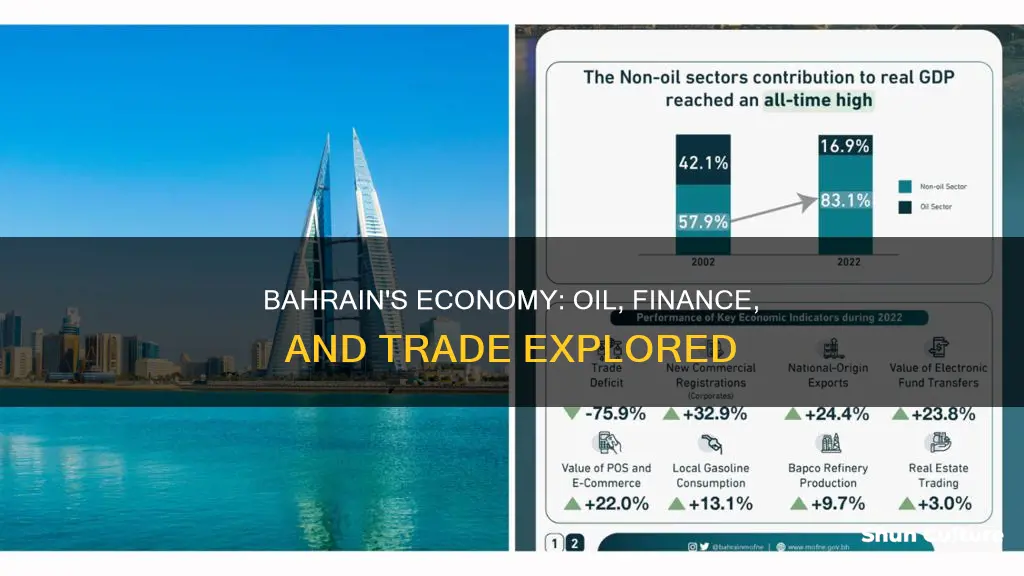

Bahrain's economy is largely dependent on oil and gas, with petroleum being the country's most exported product. However, Bahrain has the most diversified economy in the Gulf Cooperation Council, with non-oil sectors contributing significantly to its GDP. The country has invested heavily in the banking and tourism sectors, with its successful finance industry recognised as the world's fastest-growing financial centre in 2008. Bahrain's economic vision for 2030 focuses on improving living standards for citizens, embracing sustainability, achieving competitiveness in the global economy, and ensuring justice and equal opportunities.

Oil and gas

Bahrain has the most diversified economy in the Gulf Cooperation Council (GCC), but it is racing to pivot away from oil. The country has stabilized its oil production at about 40,000 barrels per day, and reserves are expected to last 10 to 15 years. The Bahrain Petroleum Company refinery was the first in the Persian Gulf, built in 1935, with a capacity of about 250,000 barrels per day. After selling 60% of the refinery to the Bahrain National Oil Company in 1980, Caltex, a U.S. company, now owns 40%.

Bahrain also has a liquefaction plant that utilizes gas piped directly from its oil fields. Gas reserves are expected to last about 50 years at present consumption rates. The Gulf Petrochemical Industries Company (GPIC) is a joint venture between the petrochemical industries of Kuwait, the Saudi Basic Industries Corporation, and the Government of Bahrain. The plant, completed in 1985, produces ammonia, methanol, and urea for export.

Bahrain's economy heavily relies on oil and gas, international banking, and tourism. The country has the second-highest-valued currency unit globally and has been recognized as a high-income economy by the World Bank.

Piastri's Bahrain GP: What Really Happened?

You may want to see also

Banking and finance

Bahrain's economy is the most diversified among all the Gulf countries in the region. The financial and banking sector is one of the most important non-oil sectors in Bahrain. In fact, Bahrain has 406 financial institutions, which contribute to 16.7% of the country's total GDP.

Bahrain's finance industry is very successful. In 2008, Bahrain was named the world's fastest-growing financial centre by the City of London's Global Financial Centres Index. Bahrain's banking and financial services sector, particularly Islamic banking, have benefited from the regional boom driven by the demand for oil. Bahrain is the main banking hub for the Persian Gulf and a centre for Islamic finance, which has been attracted by the country's strong regulatory framework for the industry.

Bahrain has heavily invested in the banking and tourism sectors since the late 20th century. The country's capital, Manama, is home to many large financial institutions. Bahrain's international airport is one of the busiest in the Persian Gulf, serving 22 carriers. A modern, busy port offers direct and frequent cargo shipping connections to the U.S., Europe, and the Far East.

Bahrain's banking and insurance sectors will eventually undergo consolidation. Bahrain intends to expand its high-tech industries, invest in research and development, and strengthen its competitive edge within a global economy.

Where to Watch the Bahrain GP: Channel Guide

You may want to see also

Manufacturing

Bahrain has the most diversified economy in the Gulf Cooperation Council (GCC), with manufacturing being the third-largest contributor to the economy, accounting for 14.9% of real GDP. Bahrain's economy has expanded into sectors such as banking, heavy industries, retail, and tourism.

The country offers an ideal environment for manufacturers, with lower operating costs, a strategic location, a highly skilled workforce, and world-class infrastructure. Bahrain's favourable business environment and business-friendly policies, such as 0% corporate income tax, make it an attractive destination for manufacturing businesses.

Manufacturers in Bahrain can benefit from lower setup and operational costs compared to other GCC countries, with up to 56% lower costs. The country also offers investment grants, low industrial land lease rates, and a lower cost of living. Bahrain's efficient transport links provide direct access to Saudi Arabia and the surrounding markets, making it a gateway to the region.

