Belize has a small, developing, free-market economy that is highly dependent on tourism, agriculture, and services. The country has a unique cultural heritage and is the only English-speaking nation in Central America. It has a population of around 400,000–450,000 people and a GDP of approximately $2.5 billion as of 2022. Belize's economy is primarily based on agriculture, tourism, and services, with international tourism accounting for about 40% of the country's economic activity. The country has a history of stable democratic government and peaceful elections, and it gained independence in 1981.

| Characteristics | Values |

|---|---|

| Population | 405,000 (2022) |

| GDP | $2.5 billion (2022) |

| Per Capita GDP | $6049 (2022) |

| Primary Economic Sectors | Tourism, Agriculture, Services |

| Primary Exports | Citrus, Sugar, Bananas |

| Primary Imports | Machinery, Transport Equipment, Food, Fuels and Lubricants, Chemicals |

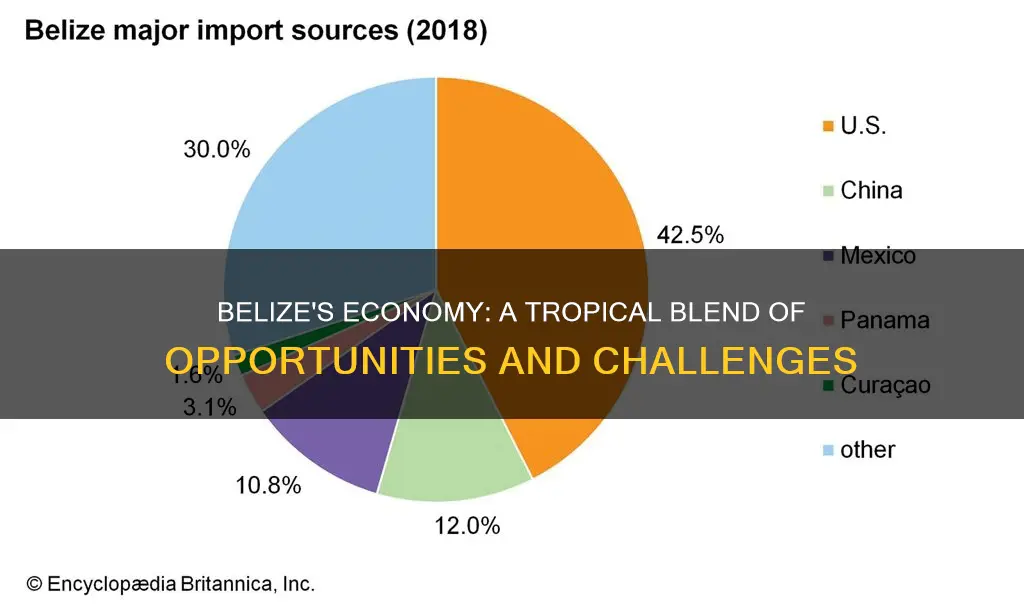

| Trading Partners | USA, UK, China, Mexico, Curaçao, Panama, CARICOM |

| Exchange Rate | 2 BZD: 1 USD |

| Unemployment Rate | 5% |

What You'll Learn

Belize's economy is vulnerable to external shocks

The country's small, tourism-dependent economy is particularly vulnerable to external shocks like a weakened US growth and depressed market environments. Belize's proximity to North America has led to a dependence on tourism as the primary economic sector, contributing to its vulnerability to external factors. The COVID-19 pandemic, for example, severely impacted the tourism industry, as travel restrictions and health concerns caused a sharp drop in international arrivals.

Belize's agricultural sector, which is the second most important economic sector, is also vulnerable to external shocks. The country's agricultural exports, such as sugar, bananas, and citrus juice, are often affected by preferential market access policies in the region. Additionally, environmental disasters like droughts, hurricanes, and climate-related effects can damage crops and disrupt the industry.

Belize's economy is also vulnerable to fluctuations in commodity prices and the continuation of preferential trading agreements. For example, the country has preferential trade agreements with the US for cane sugar and with the UK for bananas. Any changes in these agreements or fluctuations in commodity prices can have a significant impact on Belize's economy.

Furthermore, Belize's high public debt and the high cost of doing business also contribute to its vulnerability to external shocks. The country has a history of bureaucratic delays, insufficient infrastructure, and corruption, which can deter investment and make it challenging to diversify and expand the economy.

Overall, Belize's small, open economy, heavily reliant on tourism and exports, makes it susceptible to external shocks and vulnerable to economic downturns caused by factors beyond its control. The country's economic stability is closely tied to external factors, including the performance of its major trading partners, environmental conditions, and global market trends.

Skydiving in Belize: Is It Safe to Take the Leap?

You may want to see also

The country's economic outlook is troubled

Belize's economy is troubled, with a small population, high public debt, bureaucratic delays, insufficient infrastructure, and corruption. The country's economic outlook is uncertain, particularly in the context of the global health crisis and its economic fallout.

Belize has the smallest economy in Central America, with a Gross Domestic Product (GDP) of $1.4 billion, largely based on tourism. The country is heavily dependent on tourism as its primary economic sector, which makes it vulnerable to external shocks, such as the COVID-19 pandemic. The pandemic caused a steep decline in tourism, which was the first sector to collapse with the onset of the crisis. Belize is also exposed to environmental disasters such as droughts, hurricanes, and climate-related effects, which pose additional risks to its economy.

Moreover, Belize's agricultural exports, which are the second most important economic sector, are often impacted by preferential market access policies common in the region. The country's small, tourism- and export-dependent economy is vulnerable to external factors such as weakened US growth and depressed market environments.

