Bolivia is a lower-middle-income country with a history of political instability and a largely natural resource-driven economy. The Bolivian government has a strong presence in the country's economy, owning and operating over sixty businesses, including in the energy, mining, telecommunications, and banking sectors.

Bolivia's economy is driven by its natural resources, particularly hydrocarbons and mining, which account for a significant portion of foreign direct investment. The country has implemented policies to encourage private investment, such as legislative reforms in the hydrocarbon and telecommunication sectors, and foreign investors are generally accorded national treatment.

However, there are challenges to investing in Bolivia, including a lack of legal security, corruption, and unclear arbitration measures, and a complex regulatory environment. Additionally, the country's history of nationalizing industries and expropriating property can be a concern for potential investors.

When researching ownership in Bolivia, it is important to consider the role of the government and the regulations that may impact foreign investment. Understanding the legal and regulatory framework, as well as the political and economic environment, is crucial for making informed decisions about ownership and investment in the country.

| Characteristics | Values |

|---|---|

| Immigration status required to become an owner or partner in a company | No special status required |

| Legal value of documents given in foreign countries | Valid if issued and apostilled in member countries of the Hague Apostille Convention; otherwise, documents must be legalized through the regular process at the nearest Bolivian consulate |

| Rights and obligations of foreigners in the business field | Same rights and obligations as Bolivian companies |

| Treatment of foreigners by banks in Bolivia | Foreigners can open bank accounts but need a Bolivian foreign carnet, visa, or valid immigration status |

| Types of companies that can be constituted with private contributions | Limited liability companies, corporations, sole proprietorships, Sociedad Colectiva, limited partnerships, partnerships limited by shares, unincorporated associations, partially government-owned enterprises, and partially enterprises |

| Procedures required for companies to start working | Public deed formation, registration in the Trade Registry Office, tax registration, municipal operating license, and employer registration |

| Labor issues to be taken into account | Enrollment of all workers in long-term and short-term social security; minimum wage set at Bs. 2,500.00 (approximately $359.20 USD) |

| Taxes to be paid by businesses | Value Added Tax (13%), Tax on Company Profits (25%), Transaction Tax (3%), Financial Transaction Tax (0.30%), Property and Vehicle Tax, and Municipal Transfer Tax on Real Estate and Vehicles |

| Double taxation agreements | Bolivia has signed agreements with Argentina, France, Germany, Spain, Sweden, and the UK to avoid double taxation |

What You'll Learn

Foreign ownership of companies in Bolivia

Bolivia is open to foreign direct investment (FDI) and companies in the country can be 100% foreign-owned. However, there are some restrictions and challenges to be aware of when it comes to foreign ownership of companies in Bolivia.

Firstly, Bolivia's 2009 Constitution nationalised companies in "strategic" sectors, including extractive industries like fossil fuels and mining, telecommunications, and electricity. This means that foreign investment is not allowed in sectors relating directly to national security. The Constitution also stipulates that Bolivian investment takes priority over foreign investment, and that the government will determine which sectors require private investment.

In addition, there are some complexities surrounding company formation in Bolivia. For example, companies must have a physical office in the country and appoint a legal representative who is a Bolivian national or a foreigner with the right to live and work in the country. The process of registering a company can take around 5 to 6 weeks and requires submitting various documents to the relevant authorities.

Another important consideration is the regulatory environment in Bolivia. The country has been criticised for its lack of legal security, corruption allegations, and unclear investment incentives. The judicial system is also perceived to be inefficient and susceptible to political influence. Furthermore, bureaucratic procedures can be cumbersome and time-consuming, impacting the ease of doing business in the country.

Despite these challenges, Bolivia offers some attractive features for foreign investors. The country is a member of the World Trade Organization and the Andean Community, and it has free trade agreements in place with several countries. Bolivia also boasts an abundance of natural resources and a strategic location in South America. The country's economy is growing, with sectors such as hydrocarbons, manufacturing, industry, and commerce attracting significant FDI.

In conclusion, while there are some restrictions and challenges to foreign ownership of companies in Bolivia, the country remains open to FDI and offers a range of opportunities for investors willing to navigate the complexities of the local business environment.

The Drug Trail: Bolivia to the US

You may want to see also

The Bolivian economy and its reliance on natural resources

Bolivia's economy is heavily reliant on its natural resources, which have made it a regional leader in economic growth, fiscal stability, and foreign reserves. The country has historically had a single-commodity focus, with its economy driven largely by silver, tin, and coca. Bolivia's mining industry, particularly the extraction of natural gas and zinc, currently dominates its export economy. The country has the second-largest natural gas reserves in South America, and its exports to Brazil and Argentina have significantly reduced its dependence on foreign assistance.

Bolivia's agricultural sector, which includes activities such as subsistence farming and the production of coca, soybeans, cotton, coffee, and sugarcane, has faced challenges due to political instability and difficult topography. The services industry in Bolivia remains underdeveloped, with weak purchasing power among its inhabitants.

The country's water resources, including the Altiplanic basin (Lake Titicaca, River Desaguadero, etc.), hold enormous potential for hydroelectric power generation and export to neighbouring countries. Additionally, Bolivia possesses the largest reserve of lithium globally, with state-led industrialization projects currently in progress.

