Bahrain has a strong and sophisticated banking industry, with a mix of local and foreign banks operating in the country. The Central Bank of Bahrain (CBB) is the country's primary financial regulator, responsible for maintaining monetary and financial stability. The country is also a significant centre for Islamic banking in the Middle East. Expats relocating to Bahrain can benefit from efficient and reliable banking services, with options such as Arab Bank, HSBC Bahrain, Ahli United Bank, Citibank, and Bank of Bahrain and Kuwait (BBK) being popular choices. The currency used in Bahrain is the Bahraini dinar (BHD), and the country offers a range of digital banking options and a wide network of ATMs.

What You'll Learn

The Central Bank of Bahrain

The CBB is responsible for maintaining monetary and financial stability in the Kingdom of Bahrain and is the single integrated regulator of Bahrain's financial industry. Its responsibilities include implementing monetary policy, supervising and regulating the banking sector, acting as the government's fiscal agent, encouraging the growth of Bahrain as a major international financial centre, and managing the kingdom's foreign currency, cash and gold reserves.

The CBB also houses a coin and currency museum, which opened on 16 February 1999 and showcases some of the rarest coins in the region, with collections dating back to 653 AD. Admission to the museum is free.

The current Central Bank of Bahrain governor is Rasheed Al Maraj, who was appointed in November 2014.

The Runaway Princess: Where is She Now?

You may want to see also

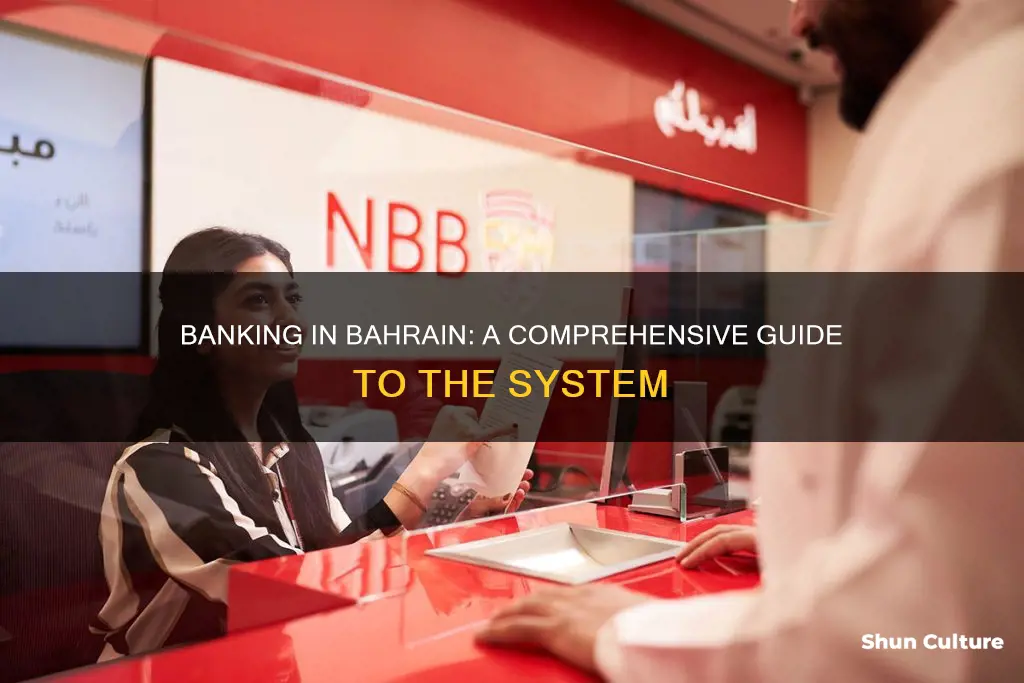

Opening a bank account

Bahrain has a strong and sophisticated banking industry, with a number of good options for expats looking to open a local bank account. Popular banks with expats in Bahrain include Arab Bank, HSBC Bahrain, Ahli United Bank, Citibank and Bank of Bahrain and Kuwait (BBK). Many expats find it more convenient to open an account with the bank their employer uses.

There are plenty of ATMs in Bahrain, with the majority offering 24-hour service. While Bahrain has been a predominantly cash-based society, it is moving towards digital payments, with expats now able to pay with debit or credit cards almost everywhere, and many establishments also accepting online payment apps.

Bahrain's Bapraka: A Cultural and Historical Treasure

You may want to see also

ATMs and credit cards

Bahrain has a strong and sophisticated banking industry, with a number of options for both locals and expats. The country's previous cash-based society is moving towards digital payments, with the wide availability of ATMs and the option to pay with debit or credit cards almost everywhere. Many establishments also accept online payment apps.

ATMs are easy to find in Bahrain, with the majority offering 24-hour service. Expats and locals can use these machines to withdraw cash in the local currency, the Bahraini dinar (BHD). Notes come in denominations of ½ BHD, 1 BHD, 5 BHD, 10 BHD, and 20 BHD, and coins are available in 5, 10, 25, 50, and 100 fils (1 dinar = 1,000 fils).

