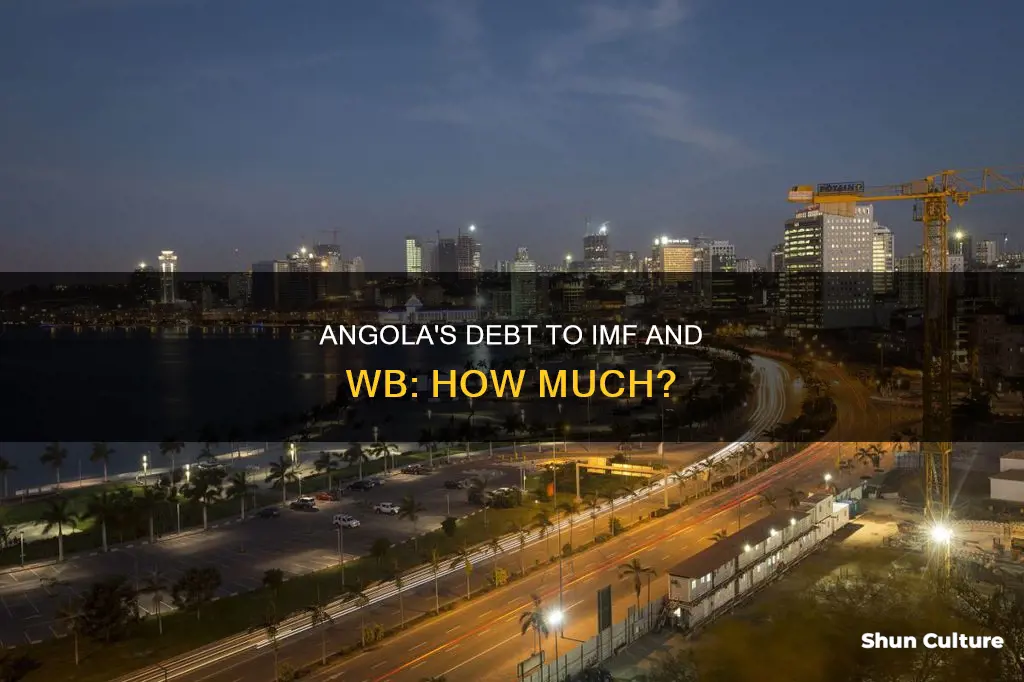

Angola owes its creditors, including the IMF, more than $20 billion, with $14.5 billion owed to the China Development Bank, $5 billion to the Export-Import Bank of China, and an undisclosed amount borrowed from ICBC, China's largest lender. The country has been granted $6.2 billion in debt relief over the next three years, with the IMF reporting that Angola's debt-to-GDP ratio is expected to decrease from 120% at the end of 2024 to 37.8% by the end of 2030. Angola's debt has accumulated over the years due to various factors, including the sharp decline in oil prices, the economic fallout from the COVID-19 pandemic, and the adverse effects of the 2008 global economic crisis. The country's economic recovery and ability to repay its debts are heavily dependent on the oil sector and the implementation of structural reforms to diversify its economy.

| Characteristics | Values |

|---|---|

| Amount owed to IMF | $2989.9 million (as of June 30, 2024) |

| Special Drawing Rights (SDR) | 467.41 million |

| Quota (SDR) | 740.1 million |

| Number of Arrangements since membership | 2 |

| Amount owed to Chinese entities | Over $20 billion |

| Amount owed to China Development Bank (CDB) | $14.5 billion |

| Amount owed to Export-Import Bank of China (EximBank) | $5 billion |

What You'll Learn

Angola's capacity to repay the IMF

Angola's economic recovery in 2021-22 was supported by successful reforms and stable oil prices. However, the country's economy faced significant challenges due to a decline in oil production towards the end of 2022 and into the first half of 2023. This led to a weakening of the oil sector, with both oil prices and production declining, resulting in reduced exports and oil revenues, and a significant depreciation in the nominal exchange rate in June 2023.

