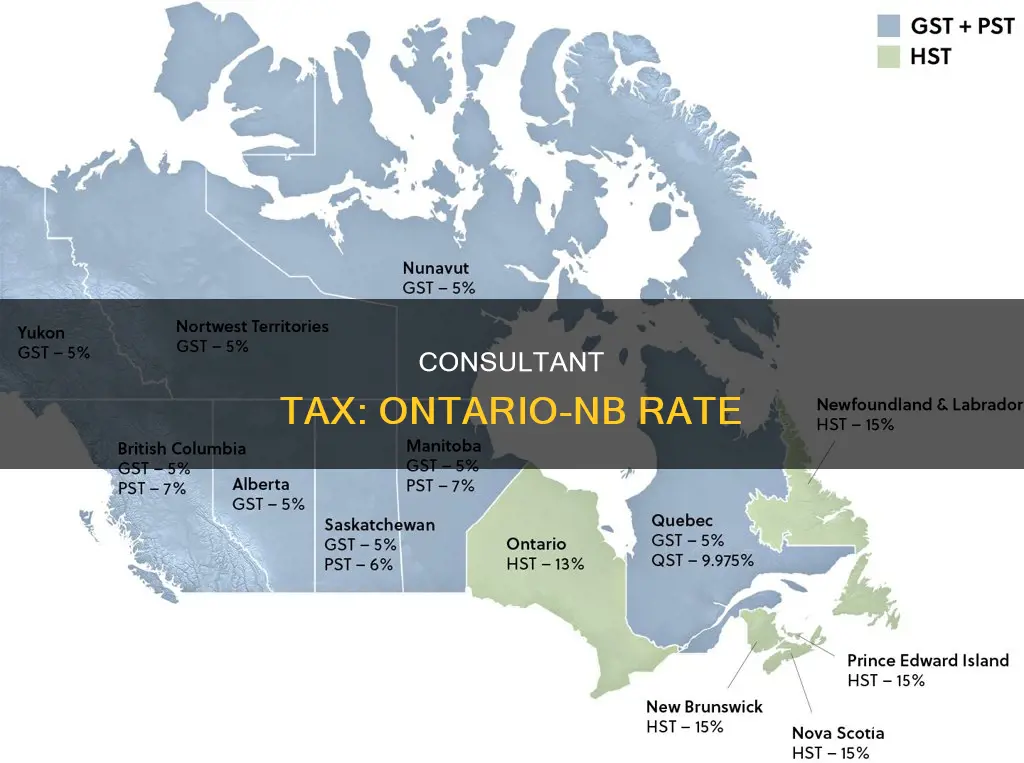

The tax rate that an Ontario consultant should charge a client in New Brunswick depends on the nature of the business and the location of the client. If the Ontario consultant is providing services to a client in New Brunswick, they would typically charge the Harmonized Sales Tax (HST) since New Brunswick has harmonized its sales tax with the federal Goods and Services Tax (GST). The HST rate in New Brunswick is 15%. However, if the Ontario consultant is delivering goods to a client in New Brunswick, they would charge the GST rate of 5% plus the New Brunswick provincial sales tax rate, resulting in a combined tax rate of 15%. It is important to note that tax rules can be complex, and there may be exceptions or special considerations depending on the specific circumstances.

| Characteristics | Values |

|---|---|

| Tax rate charged by Ontario consultant to New Brunswick client | 15% HST |

| Ontario tax rate | 13% HST |

| New Brunswick tax rate | 15% HST |

| GST | 5% |

What You'll Learn

Ontario consultants must charge New Brunswick clients 15% HST

When it comes to sales tax, things can get a little tricky, especially when dealing with out-of-province clients. In Canada, the CRA's Place of Supply rules determine which tax a business should collect.

Now, if you're an Ontario consultant with clients in New Brunswick, here's what you need to know: Ontario and New Brunswick are two of the provinces that have harmonized their sales tax with the GST, creating the Harmonized Sales Tax (HST). This means that instead of charging the GST and the provincial retail services tax separately, these provinces have combined them into a single HST rate.

