Belarus has a mixed economy, with a large industrial sector (24% of GDP in 2024) and a well-developed manufacturing industry, services sector, and agricultural sector (8% of GDP). The country is heavily reliant on exports, particularly to Russia, and has a strong focus on maintaining full employment.

The Belarusian economy is heavily influenced by external forces, including sanctions from the EU and US, and its close economic ties with Russia. The country's economy is also impacted by its political situation, with the controversial re-election of President Lukashenko in 2020 leading to widespread protests and subsequent sanctions.

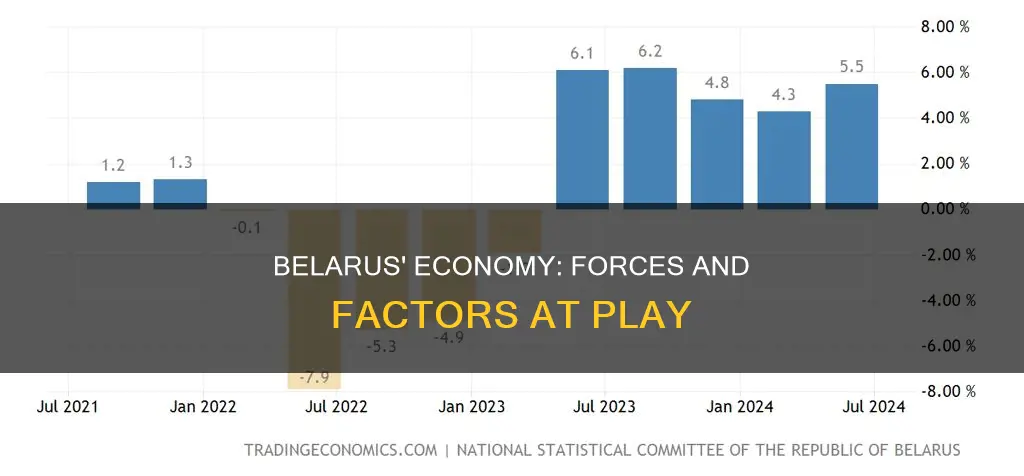

Belarus's economy has also been affected by the COVID-19 pandemic, though less so than many other countries due to relatively light lockdown measures. The country experienced a sharp recession and a 4.7% drop in GDP following the Russian invasion of Ukraine in 2022, which resulted in the exodus of many international firms and investors from the Belarusian market.

The country's economic growth is further influenced by its efforts to promote private-sector development and strengthen the position of small and medium-sized enterprises (SMEs). Additionally, Belarus has a highly skilled and well-educated workforce, which contributes to its economic development.

Overall, the Belarusian economy is subject to a range of internal and external forces that impact its growth, development, and stability.

| Characteristics | Values |

|---|---|

| GDP | $20,100 per capita in 2019 |

| Major industries | Manufacturing, services, agriculture |

| Economic model | Socially-oriented market economy |

| GDP growth rate | 20% in 2005 |

| Poverty rate | 60th out of 191 countries on the Human Development Index |

| FDI | $1.53 billion in 2022 |

| Main export destinations | Russia (39%), Ukraine (12%), the United Kingdom (9%) |

| Main imports | Machinery and equipment, mineral products, chemicals, metals, textiles, foodstuffs |

| Employment rate | 99.5% |

| Unemployment rate | 1% |

| Inflation rate | 4.9% in 2018 |

What You'll Learn

Dependence on Russia

Since the dissolution of the Soviet Union, Belarus has remained strategically aligned with Russia. In 1999, the two nations reached an agreement to become a "union state", with the aim of creating a USSR-like federation with a shared government, currency, flag, and army. This agreement is part of Moscow's effort to re-establish regional hegemony in the former Soviet space.

Russia's importance in the Belarusian economy has markedly increased since the election of President Alexander Lukashenko in 1994. Cheap oil and gas exported from Russia represent 15% of Belarus's GDP, and Russia accounts for 41% of Belarusian exports. During times of escalated tension between Russia and the West, Belarus has served as Russia's "middleman" by importing goods from the EU, coining them as "Belarusian", and re-exporting them to Russia, and vice versa.

