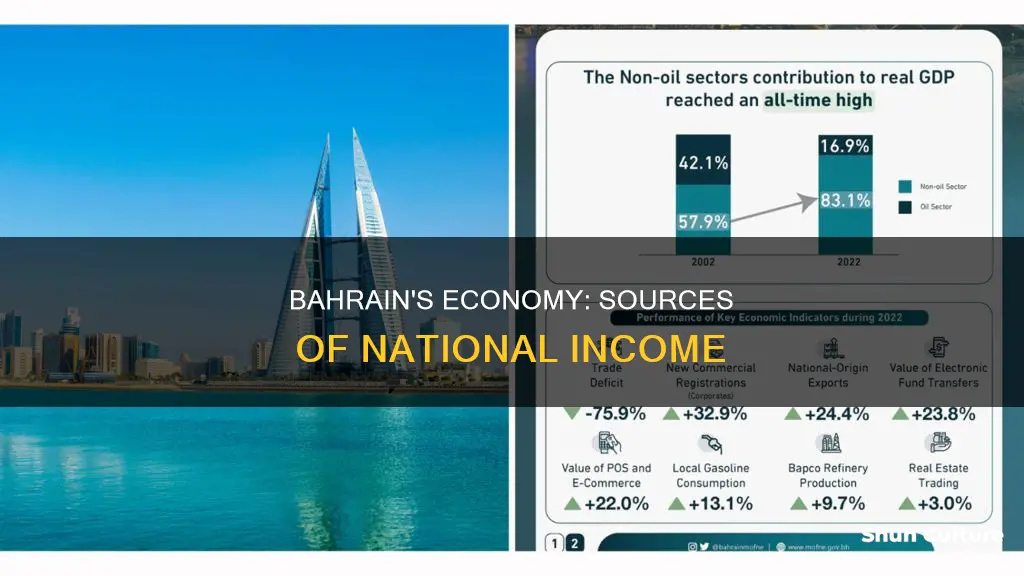

Bahrain's economy is largely dependent on its oil and gas sector, with petroleum production and refining accounting for more than 60% of its export receipts, 70% of government revenues, and 11% of GDP. However, Bahrain has minimal oil reserves and has had to turn to petroleum processing and refining to sustain its economy. In addition, Bahrain has also established itself as an international banking centre. The country has a mixed economy, with the government controlling many basic industries, including oil and aluminium. Bahrain's other sources of income include tourism, ship repairing, and offshore banking.

| Characteristics | Values |

|---|---|

| Top 3 Trade Partners | Saudi Arabia, China, and the United Arab Emirates |

| Top 3 Exported Goods | Oil & Mineral Fuels, Aluminum, and Ores |

| Top Industries | Petroleum Processing and Refining, Aluminum Smelting, Iron Pelletization, and Fertilizers |

| GDP | $90,141,730,810 (2022) |

| GDP Per Capita | $61,228 (2022) |

| Petroleum and Natural Gas Contribution to Budget Revenues | 60% |

| Petroleum and Natural Gas Contribution to Exports | 61% |

| Petroleum and Natural Gas Contribution to GDP | 11% |

| Government Income from Hydrocarbon-Related Revenue | 75% (2017) |

| Oil Reserves | 124.6 million barrels |

| Oil Production | 198,000 barrels per day |

| Oil Fields | Onshore Bahrain field and Offshore Abu Safah field |

| Aluminum Smelting Company | Aluminum Bahrain |

| Number of Licensed Political Societies | 2 |

What You'll Learn

Oil exports

Bahrain's hydrocarbon endowment is relatively small compared to other Gulf nations, with an output of around 198,000 barrels per day (bpd), of which around 150,000 bpd come from the shared offshore field. In contrast, Saudi Arabia's production is significantly higher at 12.3 million bpd. Bahrain's onshore oil reserves are estimated at around 125 million barrels, which, at the current rate of production, would last less than seven years.

However, in April 2018, Bahrain announced its biggest oil discovery since the 1930s, with an estimated 80 billion barrels of tight oil found off its west coast. This discovery could significantly enhance Bahrain's economic and fiscal strength by boosting hydrocarbon production and extending the current rate of production. The deposits are yet to be verified by an international oil consortium as technically and economically recoverable.

In addition to oil, Bahrain also exports natural gas, with gas reserves expected to last about 50 years at the current rate of consumption. The country is actively exploring Carbon Capture and Storage (CCS) technology to deploy across its oil, gas, and industrial sectors.

Bahrain has been working to diversify its economy away from oil, but revenues from oil exports remain crucial. The government is targeting the manufacturing sector, including plastics, fiberglass, chemicals, petrochemicals, and food processing, with a particular emphasis on developing the petrochemical industry.

