Bolivia has experienced relatively low inflation rates compared to other countries in Latin America. The country's inflation rate for 2022 was 1.75%, with an average of 2.9% over the previous ten years. Bolivia's government has implemented various economic policies to maintain low inflation, including a fixed exchange rate and subsidies for essential products. These interventions have kept prices stable and contributed to steady economic growth. However, they have also led to challenges, such as a negative impact on producers and the need to monetise gold reserves.

| Characteristics | Values |

|---|---|

| Inflation Rate in 2022 | 1.75% |

| Inflation Rate in 2021 | 0.74% |

| Inflation Rate in 2020 | 0.94% |

| Inflation Rate in 2019 | 1.84% |

| Inflation Rate in July 2024 | 4% |

| Inflation Rate in 2023 | 2.6% |

What You'll Learn

Bolivia's inflation rate in 2024

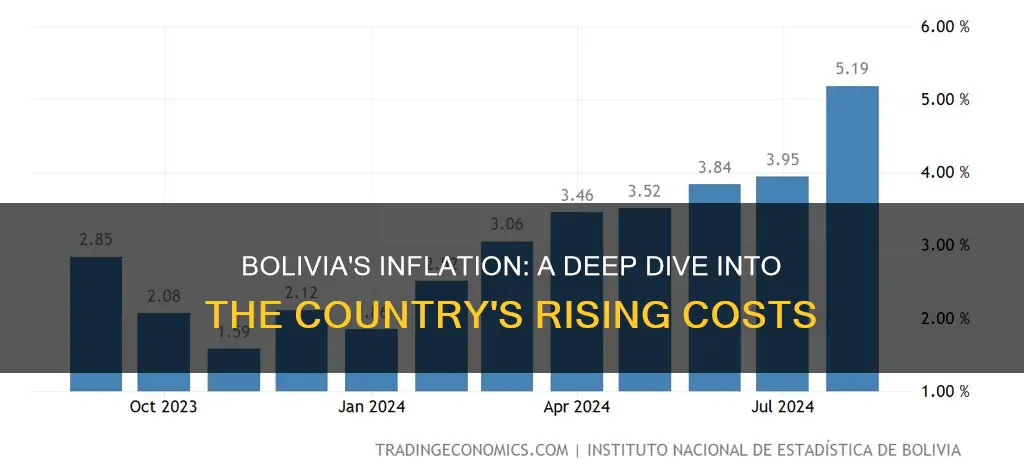

Bolivia's inflation rate has been relatively low in recent years, and it is projected to decrease further in the coming years. Between January 2018 and May 2024, the inflation rate in Bolivia seldom exceeded three per cent. As of May 2024, the Consumer Price Index (CPI) was 3.52 per cent higher than the same month in 2023. The inflation rate only dipped into negative numbers once during this period, in November 2020, when the CPI decreased by 1.1 per cent compared to November 2019.

The average inflation rate in Bolivia is forecast to continuously decrease between 2024 and 2029, by a total of 0.7 percentage points. The inflation rate is estimated to be 3.8 per cent in 2029. This decrease in inflation is based on the year-on-year change in the average consumer price index, which reflects the annual percentage change in the cost of acquiring a basket of goods and services for the average consumer.

The food and non-alcoholic beverages sector experienced the largest increase in prices based on the CPI in October 2023. Compared to October 2022, the inflation rate of food stood at 2.97 percentage points. The annual inflation rate of transportation was 2.5 per cent, ranking third.

Bolivia's inflation rate was 4.0 per cent in July 2024, up from 3.8 per cent in June 2024.

Bolivian Lithium: Powering Green Energy, Fighting Climate Change

You may want to see also

Inflation rate compared to previous years

Bolivia's inflation rate has fluctuated over the past few years. Between January 2018 and May 2024, the inflation rate rarely exceeded three per cent, with the Consumer Price Index (CPI) 3.52 per cent higher in May 2024 than the same month in 2023. The inflation rate only went into negative figures in November 2020, when the CPI decreased by 1.1 per cent compared to November 2019.

The inflation rate for consumer prices in Bolivia has moved between -0.7 per cent and 11,749.6 per cent over the past 63 years. In 2023, the inflation rate was 2.6 per cent. During the observation period from 1960 to 2023, the average inflation rate was 226.3 per cent per year. Overall, the price increase was 782.65 million per cent.

The average inflation rate in Bolivia is projected to decrease steadily between 2024 and 2029, by a total of 0.7 percentage points. Inflation is expected to be 3.8 per cent in 2029.

Exploring Bolivia's Pineapple Cultivation Possibilities

You may want to see also

The impact of fixed exchange rates

Bolivia's exchange rate has been fixed since 1985, making it an outlier among Latin American economies, which have largely favoured floating exchange rates. The country's monetary policy has been based on an exchange rate anchor, and its financial sector remains highly dollarized.

