An International Bank Account Number (IBAN) is a system of identifying bank accounts across national borders. It was originally adopted by the European Committee for Banking Standards (ECBS) and has since been implemented by most European countries and numerous countries in other parts of the world. An IBAN consists of up to 34 alphanumeric characters, including a country code, check digits, and a basic bank account number (BBAN). In Angola, the IBAN is structured as follows: AO06004400006729503010102, where the first two characters are the country code, the third and fourth characters are checksum digits, and the remaining characters are the BBAN.

| Characteristics | Values |

|---|---|

| Country Code | AO |

| Check Digits | 2 digits |

| Bank Identifier | 4 characters |

| Branch Information | 6 digits |

| Account Number | 8 digits |

What You'll Learn

IBANs are made up of up to 34 letters and numbers

An International Bank Account Number (IBAN) is a standard international numbering system for individual bank accounts. It is used to identify an individual account involved in an international transaction. An IBAN number contains up to 34 alphanumeric characters.

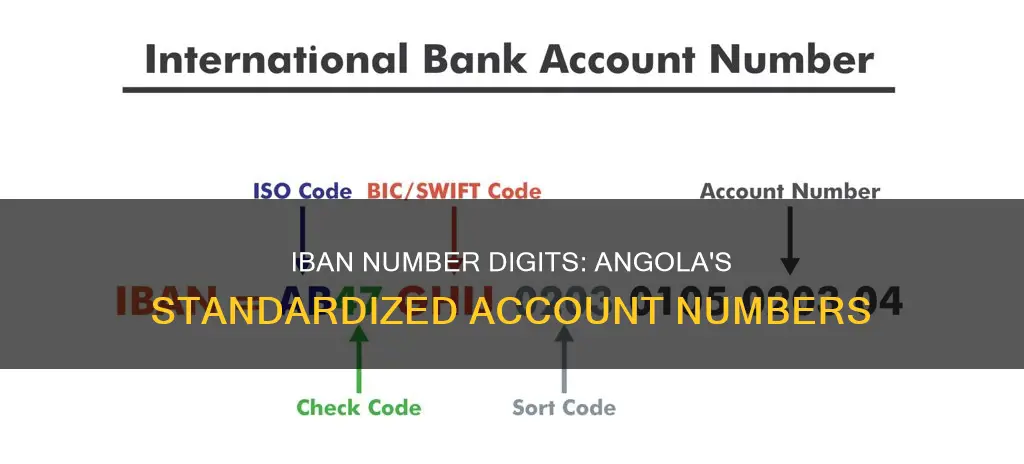

The IBAN system was originally developed by European banks to simplify transactions between European countries. It has since expanded worldwide, although not all banks and regions have adopted the standard. An IBAN number is made up of the following components:

- Country code: The country code is the ISO (International Organization for Standardization) country code. Each country that participates in the IBAN system has a designated code.

- Check digits: The check digits are provided by the issuing financial institution and act as a security layer.

- Bank identifier: This code identifies the financial institution and, when appropriate, the specific branch of the institution.

- Basic bank account number (BBAN): This is a code that identifies an individual account at a specific financial institution in a specific country. The BBAN typically includes a bank code and branch reference, as well as the account number. The format of the BBAN portion varies from country to country.

IBAN numbers are used for fast and secure payments, both domestically and internationally. They are unique to each account and offer a safeguarding system that checks account data before sending funds between international banks. This added level of security reduces transaction errors, rejected payments, and transfer delays.

IBAN numbers are not used for all types of transactions. They can only be used to send or receive funds and cannot be used for other transactions, such as cash withdrawals. Additionally, while the IBAN system is recognised in countries like the US and Canada, it is not required for transferring funds to those countries.

Angola's Proximity: How Far is it From You?

You may want to see also

The first two letters of an IBAN are the country code

The International Bank Account Number (IBAN) is a globally recognised system for identifying bank accounts across national borders. The IBAN consists of up to 34 alphanumeric characters, which are organised as follows: a country code, check digits, and a basic bank account number (BBAN).

The country code is a two-letter code that indicates the country where the bank account is held. This is specified by the ISO 3166-1 alpha-2 standard. For example, 'FR' is the country code for France and 'DE' is the country code for Germany.

The check digits are two numbers that enable a check of the bank account number to confirm its integrity before a transaction is submitted. The check digits are provided by the issuing financial institution.

The BBAN is made up of up to 30 alphanumeric characters that are specific to the country. It includes the domestic bank account number, branch identifier, and potential routing information. The BBAN format is decided by the national central bank or designated payment authority of each country.

