The General Sales Tax (GST) in Belize has been set at 12.5% since 2010. It is a consumption tax that applies to all commodities. However, certain staple food items, such as rice, beans, corn, fresh meat, flour, sugar, eggs, bread, and tortillas, are taxed at 0%. Additionally, specific goods and services are exempt from GST, including water, school fees, house rent, insurance, medicine, and hotel rooms. Businesses with an annual turnover of $75,000 or more per annum, or an average monthly value of taxable supplies of $6,250 or more, are required to register for GST.

| Characteristics | Values |

|---|---|

| GST Standard Rate | 12.5% |

| Zero-Rated Supplies | 0% |

| Annual Turnover Threshold for GST Registration | $75,000 |

| Average Monthly Value of Taxable Supplies Threshold for GST Registration | $6,250 |

| Tax Identification Number (TIN) | Unique identifying number on the certificate of registration |

| Payment Deadline | 7:00 PM on the tax due date |

| Late Payment Consequences | Penalties and interest |

| Records to Keep | Registration certificate, tax invoices, till rolls, Z-tapes, invoice books, tax invoices for tax paid on purchases, custom documents for imported goods, debit and credit notes, working papers, GST returns, refund claims |

| Record-Keeping Formats | Traditional books and records, electronic readable format, supporting documents |

| Exempt Goods and Services | Water, school fees, house rent, insurance, medicine, hotel rooms |

| Zero-Rated Food Items | Rice, beans, corn, fresh meat, flour, sugar, eggs, bread, tortilla |

What You'll Learn

Annual turnover threshold for registration: $75,000

In Belize, businesses with an annual turnover of $75,000 or more per annum are required to register for General Sales Tax (GST). This threshold applies to the total value of taxable supplies, sales, receipts, and takings from all taxable activities, excluding the GST charged. It is important to note that the GST rate in Belize is typically 12.5% for most goods and services.

For instance, if a business has an annual turnover of $80,000, they would need to register for GST. On the other hand, if a business has an annual turnover of $60,000, they would not be required to register for GST based on the turnover threshold.

Additionally, businesses that have been operating for less than 12 months but have an average monthly value of taxable supplies of $6,250 or more are also required to register for GST. This rule ensures that even new businesses with a significant turnover contribute to the GST system.

Businesses that meet the registration criteria must obtain a green GST certificate and a Taxpayer Identification Number (TIN). The TIN is a unique identifier assigned to registered taxpayers under the GST Act. It is essential for businesses to comply with these requirements and voluntarily register for GST to avoid penalties and interest charges. By doing so, businesses contribute to the tax system and ensure they are meeting their legal obligations.

The Natural Wonder of Belize

You may want to see also

Taxable supplies and standard rate: 12.5%

In Belize, the standard rate of GST is 12.5%. This rate applies to most goods and services provided by businesses. However, there are certain supplies that are exempt from GST, such as financial services, medical products, and some agricultural products like rice, flour, beans, sugar, and locally produced fresh fruits and vegetables.

To clarify, "taxable supplies" refer to the total value of sales, receipts, or takings made from taxable activities. This does not include the GST charged. When determining whether a business needs to register for GST, it is essential to consider the total value of taxable supplies from all branches and taxable activities.

The standard rate of 12.5% is applied to taxable supplies that are standard-rated. On the other hand, zero-rated supplies, as outlined in the GST law schedules 1, 2, and 3, are taxed at a rate of 0%. This means that certain supplies are exempt from GST and are taxed at a rate of 0%.

It is important to note that the GST is a consumption tax levied on the supply of goods and services within Belize. It is applicable to businesses with annual sales or gross revenue of $75,000 or more. Additionally, to be eligible for GST, the business must have been in operation for 12 or fewer months.

