The Austrian gold ducat is one of the world's oldest and purest bullion coins, containing 98% gold content (23-karat). The value of a gold ducat depends on whether it is a single ducat or a 2, 3, 4 or 6 ducat quality. The intrinsic melt value of one Austrian Gold 1 Ducat is $335.57 based on today's gold spot price. In 1913, the gold ducat was worth the equivalent of nine shillings and four pence sterling, or somewhat more than two dollars.

| Characteristics | Values |

|---|---|

| Gold content | 98-98.6% (23-23.75 karats) |

| Thickness | 0.7mm |

| Weight | 0.1106 troy ounces of bullion |

| Melt value | $335.57 |

| Face value (1913) | Nine shillings and four pence sterling, or $2 |

| Face value (2022) | $397.70 |

| Historical significance | Mentioned in Shakespeare's The Merchant of Venice |

What You'll Learn

- The Austrian Mint still mints single and four-ducats, both dated 1915

- The Gold Austrian Ducat is one of the world's oldest and purest bullion coins

- Austrian Ducats were minted with 98.6% gold purity (23.75 karats)

- The ducat is central to the plot of Shakespeare's *The Merchant of Venice*

- The gold ducat was worth the equivalent of nine shillings and four pence sterling in 1913

The Austrian Mint still mints single and four-ducats, both dated 1915

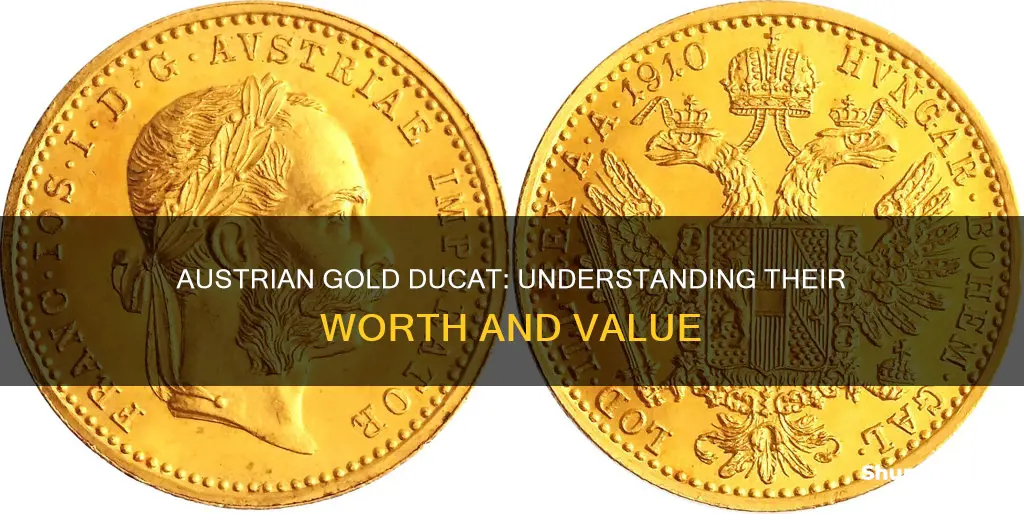

The Austrian Mint still mints single and four-ducat gold coins, both dated 1915. These coins are considered bullion coins, rather than numismatic collector's pieces, because they were re-struck much later. The Gold Austrian Ducat is one of the world's oldest and purest bullion coins, containing 98% gold content (23-karat). The coin features Franz Joseph I on the obverse, with the coat of arms of Austria and a double-headed Imperial Eagle on the reverse.

The Austrian Ducat is renowned for its historical significance, exceptional purity and intrinsic gold value. Austrian Ducats were minted with 98.6% gold purity (23.75 karats) and played a crucial role in trade and commerce during the era of the gold standard throughout all of Europe and beyond. The ducat is also central to the plot of Shakespeare's *The Merchant of Venice*, where Shylock lends Antonio three thousand ducats to help his friend Bassanio court Portia.

