Customs duty is a tax imposed on certain goods brought into a country. In Bahrain, customs duty is calculated using the CIF method, which means that the import duty and taxes are determined based on the value of the imported goods, insurance, and shipping costs. The general rate of customs duty in Bahrain is 5% of the CIF value, but there are different rates for specific categories of goods, such as tobacco and alcoholic beverages, which are taxed at 100% and 125%, respectively. When importing goods into Bahrain, it is important to be aware of the applicable customs duty rates and to make sure that all necessary documentation is provided to ensure a smooth clearance process.

| Characteristics | Values |

|---|---|

| Basis of calculation | Value of the imported goods and shipping costs |

| Valuation method | CIF (cost, insurance, and freight) |

| General rate of customs duty | 5% of CIF value |

| Alcoholic beverages | 125% |

| Tobacco products | 100% |

| Paper and aluminium products | 20% |

| Excise tax on tobacco products and energy drinks | 100% |

| Excise tax on soft drinks | 50% |

| Value-added tax (VAT) | 10% |

| Registration threshold for businesses in Bahrain | BHD 37,500 |

| Voluntary registration threshold | BHD 18,750 |

What You'll Learn

The CIF method

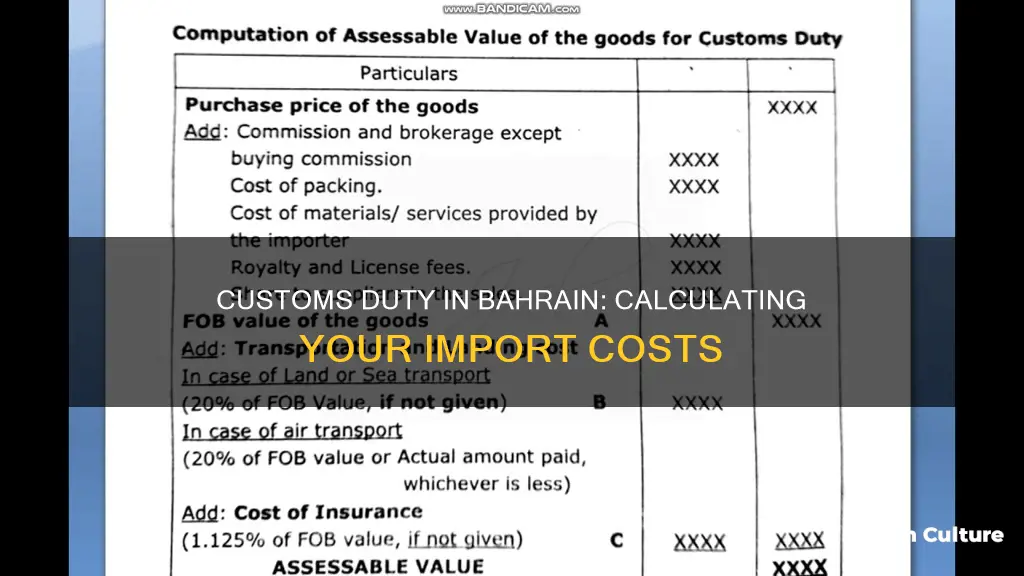

The CIF (Cost, Insurance, Freight) method is used in Bahrain to calculate import duty and taxes based on the value of the imported goods and shipping costs. This means that, in addition to the value of the goods themselves, the cost of insurance and freight to ship those goods is also factored into the calculation of the import duty and taxes.

The general rate of customs duty in Bahrain is 5% of the CIF value. However, there are exceptions for certain types of goods. For example, alcoholic beverages are subject to a 125% import duty, while tobacco products are taxed at 100%. These exceptions are outlined in Bahrain's tariff schedule and the Unified GCC Customs Tariff of 2017, which eliminated tariffs on 426 items, primarily food and medical products, for trade within the GCC (Gulf Cooperation Council) member states.

It's important to note that customs duties are separate from other charges that may be incurred during the import process. For instance, there are typically fees levied by the import customs broker for filing the necessary customs clearance documents with the local authorities. These brokerage fees are in addition to any customs duties and import VAT or GST applied to the goods.

To calculate the import duty for a shipment to Bahrain using the CIF method, you can follow these steps:

- Determine the CIF value of your shipment: Calculate the total cost of the goods, insurance, and freight (shipping) for the items you are importing.

- Identify the applicable duty rate: Different types of goods may have different duty rates. Refer to Bahrain's tariff schedule and the Unified GCC Customs Tariff for specific duty rates.

- Multiply the CIF value by the duty rate: Apply the relevant duty rate to the CIF value of your shipment to calculate the import duty amount.

- Include additional charges: Remember to consider other charges, such as customs brokerage fees, that may be incurred during the import process.

By following these steps and using the CIF method, you can estimate the import duty and taxes for your shipment to Bahrain. However, it's always advisable to consult official sources and local regulations for the most accurate and up-to-date information.

Best Places to Buy Flowers in Bahrain

You may want to see also

Customs duty rates

When importing goods into Bahrain, whether as a private individual or a commercial entity, you will need to pay customs duties and taxes. The rate of customs duty is typically 5% of the value in cost, insurance, and freight (CIF) for most commodities imported from countries outside the Gulf Cooperation Council (GCC). This is calculated based on the CIF method, which takes into account the value of the imported goods as well as shipping costs.

However, there are exceptions to the 5% duty rate. Alcoholic beverages and tobacco products, for instance, are taxed at 125% and 100% respectively. Additionally, certain categories of goods, such as paper and aluminium products, are subject to a 20% duty rate.