So, how much HST should you, as an Ontario consultant, charge your New Brunswick clients? The answer is 15%. That's the HST rate applicable in New Brunswick, and it's the rate you should use when billing your clients there. This rate includes both the federal GST and the provincial portion of the tax.

It's important to note that the HST rate can vary between provinces, so always make sure to check the correct rate for the province you're dealing with. Additionally, if your business provides taxable supplies or services, you generally need to register for the GST/HST if your total taxable revenues exceed $30,000 in a year or a single calendar quarter.

The Meanings Behind New Brunswick's Flag Colors

You may want to see also

HST is a combination of GST and regional tax

The Harmonized Sales Tax (HST) is a combination of the federal Goods and Services Tax (GST) and a Provincial Sales Tax (PST). In Canada, five provinces have implemented the HST: Ontario, New Brunswick, Nova Scotia, Prince Edward Island, and Newfoundland and Labrador. The HST rate varies by province, ranging from 13% in Ontario to 15% in Newfoundland and Labrador.

The HST was introduced in 1997 to streamline the recording and collection of federal and provincial sales taxes. Prior to the HST, Canadian sales taxes were divided into the federal GST and the PST, with each province setting its own rates. This resulted in significant differences in sales tax rates across Canada. By combining the federal and provincial taxes, the HST aimed to simplify the tax system and reduce costs for businesses, which would ultimately benefit consumers through lower prices.

The HST is paid by purchasers at the point of sale, and the vendor collects the tax by adding the HST rate to the cost of goods and services. For example, if you hire a contractor in Ontario who charges $10,000 for their services, the final bill with HST will be $11,300. This includes the federal GST of 5% ($500) and the provincial tax of 8% ($800), totalling 13% ($1,300) in taxes.

The HST applies to a range of goods and services, including everyday items like home renovations, car repairs, and professional services such as legal or accounting fees. However, certain items are zero-rated or exempt from the HST, such as basic groceries, prescription drugs, and medical devices.

Understanding the difference between GST and HST is essential for businesses and consumers alike, as it impacts purchasing decisions and tax obligations. While GST is a federal tax applied across Canada, HST is a combination of federal and provincial taxes specific to certain provinces.

Moncton, New Brunswick: A Great Place to Live?

You may want to see also

GST is charged on labour and materials

When it comes to charging taxes as a consultant, the process can be confusing, especially when dealing with clients from different provinces. In Canada, the tax you charge depends on the province or territory where the product or service is supplied to the customer. This is known as the Place of Supply rules.

Now, let's discuss the scenario of an Ontario consultant with a client in New Brunswick. New Brunswick collects the Harmonized Sales Tax (HST), which combines the federal Goods and Services Tax (GST) and the regional tax. The current HST rate in New Brunswick is 15%. So, if you are an Ontario consultant providing services to a client in New Brunswick, you would typically charge the 15% HST on your labour and materials.

However, it's important to note that the tax rate may vary depending on the specific circumstances and the nature of the services provided. For example, if your consulting work involves certain types of labour contracts, the GST rate may differ. Pure labour contracts, where no materials are used, typically attract a GST of 18%. On the other hand, work contracts, which involve both labour and the supply of materials, may be subject to a GST of 12% or 18% depending on the nature of the service.

Additionally, it's worth mentioning that the billing address of your client plays a crucial role in determining the applicable tax rate. In some cases, you may need to separate the labour and materials on your invoice, especially if the client is paying for the materials directly. In such cases, the materials may not be taxable, and only the labour portion is subject to GST.

It's always a good idea to consult with a tax professional or accountant to ensure you are charging the correct tax rates and complying with the tax regulations in the relevant provinces. They can guide you through the intricacies of GST, HST, and other tax considerations.

