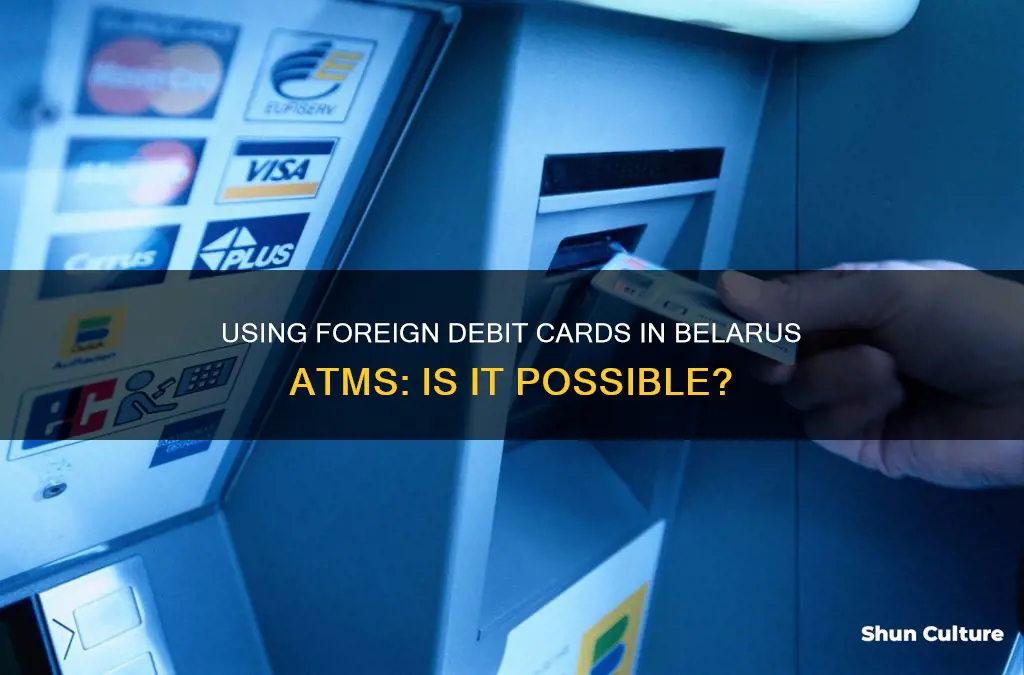

If you're planning a trip to Belarus, you'll need to get to grips with the local currency, the Belarusian ruble (BYN). It's a good idea to carry a reasonable amount of cash in small denominations of EUR or USD, but you can also use your debit card in Belarus. Visa is the most commonly accepted card at ATMs, but an increasing number of ATMs also accept Cirrus/MasterCard. It's worth noting that most ATMs in Belarus charge a withdrawal fee, and your bank may charge an additional fee on top of this.

| Characteristics | Values |

|---|---|

| ATM Availability | ATMs are available in Belarus, particularly in Minsk. |

| Card Acceptance | Visa and Mastercard are the most widely accepted card networks. Cirrus/Mastercard acceptance is increasing. |

| ATM Fees | Most ATMs charge a withdrawal fee. |

| Currency Conversion | The Belarusian Ruble (BYN) is the official currency and is not fully convertible, so it cannot be obtained before arriving in the country. |

| Cash Usage | Cash is accepted in some shops and restaurants. Carrying a mix of cash and cards is recommended. |

| Card Alternatives | Alternatives like Wise and BigPay may offer lower fees and better exchange rates. |

| Fraud | ATM fraud is not uncommon in Belarus. |

What You'll Learn

ATM compatibility with foreign cards

When travelling to Belarus, it's important to be aware of the compatibility of your debit card with local ATMs. Here are some key points to consider:

Card Acceptance in Belarus

Belarus uses the Belarusian Ruble (BYN) as its official currency, and you will need this currency to make purchases during your visit. Bank cards are widely accepted in Belarus and can be used in shops, hotels, restaurants, and self-service kiosks. The most commonly accepted international payment systems in Belarus are Visa and MasterCard. However, it is always a good idea to carry some local currency with you as well.

ATM Compatibility

ATMs in Belarus are compatible with foreign cards, especially those from the Visa and MasterCard networks. You can find ATMs in any bank office, supermarket, or shopping mall, particularly in cities like Minsk. While your foreign debit card will generally work, it is recommended to carry a low-cost ATM card to avoid high transaction fees. Additionally, some ATMs may charge a withdrawal fee, and your bank may also charge additional fees for international withdrawals.

Tips for Using ATMs in Belarus

To avoid unexpected fees, consider the following tips:

- Obtain a low-cost ATM card with free or cheap international withdrawals.

- Always choose to pay in the local currency (BYN) when withdrawing cash to avoid additional charges and unfavourable exchange rates.

- Check if your ATM card has a fixed cost per transaction. In such cases, making fewer, larger withdrawals may be more cost-effective.

- Be cautious of ATM fraud and skimming devices. Always check the ATM for any suspicious attachments and avoid using machines that appear tampered with.

