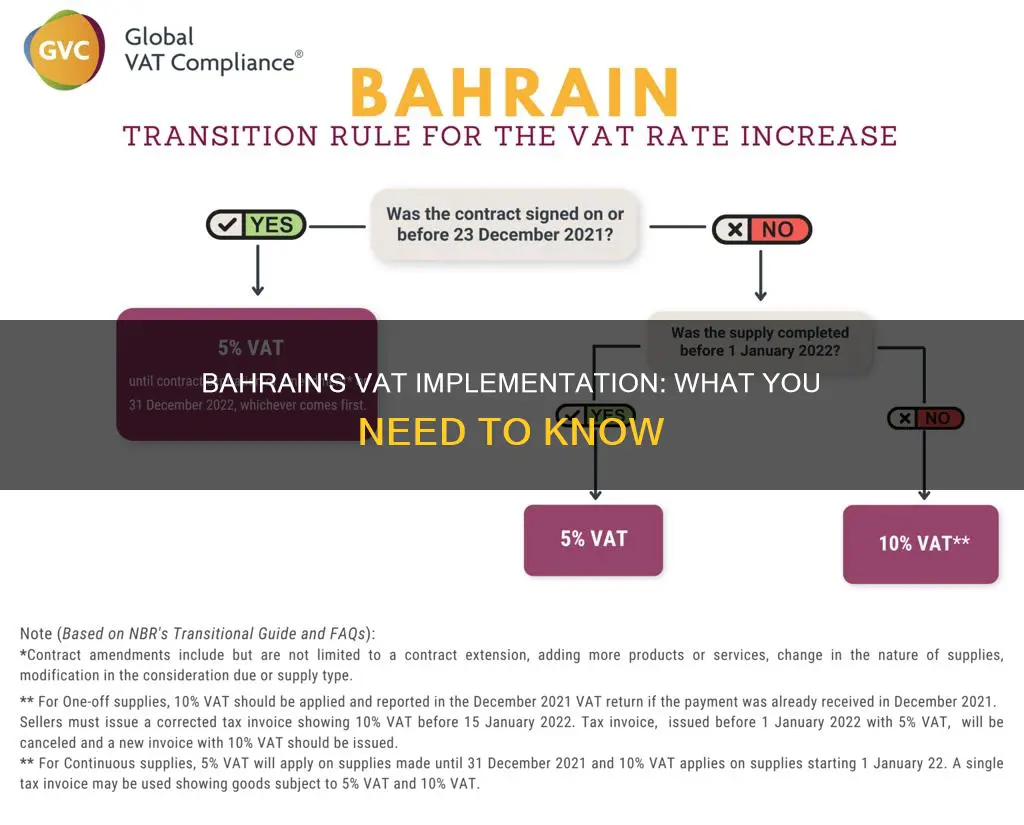

Bahrain implemented a value-added tax (VAT) on 1 January 2019. The standard VAT rate was initially 5% but was increased to 10% on 1 January 2022. The Kingdom of Bahrain is the third Gulf Cooperation Council (GCC) country to implement VAT, following the United Arab Emirates and Saudi Arabia. The VAT is levied on almost everything sold in the country, with certain exceptions and specific rules for digital products.

| Characteristics | Values |

|---|---|

| Date VAT was implemented in Bahrain | 1 January 2019 |

| VAT rate from 1 January 2019 to 31 December 2021 | 5% |

| VAT rate from 1 January 2022 | 10% |

| VAT rate for some food items, medical equipment, goods for kids, precious metals, and gems | 0% |

| Mandatory registration threshold for businesses resident in Bahrain | 37,500 Bahraini dinars (BHD) |

| Voluntary registration threshold for businesses resident in Bahrain | 18,750 BHD |

| Registration threshold for non-resident businesses | 0 |

| Registration timeline for businesses with annual turnover above BHD 5 million | Due date for filing return: End of the month following the tax period |

| Registration timeline for businesses with annual turnover below BHD 5 million | Due date for filing return: End of the month following the tax period |

| Late submission of a VAT return | 5%-25% of the value of the VAT declared or paid |

| Late payment of VAT due | 5%-25% of the value of the VAT declared or paid |

What You'll Learn

Bahrain's VAT rate structure

Bahrain implemented a Value-Added Tax (VAT) on 1 January 2019, joining other Gulf Cooperation Council (GCC) member states in doing so. The standard VAT rate in Bahrain is 5%, levied on all taxable supplies of goods and services. This standard rate applies to most goods and services, though there are some exceptions.