It is important to note that Bahrain is a party to the GCC Unified Customs Union agreement, which eliminated tariffs for GCC member states on 426 items, primarily food and medical products. Trade within the GCC customs union and under the US-Bahrain Free Trade Agreement (FTA) is generally duty-free, except for tobacco and alcoholic beverages, which are taxed at 100% and 125% respectively.

To calculate the exact customs duty for your shipment, you can use an import duty calculator, which will take into account the shipment value, product type, and applicable duty rates for Bahrain. It is important to be aware of any applicable customs duty rates to avoid unexpected costs and delays in the shipping process.

Unlocking Bahrain: Phone Number Essentials

You may want to see also

Import tax

When importing goods into Bahrain, whether as a private individual or a commercial entity, you will need to pay customs duties and import tax. The import duty is a tax imposed by the Bahraini government on goods from other countries, designed to make foreign products less desirable and encourage support for the domestic market.

The general rate of customs duty in Bahrain is 5% of the value in cost, insurance, and freight (CIF). This is calculated based on the CIF method, which means the import duty and taxes are determined based on the value of the imported goods and shipping costs. However, there are exceptions to this 5% rate. Alcoholic beverages are taxed at 125%, while tobacco products are taxed at 100%. Certain categories of goods, such as paper and aluminium products, are subject to a 20% duty rate.

Under the US-Bahrain FTA, bilateral trade in industrial and consumer products, excluding some agricultural items, may be conducted duty-free. Additionally, Bahrain does not levy duties on imports of raw materials or semi-manufactured goods if the final products assembled using these inputs will be exported out of the country. The country also allows items imported for development projects (excluding spare parts) and transshipments to be imported duty-free.

To calculate the import duty for your shipment, multiply the taxable value of your shipment by the tax and duty percentage for Bahrain. The taxable value is usually based on the value of the goods, but it can also include other amounts depending on the valuation method chosen.

Croatian Visa Application Process for Bahraini Citizens

You may want to see also

Customs brokerage fees

In Bahrain, customs duties are calculated using the CIF (Cost, Insurance, and Freight) method, which means the import duty and taxes are calculated based on the value of the goods and shipping costs. The general rate of customs duty is 5% of the CIF value, except for alcoholic beverages (125%) and tobacco products (100%).

When shipping goods to Bahrain, it is important to be aware of the potential customs brokerage fees and other charges that may apply. Customs brokerage fees can vary depending on the broker and the complexity of the shipment. It is recommended to use a reputable broker who can guide you through the process and ensure compliance with all regulations.

To calculate the total cost of importing goods into Bahrain, you should consider the customs duty, import VAT/GST, and customs brokerage fees. Additionally, be mindful of any potential taxes or duties that may be imposed on specific goods, such as the higher rates for alcoholic beverages and tobacco products.

Online tools, such as import duty calculators, can assist in estimating the total taxes and duties for your shipment. These tools consider factors like shipment value, product type, and shipping costs to provide an accurate estimate of the customs brokerage fees and other charges. By using these resources, businesses can streamline the customs clearance process, avoid unexpected costs, and provide transparent pricing to their customers.

The Current Time in Manama, Bahrain

You may want to see also

VAT and excise duty

Value-added tax (VAT) was introduced in Bahrain on 1 January 2019. The standard VAT rate was initially 5% until 31 December 2021, but from 1 January 2022, the rate was increased to 10%. However, the 5% rate may still apply in certain circumstances under transitional provisions. The standard rate applies to most goods and services, but there are exceptions where certain goods and services may be subject to a 0% rate or be exempt from VAT.

The mandatory registration threshold for VAT in Bahrain is 37,500 Bahraini dinars (BHD) for businesses resident in the country, and the voluntary registration threshold is BHD 18,750. Non-resident businesses are required to register upon making their first supply subject to VAT in Bahrain.

Excise tax has been in force in Bahrain since 30 December 2017, following the country's signing of the Common Excise Tax Agreement of the Gulf Cooperation Council (GCC) States on 1 February 2017. Tobacco products and energy drinks are subject to excise tax at 100%, while soft drinks are taxed at 50%. Other goods may also be subject to excise tax in the future.

Calculating VAT and Excise Duty

The value of imported goods for VAT purposes is determined by their customs value, which includes costs relating to the import, such as transportation and insurance, as well as any additional charges incurred until the goods reach Bahrain. In the case of goods that are temporarily exported for repair or other services, the VAT due is based on the value added to the goods while they were outside of Bahrain.

If adjustments are made to the customs value of goods after they have been imported, such as discounts, the VAT liability may be affected. However, if there are no adjustments to the customs value, there will be no change in the VAT liability, and the importer does not need to make any changes to their tax returns.

VAT Exemptions and Special Cases

Certain goods and transactions are exempt from VAT in Bahrain, including basic food items, precious metals sold for investment, pearls, precious stones, prescribed medicines, and medical equipment. Goods imported for persons with special needs are also exempt, provided that the importer has the relevant documentation as per customs law.

Diplomatic exemptions apply to belongings and household appliances belonging to Bahraini citizens residing abroad or foreigners moving to Bahrain for the first time. Personal belongings and gifts brought by passengers are also exempt from VAT.

VAT Payment Procedures

VAT on imported goods is generally due at the point of import and must be paid to Bahrain Customs Affairs before the goods are released. The payment procedure for VAT is the same as for customs duties and excise tax.

In some cases, VAT-registered agents or importers may be able to defer the payment of import VAT or claim a refund. To do so, they must meet specific conditions, such as being registered for VAT in Bahrain and maintaining proper documentation.

Allah's Vision: Bahrain and Beyond

You may want to see also