- Watch out for warnings of extra fees on the ATM screen, as some ATMs may charge additional operator fees.

Alternative Options

If you encounter issues with ATM compatibility or wish to avoid high fees, there are alternative options for accessing cash:

- Send money to yourself online and pick it up at an authorised local cash pickup point. This can be a quick and convenient way to access cash without relying on ATMs.

- Obtain a travel card with favourable exchange rates and low or no ATM withdrawal fees overseas.

- Carry a reasonable amount of cash in small denominations, such as clean and undamaged EUR or USD 10, 20, or 50 notes. This can be useful for smaller purchases or at establishments that may not accept card payments.

In summary, while foreign debit cards are generally compatible with ATMs in Belarus, it is important to be aware of potential fees and have backup options for accessing cash. Carrying a mix of payment methods, including a low-cost ATM card and some local currency, will ensure you are prepared for various scenarios during your trip to Belarus.

Belarus Women: Trustworthy or Not?

You may want to see also

ATM fees

If you're planning a trip to Belarus, it's good to know that the official currency is the Belarusian Ruble (BYN). You'll need to find ways to spend in Belarusian Rubles while you're there.

There are plenty of ATMs in major cities in Belarus, but there are currently difficulties withdrawing cash using foreign credit and debit cards. Almost all major banks in Belarus do not accept foreign-issued cards, and those that do may charge a higher rate of commission.

Most ATMs in Belarus charge a withdrawal fee, and your bank will likely charge an additional fee for using a foreign ATM. Withdrawal limits depend on the bank and are generally around 200 USD, which means multiple transactions are often needed, and transaction fees can add up.

- Get a low-cost ATM card that offers free or cheap international withdrawals.

- Always pay in the local currency when you withdraw to avoid additional charges and poor exchange rates offered by the ATM.

- Check if your ATM card has a fixed cost per transaction. This might mean that making fewer, larger withdrawals is cheaper.

- Watch the ATM screen for warnings of extra fees the ATM operator may add, and consider finding an alternative terminal if there are additional charges.

- Consider using a Wise (formerly TransferWise) MasterCard, which can help reduce your bank fees and gives a great exchange rate on purchases. With their borderless account/card, you can hold your money in over 40 currencies and use the debit card to get your cash out with low conversion fees and zero transaction fees.

- If you want to avoid using ATMs altogether, you can send money to yourself online and pick it up at an authorized local cash pick-up point. This is a quick and safe option, and you can often find these pick-up points at major hotels that accept debit/credit cards.

Exploring Belarus: Tour Bus Travel Options

You may want to see also

Payment cards for non-residents

As the Belarusian Ruble (BYN) is the official currency in Belarus, you'll need to find a convenient way to pay using this currency.

Foreign cards do not work in Belarus. This applies to all foreign Visa/MasterCard cards issued by any country except Belarus. The only exception is the 'MIR' payment system, which is accepted at all terminals and ATMs in Belarus. However, MIR cards issued by sanctioned banks may encounter problems with online transactions and payments at some retail outlets.

If you are a non-resident in Belarus, you can open an international Visa or MasterCard to pay for purchases in Belarus and abroad. You can also open a Belkart or MIR card. Belkart is an internal payment system in Belarus, which is also accepted in the service network of the MIR payment system and its partner payment systems (the Russian Federation, the Republic of Armenia, Abkhazia, and South Ossetia).

To open a Belkart or MIR card as a non-resident, you will need:

- A passport (in some cases, a foreign passport)

- A Belarusian SIM card (in some banks, you can use a Russian number)

- If your passport is not in Russian, you will need a copy of your passport translated into Russian/Belarusian and certified by a notary or a foreign authorised person

You can issue a card in any Belarusian city where there is a branch of the bank. At the moment, you can open an account in Belarusian rubles, dollars, euros, and Russian rubles in Belarusian banks.

- Cards: Visa Classic, Gold and Platinum. Currency: BYN/USD/EUR. Cost: 200 BYN /70 USD / EUR. Crediting of funds: No fee by card number within the country, 1.5% from abroad. Cash withdrawal: No fee at BTA ATMs, 1% at partner ATMs, 2% at other ATMs

- Cards: Visa Classic, Mastercard Standard. Currency: BYN (Visa Classic) and USD/EUR (Mastercard Standard). Cost: 300 BYN for the whole term. Crediting of funds: 2% for BYN accounts, 0.5% for USD/EUR accounts. Cash withdrawal: No fee at MTBank and partner ATMs, 3.5% at other ATMs

- Cards: All available. Currency: BYN/USD/EUR/RUB. Cost: 330 BYN for the whole term for all cards. Crediting of funds: No commission by card number, 2% by account number. Cash withdrawal: No fee at Paritetbank ATMs, 3% at other ATMs

- Cards: Visa Classic, Visa Gold, package ‘Visa Gold+Belkart’. Currency: BYN/USD/EUR. Cost: Visa Classic - 270 BYN, Visa Gold - 290 BYN, ‘Visa Gold+Belkart’ package - 350 BYN. Crediting funds: No fee by card number. Cash withdrawal: No fee at ATMs of Zepter Bank, 2.5% domestically, 2.7% abroad

- Cards: Smart Classic, Smart Gold, Smart Platinum, Smart Black. Currency: BYN/USD/EUR. Cost: 250 BYN for connection to the package of solutions. The cost of the Smart Classic solution package is 4.9 BYN per month. If free of charge criteria are fulfilled, no commission. Crediting funds: No commission by account number. Cash withdrawal: No fee at Alfa Bank partner ATMs, 3% at other ATMs

It is also possible to obtain a virtual card via internet banking.