South Brunswick High School Teacher Count

You may want to see also

GST/HST registration is mandatory for businesses making over $30,000 a year

If you are a business owner in Canada, you must determine whether you need to register for a GST/HST account. GST stands for Goods and Services Tax, and HST stands for Harmonized Sales Tax, which is a combination of the GST and Provincial Sales Tax (PST).

In Canada, GST/HST registration is mandatory for businesses that are no longer considered a "small supplier". A small supplier is defined as a business that does not exceed a revenue threshold of $30,000 over four consecutive calendar quarters. If your business surpasses this threshold, you are required to register for a GST/HST business number and start charging and remitting GST or HST.

The requirement to register for GST/HST applies when your business's revenue (before expenses) exceeds $30,000 in a single calendar quarter (three consecutive months) or $30,000 within the previous four consecutive calendar quarters. It is important to note that this is based on revenue and not profit. Therefore, as soon as you meet either of these criteria, you must register for GST/HST and begin charging and remitting the appropriate tax.

The process of registering for GST/HST is straightforward and can be done online through the Business Registration Online (BRO) program. Once registered, you will receive a nine-digit business number and become a GST/HST registrant. This number should be included on your invoices, receipts, or contracts. Additionally, you must clearly indicate on these documents whether the GST/HST is included in the pricing or will be added separately.

As a GST/HST registrant, you will be able to charge and collect GST/HST on the goods and services you provide. The rate you charge depends on the province or territory in which your business is located, known as your place of supply. For example, in Ontario, you must charge HST because they have combined the GST with the PST. On the other hand, provinces like Alberta only collect GST.

In addition to charging GST/HST, you can also claim credits, known as input tax credits (ITCs), on the GST/HST you have paid for business expenses. These credits can help offset the taxes you have collected and improve your cash flow. However, it is important to keep accurate records of your GST/HST collections and expenses to ensure compliance with tax regulations.

Perrineville Rd: Distance from East Brunswick

You may want to see also

Ontario businesses must charge the HST rate of the province they are supplying to

When it comes to charging the correct tax rate, things can get a little tricky for Ontario businesses dealing with clients in other provinces. The key thing to remember is that the tax rate you charge depends on the province or territory where the product or service is supplied to the customer. This is known as the "place of supply" and it's what determines the applicable tax rate.

So, if you're an Ontario business supplying goods or services to a client in New Brunswick, you would typically charge the New Brunswick HST rate of 15%. This is because New Brunswick is one of the provinces that have combined the federal Goods and Services Tax (GST) with the regional tax, creating the Harmonized Sales Tax (HST).

In Ontario, the HST rate is 13%. However, when you're supplying to a client in another province, you apply the tax rate of that province. This is the case even if your business is registered in Ontario and you're only providing services remotely or electronically. The tax rate is determined by the client's location, not yours.

It's important to note that there are some exceptions and special cases when it comes to charging taxes across provincial borders. For example, if you're delivering goods to a customer in another province, you would typically charge the tax rate of the province where the goods are delivered. Additionally, certain types of goods and services may be zero-rated or tax-exempt, meaning they are taxed at a rate of 0%.

To ensure that you're charging the correct tax rate, it's always a good idea to review the specific rules and guidelines provided by the Canada Revenue Agency (CRA). They provide resources and calculators to help businesses determine the appropriate tax rates for their specific situations.

Brunswick's Mystery Construction

You may want to see also

Frequently asked questions

The tax rate in Ontario is 13% as it has a Harmonized Sales Tax (HST) which combines the Goods and Services Tax (GST) with the provincial retail services tax.

The tax rate in New Brunswick is 15% as it also has a Harmonized Sales Tax (HST).

The rate of tax to charge is determined by the province or territory in which the product or service is supplied to the client.

If your business provides taxable supplies and your total taxable revenue exceeds $30,000 in any single calendar quarter or in four consecutive calendar quarters, you will need to register for the GST/HST.

Service providers are subject to the same rules as property providers. If you provide taxable services in Canada and your total taxable revenue exceeds $30,000 in any single calendar quarter or four consecutive calendar quarters, you will have to register and charge GST/HST.