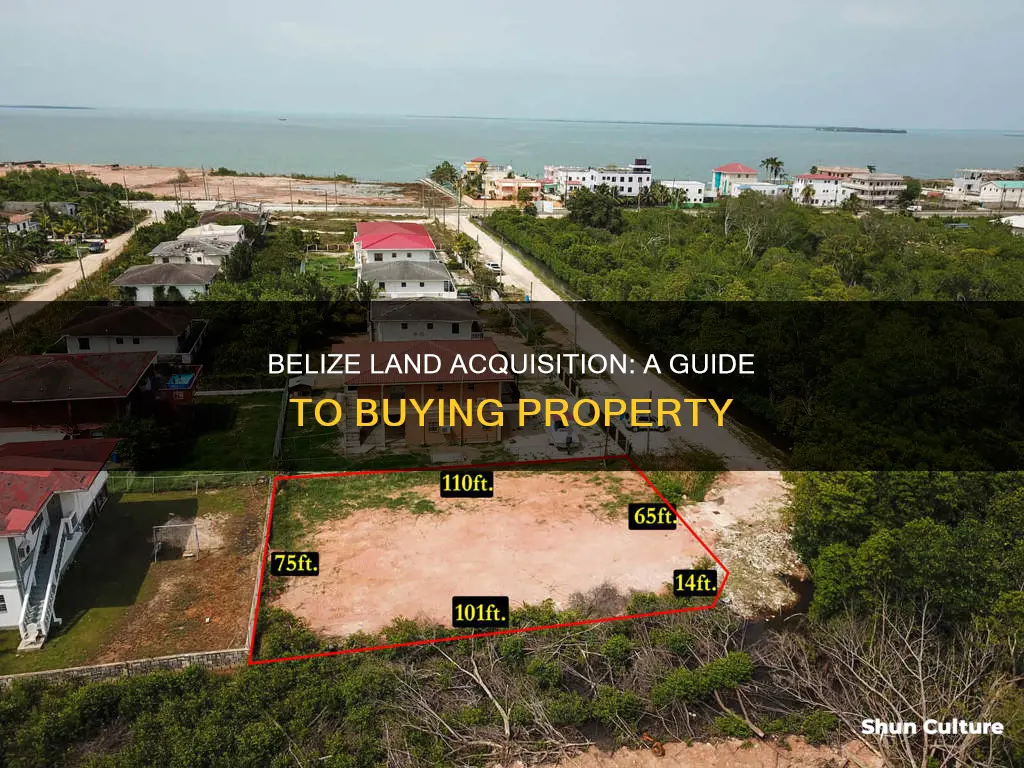

Belize is an attractive destination for foreign investors due to its tropical climate, stunning beaches, diverse wildlife, and low property taxes. Foreigners enjoy the same rights as Belize citizens when it comes to land ownership and can own land with Absolute Title. There are no restrictions on foreign ownership, and no capital gains tax, making it a profitable investment opportunity.

When buying land in Belize, it is important to understand the laws and regulations and choose the right type of ownership. The buying process is similar to that of other foreign countries, but it is recommended to hire a local real estate agent or attorney to guide you through the process and ensure all legal requirements are met.

There are four main types of land ownership in Belize: Deed of Conveyance, Land Certificate, Minister Fiat Grant, and Transfer Certificate of Title. The process of purchasing land includes searching for properties, choosing a property, making an offer, negotiating with the seller, conducting a title search, signing a purchase agreement, paying the purchase price and associated fees, and transferring the title.

With its natural beauty, favourable laws for foreigners, and diverse real estate options, Belize offers a unique opportunity to invest in a little piece of Caribbean paradise.

What You'll Learn

Foreigners can own land in Belize with the same rights as citizens

Belize is one of the few countries in the world where foreigners can own land with the same rights as citizens. There are no restrictions on foreign ownership of property in Belize. Foreigners can own land with Absolute Title and have the same property rights as Belizean citizens. They can sell, transfer, or lease the land, as well as build structures and develop the property as they see fit.

When purchasing land in Belize, it is important to understand the different types of land ownership and choose the one that suits your needs. The four main types of land ownership in Belize are:

- Deed of Conveyance: This is the most common type of land ownership in Belize. It is used for land located in unregistered or undeclared areas and islands. A Deed of Conveyance must be signed by the seller and witnessed by a Justice of the Peace or a Notary Public. It is important to register this deed with the Lands Department to be recognized as a legal document.

- Land Certificate: This type of ownership is typically used for land located in urban areas and more developed islands that have been surveyed by the Belizean government. A Land Certificate is issued by the government's Lands Department and serves as proof of ownership.