The relationship is not entirely symbiotic, however. Russia needs Belarus as an ally for energy trade since the pipeline that runs through the country is one of the only reliable transporters of energy resources from Russia to Europe. This gives Belarus some leverage, and Lukashenko has previously attempted to keep Russia at arm's length while still maintaining close ties.

However, Belarus's poor relations with the West in recent years, primarily due to human rights violations and election fraud, have pushed the country further into Russia's orbit. The EU imposed economic sanctions on Belarus after the 2020 presidential election, which was largely viewed as corrupt. This has isolated Belarus from Western countries and resulted in increased dependence on and commitment to Russia's strategic goals.

The growing unity between Moscow and Minsk has isolated Belarus from the West, forcing Lukashenko to become fully compliant and willing to cater to Russia's needs. This situation motivated Lukashenko to remove the neutrality clause in Belarus's constitution in July 2021, publicly displaying his allegiance to Russia.

The Belarusian economy is heavily dependent on Russia in terms of energy, trade, and finance. This dependence has increased in recent years due to Western sanctions and Belarus's role in Russia's invasion of Ukraine. In response to these sanctions, Belarus has redirected its trade towards Russia and received economic support from Moscow.

The current crisis in Belarus's trade exchange will translate into a significant aggravation of the trade deficit. The magnitude of the deficit will likely exceed that recorded in previous years, as Belarus has lost almost all of its most profitable export categories to EU member states and Ukraine. The country is also facing a brain drain, with IT specialists, investors, and businesses leaving the country due to the political situation and sanctions.

To mitigate the consequences of the looming crisis, Belarus has turned to Russia for economic support. The two nations agreed to abandon the US dollar and switch to the Russian rouble in settlements for fuel supplies. Additionally, Russia agreed to defer Belarus's debt repayments for five to six years. These measures are intended to postpone the threat of a total collapse of Belarusian public finances.

However, Belarus's dependence on Russia comes at a cost. The country's independence has slowly diminished as Russia's military presence expands, and Belarusian sovereignty may be at risk. Despite the asymmetric power dynamic, Lukashenko has tested Putin's patience by publicly opposing Russian actions in Ukraine and Crimea. While Russia needs Belarus as an ally, it remains to be seen how long this patience will last.

Belarus' Stance on Bitcoin Legality: Explained

You may want to see also

Sanctions by the EU and US

Since the 2020 Belarusian presidential election, the EU and US have imposed several rounds of sanctions on Belarus. These sanctions have been imposed in response to the fraudulent nature of the election, the regime's subsequent crackdown on protestors, and the country's support for Russia's invasion of Ukraine.

EU Sanctions

In June 2024, the EU passed a broad new set of sanctions on Belarus, including measures to bring EU-Belarus sanctions more closely in line with similar Russia-related measures. These sanctions include:

- Various export and import controls, including on goods that could contribute to the enhancement of Belarusian industrial capacities, luxury goods, maritime navigation goods and technology, and goods and technology suited for use in oil refining and liquefaction of natural gas.

- A "no Belarus clause" requirement, mirroring the "no Russia clause" in EU-Russia sanctions. This requires EU operators exporting restricted items to seek assurances from counterparties that the items will not be re-exported to Belarus.

- Anti-circumvention measures, including a "best efforts" standard requiring EU companies to ensure that any non-EU company they own or control does not participate in activities that undermine the sanctions.

- Risk assessment requirements for EU operators trading in common high-priority items, to prevent their products being diverted to Belarus.

- New professional service sanctions, prohibiting the provision of restricted services to the Belarusian government, public bodies, corporations, agencies, or any person or entity acting on their behalf.

- Diamond restrictions, including on the purchase, import, or transfer of diamonds and products incorporating diamonds originating in or exported from Belarus.

- New restrictions on investment in the Belarusian energy sector, including acquiring or extending interests in energy entities, providing financing, creating joint ventures, or providing investment services.

- A divestment provision, allowing member states to issue licenses for restricted sales, imports, or services necessary for the divestment from Belarus or the wind-down of business activities.

