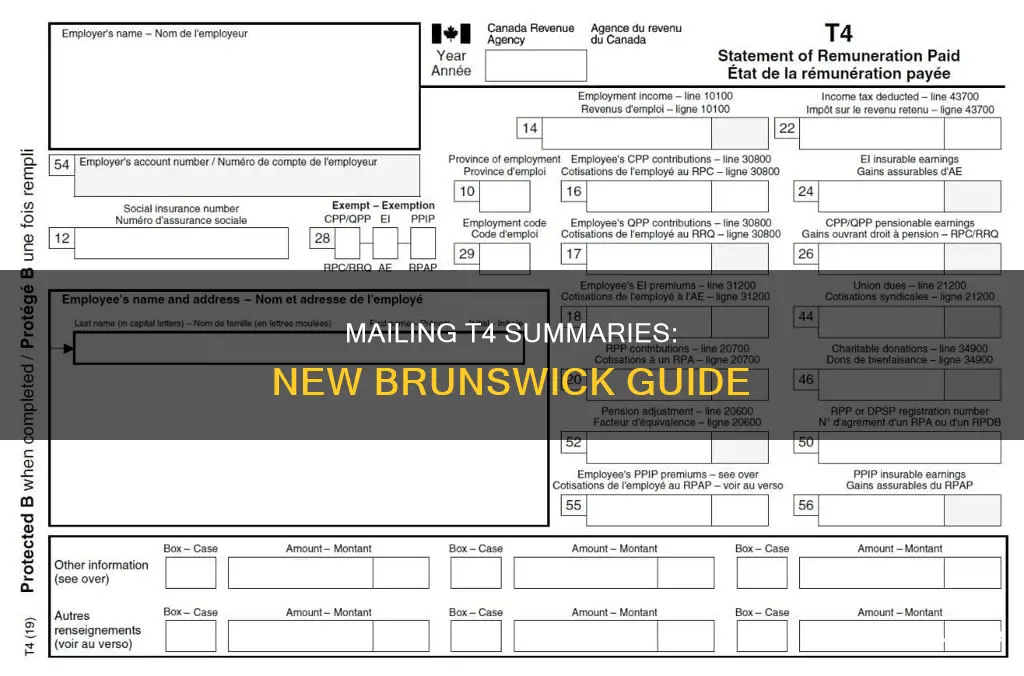

The T4 Summary is a document that outlines the total remuneration paid to employees, as well as the total of amounts entered on the T4 slips. It must be filed by the last day of February of the following calendar year and can be submitted either electronically or via paper forms. If more than 50 T4 slips are issued for the year, electronic filing is mandatory. The T4 Summary does not need to be completed when the T4 information return is filed electronically.

The T4 Summary, along with the T4 slips, should be sent to the following address:

Jonquière TC T4 Program

Post Office Box 1300 LCD

Jonquière, QC, G7S 0L5

| Characteristics | Values |

|---|---|

| Where to mail T4 summary in New Brunswick | Not found |

| Where to mail T4 summary in Canada | Jonquière TC T4 Program, Post Office Box 1300 LCD Jonquière, Jonquière QC G7S 0L5 |

What You'll Learn

Where to mail T4 summary in New Brunswick

The T4 Summary is a form that outlines the total of the amounts entered on the T4 slips. It is mandatory to file the T4 Summary form when filing on paper, but not when filing electronically.

The T4 Summary must be filed no later than the last day of February following the calendar year to which the information return applies. If you are filing on paper, send the T4 Summary and the related T4 slips to the following address:

Jonquière TC T4 Program

Post Office Box 1300 LCD

Jonquière, QC G7S 0L5

If you are filing electronically, you can do so via the "File a return" service:

- My Business Account: for business owners, at canada.ca/my-cra-business-account

- Represent a Client: for authorized representatives or employees, at canada.ca/taxes-representatives

Nicholls to Brunswick: A Georgia Road Trip

You may want to see also

When to mail T4 summary

The T4 Summary is a document that outlines the total amounts reported on all T4 slips for each employee for a calendar year. It must be filed by the last day of February following the calendar year in question, using either paper forms or electronic media. If you are filing more than 50 T4 slips, electronic filing is mandatory.

The T4 Summary includes the total amounts from the T4 slips for the following:

- Employment income

- Registered pension plan contributions

- Pension adjustment

- Employee's CPP contributions

- Employee's second CPP contributions

- Employer's CPP contributions

- Employee's EI premiums

- Employer's EI premiums

- Income tax deducted

The T4 Summary also requires the employer's account number, name, and address, as well as the total number of T4 slips filed.

If there is a difference between the total deductions reported and the amount remitted for the year, this should be noted, and an overpayment or balance due may need to be reported.

If filing electronically, the T4 Summary does not need to be completed. However, if filing on paper, the T4 Summary is required.

Photo Radar: New Brunswick's Reality

You may want to see also

What to include in the T4 summary

The T4 Summary is a report that an employer creates and submits to the Canada Revenue Agency (CRA) by the end of February each year. It represents the total of the information reported on all of the T4s they created for each employee for the calendar year.

