Bahrain's current account balance has fluctuated over the years, recording a surplus of 671.7 USD million in June 2024 and a deficit of 1.5 USD billion in June 2020. The country's economy is heavily dependent on oil and gas, with petroleum being the most exported product, accounting for a significant portion of its export earnings, government revenues, and GDP. Despite efforts to diversify, lower world energy prices have led to budget deficits in recent years. The success of Bahrain's economy is closely tied to the performance of the energy market, impacting its current account balance.

What You'll Learn

Fluctuating oil prices

Bahrain's economy is heavily dependent on oil and gas. Petroleum is the country's most exported product, accounting for 60% of export receipts, 70% of government revenues, and 11% of GDP. While Bahrain has worked to diversify its economy, oil still comprises 85% of Bahraini budget revenues. Therefore, the country's current account balance is vulnerable to fluctuations in oil prices.

When oil prices are high, Bahrain's current account balance tends to improve. For example, in 2003 and 2004, rising oil prices and increased receipts from the services sector led to a current account surplus of US$219 million and US$442 million, respectively. In contrast, lower world energy prices in recent years have generated sizeable budget deficits, such as about 10% of GDP in 2017.

The impact of fluctuating oil prices on Bahrain's current account balance can be significant. For instance, the balance dropped to a deficit of US$35 million in 2002, likely due to lower oil prices. In 2020, the current account balance reached an all-time high of 17.2% of Nominal GDP in the previous quarter, possibly influenced by higher oil prices. However, in the same year, it also hit a record low of -19.1% in June, suggesting a sharp decline in oil prices during that period.

Fluctuations in oil prices can be influenced by various factors, including global demand, supply disruptions, geopolitical tensions, and economic conditions. These price changes can have a direct impact on Bahrain's current account balance, affecting its trade surplus or deficit and government revenues.

Exploring Gudaibiya in Manama, Bahrain: A Neighborhood Guide

You may want to see also

Budget deficits

Bahrain's budget deficits can be attributed to a combination of factors, including lower oil revenues and the impact of the COVID-19 pandemic on vital sectors such as energy and tourism.

Bahrain, unlike other Gulf Arab states, does not possess vast oil wealth and has historically relied heavily on oil exports for revenue. In recent years, however, oil prices have been volatile, and production has been affected by events such as the 2014-2015 oil price shock and the more recent COVID-19 pandemic. As a result, Bahrain's economy contracted by 5.4% in 2020, according to the International Monetary Fund (IMF). The pandemic hit key sectors such as energy and tourism, which are crucial sources of foreign currency earnings for the country.

To address its budget deficits, Bahrain has implemented a range of fiscal reforms and sought financial support from its Gulf allies. In 2018, the country secured a $10 billion aid package from Saudi Arabia, the United Arab Emirates, and Kuwait, which helped it avoid a credit crunch. As part of its fiscal reform program, the Bahraini government has cut subsidies, raised taxes and fees, and introduced a value-added tax (VAT). These measures have helped to reduce the deficit, with the government reporting a 35% decrease in 2018 compared to the previous year.

Despite these efforts, Bahrain continues to face financial challenges. Public debt has risen significantly, reaching 133% of GDP in 2020, up from 102% in 2019. The country aims to eliminate its budget deficit by 2022 and has projected lower deficits for the coming years. However, achieving these goals will depend on a range of factors, including the recovery of the energy and tourism sectors, the price of oil, and the effectiveness of the government's fiscal reforms.

Best Places to Buy Flowers in Bahrain

You may want to see also

Foreign investment

Bahrain has been actively working to attract foreign investment, and it has been ranked as the 12th most open economy worldwide by the Wall Street Journal’s 2013 Index of Economic Freedom. The country offers 100% foreign ownership across most sectors, with no requirement for a local partner. In 2020, Bahrain was ranked 1st in the GCC for inward FDI stocks relative to GDP, with a compound annual FDI growth rate of 4% across 2016-2020.