- Road transport restrictions, prohibiting the transport of goods by road within the EU by Belarusian road transport undertakings or EU undertakings owned 25% or more by a Belarusian natural or legal person.

US Sanctions

The US has also imposed a range of sanctions on Belarus, targeting individuals, entities, and sectors of the economy. These include:

- Prohibitions on any commercial activity with certain Belarusian banks, including Dabrabyt Bank, Belinvestbank, and Belarusian subsidiaries of sanctioned Russian banks.

- Prohibitions on transactions with the National Bank of Belarus and blocking access to the SWIFT secure messaging system for several Belarusian banks.

- Sanctions on state-owned enterprises, government officials, and Lukashenko's aircraft.

- Sanctions on networks and individuals enabling sanctions evasion and supporting Russia's war machine.

- Sanctions on individuals and entities undermining democratic processes or institutions in Belarus.

- Restrictions on the export of luxury goods to Belarus.

- Sweeping export restrictions on Belarus for enabling Russia's invasion of Ukraine.

- Sanctions on perpetrators of serious human rights abuses.

- Sanctions on individuals connected to gross human rights violations and the corrupt leader of Belarus.

- Sanctions on entities owned by blocked persons.

- Visa restrictions to hold the Lukashenko regime to account.

Discover Belarus: A Country of Surprises and Beauty

You may want to see also

The banking sector

Sanctions imposed by the US and EU on Belarus have restricted the country's ability to deal in hard currency and have resulted in a technical default on external debts. These sanctions have also blocked access to the SWIFT secure messaging system for several Belarusian banks, including the National Bank of Belarus, further isolating the country from the global financial system.

The banking system in Belarus includes 23 commercial banks and three non-banking credit and finance organisations. The sector remains vulnerable to external shocks due to the high level of dollarisation and exposure to government and state-owned enterprise debt. The six largest commercial banks, all of which have some government share, accounted for 85% of the total assets across the country's banking sector as of 2022.

Belarus has a central banking system, with the NBRB controlling the majority of the country's stocks. The state owns more than 70% of all stocks in the country, and the government is often reluctant to trade them freely. The banking sector in Belarus is dominated by state-owned enterprises, which enjoy preferential access to financial resources, raw materials, and lower energy prices. This preferential treatment creates an uneven playing field for private enterprises, hindering the development of a vibrant private sector.

Belarus has a well-developed intellectual property rights (IPR) framework, and IPR violations are subject to administrative and criminal liability. A Specialised Tribunal for Intellectual Property under the Supreme Court handles IPR-related disputes.

The country has put in place measures to combat corruption, such as the 2015 Law "On Combatting Corruption" and the National Programme for Combatting Crime and Corruption of 2017-2019. Belarus has also ratified several international anti-corruption conventions and agreements. However, the country's ranking in the Transparency International Corruption Perceptions Index has fluctuated, and the absence of an independent judicial system makes it difficult to gauge the true scale of corruption.

Belarus has a simplified taxation system for foreign-owned businesses, and the government offers various incentives and programs for foreign direct investment (FDI) depending on the sector and region. The country has six free economic zones (FEZ) that offer simplified tax and regulatory frameworks to attract foreign investment. The High Technology Park (HTP), established in 2005, is a "virtual" legal regime that extends across the country and provides beneficial tax preferences to resident companies.

The Belarusian government officially claims to welcome portfolio investment, and there have been no reported impediments in recent years. The Belarusian Currency and Stock Exchange is open to foreign investors, but it is still largely undeveloped due to stringent criteria for companies to trade stocks. Bonds are the predominant financial instrument on the country's corporate securities market.

Belarus' Economic System: A Socialist-Style Managed Economy

You may want to see also

The IT sector

In 2006, the government launched the Hi-Tech Park (HTP) on the northeastern outskirts of Minsk, which was meant to become the country's Silicon Valley. The HTP has hosted more than 750 start-ups and outsourcing companies, employing around 58,000 workers. Overall, more than 100,000 citizens work in the IT sector in Belarus.

