Core CPI, or Core Consumer Price Index, is a measure of the inflation rate that excludes volatile items such as food and energy prices. This index provides a more stable and consistent picture of the underlying inflationary trends in an economy, allowing economists and policymakers to make more informed decisions. In the context of Austria, understanding Core CPI is crucial for assessing the country's economic health and making strategic financial choices.

What You'll Learn

- Core CPI: Measures inflation excluding volatile food and energy prices

- Austrian School: Core CPI is analyzed through the lens of Austrian economic theory

- Core Inflation: Focuses on underlying price trends, excluding temporary fluctuations

- CPI Components: Core CPI excludes food and energy, impacting economic policies

- Austrian Economics: Core CPI is a key indicator in Austrian economic analysis

Core CPI: Measures inflation excluding volatile food and energy prices

The Core Consumer Price Index (CPI) is a crucial economic indicator used to gauge the underlying inflationary trends in an economy, specifically in the context of the Austrian economy. It is a modified version of the traditional CPI, designed to provide a more accurate and stable measure of price changes over time, excluding the influence of volatile and often temporary price movements in food and energy markets. This adjustment is particularly important as these sectors are known for their price volatility, which can distort the true picture of inflation.

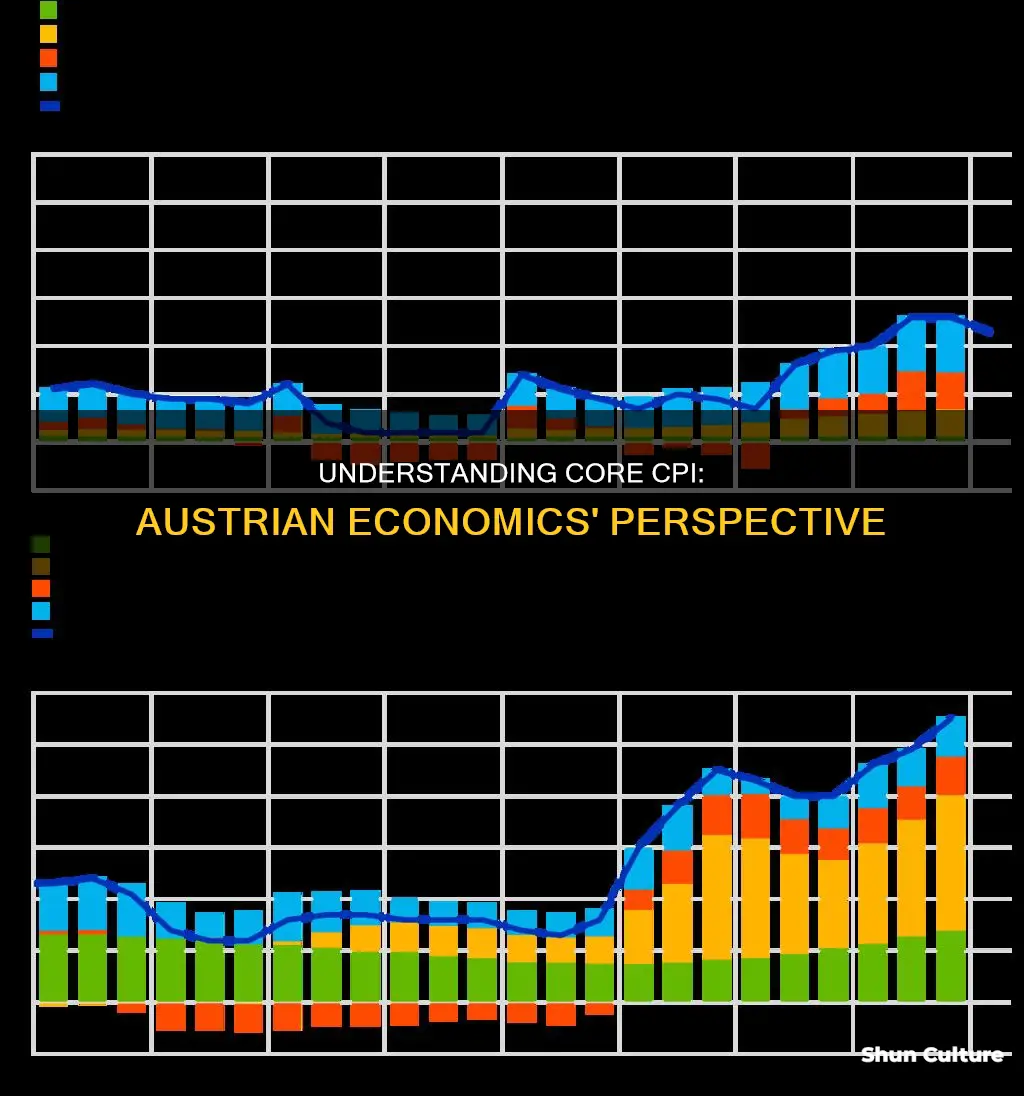

In the Austrian context, the Core CPI is calculated by removing the impact of food and energy prices from the overall CPI. This process involves a detailed analysis of price movements in various categories of goods and services. By doing so, economists and policymakers can identify more reliable patterns of inflation, which are less influenced by external factors like seasonal variations or global market fluctuations. This measure is essential for making informed decisions regarding monetary policy, as it provides a clearer view of the economy's underlying price stability.

The primary objective of using the Core CPI is to identify the persistent and structural inflationary pressures within an economy. By excluding the temporary and often unpredictable price changes in food and energy, the Core CPI highlights the consistent trends in consumer prices. This is particularly useful for central banks and financial institutions when assessing the effectiveness of monetary policies and making decisions about interest rates. For instance, if the Core CPI shows a sustained increase, it may indicate a need for monetary tightening to prevent overheating in the economy.