- Transfer Certificate of Title: This type of ownership is similar to a Land Certificate but is issued for properties already registered with the Lands Department.

- Minister Fiat Grant: This type of ownership is for unregistered areas where the Minister grants title to government land. While government land is not typically granted to foreigners, a Minister Fiat Grant can be sold to a foreigner through a conveyance.

When buying property in Belize, it is recommended to hire a local real estate agent or attorney to guide you through the process and ensure all legal requirements are met. It is also essential to conduct a thorough title search to ensure the property is free of any liens or encumbrances.

Belize offers a unique opportunity for foreigners to own land and enjoy the same rights as citizens, making it an attractive destination for those looking to invest in land or retirement options.

Travel Guide: Belize to Havana

You may want to see also

There is no capital gains tax in Belize

Belize is a beautiful country located in Central America, known for its tropical climate, stunning beaches, and diverse wildlife. It is also an attractive destination for foreigners looking to invest in land, whether for residential, commercial, or agricultural purposes.

One of the biggest perks of investing in Belize is that there is no capital gains tax. This means that if you purchase land and later sell it at a profit, you will not be taxed on the capital gains, and all profits will remain with you. This is in stark contrast to countries like the United States, where capital gains tax can be as high as 15%.

Belize has actively worked to establish itself as a tax haven, with the government eliminating taxes on a wide range of income sources, including capital gains, dividends, interest, and revenues earned offshore. The country has also implemented legislation such as the International Business Companies Act, the Trusts Act, and the Offshore Banking Act, which have made it easier for corporations to establish themselves in the country and take advantage of the tax benefits.

In addition to the lack of capital gains tax, Belize offers other financial perks. For example, property taxes in Belize are relatively low, with rates between 1% and 1.5% of the value of undeveloped land. Additionally, the cost of living in Belize is much lower than in many other countries, which can result in lower banking fees for those choosing to bank in Belize.

When purchasing land in Belize, it is important to understand the laws and regulations regarding land ownership, especially for foreigners. Foreigners can own land with Absolute Title and have the same property rights as Belizean citizens, including the right to sell, transfer, or lease the land, and build structures. All land transfers must go through the Land Registry under the Ministry of Natural Resources, Petroleum, and Mining.

Overall, Belize's status as a tax haven, lack of capital gains tax, and favorable property taxes make it an attractive destination for those looking to invest in land while minimizing their tax liabilities.

Belize's Best Souvenirs

You may want to see also

Retiring in Belize has perks like import duty exemptions

Belize is an attractive destination for foreign investors, especially those looking to retire and invest in land. The country boasts a tropical climate, stunning beaches, and diverse wildlife, as well as affordable living costs, a welcoming community, and various retirement programs.

One of the biggest perks of retiring in Belize is the Qualified Retired Persons (QRP) Program, which offers retirees an exemption from taxes on all income derived from sources outside Belize. This includes income from employment, investments, or passive sources, regardless of whether the income is remitted to Belize. Additionally, QRPs can import their personal and household goods, as well as a car, boat, and plane, without paying import duties or taxes during their first year as a resident.

To be eligible for the QRP Program, applicants must be at least 45 years old (with plans to reduce this to 40) and demonstrate a monthly income of at least $2,000, or savings/investments of $24,000 per year. To maintain QRP status, retirees must spend a minimum of one month per year in Belize.

Another benefit of retiring in Belize is the relatively low property taxes. For example, a house or condo worth US $250,000 on Ambergris Caye attracts an annual property tax of under US $375. Additionally, there is no capital gains tax in Belize, so if you sell land for a profit, you keep all the profits.

When purchasing land in Belize, it is important to understand the laws and regulations regarding land ownership. Foreigners can own land with Absolute Title and have the same property rights as citizens, including the right to sell, transfer, lease, build on, and develop the land. All land transfers must go through the Land Registry under the Ministry of Natural Resources, Petroleum and Mining. There are four main types of land ownership in Belize: Deed of Conveyance, Land Certificate, Minister Fiat Grant, and Transfer Certificate of Title, each with its own unique characteristics and requirements.

In summary, retiring in Belize offers perks such as import duty exemptions, tax exemptions, and low property taxes. Additionally, the QRP Program provides an attractive option for retirees with its flexible requirements and benefits. However, it is crucial to carefully consider all aspects of retiring in Belize, including the challenges of limited public healthcare and infrastructure, before making any decisions.