The VAT rate structure in Bahrain is classified into three categories: the standard rate, zero-rate, and nil rate. The standard rate of 5% is applied to all taxable supplies, barring a few that are either zero-rated or exempt from VAT. Zero-rated supplies include basic foodstuffs, domestic and international transport, new properties, healthcare, exports of goods and services, high-value metals, oil and gas, education, and medicine and medical equipment. For these zero-rated goods and services, registered businesses can recover the tax paid, and the final consumers do not pay any tax. Certain supplies, such as the sale and lease of real estate and financial services, are exempt from VAT, and businesses cannot recover the tax paid on these.

The mandatory registration threshold for VAT in Bahrain is 37,500 Bahraini dinars (BHD) for businesses resident in the country, while the voluntary registration threshold is BHD 18,750. Non-resident businesses are required to register for VAT upon making their first supply in Bahrain. The National Bureau for Revenue is the regulatory body responsible for overseeing and enforcing the provisions of the Bahrain VAT Law and Regulations.

Bahrain's Human Rights: Solutions for a Brighter Future

You may want to see also

VAT registration for non-residents

Bahrain implemented a Value-Added Tax (VAT) on 1 January 2019. The standard VAT rate was initially 5% but was increased to 10% on 1 January 2022.

Non-resident businesses in Bahrain must register for VAT as soon as they start making taxable supplies in Bahrain, regardless of the value of their supplies. Non-residents are required to register within 30 days of the first taxable supply to non-taxable persons in Bahrain. The VAT threshold for non-residents is zero.

Non-residents can register for VAT in one of two ways:

- Directly with the National Bureau for Revenue (NBR)

- By appointing a tax representative to register on their behalf

The tax representative must be a resident of Bahrain and approved by the NBR through an official power of attorney. They will be held accountable for any tax liabilities incurred by the non-resident.

Non-resident businesses that use a local warehouse to store goods for B2C sales must register for VAT. However, transactions where a non-resident supplier ships goods from another country to a Bahraini customer (private individual) are not considered a supply leading to an obligation to register for VAT.

If a non-resident is registered for VAT in Bahrain, they must deregister within 30 days of:

- No longer carrying out economic activity in Bahrain

- Not making any VAT-able revenue for 12 consecutive months

Exploring Manama's Best Drinking Spots in Bahrain

You may want to see also

VAT invoices in Bahrain

Bahrain implemented a Value-Added Tax (VAT) on 1 January 2019. The standard VAT rate was initially 5% but increased to 10% on 1 January 2022. Basic food items, education, health, construction of new buildings, local transportation, and oil and gas are taxed at 0%. Certain supplies related to real estate and financial services are VAT-exempt.

Every business registered under VAT in Bahrain must comply with the VAT requirements, one of which is to issue a VAT invoice. A VAT invoice is a written or electronic document that the taxable person must issue, containing the details of the supply and other provisions of the law. VAT-registered suppliers should issue a VAT invoice with 5% VAT on every taxable supply of goods or services.

Types of VAT Invoices in Bahrain

There are two types of VAT invoices in Bahrain:

- A tax invoice must be issued by the registered business on the supply of goods or services to a VAT-registered recipient.

- A simplified tax invoice can be issued by a VAT-registered supplier in the following cases:

- The recipient of the supply is not registered for VAT in Bahrain.

- The total consideration of the supply does not exceed BHD 500.

Timeline for Issuing a Tax Invoice

A tax invoice should be issued within 15 days of the supply of goods and/or services. The supplier of the goods or service must issue the tax invoice by the 15th day of the month following the month in which the supply took place.

Contents of a Tax Invoice

A tax invoice should contain the following details:

- The date the invoice was issued (the date of supply should be mentioned if different from the issuance date)

- The label "Tax Invoice"

- Invoice number (sequential and unique)

- Name and address of the supplier

- Tax ID number of the supplier

- Name and address of the customer

- Description and quantity of the goods supplied/nature of the services provided

- Gross and net values of the supply

- VAT applicable on the supply (include an explanation if the standard rate is not applied)

- The total amount due, including VAT, in Bahraini Dinars (BHD)

Adjustments to Tax Invoices

If the VAT amount on a tax invoice is overstated or understated, the supplier must make an adjustment by issuing a credit or debit note. If a VAT amount requires a downward or upward adjustment, a credit or debit note needs to be issued to correct the VAT amount.

