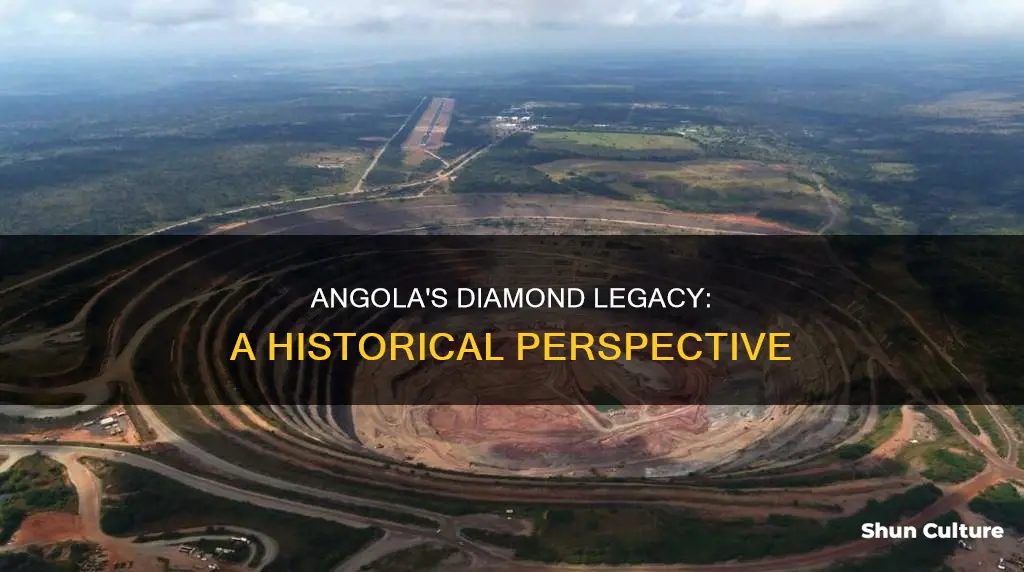

Angola is a country in Southern Africa that has long relied on diamond production for its local economy. It is currently the third-largest producer of diamonds in Africa and the sixth-largest in the world, accounting for 9% of global production. Angola's diamond mines make it one of the world's top 10 producers of diamonds, and the country has the potential to become one of the world's three biggest diamond producers within five to 10 years. The country's largest diamond mine, the Catoca Diamond Mine, is listed as the fourth-largest kimberlite mine in the world. Angola's diamond industry has faced challenges such as corruption, human rights violations, and diamond smuggling, but recent economic reforms have attracted diamond explorers and companies back to the country.

| Characteristics | Values |

|---|---|

| Diamond production rank | 3rd in Africa, 6th or 7th in the world |

| Diamond production (2023) | 8 million carats |

| Diamond production (2021) | 8 million carats |

| Diamond production (2014) | 8.791 million carats |

| Diamond production (2007) | 10,000,000 carats |

| Diamond production (2006) | 30% increase |

| Diamond exports (2023) | 4% increase |

| Diamond exports (2022-2027) | 93.67% expected increase |

| Diamond reserves | 300 million carats |

| Diamond mines | 3 |

| Diamond mine workers | 400 |

What You'll Learn

Angola's diamond production

Angola has long relied on diamond production to boost its local economy. In 2023, Angola was the world's sixth-largest producer of diamonds, accounting for 9% of global production. Angola's diamond exports are expected to grow by 9367% between 2023 and 2027. The country is the third-largest producer of diamonds in Africa, with Botswana and South Africa taking the first two spots. In terms of global production, Angola is the seventh-largest producer, accounting for roughly 5% of world diamond production.

Angola has had difficulty attracting foreign investment to its diamond industry due to corruption, human rights violations, and diamond smuggling. However, the country has implemented reforms and revised regulations to attract diamond explorers and companies. Angola's diamond sector is overseen by the Angolan state diamond mining company, Endiama, and the country's diamond trading company, Sodiam.

Understanding Angola's Monetary Unit: Kwanza

You may want to see also

Diamond mining's environmental impact

Diamond mining has a range of negative environmental impacts on the local area, affecting plants, water and soil. There are two primary methods of diamond extraction: kimberlite pipe mining and alluvial mining. Of these, pipe mining has the most significant environmental consequences.

In pipe mining, large sections of rock are removed and hauled away to screening plants where they are searched for diamonds. This requires the construction of roads, which segregates the land and disrupts local flora. For every carat of diamond produced, it is estimated that around one ton of earth must be removed. This makes it very difficult for vegetation to regrow.

Alluvial mining also negatively affects water quality. Rivers are diverted and canals and dams are created, which are typically abandoned after mining has finished. Soil deposits affect water quality, and oil and chemicals from pipe mines can contaminate the water supply.

Diamond mining also has broader ecological consequences, including soil erosion, deforestation and ecosystem destruction.

Oil Workers' Safety in Angola: Is it Safe?

