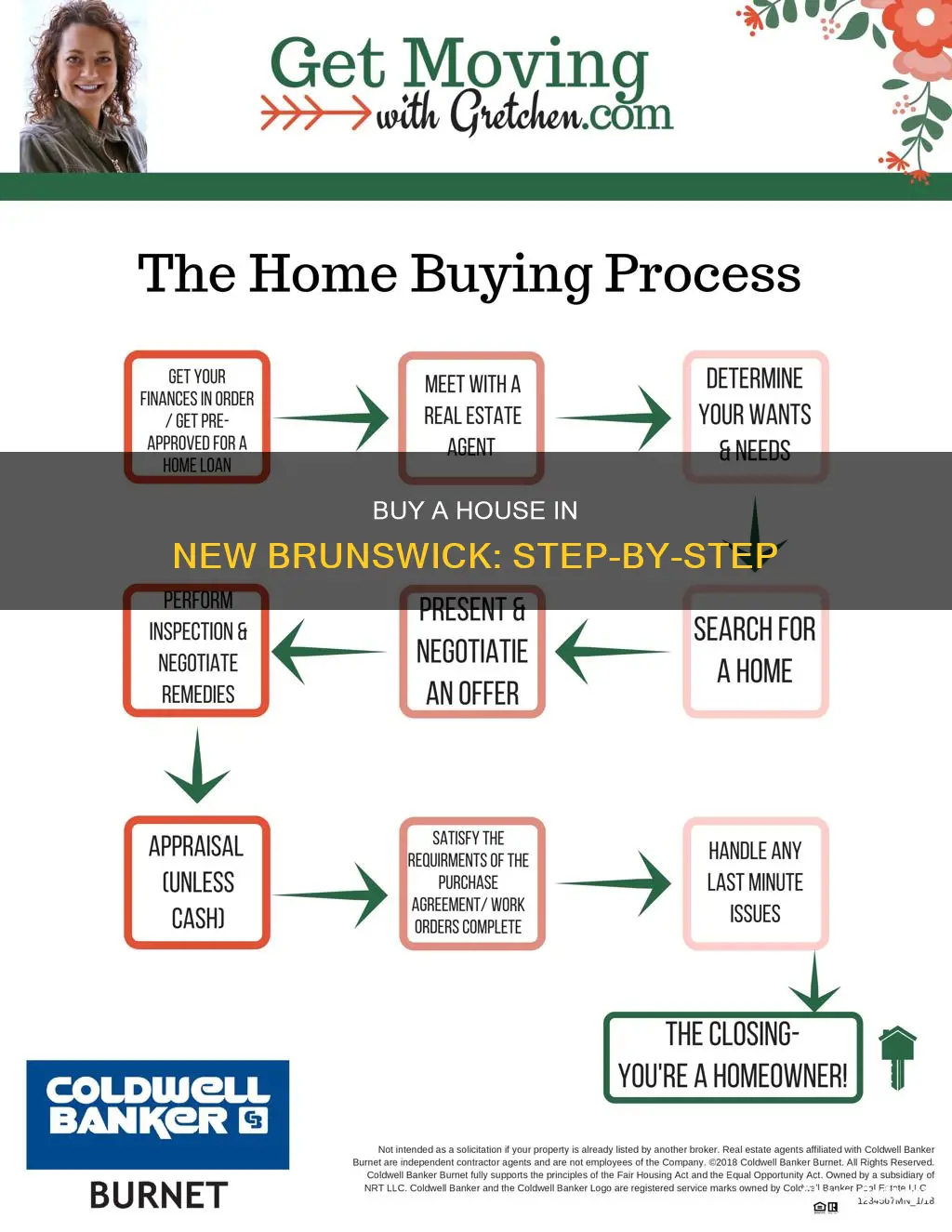

Buying a home in New Brunswick, New Jersey, is a complex process that requires careful consideration and planning. It is important to understand the local real estate market, work with professionals, and be aware of the associated costs.