Furthermore, the Core CPI is a valuable tool for investors and businesses. It helps them understand the long-term economic environment and make strategic decisions. For investors, it provides insights into the potential future direction of inflation, which is crucial for portfolio management and risk assessment. Businesses can use this data to forecast production costs, pricing strategies, and overall economic conditions, ensuring they remain competitive in a dynamic market.

In summary, the Core CPI is a refined economic metric that offers a more stable and reliable representation of inflation in the Austrian economy. By excluding the volatile food and energy sectors, it provides a clearer view of the underlying price trends, enabling better-informed economic decisions and strategic planning for various stakeholders in the country's financial landscape. This measure is a valuable addition to the toolkit of economic analysts and policymakers, contributing to a more robust understanding of the economy's health and direction.

Austria's Women World Cup Dreams: Can They Qualify?

You may want to see also

Austrian School: Core CPI is analyzed through the lens of Austrian economic theory

The Austrian School of economics offers a unique perspective on the analysis of Core CPI (Consumer Price Index), a key indicator of inflation in many countries. This school of thought, founded by Carl Menger in the late 19th century, emphasizes the role of individual action and the subjective value of goods and services in the economy. When applied to Core CPI, Austrian economics provides a distinct framework for understanding price changes and their implications.

At its core, the Austrian approach to CPI analysis revolves around the concept of marginal utility. This principle suggests that the value of a good or service is not constant but rather depends on the individual's preferences and the marginal satisfaction derived from consuming it. In the context of CPI, this means that the prices of goods and services are not determined by some fixed standard but by the varying preferences and needs of consumers. When the Core CPI is calculated, it reflects the changing prices of a basket of goods and services, but the Austrian perspective highlights that these prices are not inherently valuable; their value is derived from the preferences of consumers.

