In New Brunswick, Canada, the poverty line is $20,890 for a single individual. This means that a single person living in New Brunswick has less than $20,890 to spend on personal necessities such as food, clothing, and shelter. In 2016, the overall poverty rate in the province was 19.2%, meaning one-fifth of the population was living on a low income. This is higher than the national average of 14%.

There are different ways to define what is considered low income for individuals living in Canada. For example, an individual living in a rural area may have a lower income than someone in an urban area due to the higher cost of goods and services in cities.

Deep poverty in New Brunswick refers to those living far below the poverty line, which is an important measure for the government when planning and assessing population health. In 2016, there were approximately 100,000 people living below the poverty line in New Brunswick, with about 18,000 of them in deep poverty.

What You'll Learn

Poverty rate in New Brunswick

The poverty rate in New Brunswick, Canada, is a significant issue, with approximately 100,000 people living below the poverty line, according to a 2016 report by Daniel J Dutton of the University of New Brunswick. This figure represents around 19.2% of the province's population, which is higher than the national rate of 14%. The deep poverty rate, which refers to those living far below the poverty line, is approximately 18,000, or close to 1 in 5 people below the poverty line.

Poverty Line Definition

The definition of the poverty line is important for understanding poverty rates. In New Brunswick, income poverty is measured using the Market Basket Measure (MBM) and the Low-Income Measure after tax (LIM). Deep poverty is measured as having an income at 50% or less of the LIM in a given year. The Canadian poverty line is defined by the MBM.

Poverty Statistics

The 2016 Census data revealed that the low-income cut-off (LICO) for New Brunswick was $20,890 for a single individual, excluding benefits. This means that nearly 6 out of 10 people in the province, or 59%, lived on low incomes. This is higher than the national average of 49%.

The poverty rate is particularly high among children, with 19% of children in New Brunswick living on low incomes, compared to the national average of 12%. This equates to one-fifth of children in the province. Furthermore, over 60% of children in New Brunswick live in low-income families, slightly lower than the national average of 65%.

Social Assistance

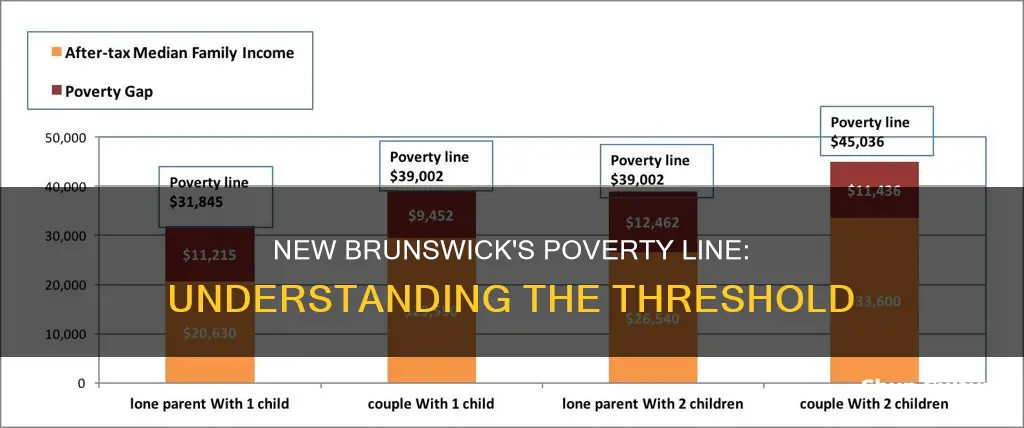

New Brunswick has the lowest social assistance rates in Canada, with welfare payments falling far short of the poverty line. For example, a single person deemed employable received about $8,030 annually, while the poverty line for a single person is $24,395. This gap between social assistance and the poverty line is the widest in Canada. As a result, many people in New Brunswick are unable to meet their basic needs, and social assistance programs are not providing adequate support.

Solutions and Challenges

To address the high poverty rate in New Brunswick, there is a need to ensure that social services are more accessible and effective. This includes increasing social assistance payments and improving the delivery of social assistance programs. However, there is a perceived lack of political will to raise social assistance rates, and the persistent attitude that people who are not earning an employment income are not deserving of assistance.

In conclusion, the poverty rate in New Brunswick is a pressing issue, with a significant number of individuals and families struggling to meet their basic needs. To address this problem, a combination of increased resources, improved social services, and a shift in attitudes towards social assistance and its recipients may be necessary.

Brunswick-Hinesville Distance Explored

You may want to see also

Low-Income Measure

In New Brunswick, income poverty is measured using a number of key indicators, including the Low-Income Measure (LIM) after tax. The LIM is a relative measure of poverty, which grows with increases in median incomes. Deep poverty is measured as having an income at 50% or less of the LIM in a given year.

The LIM is used to determine who is considered low-income in Canada. In New Brunswick, a single individual with an income (excluding benefits) of less than $20,890 is considered low-income. This means that they have less than $20,890 to spend on personal necessities such as food, clothing, and shelter.

In 2016, the overall poverty rate in New Brunswick was 19.2%, meaning that one-fifth of the population was living on a low income. This is higher than the national rate of 14%. The low-income population in New Brunswick was 26% higher than the national average.

