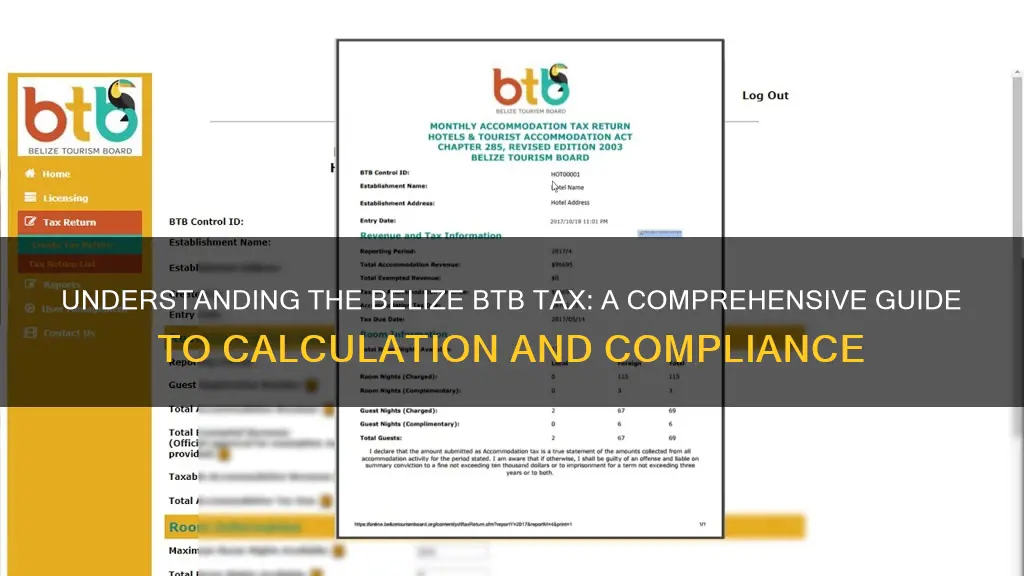

The Belize Tourism Board (BTB) collects and manages the 9% tourist accommodation tax that hotels and tourist accommodations are required to collect from each guest on behalf of the Government of Belize. The BTB Online Portal is a virtual platform that allows stakeholders to submit tax returns, make payments, and handle other official business. The portal is paper-free and provides an efficient, automated process for submitting taxes and making payments from home or the office. The BTB Online Portal launched in two phases: the first in November 2017, which allowed hoteliers to submit monthly accommodation tax returns and access online payments, and the second in December 2019, which enabled the submission of guest registration forms and automated monthly accommodation tax returns.

| Characteristics | Values |

|---|---|

| Tax Rate | 9% |

| Tax Collection Body | Belize Tourism Board (BTB) |

| Tax Collection Purpose | To sustain, market and develop Belize's tourism industry |

| Tax Collection Due Date | 14th of the following month |

| Tax Submission Process | Online via BTB Online Portal or over the counter at the bank |

| Tax Payment Methods | Online through one of the four participating banks (Atlantic Bank, Belize Bank, Heritage Bank, and Scotia Bank) or over the counter at the bank |

| Tax Invoicing | Invoices are generated upon tax declaration submission |

| Tax Receipts | Available for viewing, saving, or printing through the BTB Online Portal |

| Tax Penalties | 10% surcharge for late payment; 5% interest charge for taxes remaining in default after 30 days; violation tickets of 3x room rate for failure to submit tax returns, guest registration forms, or non-payment of taxes |

What You'll Learn

Calculating the 9% tourist accommodation tax

The Belize Tourism Board (BTB) is responsible for collecting and managing the 9% tourist accommodation tax, as legislated by the Laws of Belize. This tax is used to support the BTB's operations in sustaining, marketing, and developing the country's tourism industry. Hotels and tourist accommodations must collect this 9% tax from each guest on behalf of the Government of Belize and pay it to the BTB.

To calculate the 9% tourist accommodation tax, follow these steps:

- Determine the total number of guests who will be staying at your accommodation.

- Calculate 9% of the total room charges for each guest. You can do this by multiplying the room rate by 0.09 or using a calculator to find 9% of the room rate.

- Add up the tax amounts for all guests to find the total tax owed to the BTB.

- Report the total tax collected and guest information to the BTB by submitting a Guest Registration Form (GRF) through the BTB Online Portal. This should be done no later than the 14th of the following month, as per Section 23 of the Hotel and Tourist Accommodation Act [HTAA] (Chapter 285).

- Submit the tax payment to the BTB by the due date, which is also the 14th of the following month. Payments can be made through the BTB Online Portal using one of the four participating banks: Atlantic Bank, Belize Bank, Heritage Bank, or Scotia Bank.

- Keep proper records of all guest stays, tax collections, and payments made to the BTB. This information may be requested for audit or tax verification purposes.

Note that the BTB Online Portal also allows you to create additional sub-user accounts with different security levels, such as "Accounts" and "Front Desk," to manage tax submissions and guest registration forms more efficiently. Additionally, the BTB provides resources and support for stakeholders, including an instructional guide for the online portal and a dedicated email address for tax-related queries.

Belize Border Crossing Requirements: What You Need to Know

You may want to see also

Submitting tax returns

The Belize Tax Service Department (BTSD) is responsible for handling tax returns in Belize. The BTSD has established an online portal, IRIS Belize, for filing and submitting tax returns. All tax returns must be filed online.

Annual Tax Returns

The annual tax filing deadline in Belize is 31 March, unless otherwise approved by the Director-General of Belize Tax Service. From the tax period ending 31 March 2023, taxpayers will be required to file electronic tax returns with the BTSD via IRIS Belize.