The Residence of the President of Belarus

You may want to see also

Card payment acceptance in Belarus

ATM cards

Belarusian ATMs don't usually pose any challenges, but it's always good to be prepared for any issues. Most ATMs in the country charge a withdrawal fee, and your bank will likely charge an additional fee for using your card abroad. Visa is the most commonly accepted card at ATMs in Belarus, but an increasing number also accept Cirrus/MasterCard.

It's worth noting that ATM fraud in Belarus is not uncommon, so it's important to be vigilant when using ATMs. Some tips to avoid unexpected fees include:

- Getting a low-cost ATM card that offers free or cheap international withdrawals

- Paying in the local currency to avoid additional charges and poor exchange rates

- Checking for any fixed costs per transaction and making fewer, larger withdrawals if it's more cost-effective

- Paying attention to the ATM screen for warnings of extra fees added by the ATM operator

If you're unable to find a compatible ATM or wish to avoid ATM fees, there are alternative ways to access cash. You can send money to yourself online and then pick it up at an authorised local cash pick-up point. This is also a useful option if you want to withdraw more than ATM limits allow. Services like World Remit and Ria Money Transfer allow you to send money to Belarus and then collect it from a local branch of Technobank or Fransabank.

Card payments

Card payments are widely accepted in Belarus and can be used in shops, hotels, restaurants and self-service kiosks. However, it's worth noting that some smaller restaurants and tourist sites may only accept cash. Major hotels typically take debit and credit cards.

When paying with a card in Belarus, it's a good idea to have some cash as a backup, as there have been instances of errors or card reader malfunctions. Additionally, some establishments may accept card payments but lack the necessary equipment, so it's always good to check beforehand.

Currency

The Belarusian Ruble (BYN) is the official currency in Belarus and is not a fully convertible currency, so you won't be able to obtain it before arriving in the country. It's recommended to bring some cash in a widely accepted currency, such as USD or EUR, and then exchange it at a local bank or exchange office. Banks in Belarus charge a commission for accepting dirty or worn-out banknotes, so ensure that your bills are in good condition.

Belarusian Standard-Issue Firearms: What Guns Does the Country Use?

You may want to see also

Alternatives to using a debit card

While it is possible to use a debit card in Belarus, there are several alternative options for accessing your money.

Firstly, it is worth noting that Belarus still largely operates on a cash basis. It is a good idea to carry a reasonable amount of physical cash in small denominations, such as EUR or USD 10, 20, or 50 notes. Ensure that the bills are clean and undamaged, as banks in Belarus may charge a commission for accepting dirty or worn-out banknotes.

If you do plan to use your debit card, it is recommended to carry a low-cost ATM card, as some ATMs may charge a fee per transaction. Before your trip, check the commission rates and fees associated with your bank and card to avoid unexpected charges. Additionally, always pay in the local currency to avoid additional charges and poor exchange rates offered by the ATM.

For those who prefer not to rely on cash, there are several P2P (peer-to-peer) payment services available. These services allow you to transfer money to individuals using your mobile phone or laptop. Examples of popular P2P services include PayPal, Apple Pay, Venmo, Cash App, Google Pay, and Zelle. These services often provide high transaction speeds and strong security measures, such as data encryption and fraud tracking.

Another alternative is to obtain a travel card specifically designed for overseas spending. These cards can offer low-cost currency conversion and cash withdrawals, helping you keep your budget under control. An example of such a card is the BigPay card, which can be used in Belarus and offers budgeting tools and good exchange rates.

In conclusion, while using a debit card in Belarus is possible, it is important to be aware of potential issues, such as ATM errors or unexpected fees. As such, it is advisable to consider alternative options, including carrying cash, using P2P payment services, or obtaining a specialised travel card.

Belarus' Inflation Crisis: Why So High?

You may want to see also

Frequently asked questions

Yes, you can use your debit card in Belarus ATMs. Visa is the most commonly accepted card, but an increasing number of ATMs also accept Cirrus/MasterCard.

Most ATMs in Belarus charge a withdrawal fee, and your bank will likely charge an additional fee. Withdrawal limits depend on the bank and are generally around 200 USD, so multiple transactions are often needed and transaction fees can add up.

Yes, you can use your debit card to send yourself money online and pick it up at an authorised local cash pick-up point. This is a quick way to get cash without having to pay ATM fees or be limited by ATM withdrawal limits.