The LIM is an important measure for the government in planning and population health. It helps to identify where targeted efforts and resources should be directed to improve the lives of less fortunate individuals and families.

Lane Bridge: North Brunswick's Lifeline

You may want to see also

Deep poverty

According to a 2020 report by Daniel J Dutton, there are approximately 18,000 people living in deep poverty in New Brunswick, out of around 100,000 people living below the poverty line. This means that deep poverty affects close to 1 in 5 people living below the poverty line in the province. The report also found that those in deep poverty are more likely to be single, middle-aged, living alone, and on social assistance.

The persistence of deep poverty in New Brunswick is partly due to the low social assistance rates in the province. According to a report by the Maytree Foundation, New Brunswick has the lowest welfare payments in Canada. For example, a single person deemed employable would receive about $8,030 annually, while the poverty line for such an individual is $24,395. This gap between social assistance and the poverty line is the widest in Canada.

The low social assistance rates have been attributed to a lack of political will to raise them and an enduring attitude that people who are not earning an employment income are not deserving of assistance. Additionally, keeping the rates low may be a way to force people to work, even though many on social assistance face challenges such as disability, childcare costs, and lack of transportation that make finding and keeping employment difficult.

The issue of deep poverty in New Brunswick is a serious concern, and potential solutions include raising social assistance payments, especially for singles, and addressing the underlying systemic issues that make it difficult for people to transition off social assistance.

Edmonton to New Brunswick: Road Trip

You may want to see also

Social assistance

However, it is important to note that these welfare incomes are still below the poverty line. All four example households in a 2022 study were living in poverty, and three out of the four were in deep poverty, which is defined as having an income at 50% or less of the Low-Income Measure (LIM). This indicates that while social assistance provides some support, it may not be sufficient to lift individuals and families out of poverty.

The issue of deep poverty is particularly relevant for those with disabilities. In New Brunswick, individuals with disabilities may receive Extended Benefits (EB) as part of their social assistance. However, even with these additional benefits, their welfare incomes may still fall short. For example, in 2022, an unattached single person with a disability had a total welfare income of $10,884, which was below both the poverty line and the deep poverty threshold.

Furthermore, social assistance reforms in New Brunswick have been advocated, particularly regarding home care support for individuals with disabilities. Home care workers are often overworked and underpaid, and there is a lack of paid sick days, leading to a vulnerable situation for those who rely on their services. Reforms that address these issues and provide better support for home care workers are essential to improving the quality of life for individuals with disabilities.

In conclusion, social assistance in New Brunswick provides a level of support for individuals and families living in poverty, but there are still challenges to be addressed. The persistence of deep poverty, especially for those with disabilities, highlights the need for policy interventions. By raising social assistance payments, improving access to home care, and addressing the issues faced by home care workers, New Brunswick can work towards reducing poverty and improving the well-being of its residents.

Waterfalls of New Brunswick: Exploring Nature's Wonders

You may want to see also

Welfare payments

The total annual welfare incomes in 2022 ranged from $8,031 for an unattached single considered employable to $28,664 for a couple with two children. A single parent with one child received $21,657, while an unattached single with a disability was entitled to $10,884. These welfare incomes are made up of several components, including basic social assistance, additional social assistance, federal child benefits, provincial child benefits, federal tax credits/benefits, and provincial tax credits/benefits.

Basic social assistance payments are provided through Transitional Assistance (TA) benefits or Extended Benefits (EB). TA benefits are given to unattached singles considered employable and households with children, while EB is provided to unattached singles with disabilities. The basic TA and EB benefit amounts are indexed to inflation and may increase over time.

Additional social assistance is provided to households with special health or disability-related needs. For example, the Disability Supplement offers $100 per month to individuals with disabilities, while the Income Supplement Benefit provides an average of $102 per month to households with children.

Federal child benefits include the Canada Child Benefit (CCB), which is provided to households with children under the age of 18. The amount of the CCB varies depending on the age of the child, with higher benefits provided to children under six years of age.

Provincial child benefits in New Brunswick include the New Brunswick Child Tax Benefit, which provides $250 per child per year, or $20.83 per child per month.

Federal and provincial tax credits and benefits also contribute to the total welfare income. The GST/HST credit is a federal benefit, while the New Brunswick Harmonized Sales Tax Credit is a provincial credit. The amount of these credits may vary depending on the household composition.

While these welfare payments provide a vital source of support for individuals and families in need, it is important to note that even with these benefits, many recipients still live below the poverty line. This highlights the need for ongoing efforts to address poverty and ensure that social assistance programs meet the needs of those they serve.

New Brunswick's Level 2 License Explained

You may want to see also

Frequently asked questions

The poverty line in New Brunswick is $20,890 for a single individual. This means that a single person living in New Brunswick has an income (excluding benefits) of less than $20,890 to spend on personal necessities such as food, clothing, and shelter.

The poverty rate in New Brunswick was 19.2% in 2016. This means that one-fifth (20%) of the population was living on a low income.

In any given year, there are approximately 100,000 people living below the poverty line in New Brunswick.

A person living in New Brunswick is considered to be low income if their income (excluding benefits) is less than $20,890. This is the low-income cut-off (LICO) threshold used to define low-income in Canada.