While Bolivia's natural resources present significant economic opportunities, it is crucial to balance their exploitation with environmental considerations and sustainable practices.

Bolivia's Ban on McDonald's: Why All Outlets Shut Down?

You may want to see also

The Bolivian government's role in the economy

The Bolivian government has a heavy hand in the country's economy, with a focus on public spending. The government has a history of nationalizing companies in "strategic" sectors, including extractive industries like fossil fuels and mining, telecommunications, and electricity. The Movement Towards Socialism (MAS) government of President Luis Arce favors nationalization and an "import substitution model" for its statist economic model.

The government determines which sectors require private investment and has implemented policies to promote internal consumption of Bolivian-made products. The government has also been criticized for inefficient management of state-owned enterprises, with total profits from these enterprises declining by 94% from 2014 to 2021.

Bolivia's economy is largely driven by its natural resources, particularly natural gas and mining. The government has implemented policies to encourage private investment in these sectors, such as signing long-term sales agreements for natural gas exports and providing tax incentives for exploration and production of hydrocarbons. However, the government also faces challenges in these sectors, such as declining natural gas production and the emergence of a parallel exchange rate market.

The government has also made efforts to promote the private sector and reduce the country's dependence on natural resources. This includes supporting the development of the agricultural sector, which has seen increasing exports in recent years, and promoting the use of local technologies and innovations.

Overall, the Bolivian government plays a significant role in the country's economy, with a focus on public spending, nationalization of key sectors, and promotion of domestic industries.

Exploring Chile and Bolivia: A Road Trip Adventure

You may want to see also

Foreign investment in Bolivia

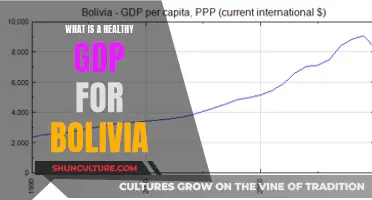

Bolivia is open to foreign investment, and in 2021, gross foreign direct investment (FDI) flows reached USD 440 million, with the leading sectors being hydrocarbons, manufacturing, industry, and commerce. Bolivia's economy is the 95th-largest in the world, and it is classed as a lower-middle-income country. Driven by its natural resources, Bolivia has become a regional leader in economic growth, fiscal stability, and foreign reserves.

Bolivia's 2009 constitution nationalized companies in "strategic" sectors, including fossil fuels, mining, telecommunications, and electricity. The Bolivian government owns and operates more than 60 businesses, and the largest state-owned enterprises can acquire credit from the Central Bank at very low-interest rates.

Bolivia abrogated its Bilateral Investment Treaty (BIT) with the United States in 2012, and there is currently no significant FDI from the US in Bolivia. The Bolivian government claimed that the abrogation was necessary to comply with the 2009 Constitution.

The investment rate in Bolivia as a percentage of GDP was 18% in 2021, in line with regional averages. FDI is highly concentrated in natural resources, especially hydrocarbons and mining, which account for nearly two-thirds of FDI in Bolivia.

Bolivia's judicial system is believed to be influenced by political actors, and there is a lack of legal security, corruption allegations, and unclear investment incentives, all of which are impediments to investment in the country.

Keeping Bolivian Rams: Solo or in a School?

You may want to see also

The Bolivian banking system

The Banco Nacional de Bolivia (BNB) is one of Bolivia's oldest banks, founded in 1871. It is the second-largest bank in the country by total assets and provides a range of financial products and services to a diversified individual and corporate customer base.

The banking sector is stable and healthy, with delinquency rates at less than 2% in 2017. However, the sector has faced challenges due to dollar scarcity and liquidity issues. In 2023, Bolivia faced a liquidity crisis, with foreign exchange reserves falling to less than $500 million.

The Bolivian government has implemented a program of macroeconomic stabilisation and structural reform, including legislative reforms that encourage private investment. Foreign investors are accorded national treatment, and foreign ownership of companies faces virtually no restrictions.

The banking system is also characterised by a high level of dollarisation, with about 90% of Bolivian bank deposits held in US dollars. This has led to challenges in recent years due to fluctuations in the value of the dollar and restrictions imposed by the government and the central bank.

Overall, the Bolivian banking system is small but improving, with efforts to strengthen regulation and encourage foreign investment.

Bolivia: Travel Tips and Taboos

You may want to see also

Frequently asked questions

There is no special immigration status required to become an owner or partner in a company in Bolivia. However, once the company is constituted, it must have a legal representative who has a Bolivian foreign carnet, visa, temporary residence of one or two years, multiple visa or visa of undefined permanency.

Foreigners can open bank accounts in Bolivia, but the process is slightly more complex than for Bolivian citizens. Foreigners need to have a Bolivian foreign carnet to open and manage bank accounts in Bolivia, so they need to have a regular residence or a valid immigration status in Bolivia.

Businesses in Bolivia are subject to the following taxes: Value Added Tax (VAT), Tax on Company Profits (IUE), Transaction Tax (IT), Financial Transaction Tax, Property and Vehicle Tax, and Municipal Transfer Tax on Real Estate and Vehicles.

No, Bolivia has signed international agreements to avoid double taxation with Argentina, Germany, the UK, Spain, Sweden, France, Colombia, Ecuador and Peru.