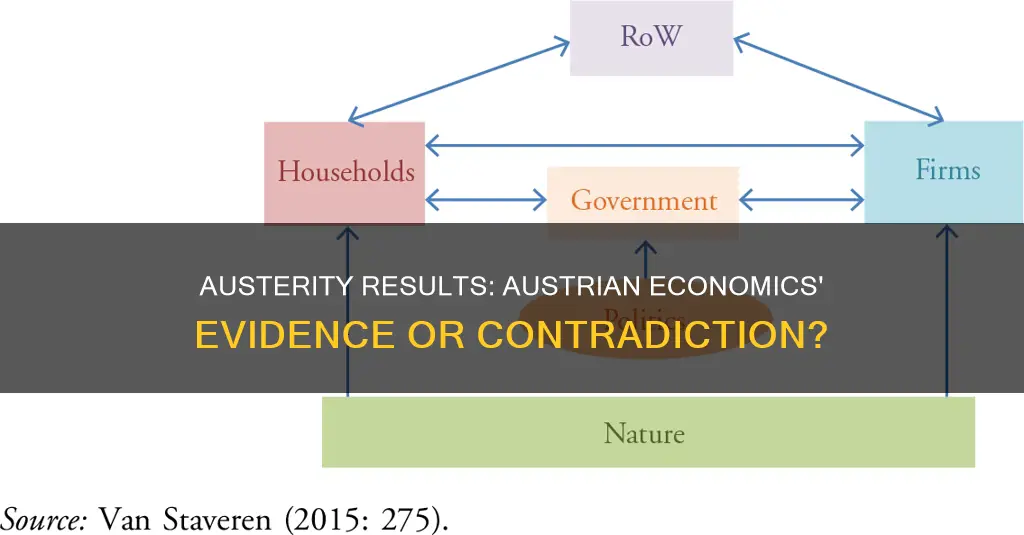

Austrian economics is a school of economic thought that advocates for minimal government intervention and austerity to correct market distortions. Austerity measures are typically implemented by governments to reduce budget deficits and avoid unsustainable levels of national debt. While austerity has been a hotly debated topic, with some viewing it as a necessary approach to economic recovery, others argue that it can lead to social unrest and economic stagnation. The effectiveness of austerity policies is influenced by various factors, such as the specific measures taken, the economic environment, and societal structure. This raises the question: Are the results of austerity measures evidence for or against Austrian economics?

What You'll Learn

Austrian School economists reject the Keynesian stimulus approach

The Keynesian approach, favoured by economists at the International Monetary Fund (IMF), involves spending cuts, increasing taxes, and borrowing and spending to stimulate the economy. This approach is seen as counterproductive by Austrian School economists, who believe that it does not address the underlying issues of excessive public spending and debt. They argue that true austerity, as seen in countries like Latvia and Estonia, has been successful in promoting economic growth.

Austrian School economists view austerity as a way to correct market distortions caused by excessive government spending and debt. They believe that reducing government intervention and living within their means can lead to more efficient allocation of resources and promote long-term economic growth. This aligns with their belief in minimal government intervention and the importance of individual freedom and free markets.

Austrian School economists also criticise the IMF's approach as being "pro-bankster", focusing on repaying government creditors at the expense of the public. They argue that increasing taxes on individuals is not a form of real austerity and can hinder economic production. Instead, they suggest that tax cuts, particularly on investment and capital, can stimulate economic activity and promote growth.

Overall, Austrian School economists reject the Keynesian stimulus approach because they believe it fails to address the root causes of economic issues and can lead to deeper recessions and prolonged recovery. They favour real austerity measures that involve reducing government spending, taxes, and benefits, as well as selling government assets, to promote long-term economic growth and stability.

Exploring Italy-Austria Train Travel: How Far by Rail?