The three main steps for filing an annual Business Tax Return in Belize are as follows:

- Apply for a Tax Identification Number (TIN) from the Registry: This is for tax authorities to effectively manage the status of the IBC. It usually takes about 7 working days to obtain an approved TIN.

- Fill out the IBC Annual Business Tax Form (BTS290) for annual tax return submission: This form consists of 5 parts – taxpayer information, tax declaration & computation, declaration, tax paid on income from foreign sources, and annual net gain computation.

- Submit all required documents and proofs to your registered agent via email.

General Sales Tax (GST) Returns

All businesses registered for General Sales Tax must file a GST return. Businesses with an annual turnover of $75,000 or more per annum must register for GST. If a business has been operating for less than 12 months and the average monthly value of taxable supplies was $6,250 or more, it must also register for GST. The GST return form consists of boxes for output tax and input tax, with the difference between the two representing the registered person's tax liability or credit for that tax period.

Hotel and Tourist Accommodation Taxes

The Belize Tourism Board (BTB) is responsible for collecting and managing the 9% tourist accommodation tax levied on each guest. Hotels and tourist accommodations are required to collect this tax on behalf of the Government of Belize and submit it to the BTB. The BTB Online Portal allows for the submission of monthly accommodation tax returns and guest registration forms, as well as online payments.

Belize-Bound: A Guide to Properly Addressing Mail for the Country

You may want to see also

Making online payments

The BTB Online Portal is a virtual platform that allows hoteliers to submit guest registration forms, tax returns, and make payments online. The portal offers a paper-free, efficient, and secure way to conduct business with the BTB from anywhere.

To make an online payment, follow these steps:

- Note your Invoice or Statement Balance Amount.

- Select your bank from the four participating banks: Atlantic Bank, Belize Bank, Heritage Bank, or Scotia Bank.

- Log in to your chosen bank's portal with your bank credentials.

- Go to the Bill Payment Tab.

- Select the "Belize Tourism Board (BTB)" as the payee.

- Input your BTB Control ID as the account number. This is an 8-digit alphanumeric ID that can be found on BTB invoices and receipts issued after April 1, 2017.

- Input the recorded Invoice or Statement Balance Amount for payment.

- Confirm the payment process.

- Review and record the bank receipt.

It is important to note that payments must be made in full on or before the 14th of the following month to avoid penalty and fine charges. Additionally, credit card, PayPal, and other e-commerce payment options are currently unavailable for BTB payments.

Belize: A Dangerous Paradise

You may want to see also

Registering for a BTB Online Account

The BTB Online Portal is a virtual platform that allows stakeholders to conduct official business such as tax submissions, licensing, guest registration, and payments online. To register and create a BTB Online Account, you will need to gather the following information:

- An email address that is not already registered with BTB.

- A BTB account number, which can be found on your bill.

- Your BTB Control ID, which is an 8-digit alphanumeric ID that uniquely identifies you as an account holder. This can be found on all BTB invoices and receipts issued after April 1, 2017. You can also contact the BTB licensing department to obtain your Control ID.

Once you have this information, you can begin the registration process by visiting the BTB website and accessing the Online Portal. Click on the "Register" or "Create an Account" option and follow the prompts to enter your information. You will also need to create a password for your account.

After registering, you will receive a confirmation email from BTB. This email will contain important information about your account, including your account number and any additional steps you need to take to complete your registration. It is important to keep this email for your records.

If you are the main administrator of the account, you can create additional sub-accounts for other users. This can be done by accessing the User Management or Account Settings section of your BTB Online Account and following the instructions to add new users.

It is important to note that BTB automatically registers all licensed accommodations for a BTB Online Account. If you are a licensed accommodation and do not know your online account access information, you can contact the BTB licensing officer at the provided email address or phone number. They will be able to assist you in retrieving your login details or creating a new account if needed.

The Battle of St. George's Caye: A Defining Moment in Belize's History

You may want to see also

Understanding the BTB Online Portal

The BTB Online Portal is a virtual platform that allows stakeholders to conduct official business such as tax submissions, licensing, guest registration, and payments online. It offers a convenient, paperless, and secure way to interact with the Belize Tourism Board (BTB). The portal was launched in phases, with the first phase in November 2017, enabling hoteliers to submit monthly accommodation tax returns and access online payments. The second phase, launched in December 2019, allowed hoteliers to submit guest registration forms and automated monthly accommodation tax returns.

The BTB Online Portal offers several benefits to its users. Firstly, it provides an efficient, automated, and paperless process, saving time and effort for both stakeholders and the BTB. Secondly, it offers the convenience of conducting business remotely from the comfort of one's home or office. Thirdly, it ensures fast, accurate, and secure transactions. Additionally, the portal allows payments through four participating banks: Atlantic Bank, Belize Bank, Heritage Bank, and Scotia Bank.

To register and create a BTB Online Account, users can contact the licensing officer at the provided email addresses. Each account has a unique 8-digit alphanumeric Control ID, which is included in all BTB invoices and receipts issued after April 1, 2017. This Control ID is essential for tax returns and payments. The portal also offers different security levels for users, including Administrator, Accounts, Front Desk, and Viewer, with varying access and creation privileges.

The BTB Online Portal provides step-by-step guides for various processes, such as filling out guest registration forms, automating tax returns, and making online payments. It also offers the ability to download transaction histories and activity logs. The portal ensures transparency and accountability by providing invoices, receipts, and monthly statements for all transactions.

Overall, the BTB Online Portal streamlines the interaction between stakeholders and the BTB, offering a user-friendly and efficient platform for tax submissions, licensing, guest registration, and payments.

Belize's Uncertain Future: A Country in Limbo

You may want to see also