Credit cards are also widely used in Bahrain, with banks offering various benefits and rewards to their customers. For example, HSBC Bahrain offers a cashback credit card with up to 2% cashback and no annual fees for the first year. The National Bank of Bahrain (NBB) provides credit cardholders with exclusive offers and rewards through their Points by NBB programme. Additionally, NBB offers a "Win Back Your Money" campaign, where credit cardholders have the chance to win exciting cash prizes.

Bahrain's Rejection of Arab Tunisia: A Historical Perspective

You may want to see also

Income tax and social security

Bahrain is an attractive option for expats due to its tax-friendly policies. The country does not levy any income tax on personal earnings. This means that expats are exempt from paying taxes on their income, which can lead to significant savings and a higher quality of life. However, expats are still liable to pay social security contributions, which amount to 1% of their monthly income. Additionally, expat employers are required to contribute an additional 3% towards each expat employee's social security.

The social security system in Bahrain is administered by the Social Insurance Organization (SIO). The contribution rates for social insurance are 23% for local employees (15% employer, 8% employee) and 4% for expatriate employees (3% employer, 1% employee). These contributions are withheld by the employer and remitted to the SIO on a monthly basis.

It is important to note that while Bahrain does not have income tax, expats may still be subject to double taxation if their country of origin taxes their global income. Therefore, it is advisable for expats to consult with a specialist tax practitioner to ensure they meet all their tax obligations.

In addition to social security contributions, expats in Bahrain are also required to pay a municipal tax, which is equal to 10% of their monthly rent. This tax is applicable even for short-term rentals and is paid by the tenant.

Bahrain's tax landscape is largely shaped by its strong economy, particularly the petroleum and aluminium production industries. The country's wealth allows it to offer generous tax exemptions and provides an attractive environment for expats seeking employment and a high quality of life.

Bahrain's Independence: Breaking Free from Iranian Rule

You may want to see also

Islamic banking

Bahrain is recognised as a global leader in Islamic finance, ranking 2nd in MENA and 4th globally for Islamic finance development. The country has the highest concentration of Islamic finance institutions in the region: 11 wholesale Islamic banks and 6 retail Islamic banks.

Islamic finance, or Shari’a-compliant banking and finance, is a system that follows the principles of Islamic law (Sharia). It is based on ethical and moral principles that promote fairness, justice, and social welfare. Islamic finance is considered beneficial for overall economic growth.

The Central Bank of Bahrain (CBB) was established on 6 September 2006 and is responsible for maintaining monetary and financial stability in the country. It has played a leading role in the introduction of innovative Islamic financial products and services. The CBB introduced a separate regulatory framework and a comprehensive prudential and reporting mechanism for the Islamic banking segment, which covers areas such as licensing requirements, capital adequacy, risk management, business conduct, financial crime, and disclosure/reporting requirements.

The growth of Islamic banking in Bahrain has been remarkable, with total assets increasing from US$1.9 billion in 2000 to US$32.7 billion as of July 2020, an increase of over 17 times. The market share of Islamic banks has also grown significantly, from 1.8% in 2000 to 15.3% in July 2020.

Islamic financial institutions in Bahrain offer a range of Shari’a-compliant products and services, including retail and wholesale banking, Islamic windows of conventional banks, Takaful and Re-Takaful companies, and Islamic securities (Sukuk).

Islamic finance prohibits interest, gambling, uncertainty, and investments in forbidden industries. Instead, it focuses on partnerships and profit-sharing, promoting risk-sharing and profit-sharing arrangements. It encourages ethical investments that benefit society, such as healthcare, education, renewable energy, and infrastructure.

Bahrain is also home to several global organisations that are central to the development of Islamic finance, including:

- Accounting and Auditing Organization for Islamic Financial Institutions (AAOIFI)

- International Islamic Financial Market (IIFM)

- General Council for Islamic Banks and Financial Institutions (CIBAFI)

- Islamic International Rating Agency (IIRA)

- Bahrain Institute of Banking and Finance (BIBF) – Centre for Islamic Finance

Bahrain in Asian Games: A Geographical Identity Question

You may want to see also

Frequently asked questions

The currency used in Bahrain is the Bahraini dinar (BHD), which is divided into 1,000 fils.

Popular banks in Bahrain include Arab Bank, HSBC Bahrain, Ahli United Bank, Citibank, and Bank of Bahrain and Kuwait (BBK).

Opening a bank account in Bahrain requires a fair amount of paperwork and an in-person visit to the prospective bank. Documents such as a passport, work and/or residence permit, and proof of residence are typically required.

Bahrain has a strong and sophisticated banking industry, offering efficient and reliable services. Additionally, there is no income tax on personal earnings, making it financially attractive for expats.