The Austrian School of Economics is a diverse group with a strong interest in monetary economics and the processes of social coordination. The Austrian School holds that the creation of money out of thin air and the lowering of interest rates for lending that money are the primary causes of inflation and the boom-bust cycle. This school of thought also suggests that if money creation is followed strictly with the commodity (gold) standard, then loans can only be given using savings, and there will be no possibility of an increase in the money supply.

| Characteristics | Values |

|---|---|

| Money creation | The Austrian School suggests that if money creation is followed strictly with the commodity (gold) standard then loans can only be given using savings, and there will be no possibility of an increase in the money supply |

| Inflation | The Austrian School believes that the creation of money out of thin air and the lowering of interest rates for lending that money are the primary causes of inflation |

| Interest rates | The Austrian School holds that interest rates are determined by the subjective decision of individuals to spend money now or in the future |

| Government | The Austrian School is of the opinion that the government should lower its tax rate or abolish tax altogether |

| Central bank | The Austrian School believes that the central bank creates fiat money or debt money to give loans and thus increases the supply of money |

What You'll Learn

- The Austrian School of Economics suggests that money creation should be strictly followed with the commodity (gold) standard

- The Austrian School argues that creating the wrong capital goods leads to real economic waste

- The Austrian School holds that interest rates are determined by the subjective decision of individuals to spend money now or in the future

- The Austrian School is of the opinion that the government should lower its tax rate or abolish tax altogether

- The Austrian School is interested in monetary economics in connection with the processes of social coordination

The Austrian School of Economics suggests that money creation should be strictly followed with the commodity (gold) standard

The Austrian School also believes that the government, in connivance with the central bank, adopts policies such as bailing out and spending excessively. They argue that the central bank creates fiat money or debt money to give loans and thus increases the supply of money. The Austrian School suggests that the government should lower its tax rate or abolish tax altogether.

The Austrian School of Economics is a diverse group with a strong interest in monetary economics and the processes of social coordination. They also have a profound concern with phenomenology, or the essential nature and "meanings things have in our experience". This school of thought rejects the classical view of capital, which says that interest rates are determined by the supply and demand of capital. Instead, they hold that interest rates are determined by the subjective decision of individuals to spend money now or in the future.

Autism and Country: Understanding the Global Perspective

You may want to see also

The Austrian School argues that creating the wrong capital goods leads to real economic waste