Belize also faces challenges such as a high cost of doing business, which acts as a barrier to investment. The country has a history of bureaucratic delays, insufficient infrastructure, and corruption, which further hinder economic growth and development. Additionally, the financial system in Belize is stable but fragile, with high lending rates and a low level of risk acceptance in business loans due to previously high default rates.

The government is actively seeking Foreign Direct Investment (FDI) to relieve fiscal pressure and diversify the economy. However, the combination of factors mentioned above constitutes significant investment challenges.

Shoes for Belize: What to Pack

You may want to see also

Belize's economy is heavily reliant on tourism

The development of tourism in Belize has been a priority for the government, which has implemented measures to promote and support this sector. In 2022, Belize's gross domestic product (GDP) grew to US$2.95 billion, with tourism being a key driver of this growth. The country's proximity to North America and its status as the only English-speaking nation in Central America have contributed to its appeal as a tourist destination, particularly for visitors from the United States, who made up the majority of international tourists in 2022.

However, the tourism industry in Belize is vulnerable to external shocks, such as the COVID-19 pandemic, which caused a steep decline in tourism arrivals, and environmental disasters like droughts, hurricanes, and climate-related impacts. The economy's heavy reliance on tourism makes it susceptible to fluctuations in this sector, highlighting the importance of economic diversification.

To enhance the resilience of the tourism sector and the overall economy, Belize has invested in infrastructure development and promoted sustainable environmental practices. The government has also encouraged foreign direct investment (FDI) to support economic diversification and growth, although challenges such as a small population, high costs of doing business, and bureaucratic delays persist.

While agriculture and exports, particularly of sugar, bananas, and citrus fruits, remain important sectors, tourism has become the primary economic activity in Belize, shaping the country's economic landscape and outlook.

Belize's Liquid Gold: Exploring the Country's Drinkable Tap Water

You may want to see also

Agriculture is the second most important economic sector

Belize has a small, developing, free-market economy that is based primarily on agriculture, tourism, and services. Agriculture is the second most important economic sector and is based on a small group of exports, including sugar, bananas, and citrus fruits and juices.

Belize has about 8,090 km2 of arable land, but only a small fraction of this is under cultivation. Most farms are smaller than 100 acres (40 hectares), and many of them are milpas (temporary forest clearings). On most of these farms, traditional shifting cultivation is practised, largely because of the nutrient-poor soils of the lowlands. The remaining farms or plantations are devoted to the raising of crops for export. Sugarcane is grown around the towns of Corozal and Orange Walk, and sugar is exported to the United States and the European Union. Some sugar is converted into molasses for rum distillation. Citrus fruits, including oranges and grapefruit, and bananas are grown mainly in the Stann Creek and Cayo areas, south and west of Belize City. Rice is cultivated on large mechanized farms in the Belize River valley, while corn, roots and tubers, red kidney beans, and vegetables are raised throughout the country, mostly on smaller plots. Increased production of non-traditional agricultural products such as papayas and habanero peppers has also aided the economy.

Belize's small, tourism- and export-dependent economy is especially vulnerable to exogenous shocks, such as a weakened US growth and depressed market environments. Belize is also exposed to environmental disasters, such as drought, hurricanes, and climate-related effects. Finally, Belize's agricultural exports are often impacted by preferential market access policies common in the region.

Hopkins Bay: Belize's Best-Kept Secret

You may want to see also

The country's financial system is stable but fragile

Belize's financial system can be characterised as stable but fragile. The high cost of finance and relatively high lending rates are important constraints on economic growth. Domestic banks accept only a low level of risk in business loans due to previously high default rates. While the country has re-established correspondent banking relationships lost in 2015, this has resulted in fewer banking services at increased costs.

The high cost of finance is due to a number of factors. Firstly, Belize has a small population, which means the country has a small domestic market. This, in turn, means that the cost of doing business is high. Secondly, the country has a history of high public debt, which stood at 72.8% of GDP in 2022. This has been exacerbated by the COVID-19 pandemic, with government borrowing increasing as a result of mitigation and recovery efforts. Pre-pandemic estimates for debt-to-GDP were above 90% and are expected to rise to 112-125% in a post-COVID environment.

Another factor contributing to the high cost of finance is the country's fragile banking system. Belize's financial system is small, with little to no foreign portfolio investment transactions, and an underdeveloped banking sector. The country's capital market operations are rudimentary, and the market for corporate bonds is almost non-existent. The government securities market is also underdeveloped.

In addition to the above, the country's banking system has been affected by the loss of correspondent banking relationships in 2015. Although these relationships have since been re-established, they are still tenuous, with delays in transactions and fewer services offered at higher costs.

The relatively high lending rates in Belize are due to the high default rates on business loans in the past. As a result, domestic banks now accept only a low level of risk in business loans. This has implications for economic growth, as it means that businesses may struggle to access the finance they need to expand.

Overall, while Belize's financial system is stable, it is also fragile, and the country faces a number of challenges that could impact its economic growth.

Southwest's Belize Blackout: Why the Airline Has Stopped Flying to the Tropical Paradise

You may want to see also

Frequently asked questions

Belize's economy is based primarily on agriculture, tourism, and services.

Belize's primary exports are citrus fruits, sugar, bananas, seafood, and apparel.

Belize has the smallest economy in Central America, with a Gross Domestic Product (GDP) of $1.4 billion in 2020, which grew to $2.95 billion in 2022.

Belize faces challenges such as a small population, high costs of doing business, high public debt, bureaucratic delays, insufficient infrastructure, and corruption. However, the country has prospects for growth in sectors like tourism, agriculture, renewable energy, and business process outsourcing.