The value of an Austrian Gold Ducat depends on whether it is a single Ducat or a 2, 3, 4, or 6 ducat quality. The intrinsic melt value of one Austrian Gold 1 Ducat is $335.57 based on today's gold spot price. The coin contains 0.1106 troy ounces of bullion.

Austria's Pit Bull Laws: What You Need to Know

You may want to see also

The Gold Austrian Ducat is one of the world's oldest and purest bullion coins

The ducat is also central to the plot of Shakespeare's *The Merchant of Venice*, where Shylock lends Antonio three thousand ducats to help his friend Bassanio court Portia. In terms of its value, the gold ducat was worth the equivalent of "nine shillings and four pence sterling, or somewhat more than two dollars" around 1913. The intrinsic melt value of one Austria Gold 1 Ducat is $335.57 based on today's gold spot price. The price of a Gold Austrian Ducat coin ranges from $397.70. The value of the ducat depends on whether it is a single ducat or a 2, 3, 4 or 6 ducat quality.

Austrian Airlines: Flights to Australia?

You may want to see also

Austrian Ducats were minted with 98.6% gold purity (23.75 karats)

The value of an Austrian Gold Ducat depends on whether it is a single ducat or a 2, 3, 4 or 6 ducat quality. The Gold Austrian Ducat is one of the world's oldest and purest bullion coins, containing 98% gold content (23-karat). This coin is dated 1915, but was re-struck much later, so it should be considered as a bullion coin rather than a numismatic collector's piece. Based on the metal content and weight, the intrinsic melt value of one Austria Gold 1 Ducat is $335.57 based on today's gold spot price. Around 1913, the gold ducat was worth the equivalent of "nine shillings and four pence sterling, or somewhat more than two dollars".

Switzerland's Austrian Territory: A Historical Perspective

You may want to see also

The ducat is central to the plot of Shakespeare's *The Merchant of Venice*

The ducat played a crucial role in trade and commerce during the era of the gold standard throughout Europe and beyond. Its value was based on the metal content and weight, with the intrinsic melt value of one Austrian Gold Ducat being $335.57 based on today's gold spot price. However, the value of the ducat has fluctuated over time. For example, around 1913, the gold ducat was worth the equivalent of "nine shillings and four pence sterling, or somewhat more than two dollars".

The Austrian Mint still mints single and four-ducats, both dated 1915. These coins are considered bullion gold and are sold by banks to private investors or collectors. The Gold Austrian Ducat is one of the world's oldest and purest bullion coins, with a thickness of around 0.7mm. Franz Joseph I features on the obverse of the coin, with the coat of arms of Austria and a double-headed Imperial Eagle on the reverse.

The value of a ducat can depend on whether it is a single ducat or a higher quality 2, 3, 4, or 6 ducat.

Austria's Entry Requirements: What's Changing and Why

You may want to see also

The gold ducat was worth the equivalent of nine shillings and four pence sterling in 1913

The Austrian gold ducat is one of the world's oldest and purest bullion coins, containing 98% gold content (23-karat). The intrinsic melt value of one Austrian Gold 1 Ducat is $335.57 based on today's gold spot price. However, the price of a gold Austrian ducat can vary depending on whether it is a single ducat or a 2, 3, 4 or 6 ducat quality.

Around 1913, the gold ducat was worth the equivalent of nine shillings and four pence sterling, or somewhat more than two dollars. This was based on the metal content and weight of the coin. The gold ducat was worth more than the silver ducat, which was of about half its value.

The Austrian Mint still mints single and four-ducats, both dated 1915. These coins are bullion gold and are sold by banks to private investors or collectors.

A Holiday in Austria: Affordable or Pricey?

You may want to see also

Frequently asked questions

The value of an Austrian gold ducat depends on whether it is a single ducat or 2, 3, 4 or 6 ducat quality.

Austrian gold ducats contain 98% gold content (23-karat).

The Gold Austrian Ducat is available to buy from $397.70.

The intrinsic melt value of one Austrian Gold 1 Ducat is $335.57 based on today's gold spot price.

Yes, the Austrian Mint still mints single and four-ducats, both dated 1915.