Despite these challenges, Angola's capacity to repay the IMF is expected to increase over the medium term, peaking in 2026 at manageable levels. This resilience is attributed to the country's structural reform and diversification agenda, which is projected to stabilize growth at around 3.4% in the medium term. Additionally, the Angolan authorities' commitment to sound policies, macroeconomic stability, and the protection of vulnerable populations has contributed to positive economic indicators.

To ensure continued economic recovery and enhance their capacity to repay the IMF, Angola should focus on reversing fiscal slippage, implementing subsidy reforms, and pursuing tax policy measures to mobilize non-oil domestic revenue. Additionally, maintaining a focus on medium-term structural reforms, improving governance, and promoting private investment are crucial to reducing the country's dependence on the volatile oil sector.

Angola, NY: Public Defender Availability in Court

You may want to see also

Angola's economic recovery

Angola's economy is heavily dependent on oil, which accounts for 90% of the nation's total merchandise exports and 37% of its GDP. The country is facing significant challenges due to the decline in international oil prices, which has aggravated its vulnerability to external shocks. Overdependence on a single export item has also hindered its participation in global value chains and the export of manufactured goods and value-added services.

To reduce its dependency on oil, Angola needs to invest significantly in other economic sectors to stimulate growth. There are opportunities for development in the precious minerals, tourism, agriculture, fisheries, and hydropower sectors. The government has recognized the need to diversify the economy and has taken steps such as creating the National Oil and Gas Agency (ANPG) to improve transparency in the oil sector and encouraging foreign direct investment (FDI) through initiatives like the New Private Investment Law (NPIL).

The COVID-19 pandemic and the resulting economic shocks have also impacted Angola's recovery. The authorities have supported the recovery through sound policies that aim to stabilize the economy, create opportunities for inclusive growth, and protect the most vulnerable. The ongoing fiscal adjustment has helped reinforce debt sustainability while allowing for increased health and social spending.

To maintain growth in the context of declining oil production, Angola needs to lessen its dependence on the oil sector and continue its efforts to strengthen governance, improve the business environment, and promote private investment. The country's capacity to repay its debts to the IMF is adequate, and its projected repayments are expected to increase over the medium term but remain manageable.

The Mystery of Manna: Angola's Scientific Exploration

You may want to see also

Angola's debt-to-GDP ratio

The country's economic recovery has been supported by successful reforms and firmer oil prices. Angola received a boost from the International Monetary Fund (IMF) in the form of a three-year Extended Fund Facility (EFF) arrangement approved in 2018, totalling about $3.7 billion. This support aimed to restore external and fiscal sustainability, improve governance, and diversify the economy to promote sustainable, private sector-led growth.

Despite these efforts, Angola's economy remains heavily dependent on the oil sector, and any declines in oil prices or production can significantly impact its fiscal health. For instance, in 2022 and the first half of 2023, the oil sector weakened due to extended temporary maintenance operations, resulting in a depreciation of the nominal exchange rate and an increase in inflation.

To mitigate risks and reduce its debt-to-GDP ratio, Angola has implemented various measures. These include pursuing tax policy measures to increase non-oil domestic revenue and continuing structural reforms to lessen the dependence on the oil sector. The National Bank of Angola (BNA) has also played a role by adjusting its monetary policy stance and tightening liquidity conditions to manage inflation.

While Angola's capacity to repay its debts remains adequate, the country continues to face challenges in diversifying its economy and reducing its reliance on the volatile oil sector.

Angola's Governance: Control Mechanisms Explored

You may want to see also

Angola's debt relief negotiations

Angola's debt challenges have been exacerbated by a sharp decline in crude oil prices and the economic impact of the COVID-19 pandemic. The country relies heavily on oil revenues, which account for a third of its state revenues. In 2020, the pandemic and an oil price shock caused crude futures to plunge below $20 per barrel, putting immense strain on Angola's economy. The country's debt-to-GDP ratio topped 100%, and servicing the debt was costing $9 billion annually.

To address these challenges, Angola has sought debt relief from various sources. In 2020, Angola requested debt relief from the Group of 20 (G20) wealthy economies under the Debt Service Suspension Initiative (DSSI). The country also entered into negotiations with a number of Chinese banks and government agencies, including the China Development Bank (CDB) and the Export-Import Bank of China (EximBank). These negotiations resulted in agreements for a three-year deferral of principal payments, with a longer repayment period thereafter.

