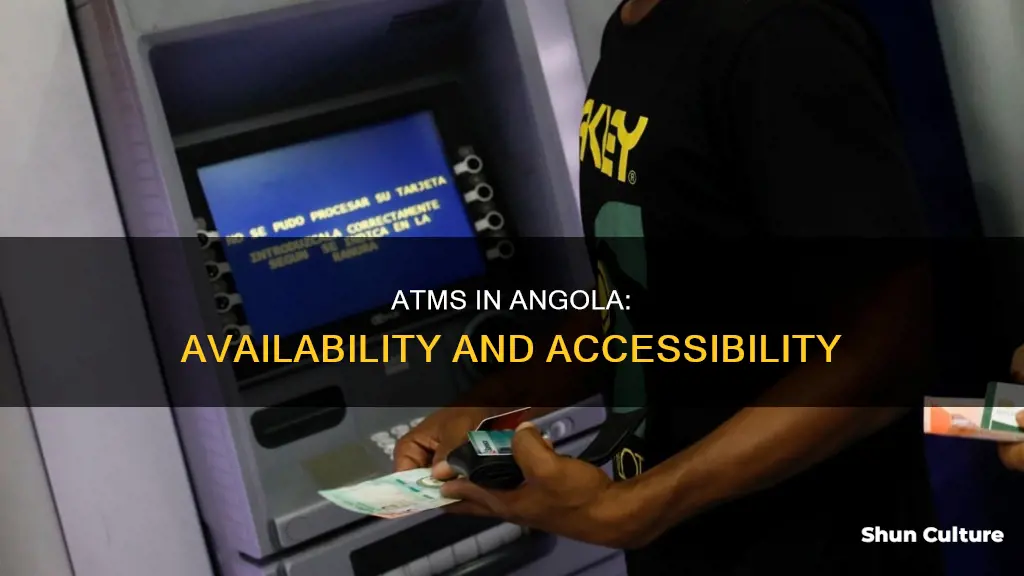

Angola is a fascinating country with a lot to offer tourists, but it can be a complex place to navigate. One of the challenges visitors face is accessing cash. ATMs are available in Angola, but they can be scarce and often run out of money. In addition, not all ATMs accept foreign accounts, and those that do may charge high fees. This article will explore the options available for accessing cash in Angola, including the use of ATMs, cash pick-up points, and debit/credit cards. We will also discuss the potential challenges and risks associated with each option to help travellers make informed decisions about managing their money during their stay in Angola.

| Characteristics | Values |

|---|---|

| Number of ATMs in Angola | 3,500 |

| Number of ATM cards in Angola | 7.6 million |

| Average number of ATMs per bank | 184 |

| Number of ATMs per 100,000 inhabitants in 2024 | 20.8 |

| Number of ATMs per 100,000 inhabitants in 2029 | 21.6 |

| Interbank commission for ATM withdrawals | 700 Kwanzas |

| Official currency | Angolan Kwanza |

| Other accepted currency | US Dollars |

| Availability of ATMs | Scarce |

What You'll Learn

ATM availability in Angola

ATMs in Angola are generally accessible, but there are a few things to keep in mind when planning to use one. Firstly, not all ATMs in Angola accept foreign accounts, and even when they do, there may be high withdrawal fees and fraud concerns. It is also common for ATMs to be out of cash, so it is recommended to have a backup plan for accessing money.

The availability of ATMs in Angola has been increasing, with a forecast of a 3.85% increase in the number of ATMs per 100,000 inhabitants between 2024 and 2029. This is partly due to the increase in the interbank commission, which incentivizes banks to install more ATMs and ensure they are well-stocked with cash. As of 2023, there are around 3.5 thousand ATMs in the country, with an average of 184 ATMs per bank.

When using an ATM in Angola, it is important to be aware of potential fraud and take precautions to protect yourself. It is also recommended to bring USD as a backup, as ATMs can be unreliable.

If you are unable to use an ATM or prefer not to, there are alternative options for accessing cash. You can use a reputable international money transfer service to send money to a local cash pick-up point, such as World Remit or Ria Money Transfer. Additionally, major hotels accept debit and credit cards, but cheaper accommodations, tourist sites, and smaller restaurants usually only take cash.

Angola Incarceration: Exploring Sexuality Among Male Prisoners

You may want to see also

ATM fraud in Angola

Angola's ATM network is small but growing, with an estimated total of 2,300 ATM cardholders out of a population of 20 million people. The number of ATMs per 100,000 inhabitants in Angola is expected to increase by 0.8 ATMs (+3.85%) between 2024 and 2029, reaching a projected peak of 21.6 ATMs per 100,000 people in 2029.

While ATMs in Angola do not usually pose any significant challenges, there are some concerns about fraud and security. Not all ATMs in the country allow access to foreign accounts, and when they do, fraud is a concern, and withdrawal fees can be high. In addition, cardholders may be charged additional fees by their banks for using foreign ATMs.

To avoid potential issues with ATMs in Angola, travellers are advised to carry cash, preferably in US Dollars, as it is widely accepted. Additionally, major hotels accept debit and credit cards, but cheaper accommodations, tourist sites, and smaller restaurants usually only accept cash.

When using ATMs, it is essential to be cautious and aware of potential scams and fraudulent activities, such as "skimming," where devices are used to illegally obtain card information. It is recommended to look out for suspicious devices attached to ATMs and to ensure there is adequate security, especially in busy areas like Luanda, which can be a challenging environment.