Currency of the Invoice

The base currency of tax invoices should be Bahraini Dinars (BHD). If the supply is made in a foreign currency, the value should be converted to BHD based on the daily conversion rate prescribed by the Central Bank of Bahrain for the date of supply.

Period of Retaining a Tax Invoice

The tax invoice should be retained by the taxpayer for a period of five years from the end of the tax period to which it belongs.

Bahrain: A Business Haven in the Middle East

You may want to see also

VAT collection and administration authority

Bahrain introduced a Value-Added Tax (VAT) on 1 January 2019. The standard VAT rate was initially 5% from 1 January 2019 to 31 December 2021, before being increased to 10% from 1 January 2022. The VAT is levied on all taxable goods and services, with the standard rate applying to most goods and services. The National Bureau for Revenue in the Kingdom of Bahrain is responsible for overseeing and administering the collection of VAT.

The VAT collection and administration authority in Bahrain, the National Bureau for Revenue, plays a crucial role in upholding the provisions of the Bahrain VAT Law and Regulations. The Bureau ensures compliance with the VAT regulations and collects the tax revenue for the government.

The National Bureau for Revenue has implemented certain provisions to facilitate a smooth transition for businesses to the new VAT system. These provisions include guidelines for invoicing, tax periods, and registration requirements. For instance, a taxable person must issue a tax invoice within 15 days of supplying goods or services, and the tax period for a taxable person should not be less than one month.

In terms of registration, a resident taxable person must register for VAT if their total taxable supplies exceed a certain threshold, which varies depending on the annual turnover in sales. There is also a voluntary registration option for those with lower taxable supplies. Non-resident suppliers making taxable supplies in Bahrain are mandated to register as well.

The VAT collection and administration authority also enforces compliance with the VAT regulations. Administrative penalties and fines are imposed on taxpayers who fail to comply with the regulations, such as delayed submission of VAT returns or failure to register for VAT within the specified timeframe.

Overall, the National Bureau for Revenue in the Kingdom of Bahrain plays a vital role in overseeing the collection and administration of VAT, ensuring compliance, and providing support to businesses during the transition to the new tax system.

Exploring Manama: A Vibrant City in the Heart of Bahrain

You may want to see also

VAT compliance

Bahrain implemented a Value-Added Tax (VAT) on 1 January 2019. The standard VAT rate was initially 5% but was increased to 10% on 1 January 2022. The VAT is levied on most goods and services, with certain exceptions, such as basic food items, education, health, construction of new buildings, local transportation, and oil and gas, which are taxed at 0%. Certain supplies related to real estate and financial services are VAT-exempt.

The VAT compliance process typically involves the following:

- Registration: Businesses must register for VAT and obtain a valid VAT number. In Bahrain, the mandatory registration threshold is 37,500 Bahraini dinars (BHD) for resident businesses, and the voluntary registration threshold is BHD 18,750. Non-resident businesses must register upon making their first supply subject to VAT in Bahrain.

- Invoicing: Businesses must issue VAT-compliant invoices for any transactions liable for VAT. In Bahrain, tax invoices must include the date of issuance, a sequential invoice number, the name and address of the supplier and customer, the supplier's tax ID number, a description and quantity of the goods or services, and the net, VAT due, and gross value of the supply.

- Record-keeping: Businesses must maintain organised records, tax invoices, and accounting books related to their VAT transactions for a specified period, typically several years.

- Reporting: Businesses must submit periodic VAT returns to report taxable transactions to the relevant tax authority. This typically involves gathering sales and purchase data and categorising transactions accordingly.

- Payment: After reporting their VAT transactions, businesses must remit any VAT collected to the tax authority.

Compliance with VAT obligations is crucial, as non-compliance can result in penalties, fines, late interest imposed by tax authorities, and, in some cases, business closure or detention for directors and senior business leaders.

Exploring Alba: Bahrain's Ancient History and Culture

You may want to see also

Frequently asked questions

Yes, Bahrain implemented VAT on 1 January 2019.

The standard VAT rate in Bahrain is 10%. From 1 January 2019 to 31 December 2021, the standard VAT rate was 5%.

The mandatory registration threshold for businesses resident in Bahrain is 37,500 Bahraini dinars (BHD).

The voluntary registration threshold for businesses resident in Bahrain is BHD 18,750.

The National Bureau for Revenue.