The country has established several industrial zones, such as the Bahrain International Investment Park (BIIP), which offers companies a world-class and cost-effective environment for manufacturing. BIIP provides benefits such as 100% foreign ownership rights, a 10-year guaranteed 0% tax rate, competitive land rental prices, and duty-free access to key markets.

Bahrain's manufacturing sector includes a range of industries such as food and beverage, fibreglass production, plastics, chemicals, and aluminium smelting. The country's advanced infrastructure and efficient transportation network further enhance its attractiveness for manufacturing businesses.

With its diversified economy, strategic location, and supportive business environment, Bahrain offers significant opportunities for manufacturing companies looking to establish themselves in the region.

Desalination in Bahrain: Pros, Cons, and Challenges

You may want to see also

Transport and tourism

Bahrain's transport system encompasses road, air, and sea transportation. The country has well-constructed roads connecting the four main islands and all towns and villages. As of 2010, there were 4,122 km of roadways, with 3,392 km paved. Multiple causeways connect the main island to Muharraq Island and Sitra Island. A four-lane highway on a 24 km causeway, financed by Saudi Arabia, links Bahrain with the Saudi Arabian mainland via Umm an-Nasan Island. The King Fahd Causeway, a 25 km multiple-dike bridge, also connects Bahrain and Saudi Arabia. Plans are underway for the Qatar-Bahrain Friendship Bridge, which will be the longest fixed link in the world at 45 km.

Bahrain has four airports, with one civil airport, Bahrain International Airport, and three military airports. The civil airport has undergone significant upgrades in recent years, with a new terminal opening in 2021, boasting a capacity of 14 million passengers per year. As of 2020, Bahrain owns three harbors in Manama, Mina Salman, and Sitrah. The port of Mina Salman can accommodate 16 oceangoing vessels.

Bahrain has a public transport system with over 20 bus routes, providing a convenient and cost-effective means of transportation. Taxis are also widely available, with drivers mandated to use meters to calculate fares.

Tourism is a significant sector in Bahrain's economy. The country has invested in developing its tourism infrastructure, including transport links and facilities. Bahrain's tourism initiatives have had a positive impact, with a notable increase in international visitors arriving by sea. Bahrain's capital, Manama, is a regional financial and business centre, attracting tourists from the region. The success of events such as the Bahrain Grand Prix has raised the country's international profile, encouraging major airlines to resume services.

Sonal: A Common Name in Bahrain?

You may want to see also

Economic freedom

Bahrain's economy is the most diversified among the Gulf countries, with non-oil sectors contributing to 79.2% of total GDP. The country has a strong financial and banking sector, with 406 financial institutions contributing to 16.7% of total GDP. Bahrain's economy is also based on modern and integrated infrastructure and sophisticated legislation.

Bahrain pursues economic freedom as a strategic option to encourage both domestic and foreign investment and strengthen its position as a financial and tourist hub in the Middle East. According to the Index of Economic Freedom, Bahrain has the fourth-freest economy in the Middle East and North Africa region and is the 40th-freest economy globally.

Bahrain offers legislative incentives and advantages for foreign companies, including complete ownership of companies and the establishment of branches without the need for a local agent. The country also provides freedom and stability in its fiscal and monetary policies.

The country's economic freedom is based on several factors, including:

- Property rights: Bahrain's legal framework allows individuals to acquire, hold, and utilize private property, with effective law enforcement to protect these rights.

- Judicial effectiveness: The country has a properly functioning legal framework to protect the rights of citizens against unlawful acts and ensure fair and appropriate legal actions.

- Government integrity: Bahrain aims to reduce corruption, which erodes economic freedom and increases the costs of economic activity.

- Tax burden: The country has a composite measure that reflects marginal tax rates on personal and corporate income, with a total tax burden of approximately 30% of GDP.

- Government spending: Bahrain's government spending is close to zero, which is lightly penalized in the Index of Economic Freedom's scoring system.

- Regulatory efficiency: Bahrain's regulatory and infrastructure environments support the efficient operation of businesses, with a focus on access to electricity, business environment risk, regulatory quality, and women's economic inclusion.

- Labour freedom: The country's legal and regulatory framework for the labour market considers various aspects, including minimum wages, associational rights, and restrictions on layoffs and overtime work.

- Monetary freedom: Price stability is a key aspect of Bahrain's free-market approach, with limited government manipulation of prices through controls or subsidies.

- Trade freedom: The country has a composite measure of tariff and non-tariff barriers affecting imports and exports, with a focus on maintaining a competitive global economy.

- Investment freedom: Bahrain aims for unrestricted flow of investment capital, with equal treatment for foreign and domestic investment and minimal restrictions on foreign exchange and capital transactions.

- Financial freedom: Bahrain's financial sector is characterized by efficient banking services, limited government control, and independence of financial institutions, with a focus on contractual obligations, credit allocation, and financial market development.

Bahrain: A Safe Haven for Indians?

You may want to see also

Frequently asked questions

Bahrain's economy is based on a modern and integrated infrastructure and sophisticated legislation. The country's economy is the most diversified among all regional Gulf countries, with non-oil sectors contributing to 79.2% of total GDP.

The financial and banking sector is one of the most important non-oil sectors in Bahrain, contributing 16.7% of total GDP. Other significant non-oil sectors include manufacturing industries (14.5%), transport and communications (6.8%), construction (6.6%), real estate (4.1%), and hotels and restaurants (2.4%).

The oil sector contributes 20.8% of total GDP in Bahrain. Petroleum and natural gas are the country's only significant natural resources, and oil comprises 85% of Bahraini budget revenues.

Bahrain's top three exported goods are oil and mineral fuels, aluminium, and ores. Petroleum is the country's most exported product, accounting for 60% of export receipts.

Bahrain's economic growth is expected to pick up, supported by strong activity in the non-oil sector. The country aims to pivot further from oil and continue its push towards a cleaner, more diversified economic future.