Belize's Credit Card Conundrum: Navigating Accepted Payment Methods

You may want to see also

Hiring a local real estate agent or attorney is recommended

When buying land in Belize, it is highly recommended that you hire a local real estate agent or attorney. They will be able to guide you through the buying process, provide valuable insight into the local market, assist with negotiations, and ensure that all legal requirements are met.

A local real estate agent or attorney can help you navigate the different types of land ownership in Belize and determine which type is best suited for your specific needs and preferences. The four main types of land ownership in Belize are Deed of Conveyance, Land Certificate, Minister Fiat Grant, and Transfer Certificate of Title, each with its own unique characteristics and requirements.

For example, a Deed of Conveyance is typically used for land located in unregistered or undeclared areas and islands, while a Land Certificate is more common for land located in urban areas and more developed islands that have been surveyed by the government of Belize. A local professional will be able to advise you on the most appropriate type of ownership for your desired location and intended use of the land.

Additionally, a local real estate agent or attorney can assist you in conducting a thorough title search to ensure that the property you are interested in is free and clear of any liens, judgments, or encumbrances that could affect your ownership rights. A title search can typically be performed by a local attorney or title company for a relatively low cost.

By hiring a local professional, you can also benefit from their knowledge of the local market and any potential challenges or considerations that may arise during the buying process. They can provide insights into the different areas of Belize, such as the Cayo District or Ambergris Caye, and help you find the best location for your needs.

Furthermore, a local real estate agent or attorney can assist with negotiations and ensure that you are getting a fair price for the property. They can also help you navigate the necessary legal processes, including drafting and reviewing documents such as the "Offer to Purchase" letter and the Purchase Agreement.

Overall, hiring a local real estate agent or attorney when buying land in Belize can save you time, money, and potential headaches by ensuring that you make a well-informed decision and that all legal requirements are met.

Alaska Airlines' Belize Flights: Unveiling the Travel Days

You may want to see also

There are four types of land ownership in Belize

There are four main types of land ownership in Belize, each with unique characteristics and requirements. These are:

Deed of Conveyance

This is the most common type of land ownership in Belize. It is a legal document that transfers ownership of the land from the seller to the buyer. A Deed of Conveyance must be signed by the seller and witnessed by a Justice of the Peace or a Notary Public. It is important to note that this type of deed does not provide conclusive proof of ownership and must be registered with the Lands Department to be recognised as a legal document. This process can take up to seven months as it goes through different departments. Deed of Conveyance is typically used for land located in Unregistered or undeclared areas and islands.

Land Certificate

A Land Certificate is issued by the Belizean government's Lands Department and serves as proof of ownership for land located in urban areas and more developed islands that have been surveyed by the government. This type of ownership is governed by the Registered Land Act (1977).

Transfer Certificate of Title

This type of ownership is similar to a Land Certificate but is issued for properties already registered with the Lands Department. A Transfer Certificate of Title can be obtained by completing an application and paying the appropriate fees.

Minister Fiat Grant

This type of ownership is usually in an unregistered area where the Minister grants title to Government Land. Government land is not granted to foreigners, but a Minister Fiat Grant can be sold to them.

It is important to note that foreigners have the same rights as Belizean citizens when it comes to land ownership in Belize. They can own land with Absolute Title, sell, transfer or lease the land, and build structures as they see fit. All land transfers must go through The Land Registry, which is under the Ministry of Natural Resources, Petroleum and Mining.

Exploring Belize's Remote Caulker Island: Travel Tips

You may want to see also

Frequently asked questions

Here is a simplified list of steps to buying land in Belize:

- Search for properties that interest you.

- Choose a property that suits your needs and budget.

- Make an offer to purchase.

- Negotiate with the seller and provide a deposit.

- Hire a lawyer and do a title search service.

- Sign a purchase agreement and pay.

- Pay the stamp duty.

- Transfer the title.

There are four main types of land ownership in Belize, depending on the location of the land:

- Deed of Conveyance: Typically used for land located in unregistered or undeclared areas and islands. This is the most common type of land ownership in Belize.

- Land Certificate: Typically used for land located in urban areas and more developed islands that have been surveyed by the government of Belize.

- Transfer Certificate of Title: Similar to a Land Certificate, but for properties already registered with the Lands Department.

- Minister Fiat Grant: Normally used in an unregistered area where the Minister grants title to government land.

There are several benefits of investing in Belize real estate, including:

- Foreigners can own land and have the same property rights as Belize citizens.

- There is no capital gains tax when selling property.

- Property taxes are relatively low compared to other countries.

- The cost of property and housing is relatively low.