In addition to bilateral negotiations, Angola has also received support from the IMF. In 2018, the IMF approved a three-year Extended Fund Facility (EFF) arrangement worth $3.7 billion to help restore external and fiscal sustainability, improve governance, and diversify the economy. The IMF has also provided additional funding to Angola to mitigate the impact of COVID-19 and support structural reforms. As of 2024, the IMF has endorsed Angola's capacity to repay its debts, despite elevated risks.

While Angola's debt relief negotiations have yielded positive results, the country continues to face significant economic challenges. The IMF has warned that Angola's debt dynamics remain highly sensitive to oil-price volatility. As such, maintaining a focus on medium-term structural reforms and reducing dependence on the oil sector are critical for the country's long-term economic growth and stability.

Exploring the Distance: Angola to Dunkirk, New York

You may want to see also

Angola's loan from the IMF

Angola became a member of the IMF on September 19, 1989. In 2009, the IMF approved a loan of $1.4 billion to Angola, making it the largest IMF financing package for a sub-Saharan African country during the global economic crisis. The loan was intended to support orderly policy adjustments to restore macroeconomic balances and rebuild international reserves, as well as to mitigate the repercussions of adverse terms of trade shocks. The program included a reform agenda focused on medium-term structural issues that would impact long-term non-oil sector growth.

Angola's economy has historically been heavily reliant on the oil sector, and the country experienced a sharp economic slowdown in 2009 due to plunging oil prices and a decline in export revenues. The global economic crisis severely affected the country, leading to fiscal and external deficits and a significant drop in usable reserves. In response, the Angolan government tightened fiscal and monetary policies and implemented foreign exchange rationing to stem the reserve loss. However, these measures did not fully restore market confidence in the country's economic policies.

To address the macroeconomic imbalances, the IMF provided a loan program based on three key pillars: fiscal adjustment, exchange rate adjustment, and maintaining confidence in the financial system. The fiscal program aimed for a significant reduction in the non-oil primary fiscal deficit through expenditure restraint, improved fiscal transparency, and better oversight of state-owned enterprises. The exchange rate adjustment involved a depreciation of the official exchange rate and a tight monetary policy to normalize conditions in the foreign exchange market. Additionally, the program included measures to strengthen the regulatory and supervisory framework of the National Bank of Angola (BNA) to limit risks stemming from the economic slowdown and foreign currency lending.

In 2018, the IMF approved a three-year Extended Fund Facility (EFF) arrangement for Angola, totalling SDR 2.673 billion (approximately $3.7 billion at the time of approval). The EFF aimed to restore external and fiscal sustainability, improve governance, and diversify the economy to promote sustainable, private sector-led growth. During the COVID-19 pandemic, the IMF approved an additional disbursement of SDR 540 million (about $765 million) to support Angola's efforts to mitigate the impact of the pandemic and continue structural reforms. As of June 2024, the total disbursements under the EFF arrangement reached SDR 2,678.3 billion (about $3.9 billion).

Despite challenges, Angola's capacity to repay its loans to the IMF is considered adequate, and the country appears resilient to economic shocks. However, there are risks associated with the continued high reliance on the oil sector, and the medium-term economic outlook depends largely on the recovery of the non-oil sector and the diversification of the economy.

IBAN Number Digits: Angola's Standardized Account Numbers

You may want to see also

Frequently asked questions

Angola owes over $20 billion to Chinese entities, including $14.5 billion to the China Development Bank and nearly $5 billion to the Export-Import Bank of China. It has also borrowed from China's ICBC, the largest lender in the country.

The IMF has been working with Angola to secure debt relief from its creditors. In 2020, it was reported that Angola would receive $6.2 billion in debt relief over three years, thanks to agreements with three major creditors.

Angola's economy is recovering from the COVID-19 pandemic, with growth estimated at 3.5% for 2023. The non-oil sector is performing well, with broad-based growth. Overall growth is expected to continue, reaching about 4% in the medium term.