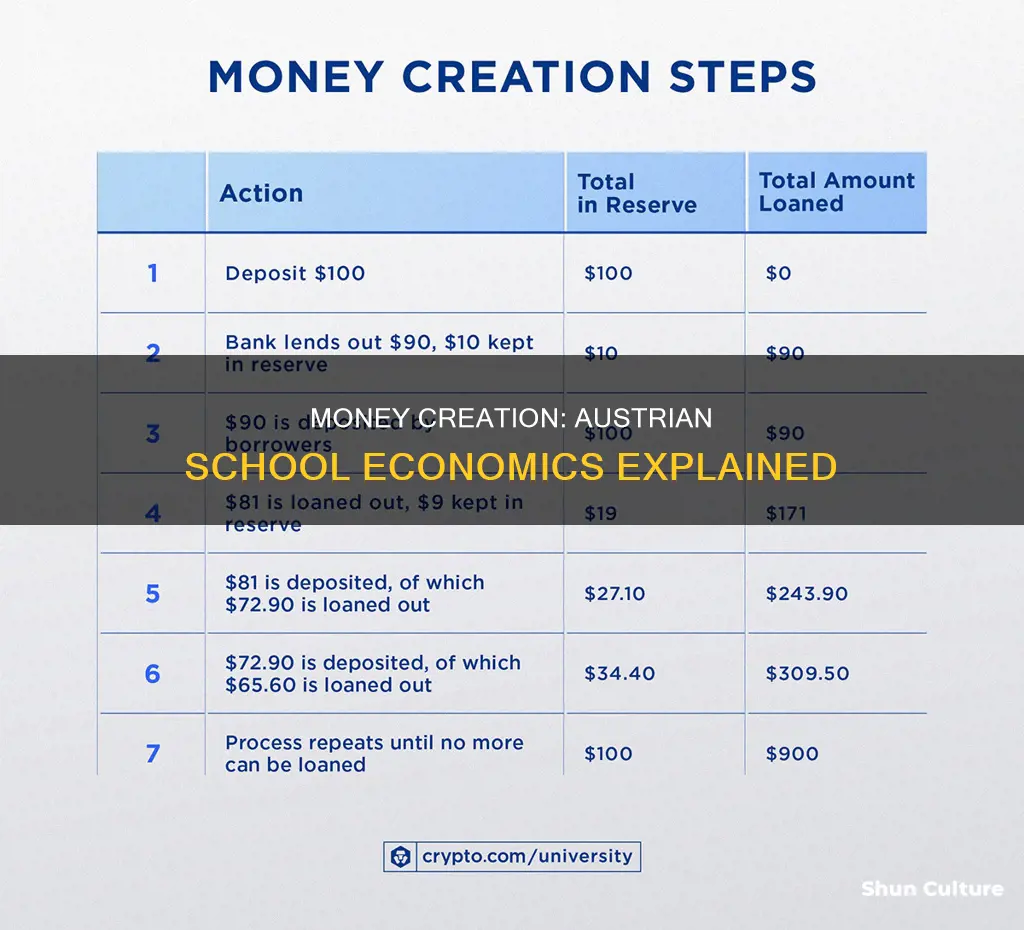

The Austrian School of Economics argues that the creation of money out of thin air and lowering interest rates for lending that money are the primary causes of inflation and the boom-bust cycle, both of which are detrimental to the economy. The Austrian School suggests that if money creation is strictly followed with the commodity (gold) standard, then loans can only be given by using savings, and there will be no possibility of an increase in the money supply as existing money that is saved will be used for lending purposes. Therefore, there is no question of inflation due to an increase in the money supply (fiat money that is created out of nothing).

The Austrian School also believes that the government, in collusion with the central bank, adopts policies such as bailing out and spending excessively. The central bank creates fiat money or debt money to give loans and thus increases the supply of money. The Austrian School argues that creating the wrong capital goods leads to real economic waste and requires (sometimes painful) readjustments. They reject the classical view of capital, which says interest rates are determined by the supply and demand of capital. Instead, the Austrian School holds that interest rates are determined by the subjective decision of individuals to spend money now or in the future.

Arnold's Austrian Death Machine: What's the Verdict?

You may want to see also

The Austrian School holds that interest rates are determined by the subjective decision of individuals to spend money now or in the future

The Austrian School of Economics is a diverse group with a strong interest in monetary economics and the processes of social coordination. The Austrian School suggests that if money creation is followed strictly with the commodity (gold) standard, then loans can only be given using savings, and there will be no possibility of an increase in the money supply. This is because existing money that is saved will be used for lending purposes. The Austrian School argues that creating the wrong capital goods leads to real economic waste and requires re-adjustments.

The Austrian School suggests that the government, in collusion with the central bank, adopts policies such as bailing out and spending excessively. The Austrian School also believes that the central bank creates fiat money or debt money to give loans and thus increases the supply of money.

Austria's Far-Right Politics: A Growing Concern?

You may want to see also

The Austrian School is of the opinion that the government should lower its tax rate or abolish tax altogether

The Austrian School of Economics is a diverse group with a strong interest in monetary economics and the processes of social coordination. It argues that the creation of money out of thin air and lowering interest rates for lending that money are the primary causes of inflation and the boom-bust cycle, both of which are detrimental to the economy. The Austrian School suggests that if money creation is followed strictly with the commodity (gold) standard, then loans can only be given by using savings, and there will be no possibility of an increase in the money supply as existing money that is saved will be used for lending purposes. Therefore, no question of inflation due to an increase in money supply (fiat money that is created out of nothing) will arise.

The Austrian School is also of the opinion that the government should lower its tax rate or abolish tax altogether. This is because it believes that in the present economic system, the central bank creates fiat money or debt money to give loans and thus increases the supply of money. The Austrian School holds that interest rates are determined by the subjective decision of individuals to spend money now or in the future. It rejects the classical view of capital, which says interest rates are determined by the supply and demand of capital.

Bornem Castle: Austria or Belgium?

You may want to see also

The Austrian School is interested in monetary economics in connection with the processes of social coordination

The Austrian School of Economics is interested in monetary economics in connection with the processes of social coordination. The Austrian School suggests that if money creation is followed strictly with the commodity (gold) standard, then loans can only be given using savings, and there will be no possibility of an increase in the money supply as existing money that is saved will be used for lending purposes. This is because, according to the Austrian School, the creation of money out of thin air and the lowering of interest rates for lending that money are the primary causes of inflation and the boom-bust cycle, both of which are detrimental to the economy. The Austrian School also believes that the central bank creates fiat money or debt money to give loans and thus increases the supply of money.

The Alpine Foodie's Delight: Switzerland, Germany, or Austria?

You may want to see also

Frequently asked questions

The Austrian School of Economics suggests that if money creation is followed strictly with the commodity (gold) standard then loans can be given only by using savings and there will be no possibility of an increase in the money supply as existing money that is saved will be used for lending purposes.

The Austrian School of Economics thinks that the creation of money out of thin air and lowering interest rates for lending that money are the primary causes of inflation and the boom-bust cycle, both of which are detrimental to the economy.

The Austrian School of Economics is of the opinion that the government should lower its tax rate or abolish tax altogether.

The Austrian School of Economics holds that interest rates are determined by the subjective decision of individuals to spend money now or in the future.