You may want to see also

Austerity is not always effective, and can be harmful

Austerity is a highly contested economic policy, often implemented during periods of economic crisis. It involves reducing government spending and increasing taxes to stabilise public finances and avoid unsustainable levels of national debt. While some argue that austerity is necessary to restore fiscal discipline and economic stability, others believe it can be harmful and ineffective. This is because austerity can lead to social unrest, economic stagnation, and prolonged recession.

One of the main arguments against austerity is that it can be harmful to society as a whole. Keynesian economists, for example, criticise austerity measures, especially during economic downturns. They argue that reducing government spending and increasing taxes can further hinder economic recovery, leading to higher unemployment and prolonged recession. Marxian analysts share similar concerns, viewing austerity as a tool that protects capitalist interests at the expense of the working class, exacerbating income inequality and social inequities.

Additionally, austerity policies can result in reduced spending on crucial sectors such as health and education, which is particularly detrimental to developing countries. In the context of the European debt crisis, for instance, countries like Greece, Spain, and Portugal underwent strict austerity programs, which led to significant social and economic challenges. While austerity measures aim to reduce budget deficits, they can have unintended consequences, such as a decrease in aggregate demand and negative impacts on consumer and investor behaviour.

Furthermore, austerity policies can be unfair to citizens, especially when taxes are increased to repay government debts. In such cases, the burden of austerity falls on the general public rather than the government and its employees, who may already be facing hardships during economic downturns. This can result in a decrease in disposable income for individuals and negatively affect their standard of living.

Moreover, austerity policies can be counterproductive if they lead to cutbacks in essential public services. For example, budget cuts in areas such as garbage collection, police forces, or fire departments can have detrimental effects on society. It is important to distinguish between necessary cutbacks and those that compromise the well-being and safety of citizens.

While austerity has its proponents, there is evidence to suggest that it can be harmful and ineffective in certain contexts. The negative impacts of austerity measures are particularly pronounced during economic downturns, as they can exacerbate existing problems and hinder long-term economic growth. Therefore, it is crucial to carefully consider the potential consequences of austerity policies and explore alternative approaches, such as stimulus packages or other economic strategies, to promote economic recovery and social welfare.

Austria's Dual Citizenship Policy: What's Allowed?

You may want to see also

Austerity measures are enacted to reduce budget deficits

Austerity measures are a set of economic policies implemented by governments to reduce budget deficits and avoid unsustainable levels of national debt. They are usually enacted when a country faces severe financial instability, often indicated by a high ratio of national debt to GDP and the potential defaulting on bond obligations.

Austerity measures typically involve a combination of expenditure cuts and tax increases. Classical economists argue that austerity is necessary to restore fiscal discipline and economic stability, believing that reducing government intervention can lead to a more efficient allocation of resources. Neoclassical economists focus on the long-term benefits of austerity, such as lower interest rates and a more sustainable fiscal environment.

Austrian economists, who advocate for minimal government intervention, support austerity as a means to correct market distortions caused by excessive public spending and debt. They propose cutting government budgets, salaries, employee benefits, retirement benefits, and taxes, as well as selling government assets and repudiating government debt.

However, critics of austerity measures argue that they can lead to social unrest and economic stagnation. Keynesian economists, for instance, reject austerity, especially during economic downturns, claiming that reducing government spending and increasing taxes can hinder economic recovery, resulting in higher unemployment and prolonged recession. Marxian analysts view austerity as a tool to protect capitalist interests, exacerbating income inequality and social inequities.

The effectiveness of austerity measures is a subject of ongoing debate, with comparative analyses revealing varied outcomes depending on the specific economic and societal context, as well as implementation strategies. While some countries, like Latvia and Estonia, have experienced economic growth alongside austerity, others, like Greece, have faced challenges.

Austria's Role in World War II

You may want to see also

Austerity policies can include expenditure cuts and tax increases

Austerity policies are a set of economic policies implemented by governments to reduce budget deficits and avoid unsustainable levels of national debt. They are usually enacted when a country faces severe financial instability, often indicated by a high ratio of national debt to GDP, and the threat of defaulting on bond obligations. Austerity policies can include expenditure cuts and tax increases.