Bolivia's exchange rate system can be described as an "incomplete crawling peg", meaning it is fixed but undergoes high-frequency readjustments that are not pre-announced to the public. The Central Bank of Bolivia has not been rigid in administering the rate, which may explain the longevity of the exchange regime. For example, during the Latin American regional crisis of 1999-2003, the Bank accelerated the rate of crawl (depreciating the currency), which may explain why Bolivia emerged from that tumultuous period relatively unscathed.

The fixed exchange rate has contributed to relatively moderate inflation, financial stability, and a high level of international reserves. However, it has also faced criticism. Bolivia's system has been described as "suffocating", with a shortage of US dollars derived from falling exports and the need for structural reforms. The country's finances are solid, but the shortage of dollars is pressing, and the erosion of the fixed exchange rate is a fact. If the exchange rate were left floating, inflation would likely increase.

The lack of US currency is a long-standing problem for Bolivia, with external factors and government negligence cited as contributing causes. The country's exports have dropped, especially after the stabilization of raw material prices and the drastic drop in gas exports, which previously allowed the government and the Central Bank to accumulate reserves. Bolivia's dependence on imports has also increased due to the fall in international demand for hydrocarbons, and the country's industry constantly needs to import inputs.

To remedy the problem, some have recommended transitioning to a floating exchange rate or raising the price of the fixed exchange rate, taking certain precautions. However, others argue that a floating rate would be a double-edged sword and that the scarcity of dollar sources and the unsustainability of the fixed exchange rate increase the demand for foreign currency.

Bolivia's Uniqueness: A Country Like No Other

You may want to see also

Government intervention to control inflation

Bolivia has experienced significant inflationary pressures over the past six decades, with rates fluctuating between -0.7% and 11,749.6%. While the inflation rate in 2023 was calculated to be 2.6%, the average inflation rate during the observation period from 1960 to 2023 was a staggering 226.3% per year. This highlights the need for effective government intervention to control inflation and maintain economic stability.

Contractionary Monetary Policy

Central banks play a crucial role in controlling inflation by adjusting the nation's monetary policy. This can be achieved through the following measures:

- Increasing interest rates: Higher interest rates make borrowing more expensive, reducing consumer and business spending. This, in turn, slows down economic growth and helps curb inflation.

- Open market operations: Central banks can buy or sell government securities (treasury securities) to increase or decrease the money supply in the economy. Buying securities promotes liquidity, while selling securities reduces it.

- Reserve requirements: While reserve requirements have been set at zero since March 2020, the Federal Reserve previously used this tool to manage the money supply. By requiring banks to hold a certain amount of money in reserve, the Federal Reserve could control the amount of money available for lending to consumers.

- Discount rate: The Federal Reserve can also adjust the discount rate, which is the interest rate charged on loans to commercial banks and other financial institutions. Increasing the discount rate can help temper inflation.

Supply-Side Policy Reforms

Congress and legislative bodies can implement supply-side policy reforms to complement the central bank's efforts:

- Reducing government spending: Lower government spending can help reduce demand-fueled inflation. It also restores confidence in the government's ability to manage debt and control inflation expectations.

- Removing barriers to work: Reforms such as occupational licensing reform, increased work flexibility, and mitigating work disincentives can increase labor force participation, reducing production costs for firms.

- Deregulation: Removing regulations in energy, housing, and other markets can lower the cost of domestic production and bring down prices.

- International supply: Reducing tariffs and eliminating regulatory barriers can provide consumers with access to cheaper goods and strengthen supply chains.

It is important to note that the effectiveness of these interventions may vary, and a combination of these strategies may be required to effectively control inflation. Additionally, the timing and aggressiveness of anti-inflationary measures must be carefully calibrated to avoid tipping the economy into recession.

McDonald's in Bolivia: A Tasty Mystery Solved

You may want to see also

Bolivia's inflation rate in 2023

Over the past 63 years, the inflation rate in Bolivia has fluctuated between -0.7% and 11,749.6%. An item costing 100 Bolivianos in 1960 would have cost 782.65 million Bolivianos at the beginning of 2024, demonstrating the impact of inflation over time.

The inflation rate reflects the annual percentage change in the cost of goods and services for consumers. It is measured using the consumer price index, which tracks the price of a basket of consumer goods and services.

While the specific factors contributing to Bolivia's inflation rate in 2023 are not readily available, it is generally influenced by various economic, political, and market conditions.

Compatibility of Bolivian Rams and Angelfish: Can They Coexist?

You may want to see also

Frequently asked questions

Bolivia's inflation rate in 2022 was 1.7% or 1.75%.

The average inflation rate in Bolivia over a 10-year period up to 2022 was 2.9%. Over a 63-year period from 1960 to 2023, the average inflation rate was 226.3% per year.

Bolivia has the lowest inflation rate in the region. The Latin American regional average for the ten years up to 2022 was 8.4%, much higher than Bolivia's average of 2.9% over the same period.