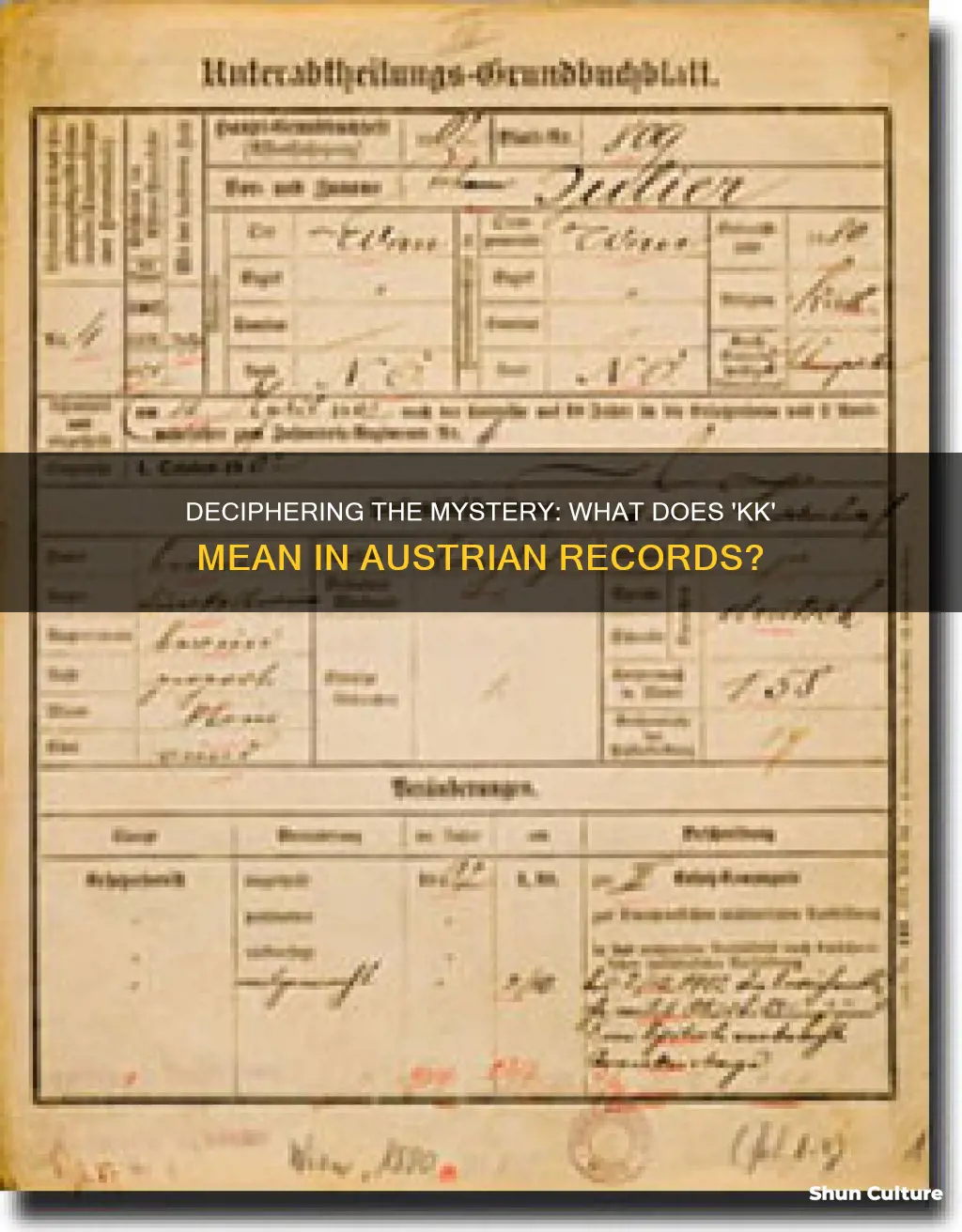

In the context of Austrian records, the abbreviation KK often stands for Kraftfahrzeug-Versicherung, which translates to Motor Vehicle Insurance in English. This term is commonly used in the insurance industry and is a crucial component of vehicle registration and ownership in Austria. Understanding the meaning of KK is essential for individuals and businesses involved in the Austrian automotive sector, as it directly relates to the legal requirements and documentation associated with vehicle ownership and insurance.

What You'll Learn

- Kassenbeleg: Receipt or invoice for a transaction, indicating the amount paid

- Kontoauszug: Bank statement summarizing account activity and balances

- Kreditkarte: Credit card used for purchases and payments

- Kontoüberweisung: Bank transfer for paying bills or transferring funds

- Kassenbuch: Record book for tracking financial transactions and sales

Kassenbeleg: Receipt or invoice for a transaction, indicating the amount paid

In the context of Austrian records, the term "Kassenbeleg" is a crucial component of financial documentation. It translates to "cash receipt" or "invoice" in English, and it serves as a vital record of transactions. When you receive a Kassenbeleg, you are essentially holding a proof of payment, which is essential for both the buyer and the seller. This document provides a clear indication of the amount paid, ensuring that both parties are aware of the financial exchange that has taken place.

