate reporting. The Ministry of Finance has stated that there will be no relaxation in charging penalties for non-compliance.

Hand-Holding in Bahrain: A Sign of Friendship or Love?

You may want to see also