The country's business-friendly laws and policies, physical proximity to other Middle Eastern countries, and inclusion in the Gulf Cooperation Council (GCC) make it an attractive destination for foreign investors. Additionally, Bahrain has a Free Trade Agreement with the United States, which allows for the relaxation of certain restrictions on trade and investment between the two countries.

There are, however, some restrictions on foreign investment in specific sectors. For example, construction, press, publishing, distribution, car and motorbike rental, fishing, foreign manpower supply, land transportation, trading, small businesses, and commercial agencies are among the sectors that require a minimum of 51% Bahraini ownership. Nevertheless, the Minister of Industry and Commerce can grant exemptions to allow foreign investment into restricted sectors if it is deemed beneficial to the country's economy.

The process of establishing a business in Bahrain is straightforward. The most common form of business vehicle is a With Limited Liability Company (“WLL”), which can have between two and 50 shareholders, with a minimum share capital of BHD20,000. Foreign investors must also comply with the Ultimate Beneficiary Owner (UBO) Disclosure Requirement, which mandates the disclosure of information regarding shareholders with more than 10% ownership and individuals with influence over corporate decisions.

Overall, Bahrain's efforts to create a business-friendly environment, combined with its strategic location and favourable policies, make it an attractive destination for foreign investment.

Barbie's Ban in Bahrain: Why and When?

You may want to see also

Trade deficit

Bahrain's economy is diversified within the GCC, with the hydrocarbon sector contributing one-fifth of its GDP. However, hydrocarbons still account for around 75% of government receipts, making the country vulnerable to fluctuations in oil prices.

Bahrain's fiscal and external breakeven oil prices are among the highest in the region, indicating a scarce ability to generate additional revenue through taxation or other means. As a result, Bahrain's fiscal and external vulnerabilities increased when oil prices collapsed between late 2014 and 2016. This caused a financial crisis at the end of 2017 as the fiscal and external deficits brought the central bank’s FX reserves down to about USD1.6 billion (import cover of just 0.8 months).

In 2018, Saudi Arabia, the UAE, and Kuwait provided a USD10 billion financial support package to Bahrain. This aid was conditioned on strict fiscal consolidation, which curtailed growth in the non-oil sector in the following years. In 2019, Bahrain introduced a 5% value-added tax, which was increased to 10% in 2021. Despite these efforts, Bahrain's public finances remain a cause for concern. The country posted an average fiscal deficit of -14% of GDP in 2015–2021, pushing public debt to 121% of GDP in 2023.