Haven Apartment Bahrain: A Luxurious and Comfortable Stay

You may want to see also

Aluminium exports

Aluminium smelting is one of the country's top industries, and Bahrain is home to the world's largest aluminium smelter, Aluminium Bahrain, which produces around 525,000 metric tons of aluminium annually. The country also has several related factories, including the Aluminium Extrusion Company and the Gulf Aluminium Rolling Mill.

In December 2022, Bahrain's aluminium exports were valued at 7,217,244.356 USD th, representing an increase from the previous year (5,408,805.373 USD th in December 2021).

Who's on Top: Bahrain's Current Leadership

You may want to see also

International banking

Bahrain is a major centre for Islamic banking in the Middle East, with a strong and sophisticated banking industry. The country's business-friendly and liberalised environment has made it an ideal entry point into the Middle East for international banks.

Bahrain's sovereign wealth fund, Mumtalakat, is diversified across a variety of business sectors including technology, real estate, tourism, financial services, food and agriculture, and industrial manufacturing. The fund regularly receives high rankings in the Linaburg-Maduell Transparency Index, which specialises in ranking the transparency of sovereign wealth funds.

The Bahrain Economic Development Board (EDB) is the first point of call for entities wanting to establish their business in Bahrain. The EDB helps guide each new or expanding company, small or large, through every step of the investment journey.

Bahrain's economy is the most diversified in the Gulf Cooperation Council (GCC) region, with particular strengths in the financial services, information and communications technology (ICT), manufacturing, logistics, and tourism sectors. The country's pro-innovation business policies and laws give businesses of all sizes the opportunity to thrive.

Bahrain also offers 100% foreign ownership in most of its thriving non-oil-based sectors, with minimum hurdles for creating and operating a company. The country's strategic location at the heart of the Gulf creates the optimal environment for businesses to grow.

The Central Bank of Bahrain (CBB) is the single regulator of the entire financial sector, with an integrated regulatory framework covering all financial services provided by conventional and Islamic financial institutions. The CBB has a regulatory sandbox that enables startups to test new cryptocurrency and blockchain technologies and assess regulatory compliance.

Bahrain's banking sector includes 84 banks, of which 30 are retail banks, 54 are wholesale banks, 17 are branches of foreign banks, and 13 are locally incorporated. Of these, seven are representative offices, and 15 are Islamic banks.

Some of the banks that are popular with expats in Bahrain include Arab Bank, HSBC Bahrain, Ahli United Bank, Citibank and Bank of Bahrain and Kuwait (BBK).

Vaping in Bahrain: What's the Legal Status?

You may want to see also

Tourism

Bahrain's tourism sector has benefited from the country's advanced infrastructure in transportation and telecommunications. Bahrain International Airport is one of the busiest airports in the Middle East, and the country also has a modern, busy port with direct and frequent cargo shipping connections to the US, Europe, and the Far East.

Bahrain's tourism sector is also supported by its successful financial services industry. The country's capital, Manama, is home to many large financial institutions, and Bahrain is the main banking hub for the Persian Gulf and a centre for Islamic finance. The success of ventures such as the Bahrain Grand Prix has further raised the country's international profile, encouraging major airlines to resume services to Bahrain.

Bahrain has also taken steps to enhance its business-friendly ecosystem through policy reform, making it an attractive destination for foreign investment in the tourism sector. The country allows 100% foreign ownership in most non-oil-based sectors, including tourism, and has expanded the sectors open to full foreign ownership in recent years.

Gold Bar Shopping: Bahrain's Top Spots

You may want to see also

Tax revenue

Bahrain has no individual income tax, and its only corporate tax is levied on oil, petroleum, and gas companies. An excise tax on carbonated beverages, energy drinks, and tobacco products was implemented in 2017. In 2019, the country introduced a value-added tax for most goods and services. Taxes make up less than one-third of the country's revenue.

Bahrain's tax revenue was reported at 1.433 billion USD in December 2021, up from 1.276 billion USD in December 2020. From 1990 to 2021, the average yearly tax revenue was 391.411 million USD, with a record high of 1.470 billion USD in 2019 and a record low of 165.691 million USD in 1990.

Petroleum and natural gas, Bahrain's only significant natural resources, account for about 60% of government revenues. Bahrain was the first Arabian Gulf state to discover oil, but due to limited reserves, the country has worked to diversify its economy over the past decade. Bahrain has stabilized its oil production at about 40,000 barrels per day, and reserves are expected to last 10-15 years.

The Bahrain National Gas Company operates a gas liquefaction plant that uses gas directly from Bahrain's oil fields. At current consumption rates, gas reserves are expected to last about 50 years.

Exploring Bahrain: The Kingdom's Largest City Unveiled

You may want to see also

Frequently asked questions

Bahrain's main exports are refined petroleum products and aluminium goods.

Revenues from oil exports account for over 70% of government income.

The currency of Bahrain is the Bahraini dinar (BD).