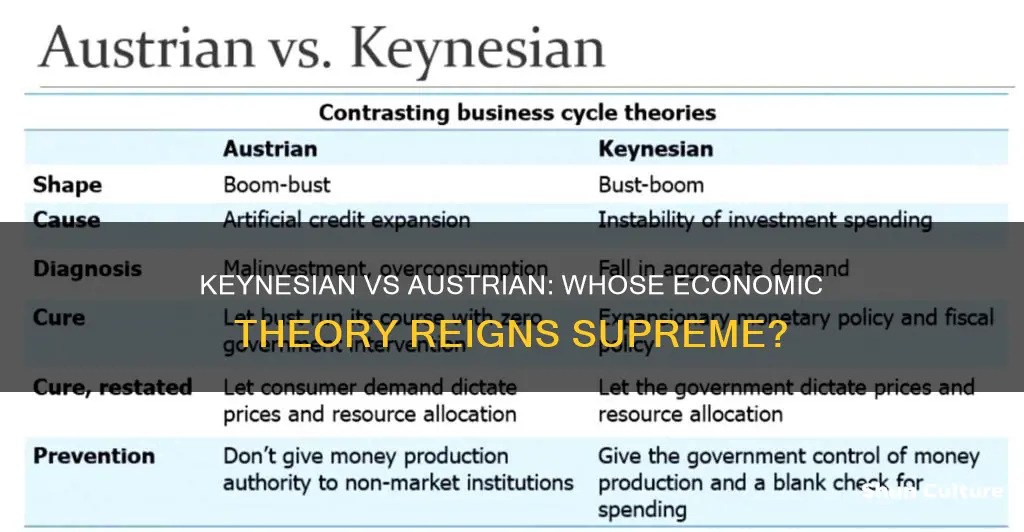

Austrian economics and Keynesian economics are two opposing theories that are still widely used today. Austrian economics, originating in the mid-1800s, argues that the market will balance itself out over time with minimal government intervention. On the other hand, Keynesian economics, introduced by John Maynard Keynes in 1936, promotes government intervention to stimulate the economy and maintain stability. While Austrian economics emphasizes free markets and minimal central bank intervention, Keynesian economics focuses on government intervention to maximize economic growth and employment. These contrasting philosophies offer different approaches to economic challenges, and individuals may align with one school of thought more closely than the other.

| Characteristics | Keynesian | Austrian |

|---|---|---|

| Economic theory | Keynesian economics | Austrian economics |

| Economic approach | Keynesians believe free markets are inefficient and volatile and require government intervention to stabilise the economy and mitigate recessions. | Austrians believe free markets are efficient and self-regulatory and that government intervention makes negative business cycles more severe. |

| Role of government | Keynesians believe in more government intervention to stimulate the market, alter interest rates, or print more money. | Austrians believe in minimal government intervention, allowing failing businesses to collapse to free up space in the market for superior competitors. |

| Inflation | Keynesians believe a low, steady inflation rate stimulates economic growth and encourages investment. | Austrians believe inflation is harmful to economic growth and are proponents of deflation, or price reductions, to encourage spending. |

| Currency | Keynesians believe in fiat currency, backed by the government. | Austrians believe in currency backed by gold or other hard assets, which cannot be created out of nothing. |

What You'll Learn

- Keynesian economics is based on the belief that government intervention can help create jobs and maintain stable prices

- Austrian economics argues that government intervention in free markets makes negative business cycles more severe

- Keynesians believe in maximising employment over minimising inflation

- Austrians believe in deflation or price reductions to encourage spending

- Keynesians believe in fiat currency, while Austrians believe in currency backed by gold or other hard assets

Keynesian economics is based on the belief that government intervention can help create jobs and maintain stable prices

According to Keynesian economics, the government should step in during economic downturns to modify monetary policy and stimulate the economy to maintain stability. This may involve increasing the money supply, implementing subsidies, increasing welfare entitlements, or cutting taxes to boost citizens' purchasing power. Keynesians may also advocate for the government to hire more workers or contractors to directly reduce unemployment.

Keynesians believe that a free market can lead to periods of inadequate demand, resulting in extended periods of high unemployment. During a recession, consumer confidence and discretionary spending plummet, causing a further drop in demand for products and services. This leads businesses to cut investments, further weakening the economy. Keynesian economists argue that government intervention is necessary to break this cycle and boost demand.