The HTP scheme has seen more than 1,000 tech companies register to operate in Belarus, with over 70,000 workers. The country's tech sector has been a hub for gaming companies, such as Wargaming, the maker of "World of Tanks", and communication platforms like Viber. The HTP says the Belarusian tech sector's exports of products and services hit a record $2.7 billion in 2020, up 25% from the year before, and accounting for 4% of the country's GDP.

However, the IT sector in Belarus has faced challenges in recent years due to the nation-wide crackdown on opposition protests after the 2020 presidential election, which was widely believed to have been rigged. This has led to an exodus of IT specialists from the country, with an estimated 20,0000 leaving out of a total of 124,000 in 2019. Some companies have even shuttered their operations entirely, like PandaDoc, a sales process software provider founded in Minsk in 2011, which closed its office in the city and relocated dozens of staff to neighbouring countries after coming under pressure from the authorities.

The exodus of IT specialists has had a significant impact on the Belarusian economy, as the sector is one of the country's best-performing economic sectors. The future of the industry is uncertain, with some experts predicting a slowdown in growth or even a recession if the situation does not change.

The Belarusian government has also taken steps to increase control over the IT sector, with President Lukashenko accusing HTP companies of working 'for the USA for half prices' in August 2021. In March 2022, taxes for IT companies were raised, and the sector now faces the same tax rates as other industries.

Visa Requirements for Nigerians Traveling to Belarus

You may want to see also

The energy sector

Belarus has only small reserves of petroleum and natural gas and imports most of its oil and gas from Russia. The country has two state-owned oil pipeline operating companies, which were inherited from Glavtransneft in 1991. Belarus also has a well-developed gas transportation and distribution network.

Belneftekhim, a government-controlled concern, carries out all activities related to prospecting, exploration, and production of oil and associated gas in the country. Belorusneft, a subsidiary of Belneftekhim, exports about 50% of its oil output. Belarus's own production covers only about 30% of domestic oil consumption.

In 2008, the Belarusian government decided to build a nuclear power plant. The country has two pressurized water reactors in the Grodno Region, with the first unit commissioned in December 2019.

The electric power sector is amalgamated into the state-owned production union "Belenergo", which consists of six regional power system enterprises and various entities that carry out repair, maintenance, and rehabilitation of facilities.

Belarus has a well-developed chemical industry that specializes in extracting value from Russian oil products, which transit through the country's pipelines to Germany and the west. Synthetic polymers like nylon, viscose, acrylic, polyester, and polyethylene are produced from this stream. Oil refineries are located in Navapolacak (Naftan) and Mazyr (Mozyr Oil Refinery).

Belarus has a central banking system led by the National Bank of Belarus, which represents the state's interest and is the main regulator of the country's banking system. The president of Belarus appoints the chair and members of the Board of the National Bank.

The country has a highly centralized economy with the state controlling key industries and eschewing privatization. The Belarusian economy is an upper-middle-income mixed economy, emphasizing full employment and a dominant public sector.

Importing from Belarus: What You Need to Know

You may want to see also

Frequently asked questions

Belarus has a mixed economy with a large industrial sector and a well-developed manufacturing industry, services sector, and agriculture. The state plays a massive role in the economy, with the public sector dominating. The country has a high trade openness, with exports and imports representing 139% of GDP in 2018. The main exports are machinery and equipment, mineral products, chemicals, metals, textiles, foodstuffs, and ICT services. The economy is heavily reliant on Russia for trade, energy, and financial support, and there is a high level of economic dependence.

The re-election of President Lukashenko in 2020 triggered widespread protests and allegations of election rigging and voter fraud. This led to several rounds of sanctions being imposed by the US, EU, and other countries, targeting individuals and several areas of the economy, such as the banking system. Many international firms and investors left the Belarusian market, causing a sharp decline in trade with the EU and Ukraine and a recession, with a 4.7% drop in GDP in 2020.

The COVID-19 pandemic had a limited impact on the economy due to the absence of mobility restrictions and credit support to state-owned enterprises. However, the country experienced a cyclical upturn in 2021 due to strong export growth.