The Kassenbeleg is a detailed document that includes specific information about the transaction. It typically lists the date of the purchase, the name or identifier of the seller or service provider, and the total amount paid. This amount is usually broken down into various components, such as the price of the goods or services, any applicable taxes, and any additional fees. By providing this level of detail, the Kassenbeleg ensures transparency and accountability in financial transactions.

In Austria, these receipts are widely used in various settings, from retail stores to service providers like restaurants, salons, and repair shops. When you make a purchase or receive a service, the business will provide you with a Kassenbeleg as a receipt. This receipt is not just a confirmation of payment but also serves as a record that can be used for tax purposes, warranty claims, or any other financial or administrative needs.

It is important to note that Kassenbeleg is a standard term in Austrian business practices and is recognized by the country's tax authorities. This means that businesses are required to issue these receipts for most transactions, ensuring that the financial records are accurate and accessible. As a consumer, having a Kassenbeleg provides you with a sense of security and the ability to verify the transaction details if needed.

In summary, the Kassenbeleg is an essential document in Austrian records, serving as a receipt or invoice that confirms the amount paid for a transaction. It is a detailed and transparent record, providing both buyers and sellers with the necessary information for their financial and administrative purposes. Understanding this term and its significance can be beneficial for anyone interacting with Austrian businesses and financial systems.

Socialism's Austrian Roots: 1889's Legacy

You may want to see also

Kontoauszug: Bank statement summarizing account activity and balances

In the context of Austrian records, the term "Kontoauszug" refers to a bank statement that provides a comprehensive summary of an individual's or business's bank account activity and balances over a specific period. This document is an essential tool for financial management and record-keeping, offering a detailed overview of transactions, deposits, withdrawals, and the overall financial health of the account.

The Kontoauszug typically includes various sections, each providing specific information. It starts with an account summary, which displays the account number, the name of the account holder, and the type of account (e.g., checking, savings). This section also indicates the currency used for transactions and the current balance. The statement then proceeds to list all transactions in chronological order, with details such as the date, amount, and description of each transaction. This level of detail ensures that account holders can verify their transactions and identify any discrepancies.

One of the critical aspects of the Kontoauszug is its ability to provide a clear picture of the account's financial activity. It shows the inflow and outflow of funds, allowing individuals and businesses to monitor their spending, income, and overall financial management. For instance, it can highlight recurring expenses, large transactions, or any unauthorized activities, enabling prompt action to address potential issues.

Additionally, the statement often includes a breakdown of fees and charges associated with the account. This information is crucial for understanding the true cost of maintaining the account and can help identify any unexpected or unnecessary fees. By providing a transparent view of the account's financial status, the Kontoauszug empowers account holders to make informed decisions about their money.

In summary, the Kontoauszug is a vital document in Austrian records, offering a detailed summary of bank account activity and balances. It serves as a comprehensive financial record, enabling individuals and businesses to manage their money effectively, identify potential issues, and make informed financial decisions. Understanding and utilizing this statement is essential for maintaining financial health and ensuring the smooth operation of banking activities.

Austria-Hungary: America's Forgotten Foe in the Great War

You may want to see also

Kreditkarte: Credit card used for purchases and payments

In the context of Austrian records, the term "KK" often refers to "Kreditkarte," which translates to "credit card" in English. This is a crucial identifier in financial documentation, especially for transactions and purchases made using credit cards. When you come across "KK" in Austrian records, it signifies that the transaction was conducted using a credit card, providing a clear and concise way to categorize and organize financial data.

Understanding the meaning of "KK" in this context is essential for anyone dealing with Austrian financial records, as it helps in quickly identifying the nature of the transaction. This simple abbreviation streamlines record-keeping and makes it easier to analyze spending patterns, track expenses, and manage personal finances.

The use of "KK" for credit cards is a practical and widely recognized convention in Austrian documentation. It ensures that financial information is accurately represented and easily understood by those involved in record-keeping and analysis. This standardization is particularly useful in a country like Austria, where credit cards are commonly used for various purchases and payments.

When reviewing Austrian records, whether it's for personal or business purposes, recognizing "KK" as the indicator of a credit card transaction is a valuable skill. It allows for efficient data interpretation and management, ensuring that financial records are accurate and up-to-date. This knowledge can be particularly helpful for individuals or businesses that frequently interact with Austrian financial institutions and need to track their credit card activities.

