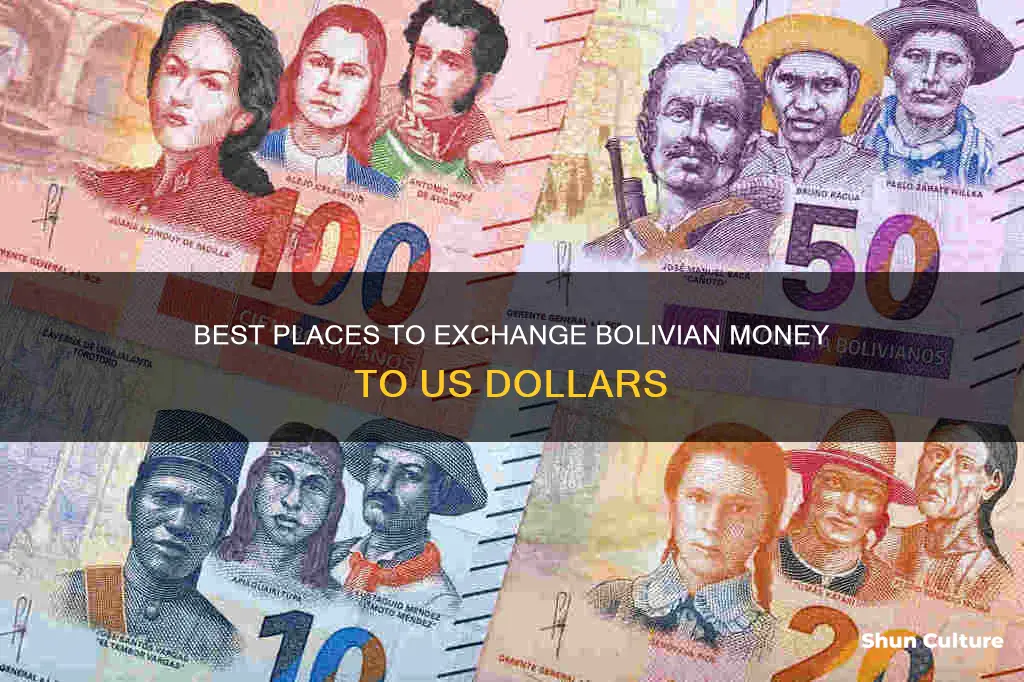

If you're looking to exchange your money from US dollars to Bolivian bolivianos, there are a few options available to you. You could use an ATM, exchange cash at a bank or a 'cambio' (money exchange company), or exchange your money at your hotel or hostel. It's worth noting that the exchange rate you'll get will vary depending on the method you choose, and it's important to be aware of any additional fees that may be charged. Some sources recommend using a Casa de Cambio as they tend to offer a better rate than banks.

| Characteristics | Values |

|---|---|

| Exchange Rate (as of 8th September 2024) | 1 USD = 6.897 BOB |

| Exchange Rate (as of 30th September 2024) | 1 USD = 6.9129409 BOB |

| Currency Code (Bolivian Boliviano) | BOB |

| Currency Symbol (Bolivian Boliviano) | $b |

| Currency Code (US Dollar) | USD |

| Currency Symbol (US Dollar) | $ |

| Recommended Exchange Locations | Banks, Exchange Offices, ATMs, Hotels/Hostels, Airports, Casa de Cambio |

| Exchange Rate Checking Tools | XE Universal Currency Converter, XE Currency Converter, Banco Central de Bolivia |

What You'll Learn

Using ATMs

- It is recommended to use ATMs inside banks, preferably during opening hours, for added security.

- Look for ATMs at major airports, town squares, tourist areas, and malls. They may be harder to find in small airports, regional bus stops, small towns off the main streets, and rural areas.

- Popular banks with ATMs in Bolivia include BCP Bolivia, Banca Ganadero, BNB – Banco Nacional de Bolivia, BancoSol, and Mercantil Santacruz.

- Most ATMs in Bolivia accept Visa and Mastercard. They may also accept Cirrus, Plus, and Maestro cards. However, they may not accept JCB, UnionPay, Amex, Diners, Discover, or RuPay cards.

- ATMs in Bolivia typically accept 4-digit PINs.

- Bolivian ATMs usually offer Spanish and English as language options.

- There is a withdrawal limit per transaction, which can vary between ATMs. The range is typically between Bs 500 and Bs 2000, with one ATM allowing up to Bs 5000.

- Some ATMs in Bolivia may charge a fee for each withdrawal, which can range from Bs. 0 to Bs 69.67. To avoid high fees, consider using fee-free ATMs or the ATM Fee Saver app to locate low-fee ATMs.

- It is advisable to inform your bank about your travel plans to prevent your card from being frozen due to suspected fraud. Also, inquire about foreign currency conversion fees and international ATM fees.

- For safety, use ATMs in busy, well-lit areas, and be cautious during nighttime withdrawals.

- Always carry only the amount of cash you need for the day, and distribute it in different places, such as a money belt or fanny pack.

- Be discreet when making transactions and withdrawing cash from ATMs.

Bolivia: A Country of Diversity and Culture

You may want to see also

Exchanging cash at a bank

If you want to exchange your cash at a bank, you can expect to pay a commission fee of 0.5% to 2% per transaction. Banks usually give the best exchange value after ATMs.

You can exchange your currency to Bolivianos at bank branches, especially for currencies like US dollars, Euros, Pounds, Japanese Yen, and Singapore dollars.

The best banks to try are BCP, BNB, and Banco Mercantil Santa Cruz. Banco Union is also a good option.

It's important to note that Bolivia is not as advanced as most countries in the areas of banking, payments, and currency exchange, so you may experience some frustration or delays.