New Brunswick offers a range of housing options, from single-family homes to condos and townhomes. The median listing home price is $475,500, and homes typically spend around 50 days on the market. It is crucial to work with licensed professionals such as real estate agents, mortgage brokers, and lawyers to navigate the process smoothly.

When buying a home in New Brunswick, it is essential to be aware of the various costs involved, including the down payment, legal fees, property taxes, and insurance. Additionally, there may be ongoing and irregular maintenance costs to consider.

Overall, purchasing a home in New Brunswick, NJ, requires careful research, financial planning, and working with experienced professionals to ensure a successful transaction.

| Characteristics | Values |

|---|---|

| Median listing home price | $475,500 |

| Median days on market | 50 |

| Average time to sell a house | 74 days |

| Number of active homes for sale | 84 |

| Time of year with most homes for sale | May |

What You'll Learn

Understanding the costs involved

When considering buying a house in New Brunswick, it is important to understand all the costs involved. Here is a comprehensive guide to help you navigate the financial aspects of purchasing a home:

Upfront and Closing Costs:

- Down Payment: In New Brunswick, you will typically need to make a down payment of at least 5% of the purchase price.

- Legal Fees and Disbursements: These can include costs associated with hiring a lawyer, such as legal advice and document preparation.

- Property Tax and Utility Bill Adjustments: The buyer is usually responsible for repaying the seller for any prepaid amounts, such as property taxes or utility bills.

- Mortgage Insurance: If your down payment is less than 20% of the purchase price, you will likely need to purchase mortgage insurance.

- Tax on Purchase Price for New Constructions: If you are buying a newly constructed home, you may be subject to additional taxes.

- Upgrades for New Constructions: New constructions may also require you to pay for any upgrades or additional features.

Costs Associated with Moving and Setting Up:

- Landscaping and Yard Maintenance Tools: This includes the cost of purchasing equipment such as a lawnmower or snow blower to maintain your new home's outdoor space.

- Moving Services: You may need to hire movers or rent a moving truck to assist with the relocation process.

- Moving Supplies: Costs for boxes, packing materials, and other moving supplies should be considered.

- Utility Setup Charges: There may be security deposits or connection fees when setting up utilities like electricity, water, and internet at your new home.

Regular Ongoing Costs:

Repairs and Maintenance: As a homeowner, you will be responsible for regular maintenance and repairs to keep your home in good condition. This includes both interior and exterior upkeep.

Large, Irregular Costs:

Major Repairs and Renovations: Over time, you may incur more significant expenses for major repairs or renovations, such as a new roof, updating plumbing, or replacing appliances.

It is essential to carefully consider all these costs when planning your home purchase in New Brunswick. Understanding the financial commitments involved will help you make a well-informed decision and ensure a smooth process when buying your dream home.

Brunswick to Charlotte: Road Trip

You may want to see also

Getting a mortgage

A mortgage broker or associate acts as an intermediary between you and a lender. In New Brunswick, they can represent either the borrower or a private lender, but not both. They can assist with the mortgage application process, searching for lenders, and negotiating mortgage terms and rates. It is important to note that mortgage brokers and associates do not lend money themselves. When acting on behalf of the borrower, they shop around for different lenders to find the best deal.

- Are you a licensed mortgage broker or associate? (You can verify their licence with FCNB if you are unsure.)

- Do you represent the borrower or the private lender? (Mortgage brokers are not allowed to represent both parties.)

- What services do you provide, and how will you help me? (They must provide information about the mortgage, fees, and costs at least two days before you enter into a mortgage agreement.)

- Do you charge a fee? (Mortgage brokers and associates cannot charge or accept a fee from the borrower until the mortgage has been funded and secured.)

- How will you be compensated? (They can be paid by the lender, the borrower, or both.)

- How many lenders do you work with? (Brokers have many lenders at their disposal, and they must provide you with a list of lenders they work with.)

Before meeting with a mortgage broker or associate, it is helpful to have certain documents prepared, including:

- Employer contact information and employment history

- Proof of address and address history

- Government-issued photo ID

- Proof of down payment (amount and source)

- Proof of savings and investments

- Details of current debts and other financial obligations

With the help of a licensed mortgage broker or associate, you can better understand your options and secure a mortgage that fits your financial situation.