The T4 Summary includes the following information:

- Total employment income

- CPP contributions

- EI premiums

- Income tax deducted

- Pension adjustment

- Total deductions reported

- Remittances

- Overpayment

- Balance due

- Total number of T4 slips filed

The T4 Summary must be filed no later than the last day of February following the calendar year to which the information return applies.

Brunswick, GA: What's Open?

You may want to see also

How to fill out the T4 summary

To fill out the T4 Summary, you will need to include the following information:

- The last two digits of the calendar year for which you are filing the return

- The 15-character payroll account number in the "Employer's account number" box

- The employer's legal name, operating or trading name, and address

- The total number of T4 slips filed with the T4 Summary

- The total of box 14 from all T4 slips (employment income)

- The total of box 20 from all T4 slips (registered pension plan contributions)

- The total of box 52 from all T4 slips (pension adjustment)

- The total of box 16 from all T4 slips (employee's CPP contributions)

- The total of box 16A from all T4 slips (employee's second CPP contributions)

- The employer's share of CPP contributions

- The total of box 18 from all T4 slips (employee's EI premiums)

- The employer's share of EI premiums (multiply the employees' total premiums by the employer's premium rate)

- The total of box 22 from all T4 slips (income tax deducted)

- The total deductions reported (add the amounts reported on lines 16, 27, 18, 19, and 22 of the T4 Summary)

- The total amount of payroll deductions and contributions remitted to the CRA for the payroll account

- The difference between the total deductions reported and the amount remitted (subtract line 82 from line 80 and enter the result)

- Overpayment (if the amount on line 82 is more than the amount on line 80)

- Balance due (if the amount on line 80 is more than the amount on line 82)

- The social insurance numbers of any proprietors or principal owners

- The name and telephone number of a contact person that the CRA can call for clarification

- An authorized person must sign and date the T4 Summary

Railway Hotel Brunswick: Then and Now

You may want to see also

Where to get a T4 summary form

The T4 Summary form is used by employers in Canada to report the income paid to employees for a given tax year. It is a crucial document for filing income tax returns with the Canada Revenue Agency (CRA). The T4 Summary includes information such as the employee's name and address, type of income, deductions, and total income earned. Here is a step-by-step guide on how to get and fill out the T4 Summary form:

Where to Get the T4 Summary Form:

- The T4 Summary form can be obtained from the Canada Revenue Agency (CRA) website. It is available for download in PDF format, which can be filled out digitally or printed and filled out by hand. The website provides instructions for downloading and filling out the form using Acrobat Reader.

- Alternatively, you can request the form by calling the CRA at 1-800-959-5525.

Filling Out the T4 Summary Form:

- Employer Information: Start by entering your company's name, address, and business number.

- Total Number of T4 Slips: Enter the total number of T4 slips issued by your company for the fiscal year.

- Employment Income: Enter the total of all amounts reported in boxes 14, 16, and 17 of the T4 slips. This includes all employment income, such as salaries, wages, commissions, and taxable benefits.

- Canada Pension Plan (CPP) Contributions: Enter the total of all amounts reported in boxes 18, 19, and 20. This includes both employee and employer CPP contributions.

- Employment Insurance (EI) Premiums: Enter the total of all amounts reported in boxes 21, 22, and 23. This includes both employee and employer EI premiums.

- Income Tax Deducted: Enter the total of all amounts reported in boxes 24, 25, and 26. This is the total amount of income tax deducted from employees' income.

- Other Deductions and Credits: Continue to enter the totals for all other boxes on the T4 slips, including boxes related to pension adjustments, shareholder benefits, and other deductions or credits.

- Grand Total: Calculate and enter the grand total of all amounts reported in boxes 14-93.

- Signature and Date: Finally, don't forget to sign and date the form.

Important Notes:

- The T4 Summary form must be filed by any employer who has issued T4 slips for the taxation year.

- The deadline to file the T4 Summary for the 2023 tax year is February 28, 2024.

- The CRA may assess penalties for late filing, up to $25 per day to a maximum of $2,500.

- All amounts on the T4 Summary form must be reported in Canadian dollars.

By following these steps, employers can accurately complete and submit the T4 Summary form, ensuring compliance with tax regulations and providing employees with important information about their income and deductions for the year.

Atlantic City: New Brunswick Travel Options

You may want to see also

Frequently asked questions

The T4 summary and the related T4 slips must be sent to the Jonquière TC T4 Program, Post Office Box 1300 LCD, Jonquière, QC, G7S 0L5.

The T4 information return must be filed no later than the last day of February following the calendar year to which the information return applies.

The T4 summary (T4SUM) represents the total of the information reported on all of the T4 slips prepared for each employee for the calendar year. It includes the totals for all employment income, CPP contributions, EI premiums, and income tax deducted, for all employees.

If there are no amounts to report on a T4 slip or summary, there is no need to send either form to the CRA.