In summary, "KK" in Austrian records stands for "Kreditkarte," representing credit card transactions. This simple yet effective notation system contributes to the clarity and organization of financial documentation, making it an essential concept to grasp when dealing with Austrian credit card-related records.

Does Austria Demand an International Driving Permit?

You may want to see also

Kontoüberweisung: Bank transfer for paying bills or transferring funds

Kontoüberweisung, often abbreviated as 'Kontoübertrag' in German, is a term commonly used in Austria to refer to a bank transfer or wire transfer. It is a method of transferring money from one bank account to another, either within the same country or internationally. This process is essential for various financial transactions, including paying bills, sending funds to friends or family, and settling debts.

When you initiate a Kontoüberweisung, you are essentially instructing your bank to send a specific amount of money to the designated recipient's account. This method of payment is widely accepted and preferred in Austria due to its efficiency and security. It provides a clear and structured way to manage finances, ensuring that payments are recorded and accounted for accurately.

The process typically involves filling out a transfer form or using online banking services to input the recipient's bank details, the amount to be transferred, and any necessary reference numbers or descriptions. These details are then verified, and the funds are moved from your account to the recipient's, often within a few hours or days, depending on the banks and the transfer method chosen.

Kontoüberweisung offers several advantages. Firstly, it is a secure way to transfer money, especially when compared to cash or check payments. The transaction is recorded and can be tracked, providing a paper trail for financial records. Additionally, many banks offer the option to set up recurring payments, which is useful for regular bill payments, such as rent, utilities, or subscriptions.

In summary, Kontoüberweisung is a straightforward and reliable method of bank transfer in Austria, allowing individuals to manage their finances efficiently and securely. It is a popular choice for various financial transactions, ensuring that payments are processed accurately and promptly. Understanding this process is essential for anyone managing their finances in Austria, as it provides a clear and structured way to handle money transfers and bill payments.

New Nations Born from Old Austria-Hungary

You may want to see also

Kassenbuch: Record book for tracking financial transactions and sales

The Kassenbuch is a crucial document in Austrian record-keeping, serving as a comprehensive record book for tracking financial transactions and sales. It is an essential tool for businesses and individuals to maintain a detailed account of their monetary activities, ensuring accuracy and providing a clear overview of their financial status. This book is a vital component of financial management, offering a structured approach to recording income and expenses.

In the context of Austrian records, the term 'Kassenbuch' refers to a specialized ledger or notebook designed for financial documentation. It is a detailed record-keeping system that allows users to log various transactions, including sales, purchases, payments, and receipts. The primary purpose is to provide an organized and accurate representation of financial dealings, which is essential for tax purposes, financial planning, and business management.

Each entry in the Kassenbuch typically includes essential details such as the date, a description of the transaction, the amount involved, and sometimes, the name or identifier of the party involved. This level of detail ensures that the record-keeping is thorough and can be easily referenced for future audits or financial analysis. For instance, a sale might be recorded with the date, customer name, product sold, quantity, and price, providing a comprehensive overview of the transaction.

Maintaining a Kassenbuch offers numerous benefits. Firstly, it provides a historical record of financial activities, enabling users to track spending, income, and trends over time. This information can be invaluable for financial planning, budgeting, and making informed business decisions. Additionally, the Kassenbuch facilitates the identification of potential areas for cost-saving or revenue generation. By regularly reviewing the records, individuals and businesses can quickly spot discrepancies, errors, or fraudulent activities, allowing for prompt corrective action.

In summary, the Kassenbuch is an indispensable tool for financial management in Austria, offering a structured and detailed approach to recording financial transactions. Its importance lies in providing an accurate and organized record of sales and financial dealings, which is essential for tax compliance, financial planning, and overall business success. By maintaining a Kassenbuch, individuals and businesses can ensure they have a robust system for tracking and managing their financial activities.

The Sound of Music's Austrian Lowland Filming

You may want to see also

Frequently asked questions

In Austrian records, "KK" typically stands for "Kraftfahrzeug-Kraftversicherung," which translates to "Motor Vehicle Insurance" in English. It is a code used to indicate the insurance status of a vehicle in the country's vehicle registration system.

When registering a vehicle in Austria, the "KK" code is used to specify whether the vehicle has valid insurance coverage. It helps authorities ensure that all registered vehicles have the necessary insurance, which is a legal requirement.

An example of a record entry might look like this: "KK: 123456789 - Valid Insurance." Here, "123456789" could be a unique identifier for the vehicle, and the "KK" code confirms that the vehicle's insurance is up to date.

Yes, there are a few other common abbreviations in Austrian vehicle records, such as "KK-Zustand" (Vehicle Condition) and "KK-Datum" (Insurance Expiration Date). These codes help provide a comprehensive overview of a vehicle's status and documentation.