Rutgers New Brunswick: Semester Start Dates and What to Expect

You may want to see also

Working with a real estate agent

Choosing a Real Estate Agent

It is important to choose the right real estate agent for your needs. Consider asking for recommendations from friends and family, or contacting local agents in your area. Schedule meetings with potential agents to gauge their experience and whether they align with your interests. Some questions you may want to ask include:

- How many years have you been in the industry?

- What is your commission fee structure? Do you charge a flat fee or a percentage of the sale?

- What types of services do you provide?

- How will you market my property?

- Will my property be listed on Multiple Listing Services (MLS® Systems)?

- Do you have a website?

- Can you provide references from past clients?

Understanding the Agency Relationship

When you hire a real estate agent, you establish an agency relationship. This means you are legally authorising the agent and their salespeople to act on your behalf. In this relationship, the agent and salespeople have a responsibility to act in your best interest. Be sure to read and understand any agreements or contracts before signing, and clarify any uncertainties.

Dual Agency Agreement

If the buyer and seller are represented by the same agent or salespeople from the same agency, this is called dual agency. In this scenario, the agent's salespeople may struggle to act in the best interest of both parties. A Dual Agency Agreement must be signed by both the buyer and seller, disclosing the agent's conflict of interest. Before signing, understand the limitations on the services provided and the information shared. If you are uncomfortable with the terms, you have the right to choose another agent.

Buyer Agency Agreement

Once you select a real estate agent, you will likely sign a Buyer Agency Agreement. This document outlines the relationship between you and the agent, including compensation and the duration of the agreement. As with any contract, be sure to read and understand the terms before signing.

Listing Agreement

Before listing your home, you will sign a Listing Agreement with your agent. This contract gives the agent permission to list your home, outlines your obligations as a seller, and details the agent's duties, commission fees, and deadline for selling. The agreement will specify whether the listing is a Multiple Listing or an Exclusive Listing. Always retain a copy of the Listing Agreement in case of any disputes.

Is Brunswick, GA Safe?

You may want to see also

Making an offer and closing

You've found the perfect home, and now it's time to make an offer. This is a legally binding contract, so it's important to understand the commitment you're making. The offer to purchase, also called an agreement of purchase and sale, is prepared by your real estate agent or lawyer. It's a big decision, and there is no cooling-off period when buying real estate in New Brunswick. If you change your mind, you will forfeit any deposit.

Decide on the amount you want to offer and what conditions you want to be met before closing the sale. Common conditions include:

- Home inspection: You can request a professional inspection and ask the seller to complete any necessary repairs before the closing date.

- Financing: Make your offer conditional on receiving financing at a set rate. A pre-approval for a mortgage does not guarantee the same interest rate.

- Fixtures and appliances: Ensure that any fixtures, curtains, or appliances you want are included in the purchase price.

- Sale of an existing home: Avoid paying two mortgages by making your offer conditional on selling your current home first.

The seller will either accept, decline, or counter your offer by asking for more money or adjusting the conditions. Once your offer is accepted and any required deposit is paid, you will need to hire a lawyer to handle the transfer of the property. Finalize the details of your mortgage with your lender, broker, or associate, and provide them with the necessary documents.

On or around the closing day, you'll visit your lawyer, sign the required paperwork, and pay the closing costs and down payment. Your lender or mortgage broker will arrange for the mortgage money to be transferred to your lawyer, who will then pay the seller, register the home in your name, and give you the keys to your new home.

Accepted to Rutgers: My Personal Story

You may want to see also

Home insurance

Types of Home Insurance Coverage

Dwelling Coverage:

This type of coverage protects the physical structure of your home. It provides financial protection if your home is damaged or destroyed by covered perils such as fire, windstorm, lightning, smoke damage, or vandalism. The coverage amount is based on the estimated cost of rebuilding your home, and it is crucial to ensure adequate coverage.