Austrian economists argue that the market is a complex system where prices are determined by the interaction of supply and demand, and these prices are always relative to the specific conditions of time and place. When analyzing Core CPI, this implies that the index should be viewed as a dynamic and context-dependent measure. For instance, a rise in the Core CPI might be interpreted by mainstream economists as an inflationary pressure, but the Austrian School would emphasize that this increase in prices could be a response to a change in consumer preferences, an improvement in production methods, or a shift in the relative scarcity of goods.

Furthermore, the Austrian School's emphasis on the role of money and credit in the economy adds another layer of complexity to CPI analysis. Austrian economists believe that the money supply and credit creation by banks significantly influence prices. They argue that when the money supply expands, it can lead to a misallocation of resources and distorted price signals, which might be reflected in the Core CPI. This perspective encourages a critical examination of the monetary policies and their potential impact on the economy's price structure.

In summary, analyzing Core CPI through the lens of the Austrian School of economics involves understanding the subjective nature of value, the dynamic nature of market prices, and the influence of monetary factors. This approach provides a unique insight into the interpretation of CPI data, challenging conventional economic theories and offering a more nuanced understanding of price movements and their underlying causes.

Bringing Edibles to Austria: What You Need to Know

You may want to see also

Core Inflation: Focuses on underlying price trends, excluding temporary fluctuations

Core inflation is a measure used to assess the underlying inflationary trends in an economy, excluding temporary price fluctuations that may be influenced by external factors or short-term market dynamics. It provides economists and policymakers with a clearer picture of the economy's long-term inflationary pressures. This concept is particularly important when analyzing the Consumer Price Index (CPI), as it helps to identify the more persistent and structural changes in prices.

The calculation of core inflation involves removing volatile components from the CPI basket. These volatile items often include food and energy prices, which can be highly sensitive to external shocks, such as weather conditions affecting crop yields or geopolitical tensions impacting oil prices. By excluding these items, core inflation focuses on the more stable and consistent price movements within the economy. For instance, in the context of the Austrian economy, core CPI might exclude food and energy prices to provide a more accurate representation of the underlying inflationary trends in non-essential goods and services.

This measure is valuable because it helps to filter out short-term noise and provides a more stable indicator of inflation. It allows economists to distinguish between temporary price changes and those that are more persistent and indicative of underlying economic issues. For example, if the core CPI in Austria shows a steady increase, it suggests that the economy is facing more fundamental inflationary pressures, potentially due to factors like wage growth, increased production costs, or changes in consumer demand.

In contrast, a stable or decreasing core inflation rate might indicate that the economy is experiencing more controlled inflation, with prices remaining relatively consistent over time. This information is crucial for central banks and policymakers when making decisions about monetary policy, as it helps them understand the economy's inflation trajectory and make informed choices to maintain price stability.

Understanding core inflation is essential for businesses and investors as well. It can influence pricing strategies, cost structures, and investment decisions. For instance, companies might use core inflation data to adjust their pricing policies, ensuring that their products or services remain competitive without being overly affected by short-term price volatility.

A Journey to the Austrian-Ukrainian Border: Distance and Geography Explored

You may want to see also

CPI Components: Core CPI excludes food and energy, impacting economic policies

The Consumer Price Index (CPI) is a crucial economic indicator that measures the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services. It is a comprehensive measure of inflation, reflecting the cost of living for a typical household. One important aspect of the CPI is the concept of "core CPI," which provides valuable insights into the underlying inflation trends.

Core CPI is calculated by excluding certain volatile components that can fluctuate significantly from month to month, such as food and energy prices. These items are often considered more sensitive to external factors and can be influenced by factors like weather conditions, supply chain disruptions, or geopolitical events. By removing these volatile elements, economists and policymakers can gain a clearer picture of the underlying inflationary pressures within an economy.

The primary reason for excluding food and energy from the core CPI calculation is to identify more stable and consistent price movements. Food and energy prices can be highly variable, and their inclusion in the index might distort the long-term inflation trend. For instance, a sudden increase in food prices due to a poor harvest might be an isolated event and not indicative of a broader inflationary trend. Similarly, energy prices can be influenced by global events, supply and demand dynamics, or government policies, leading to short-term volatility.