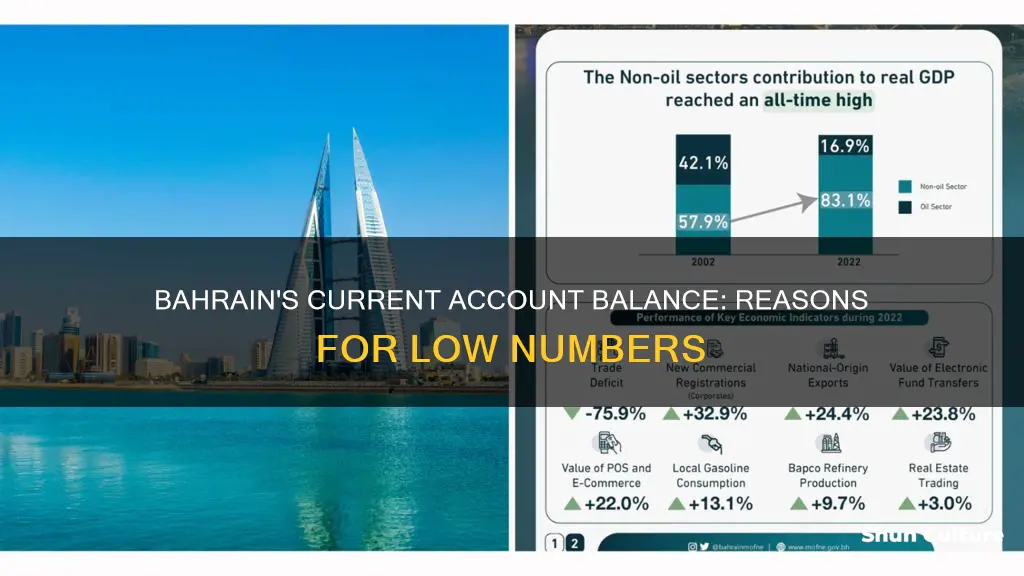

Bahrain's recovery from the double shock of the global Covid-19 crisis and the drop in oil prices in 2020 began moderately in 2021, gathering pace in 2022, with growth averaging 2.7% and 4.2%, respectively. In 2023, real GDP growth moderated to an estimated 2.6%, due to lower oil and gas revenues and subdued services, especially in the tourism and transportation sectors.

In summary, Bahrain's trade deficit is primarily due to its reliance on hydrocarbon exports, which account for a large portion of government receipts. The country's fiscal position is vulnerable to fluctuations in oil prices, and efforts to diversify the economy and increase non-oil revenue have had limited success so far.

Get Suited Up: Best Places in Bahrain

You may want to see also

Diversification of the economy

Bahrain's economy is heavily dependent on oil and gas, with petroleum being the country's most exported product. However, the country has been trying to diversify its economy since the late 20th century, investing in the banking and tourism sectors. Bahrain's finance industry is very successful, with the country being named the world's fastest-growing financial centre by the City of London's Global Financial Centres Index in 2008.

Bahrain's banking and financial services sector, particularly Islamic banking, have benefited from the regional boom driven by demand for oil. Despite these efforts, oil still comprises 85% of Bahraini budget revenues, and lower world energy prices have generated sizeable budget deficits.

Bahrain has the fourth-freest economy in the Middle East and North Africa region and is recognised as a high-income economy by the World Bank. The country has a positive and relatively stable investment climate, maintaining a business-friendly environment and a proactive approach to attracting foreign investment.

State-owned enterprises are the primary engines for growth, but Bahrain aims to expand the private sector's contribution to the economy to reduce its dependency on hydrocarbons and promote long-term economic growth. Bahrain's sovereign wealth fund, Mumtalakat, is diversified across various business sectors, including technology, real estate, tourism, financial services, food and agriculture, and industrial manufacturing.

The government has implemented new policies to address its debt burden, such as increasing the value-added tax to 10%. Bahrain's gross domestic product (GDP) grew by 2.45% in 2023, with the non-oil sector showing a robust increase of 4.48%, indicating the country's successful efforts towards economic diversification.

To further enhance its position as a regional startup hub, the government launched Bahrain FinTech Bay in 2018, established several funds to encourage startup investments, and operated a financial technology regulatory sandbox. Bahrain has also initiated a series of labour reforms to bring the labour market into line with international standards and expand its high-tech industries.

The country's national plan, Bahrain Economic Vision 2030, aims to enhance private sector growth and continue government investment in infrastructure, affordable housing, human resource development, and digital transformation. Bahrain is committed to diversifying its economy away from its limited oil supplies and has expanded into banking, heavy industries, retail, and tourism.

Exploring Manama, Bahrain: A City of Surprises and Delights

You may want to see also

Frequently asked questions

Bahrain's economy is heavily dependent on oil and gas, with petroleum being the most exported product. Lower world energy prices in recent years have generated sizeable budget deficits, impacting the country's current account balance.

Oil comprises 85% of Bahraini budget revenues, and natural gas also plays a dominant role. The country has benefited from the oil boom since 2001, with economic growth reaching 5.5%.

In 2003 and 2004, the balance of payments improved due to rising oil prices and increased receipts from the services sector. As a result, Bahrain's current account balance registered surpluses of US$219 million and US$442 million in 2003 and 2004, respectively.

Bahrain has been successful in its efforts to diversify its economy away from limited oil supplies. The non-oil sector showed a robust increase of 4.48% in 2023, indicating progress in economic diversification. The country has a strong financial sector, with Manama, its capital, being home to many large financial institutions.