You may want to see also

Diamond explorers and companies

In the early 2000s, an exodus of diamond mining companies occurred due to onerous mining regulations and widespread corruption under the regime of former President Jose Eduardo dos Santos. This period was marked by a struggle between the MPLA and UNITA, which constantly fought over diamond mines, making it unsafe for miners and leading to the planting of land mines. Despite these challenges, diamond production and sales continued, with the industry benefiting from a rise in the price per carat for Angolan diamonds.

A turning point came in 2017 when President dos Santos stepped down and was replaced by João Lourenço, who vowed to reform the economy and tackle corruption. These efforts bore fruit, as evidenced by the return of major companies like De Beers, which acquired two 35-year mining licenses. Angola's appeal to explorers and companies lies not only in its highly prospective nature but also in its relatively underexplored status. The country aims to become one of the world's top three diamond producers within five to ten years.

Notable companies currently involved in diamond exploration and mining in Angola include Rio Tinto, De Beers, and Lucapa Diamonds. Rio Tinto has formed a joint venture with the Angolan state-owned diamond mining company, Endiama, over the Chiri kimberlite deposit, owning 75% of the project. De Beers, returning to the country after a decade-long absence, is actively exploring for major kimberlite deposits. Lucapa Diamonds operates the Lulo Alluvial Mine in Angola, known for producing exceptional, large, high-value diamonds that attract the highest price per carat for alluvial diamonds globally.

The Angolan government continues to play an active role in the diamond industry, with Endiama having a 25% free equity carry in any new mine due to its initial prospecting work and infrastructure provision. The government has also implemented new capital investment, repatriation, and diamond marketing policies, with all diamond marketing regulated by the Angolan diamond trading company, Sodiam.

Making Calls to Luanda, Angola from the USA

You may want to see also

Diamond exports from Angola

Angola is the world's sixth-largest producer of diamonds, accounting for 9% of global production. In 2022, Angola's diamond production amounted to 8.8 million carats, an increase of 1.1% compared to the previous year. Exports of diamonds from Angola increased by 4% in 2023 over 2022, and Angola's diamond exports are expected to grow at a CAGR of 9367% between 2023 and 2027.

Angola has long been considered a highly prospective country for major diamond strikes, but it has also been plagued by corruption, human rights violations, and diamond smuggling. The country has had difficulty attracting foreign investment due to these issues, and production costs are high. However, the government is working to attract foreign companies to invest in the country's diamond industry, and Angola is expected to become one of the world's top three diamond producers within the next five to ten years.

The history of diamond mining in Angola dates back to the early 20th century when gems were discovered in the Lunda region in the northeast. The industry was disrupted by the country's civil war, which lasted from 1975 to 2002, and diamond mines were constantly fought over by rival factions. Despite these challenges, Angola has become a significant producer of diamonds, and the industry is expected to continue growing in the coming years.

The environmental impacts of diamond mining in Angola are also significant. The extraction process causes harm to plants, water, and soil, and it is estimated that about one ton of earth must be removed to produce less than one carat of diamond. Additionally, the construction of roads and other infrastructure for mining operations can disrupt local flora and fauna.

Exploring Angola's Diverse Plantations: A Comprehensive Guide

You may want to see also

Diamond marketing policies

Angola's diamond industry is becoming increasingly attractive to investors, thanks to legislative reforms, the discovery of high-quality deposits, and a forward-thinking government approach. The country has implemented new diamond marketing policies as part of its sectoral reforms, which have played a crucial role in enticing investors and positioning Angola as a significant player in diamond production.

The Angolan government has established a market-focused diamond marketing and sales policy, with all diamond marketing being regulated by Sodiam, the national diamond trading company. This policy ensures a transparent and well-structured process for the marketing and sales of diamonds in the country.

Sodiam plays a central role in the new diamond marketing landscape in Angola. The company is responsible for allocating diamond production among different clients. According to the policy, 60% of the production from any mine is to be sold to Sodiam's clients, while 20% is allocated to the clients of the respective mine operator, and the remaining 20% is designated for sale to diamond manufacturers and polishers within Angola. This distribution approach helps to diversify the customer base and promote local diamond processing industries.

In addition to the structured allocation of diamond production, the new diamond marketing policies in Angola have also brought about favourable tax incentives for investors. As explained by Eugenio Bravo da Rosa, the CEO of Sodiam, investors now enjoy reduced tax rates for both local polishing and exporting of rough diamonds. The tax rate for local polishing has been lowered from 3.5% to 2.25%, while the export tax has been reduced from 5.6% to 3.5%. These tax incentives make investing in Angola's diamond industry more financially appealing.

The combination of a market-focused diamond marketing and sales policy, along with favourable tax incentives, has created a positive environment for investors in Angola's diamond industry. These marketing policies not only ensure a transparent and structured process for diamond sales but also provide financial incentives that make Angola a competitive destination for diamond-related investments. As a result, Angola is well on its way to achieving its goal of becoming one of the world's top diamond producers.

Angola's Abortion Laws: Understanding the Legal Landscape

You may want to see also