Excluding these components allows economists to focus on the more persistent and structural factors that influence inflation. Core CPI provides a more stable measure of inflationary pressures, helping policymakers make informed decisions about monetary and fiscal policies. For example, if the core CPI shows a consistent upward trend, it suggests that inflation is becoming more entrenched, and central banks might consider raising interest rates to cool down the economy. Conversely, a declining core CPI could indicate that inflation is under control, potentially leading to more expansionary policies.

Understanding the components of the CPI, particularly the distinction between headline and core CPI, is essential for interpreting economic data accurately. This knowledge enables economists and investors to make more informed decisions, ensuring that policies and strategies are aligned with the underlying economic realities. By focusing on core inflation, policymakers can better navigate the complexities of economic management and make timely adjustments to maintain price stability and overall economic health.

A Republic's Evolution: Austria's Federal Parliamentary Journey

You may want to see also

Austrian Economics: Core CPI is a key indicator in Austrian economic analysis

The concept of Core CPI (Consumer Price Index) is an essential tool for understanding the Austrian School of Economics, which offers a unique perspective on economic analysis and policy. Austrian economists utilize Core CPI as a critical indicator to assess the health of an economy and the effectiveness of monetary policy. This index provides a more nuanced view of inflationary trends, allowing economists to differentiate between temporary price fluctuations and those that reflect fundamental economic changes.

In Austrian economics, the Core CPI is calculated by removing volatile components such as food and energy prices, which are considered more sensitive to short-term market fluctuations. By doing so, economists aim to identify the underlying inflationary pressures that might not be immediately apparent in the overall CPI. This distinction is crucial because it helps in understanding the monetary phenomenon and the role of central banks in managing economic stability.

The Austrian approach to economic analysis emphasizes the importance of understanding the monetary system and the impact of central bank policies. Core CPI plays a pivotal role in this framework by providing a measure of the money supply's growth and its effect on prices. When the Core CPI rises, it suggests that the money supply is expanding, potentially leading to inflationary pressures. Austrian economists argue that this indicator is more reliable than the traditional CPI because it focuses on the core components that are less susceptible to external shocks.

Furthermore, Austrian economists use Core CPI to evaluate the effectiveness of government interventions and monetary policies. For instance, if the Core CPI shows a persistent increase despite low inflation rates, it may indicate that the central bank's policies are failing to control the money supply effectively. This analysis is particularly relevant in the context of modern economic challenges, where central banks often face the task of managing inflation expectations while maintaining economic growth.

In summary, Core CPI is a vital concept in Austrian economics, offering a more precise measure of inflation and monetary policy's impact. By focusing on the core components of the CPI, economists can better understand the underlying economic dynamics and make more informed decisions regarding monetary and fiscal policies. This approach provides a unique lens through which to analyze and interpret economic data, contributing to the rich tapestry of economic thought within the Austrian School.

Dental Care in Austria: What's Covered?

You may want to see also

Frequently asked questions

Core Consumer Price Index (CPI) is a measure of the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services. It is often used as a proxy for inflation, excluding volatile food and energy prices.

In Austria, the Core CPI is calculated by the Austrian Statistics Authority (Statistisches Bundesamt). It involves a detailed process of collecting and analyzing price data for a wide range of goods and services. The basket of goods and services is periodically updated to reflect current consumer spending patterns.

Core CPI is a crucial indicator for investors and policymakers as it provides a clearer picture of underlying inflation trends. By excluding volatile items, it helps identify more stable and persistent price movements, which can influence decisions on interest rates, fiscal policies, and investment strategies.

The regular CPI includes all goods and services in the consumption basket, while Core CPI excludes food and energy prices. This distinction is made to identify more stable inflationary pressures. Food and energy prices can be highly volatile and may not accurately represent the overall inflation trend, hence the need for a core measure.