Contents Coverage:

Contents coverage in New Brunswick protects your personal belongings within your home from loss or damage caused by covered perils. This insurance reimburses you for the estimated value of your possessions, allowing you to repair or replace them.

Personal Liability Coverage:

Personal liability coverage protects you if you are legally responsible for causing injury or property damage to others. It covers legal expenses, settlements, and judgments. For example, if someone is injured on your property and sues you, liability coverage can help pay for medical expenses and legal costs.

Additional Types of Property Insurance:

Condo Insurance:

Condo insurance is specifically designed for condominium owners. It covers personal belongings, offers liability coverage, and protects any modifications made to the unit. It also includes additional living expenses if you need to relocate due to a covered peril.

Renters Insurance:

If you rent a home in New Brunswick, renters insurance is essential. It protects your personal belongings, such as electronics and jewellery, in the event of damage or theft. It also provides liability coverage for incidents that occur on the rental property.

Vacation Property and Cottage Insurance:

This type of insurance offers comprehensive coverage for risks such as fire, theft, damage to personal property, and liability for incidents involving third parties.

Additional Coverage Options:

Home Business Coverage:

If you operate a business from your home or work remotely, this coverage is essential. It provides protection for losses or damages arising from business-related activities, which are typically not covered by standard home insurance policies.

High-Value Home Insurance:

High-value home insurance is designed for luxury homes, offering higher coverage limits. It protects the home's structure and valuable assets like artwork, jewellery, and antiques. It may also include guaranteed replacement cost coverage and additional living expenses if the home becomes uninhabitable.

Sewer Backup Coverage:

This coverage protects against financial losses due to damage caused by sewage or water backup from drains, sewer lines, or septic systems. It helps cover the costs of cleaning, repairing, and replacing damaged property.

Equipment Breakdown Coverage:

Equipment breakdown coverage protects against internal failures of household equipment, such as mechanical or electrical issues. It covers the costs of repairing or replacing affected equipment.

Overland Water Coverage:

Overland water coverage protects against damage or losses caused by water infiltration from external sources like heavy rainfall, snowmelt, or overflowing bodies of water. It assists with expenses related to property damage, cleanup, repairs, and replacement.

Factors Affecting Home Insurance Costs:

The cost of home insurance in New Brunswick varies for each homeowner. Insurance companies consider factors such as the age, condition, and value of your property, as well as the safety of your neighbourhood and proximity to emergency services. Other factors include the age and condition of your roof, heating system, electrical system, and plumbing system.

Tips for Saving on Home Insurance Premiums:

Bundle Insurance Policies:

Combining your home and auto insurance policies with a single provider can lead to significant discounts.

Increase Your Deductible:

Choosing a higher deductible can result in lower insurance premiums. However, ensure that you can comfortably afford the deductible amount if needed.

Eco-Friendly Improvements:

Making eco-friendly upgrades to your home, such as installing solar panels, may qualify you for discounts on your property insurance.

Enhance Home Security:

Installing smoke alarms, monitored alarm systems, and video surveillance can lower your home insurance costs while also improving safety.

Maintain a Clean Claims History:

Avoid filing small claims that you can manage independently. A history of multiple claims may lead to higher insurance premiums in the future.

Diabetics and Brunswick Stew: A Healthy Match?

You may want to see also

Frequently asked questions

Homes for sale in New Brunswick, NJ have a median listing home price of $475,500.

On average, houses for sale in New Brunswick, NJ spend an average of 50 days on the market.

Some of the most popular neighborhoods in New Brunswick, NJ are South Broad Street, The Waterfront, South Ironbound, Upper Vailsburg, and North Ironbound.

Upfront and closing costs include a down payment, legal fees and disbursements, property tax or utility bill adjustments, mortgage insurance, and tax on the purchase price (for new constructions).

In May 2024, homes in New Brunswick were listed for a median price of $380K. With 25% down, you would need $2,539/month to cover expenses, assuming this is 35% of your total monthly income, and your total yearly income would need to be $87K.