To reduce the risk of fraud and excessive fees, some travellers suggest obtaining a Wise (formerly TransferWise) MasterCard, which can provide better exchange rates and lower fees for international transactions. Additionally, using international money transfer services, such as World Remit, Ria Money Transfer, or Wise, allows individuals to send money to a local cash pick-up point or a bank account in Angola, providing a convenient, safe, and cost-effective alternative to using ATMs directly.

Angola's Rich Cultural Heritage and Natural Beauty

You may want to see also

Interbank commission increase

The Interbank Services Company (EMIS) in Angola has increased the interbank commission from 350 to 700 kwanzas, effective from January 1, 2024. This represents a 100% increase in the fee that one bank pays to another when its customer uses the other bank's ATM. The executive administrator of EMIS, Joaquim Caniço, clarified that the new commission does not apply to the payment card user and that it will encourage banks to ensure that their ATMs are stocked with cash, avoiding constant flooding at ATMs.

The increase in the interbank commission is expected to have a positive impact on the availability of cash at ATMs in Angola. Previously, the interbank fee for withdrawing money from ATMs at different banks was 350 kwanzas. With the increased commission, banks will be incentivized to ensure that their ATMs are well-stocked with cash, as they will pay more if their customers frequently use other banks' ATMs. This should lead to a more even distribution of cash across ATMs and reduce the occurrence of empty ATMs.

The measure covers all banks that issue payment cards and install ATMs across Angola. According to Caniço, the increase in the interbank commission is one of several initiatives that EMIS has implemented to improve the electronic payment system in the country. Other initiatives include the launch of the Instant Transfer System, which serves as the infrastructure for the new payment instrument called 'KWiK' (Instant Kwanza). Caniço expressed confidence that KWiK will contribute to improving financial inclusion in Angola.

EMIS registers the existence of about 7.6 million ATM cards and close to 3.5 thousand ATMs in Angola. On average, each commercial bank has around 184 ATMs, with the larger banks tending to install more ATMs. The increase in the interbank commission aims to improve the management of cash loading into ATMs and encourage banks to make more cash available to the population.

It is important to note that the interbank commission has always existed and has never directly impacted users' pockets. This means that customers will not be charged any additional fees for using ATMs, and the increased commission is solely between banks. The measure is expected to improve the overall availability of cash at ATMs and reduce the inconvenience caused by empty ATMs.

Angola, Indiana: A Slice of Hoosier History in Steuben County

You may want to see also

Using a foreign card in Angola

If you plan to use your foreign card at an ATM in Angola, here are some things to keep in mind:

- Check with your card issuer: Before your trip, contact your bank or card issuer to confirm if your card will be accepted in Angola.

- Withdrawal fees and limits: Foreign transaction fees and ATM withdrawal fees can be exorbitant. Check with your bank to understand the fees and withdrawal limits that may apply.

- Alternative options: Consider using a travel-friendly card, such as the Wise (formerly TransferWise) MasterCard, which offers low conversion fees and zero transaction fees.

- Safety: Be cautious when using ATMs in Angola. Only use ATMs in secure locations, and be aware of your surroundings. Avoid using ATMs at night, and always use caution when handling cash.

- Backup options: In case of ATM unavailability or card compatibility issues, consider alternative options such as international money transfer services like World Remit or Ria Money Transfer. These services allow you to send money online and pick it up at local cash pick-up points in Angola.

- Currency regulations: Familiarize yourself with Angola's currency regulations. Declare amounts over $10,000 upon entry and exit, and be aware that non-residents may exit the country with up to $10,000.

It is important to stay vigilant and take the necessary precautions when using a foreign card in Angola to ensure a safe and enjoyable trip.

Angola Prison Caskets: Available for Purchase?

You may want to see also

Angola's financial inclusion efforts

Angola has been making efforts to improve financial inclusion for its citizens. The country has seen an increase in the number of people using ATMs to access their finances, with the value of transactions reaching around Akz 10 million (€80,000) every month. This increase in ATM usage is likely due to the emergence of more ATMs in the country, as well as the availability of more cash in these machines. The Interbank Rate, which is the rate agreed upon by commercial banks for reciprocal services, has increased from 350 to 700 kwanzas, encouraging banks to make more cash available in ATMs.

The Empresa Interbancaria de Servicos, an organization that oversees interbank services, has stated that they want to increase the reach of electronic payments in Angola to reduce the nation's dependency on physical money. This push for electronic payments, especially mobile money transactions, will enable those who cannot reach bank branches to access and transfer their funds more easily. It is hoped that this will promote financial inclusion, as currently, despite Angola being a resource-rich country, around 68% of the population lives below the poverty line.

Several aid agencies are working on issues of branchless banking and increasing access to finance for low-income individuals and businesses, including USAID, which has implemented several financial sector development-related programs. Mobile banking and a greater use of ATMs are also being promoted as ways to improve access to finances for citizens.

However, it is important to note that ATMs in Angola don't always work with foreign cards, and there have been reports of fraud and high withdrawal fees. Therefore, it is recommended that travelers bring cash or use alternative methods such as international money transfer services to access cash when visiting the country.

Where in the World is Maine?

You may want to see also

Frequently asked questions

Yes, there are ATMs in Angola. However, they are scarce and often empty.

It depends on the type of card you have. Not all ATMs in Angola allow access to foreign accounts. There are some ATMs for VISA cards, but it is unclear if they work with cards not issued in Angola.

Withdrawal fees can be exorbitant, and you will likely be charged a fee by your bank.