Austerity measures are typically implemented during periods of economic crisis. For example, during the European sovereign debt crisis of the early 2010s, many Eurozone countries such as Greece, Spain, and Portugal underwent strict austerity programs as conditions for receiving international financial assistance.

The term "austerity" is often associated with spending cuts and tax increases. However, the specific components of austerity plans can vary, and it is important to distinguish between plans that primarily rely on tax increases and those that focus on expenditure cuts.

According to Austrian School economists, real austerity involves cutting government budgets, salaries, employee benefits, retirement benefits, and taxes. It also includes selling government assets and repudiating government debt. They argue that austerity can correct market distortions caused by excessive public spending and debt, which aligns with their belief in minimal government intervention.

The effectiveness of austerity policies is a subject of ongoing debate. Some argue that austerity is necessary to restore fiscal discipline and promote economic stability. On the other hand, critics, including Keynesian economists, contend that austerity measures can stifle economic recovery, leading to higher unemployment and prolonged recession.

The impact of austerity policies can vary depending on the specific measures implemented, the economic environment, and societal structure. While some argue that austerity enhances fiscal responsibility and long-term growth, others warn that it can lead to social unrest and economic stagnation.

The Austrian Alps' Edelweiss Song: Cultural Icon or Myth?

You may want to see also

Austrian economists advocate for austerity

Austrian School economists reject both the Keynesian stimulus approach and the IMF-style high-tax, pro-bankster approach as counterproductive. Although “Austerians” are often associated with "Austrians", Austrian School economists support real austerity. Real austerity involves cutting government budgets, salaries, employee benefits, retirement benefits, and taxes. It also involves selling government assets and even repudiating government debt.

Austrian economists argue that austerity is necessary to address current government budgetary extravagance. They believe that government debt in many countries has already grown beyond sustainable levels. In their view, austerity is about the government living within its means.

A new book by economists Alberto Alesina, Carlo Favero, and Francesco Giavazzi provides a comprehensive empirical examination of thousands of fiscal measures implemented by 16 advanced economies since the late 1970s. The book distinguishes between austerity plans based on tax increases and those based on expenditure cuts. The authors find that tax increase-based plans are deeply recessionary and ineffective at addressing debt problems. On the other hand, expenditure reduction-based plans are not as recessionary and are effective at addressing debt issues, and can even lead to economic expansion.

Austrian School economists argue that austerity is a necessary correction to the excessive credit creation and speculative investment bubble caused by central banks' low-interest rates. They believe that the alternatives to austerity, such as bailing out banks and companies, will only make the eventual recovery more difficult and unbalanced. They assert that debt liquidation and debt reduction are the only solutions to a debt-fueled problem.

Exploring Austrian Identity: Am I Truly Austrian?

You may want to see also

Frequently asked questions

Austerity is a set of economic policies implemented by governments to reduce budget deficits and avoid unsustainable levels of national debt. These policies usually involve cutting government spending and increasing taxes.

Austrian School economists reject the Keynesian stimulus approach and the IMF-style high-tax, pro-bankster approach. They support real austerity, which involves cutting government budgets, salaries, employee benefits, retirement benefits, and taxes, as well as selling government assets and repudiating government debt.

Classical economists argue that austerity measures are necessary to restore fiscal discipline and economic stability. Neoclassical economists focus on the long-term benefits of austerity, such as lower interest rates and a more sustainable fiscal environment. Monetarists believe that controlling inflation and reducing public debt through austerity can lead to a more stable economic environment.

Keynesian economists criticise austerity, especially during economic downturns, as they believe it can stifle economic recovery and lead to higher unemployment. Marxian analysts view austerity as a tool that protects capitalist interests at the expense of the working class. Post-Keynesian economists emphasise the potential for fiscal policies to stimulate demand and argue that government spending can counteract the negative effects of low private sector demand.