For example, ATMs in Bolivia may keep your card during the transaction, so don't leave without it. Additionally, ATMs inside banks might have restricted hours, typically from 9 am to 3 pm.

It's also worth mentioning that Bolivia is known for street changers, particularly around border areas and bus stations, who are notorious for giving terrible exchange rates and not giving enough money. If you must exchange money on the street, only do so in small amounts.

Exploring the Diverse Languages of Bolivia

You may want to see also

Using a money exchange company

Step 1: Find a Reputable Money Exchange Company

Start by searching for a well-known and trusted money exchange company that offers Bolivian Boliviano (BOB) to US Dollar (USD) conversions. Look for companies with competitive exchange rates and low fees. Some popular options include Xe Money Transfer and Wise.

Step 2: Compare Exchange Rates and Fees

Visit the websites of different money exchange companies to compare their BOB to USD exchange rates. Remember that the mid-market rate, which is the rate with no markup, is typically used for informational purposes only, and the rate you receive may differ. Also, look out for any hidden fees or charges.

Step 3: Create an Account and Provide Information

Once you've selected a money exchange company, create an account and provide the necessary information. This may include your personal details, such as name, address, and contact information. You may also need to set up a payment method, such as a bank account or credit/debit card.

Step 4: Initiate the Exchange

Log in to your account and initiate the exchange process. Specify the amount of BOB you want to exchange, and review the estimated amount of USD you will receive, taking into account any fees or charges. Carefully review the exchange rate, as it fluctuates daily, and make sure you are getting a fair deal.

Step 5: Complete the Transaction

Follow the instructions provided by the money exchange company to complete the transaction. This may involve transferring your BOB funds to the company, after which they will convert them into USD and send them to your designated account or chosen payment method.

Step 6: Track Your Exchange

Most money exchange companies provide tools to track your exchange. You can usually set up rate alerts to notify you when the exchange rate reaches a certain level. This can be helpful if you're looking to exchange your money at a specific rate.

Exploring Polques Hot Springs in Bolivia's Andes

You may want to see also

Exchanging money at the airport

If you're travelling to Bolivia, you'll need to get your hands on some Bolivianos, the official currency of the country. While it's possible to use US dollars in larger cities and stores, you'll need the local currency in smaller towns and more remote regions.

One option for exchanging money is to do so at the airport. Both La Paz and Santa Cruz airports have currency exchange facilities and ATMs, so you can simply exchange or withdraw some Bolivianos upon arrival. The exchange rate at the La Paz airport has been described as "very fair" (close to 7 BOB per USD), although there is a 15 BOB service fee, so it's worth exchanging a larger amount to make it worthwhile.

It's recommended to bring plenty of small denomination US dollar notes with you from home, as many places will accept payment in USD, albeit not always at great rates. It's also worth noting that only US dollars are widely accepted and easily exchanged; other foreign currencies, such as Canadian dollars, Australian dollars, and UK pounds, will be extremely difficult, if not impossible, to exchange and will likely come with terrible rates.

When exchanging money, be sure to check the current exchange rate to avoid being given a poor "tourist" rate. Websites like XE Universal Currency Converter can help you calculate the amount you should receive. It's also important to ensure that your USD notes are in good condition, as ripped or damaged bills may not be accepted.

In addition to exchanging money at the airport, you can also use ATMs, banks, or exchange offices in major cities and towns. ATMs are a convenient option, but be aware of foreign currency conversion fees and international ATM fees charged by your bank. Banks usually offer the best exchange value after ATMs, while exchange offices are more secure than street exchangers but may have high commissions or exchange fees.

Exploring the Meaning of Plata in Bolivian Culture

You may want to see also

Using a debit or credit card

ATMs that accept international cards can be found in major cities and towns in Bolivia, but they are not commonly available in small villages. It is recommended to use ATMs attached to banks, preferably during opening hours, and to avoid withdrawing cash on weekends as machines may be empty by late Friday. When using an ATM, you will typically be asked for a four-digit PIN, but if your country uses a six-digit PIN, you can still use your card, and you will need to enter the six digits.

When withdrawing cash from an ATM, consider the exchange rate you are getting. "Casa de Cambio" (money exchange companies) often offer better exchange rates than banks. For example, at the time of writing, a "Casa de Cambio" would give you 6.97 Bolivianos to the US Dollar, while a bank would offer around 6.86. Therefore, it is a good idea to calculate how much your local currency is worth against the US Dollar and, if necessary, withdraw US Dollars from an ATM (available in main cities) and then exchange them at a "Casa de Cambio".

It is worth noting that banks and "Casa de Cambios" in Bolivia do not accept US Dollar bills that are damaged in any way, so ensure your bills are in good condition. Additionally, there is a limit to the amount of money you can withdraw from a Bolivian ATM, which varies depending on the bank, with smaller banks limiting withdrawals to around 1500 Bolivianos and larger banks allowing up to approximately 6500 Bolivianos (around 950 USD) per transaction.

While using a debit or credit card can be a convenient way to access funds in Bolivia, it is important to be mindful of the associated fees, exchange rates, and the availability of ATMs in your intended destinations.

Exploring Latin America: Is Bolivia a Part of It?

You may want to see also

Frequently asked questions

You can exchange money at a bank, exchange office, or at your hotel/hostel. You can also use your debit or credit card at an ATM for an instant exchange.

The exchange rate can change daily. You can check the daily rate in Bolivian newspapers or on a website like the XE Universal Currency Converter. As of September 8, 2024, $1 USD = 6.897 BOB.

Yes, flashing large amounts of money in Bolivia can be dangerous as it is one of the poorest countries in South America. Avoid exchanging money on the street unless you have a strong command of Spanish and knowledge of the current exchange rates. Also, check with your bank before travelling to ensure your card is not frozen due to fraud detection.