The IBAN system was designed to simplify the process of transferring money overseas and is used in some countries for domestic transfers as well. It helps to reduce errors, rejected payments, and transfer delays in cross-border transactions. As of July 2024, 88 countries were using the IBAN system.

Angola's Islamic Faith: Banned or Restricted?

You may want to see also

The next two digits are check digits

An IBAN, or International Bank Account Number, is a standard international numbering system used to identify overseas bank accounts. The number starts with a two-letter country code, followed by two check digits, and then up to thirty-five alphanumeric characters.

The check digits are calculated by forming a single number using the bank code, account number, and country designation. The bank code is at the beginning of the number, followed by the account number. If the account number is shorter than the designated length, zeros are added to the beginning. Additionally, letters are changed to two-digit numbers, with A corresponding to 10, B to 11, and so on. Finally, a set of designated digits, representing the country, are appended to the number. For Germany, for example, these digits are 131400, which stand for "DE00".

The remainder of the resulting number when divided by 97 is then subtracted from 98. If the result is a single digit, a leading zero is added. The outcome of this calculation yields the two check digits. For instance, if the remainder is 57, subtracting it from 98 gives us 41 as the check digits.

The IBAN for Angola is not readily available, but it follows the same structure as other countries' IBANs. Thus, it would begin with the country code "AO", followed by the two check digits, and then the remaining alphanumeric characters.

Angola Prison: Rodeo Tradition Still Alive?

You may want to see also

The following four characters are the bank code

An IBAN, or International Bank Account Number, is a standard international numbering system developed to identify an overseas bank account. The number starts with a two-digit country code, followed by two check digits, and then up to 30 alphanumeric characters that are country-specific. These alphanumeric characters are known as the Basic Bank Account Number (BBAN). The BBAN typically includes a bank code and branch code, as well as the account number.

For example, let's consider the IBAN for a hypothetical bank in Finland: FI21 1234 5698 7654 3210. Here, the bank code is '1234'.

The bank code is an essential element in the IBAN as it helps to ensure that transactions are sent to the correct financial institution. This is particularly important for international transactions, where there may be multiple banks with similar names in different countries.

In addition to the bank code, the IBAN may also include a branch code, which identifies a specific branch of the financial institution. This is especially relevant for banks with multiple branches or locations.

By including the bank code in the IBAN, the system helps to streamline and secure transactions by providing detailed information about the sending and receiving financial institutions. This level of detail reduces the risk of errors and ensures that funds are transferred smoothly and securely between banks, both domestically and internationally.

It is worth noting that while the IBAN includes critical information about the bank and account, it does not replace the bank's own account numbering system. Instead, it serves as an additional layer of security and verification for overseas payments.

Exploring Indiana: Mishawaka to Angola Distance

You may want to see also

The remaining characters are the Basic Bank Account Number (BBAN)

The remaining characters of an IBAN number are the Basic Bank Account Number (BBAN). This is a code that identifies an individual account at a specific financial institution in a specific country. The BBAN will typically include a bank code and branch reference, as well as the account number, although formats can differ across IBAN regions. The BBAN is made up of up to 30 alphanumeric characters that are country-specific.

The BBAN format is decided by the national central bank or designated payment authority of each country. There is no consistency between the formats adopted. The national authority may register its BBAN format with SWIFT but is not obliged to do so. It may adopt IBAN without registration.

The BBAN must be of a fixed length for the country and comprise case-insensitive alphanumeric characters. It includes the domestic bank account number, branch identifier, and potential routing information. Each country can have a different national routing/account numbering system, up to a maximum of 30 alphanumeric characters.

The check digits enable the sending bank (or its customer) to perform a sanity check of the routing destination and account number from a single string of data at the time of data entry. This check is guaranteed to detect any instances where a single character has been omitted, duplicated, mistyped, or where two characters have been transposed. Thus, routing and account number errors are virtually eliminated.

Angolan Pythons: Massive Snake Species in Africa

You may want to see also

Frequently asked questions

IBAN stands for International Bank Account Number.

An IBAN number for Angola has 24 digits.

The structure of an IBAN number is: Country Code (2 characters), Checksum Digits (2 characters), and BBAN (up to 30 characters).

The country code for Angola is "AO".

The checksum is a two-digit number used to validate the correctness of the IBAN. It is calculated using an algorithm, specifically MOD-97-10 as per ISO/IEC 7064:2003.