The Distance Between Belize and Cuba: A Tropical Trek

You may want to see also

Zero-rated supplies: 0%

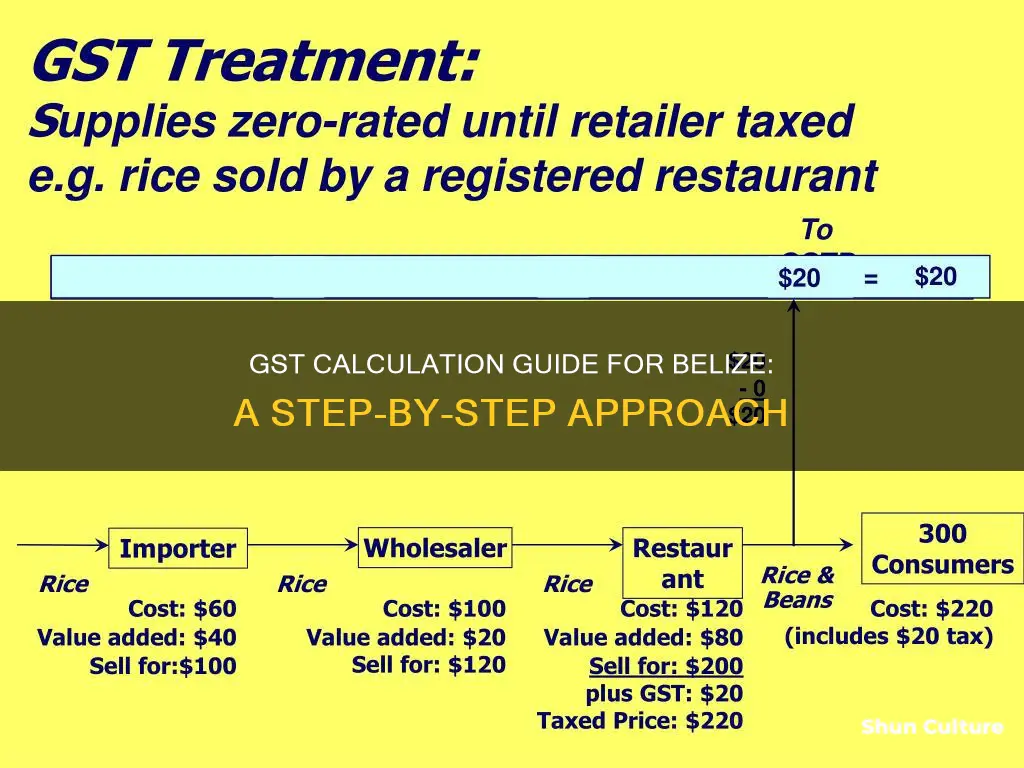

Zero-rated supplies refer to goods and services that are taxed at a rate of 0% under the GST law schedules 1, 2, and 3. This means that while these items are still subject to the GST, they are effectively exempt from the standard 12.5% tax rate.

The zero-rated category includes staple food items such as rice, beans, corn, fresh meat, flour, sugar, eggs, bread, and tortillas. Additionally, certain imported goods fall under this category, such as unprocessed and processed foods, educational items, medicines, and household supplies. Removing imported goods from this list has been proposed as a way to boost the Belizean economy by increasing the amount of GST collected and supporting local producers.

It is important to note that zero-rated supplies are distinct from exempt goods and services, which are not subject to GST at all. Examples of exempt goods and services include water, school fees, house rent, insurance, medicine, and hotel rooms.

The distinction between zero-rated and exempt items is crucial for businesses and consumers in Belize. While zero-rated items are still subject to GST, they are taxed at a rate of 0%, whereas exempt items are not subject to GST at all. This has implications for tax compliance and record-keeping, as well as for the overall cost of goods and services for consumers.

Belize Water Taxi Adventure: San Pedro to Belize City

You may want to see also

Online payments deadline: 7:00 PM

The General Sales Tax (GST) in Belize has been set at 12.5% since 2010. This rate applies to most goods and services provided by businesses. However, it's important to note that the deadline for online payments is 7:00 PM, and any payments made after this time will be accounted for on the next working day.

For businesses, the GST return must be filed if the annual turnover is $75,000 or more per annum. Additionally, if a business has been operating for less than 12 months and the average monthly value of taxable supplies is $6,250 or more, they are also required to register for GST. When filing a GST return, businesses must submit their Sales and Purchases ledgers, along with their Tax Identification Number (TIN), business address, phone and fax number, among other details.

The GST standard rate of 12.5% applies to most goods and services. However, there are certain exemptions and zero-rated supplies. For example, staple food items such as rice, beans, corn, fresh meat, flour, sugar, eggs, bread, and tortillas are subject to a 0% GST rate. Additionally, water, school fees, house rent, insurance, medicine, and hotel rooms are considered exempt from GST.

On the other hand, GST is applicable to internet data services, government contracts, and Business Processing Outsourcing companies. It's important to note that GST is also charged on goods and services sold over the internet by Belize-owned entities to customers within Belize. In such cases, the standard rate of 12.5% applies. However, if a Belize entity sells goods and services online to overseas consumers, GST is typically charged at 0%.

To summarise, while calculating GST in Belize, businesses should be aware of the applicable rate of 12.5% for most goods and services, with specific exemptions and zero-rated supplies. Additionally, the deadline for online payments is 7:00 PM, and failure to meet tax obligations by the due date may result in penalties and interest.

Weed and Wander: Exploring Marijuana Laws in Belize

You may want to see also

Non-compliance: penalties and interest

Penalties and interest will be charged for late payment of GST in Belize. Payments made online after 7:00 PM are considered late, and any payment made after this time will be accounted for on the next working day. If you do not fulfill your tax obligations, you may be charged penalties and interest. While failure to comply may be unintentional, it is important to contact the Belize Tax Service Department as soon as possible if a mistake has been made.

Reassessments can be made at any time within six years from the end of the taxable period if it is discovered that fraudulent information has been supplied or details have been omitted. It is therefore important to keep accurate records and ensure that all tax obligations are met.

The GST return must be filed by all businesses registered for General Sales Tax. Businesses must register for GST if their annual turnover is $75,000 or more per annum. Additionally, if a business has been operating for less than 12 months and the average monthly value of taxable supplies was $6,250 or more, it is also required to register for GST.

The standard rate of GST is 12.5% and has been since 2010. This rate applies to most goods and services provided by businesses. However, some items are exempt or charged at a rate of 0%. For example, staple food items such as rice, beans, corn, fresh meat, flour, sugar, eggs, bread, and tortillas are subject to a 0% GST rate. Water, school fees, house rent, insurance, medicine, and hotel rooms are considered exempt from GST.

Barricouta Pond's Secret: Unveiling the Aquatic Life of Belize

You may want to see also

Frequently asked questions

The standard GST rate in Belize is 12.5%. This rate has been in effect since 2010 and applies to most goods and services provided by businesses.

You must register for GST in Belize if your annual turnover is $75,000 or more per annum. Additionally, if you have been operating a business for less than 12 months and your average monthly value of taxable supplies is $6,250 or more, you are also required to register for GST.

When a Belize-owned entity provides goods and services to people in Belize over the internet, they charge GST at the standard rate of 12.5%. If a Belize entity sells goods and services online to overseas consumers, GST is generally charged at 0%. However, it is important to verify the location of the customer and the destination of the goods and services.