Keynesian economics stands in contrast to Austrian economics, which emphasises free markets, private property, and minimal central bank intervention. Austrian economists argue that government intervention in the economy does more harm than good and that economic recessions are necessary to eliminate inefficient businesses and allocate resources to more efficient ones. While Keynesians believe that inflation stimulates economic growth and encourages investment, Austrians view inflation as harmful to economic growth, as it devalues currencies and destroys savings.

English in Austria: Is It Widely Spoken?

You may want to see also

Austrian economics argues that government intervention in free markets makes negative business cycles more severe

Austrian economics, which emerged in the Austrian Empire in the mid-1800s, emphasizes the importance of free markets, private property, and minimal central bank intervention. Austrian economists argue that government intervention in free markets exacerbates negative business cycles. This belief is based on the Austrian Business Cycle Theory (ABCT), which attributes business cycles to excessive growth in bank credit due to artificially low interest rates set by central banks.

According to ABCT, low interest rates encourage borrowing and increase capital spending funded by new bank credit. This leads to a credit-fueled boom, resulting in widespread malinvestment. The subsequent correction or credit crunch, known as a "recession" or "bust", occurs when the credit creation runs its course, causing a contraction in the money supply and a curative recession. Austrian economists argue that central bank policies, such as unsustainable expansion of bank credit, are the predominant cause of most business cycles. They believe that these policies create artificial interest rates that are too low, leading to excessive credit creation, speculative "bubbles", and low savings rates.

In contrast to Keynesian economists, Austrians argue that government intervention during economic downturns makes negative business cycles more severe. They contend that attempts to prop up asset prices, bail out insolvent banks, or stimulate the economy with deficit spending will only prolong the depression and adjustment period needed to return to stable growth. Austrians advocate for a hands-off approach, allowing market forces to correct imbalances and reallocate resources efficiently.

Austrian economists also differ from their Keynesian counterparts in their belief that companies should be allowed to fail during economic downturns. They argue that this process eliminates inefficient businesses, allocates resources to more efficient existing businesses, and fosters the creation of new enterprises. Additionally, Austrians view inflation negatively, arguing that it destroys savings and devalues currencies, while Keynesians see a low, steady inflation rate as beneficial for economic growth and investment.

The Austrian school of economics, with its emphasis on free markets and minimal government intervention, provides a distinct perspective on economic theory and policy. However, it has faced criticism, including the argument that market failures and government intervention can sometimes be necessary to address economic challenges and promote social welfare.

Snow Socks: Austria's Lawful Traction Option for Drivers

You may want to see also

Keynesians believe in maximising employment over minimising inflation

Austrian and Keynesian economics are two opposing theories that are still widely applied today. Keynesian economics, pioneered by British economist John Maynard Keynes, argues that government intervention can stabilise the economy and maximise employment. In contrast, Austrian economics, developed by economists such as Carl Menger, Ludwig von Mises and Friedrich Hayek, advocates for free markets as the most efficient means of allocating resources.

Keynesians believe that government intervention is necessary to moderate the booms and busts in economic activity, otherwise known as the business cycle. They argue that private sector decisions can sometimes lead to adverse macroeconomic outcomes, such as reduced consumer spending during a recession. Keynesian economics supports a mixed economy guided mainly by the private sector but partly operated by the government.

Keynesians believe that changes in aggregate demand have a greater short-run effect on real output and employment, rather than prices. This is because prices and wages adjust slowly to changes in supply and demand, resulting in periodic labour shortages and surpluses. Keynesians argue that wages and employment require government intervention to stay on track.

Keynesians typically view unemployment as too high on average and too variable. They believe that periods of recession are economic maladies and that government intervention can help create jobs while maintaining stable prices. Keynesians generally believe that maximising employment should take priority over minimising inflation. They argue that a low, steady inflation rate stimulates economic growth and encourages investment.

Keynesian economics played a significant role in shaping post-World War II economies. However, its popularity waned in the 1970s due to the challenge of stagflation, which combined inflation with slow growth. Despite this, Keynesian economics experienced a resurgence during the 2007-2008 financial crisis, influencing economic policies in response to the crisis in countries such as the United States and the United Kingdom.

Austria's Fragrance Fakes: What's Real and What's Not?

You may want to see also

Austrians believe in deflation or price reductions to encourage spending

Austrian economics is based on the belief that the market will take care of itself—a philosophy also known as laissez-faire economics. Austrian economists advocate for minimal government intervention, believing that the market will eventually restore itself after a downturn. They argue that recessions are a necessary component of the economy, helping to avoid greater market fallout in the future.

Austrian economists believe that deflation or price reductions will encourage spending. Over time, as prices decrease, people will be able to buy more with their money. This belief is in direct opposition to Keynesian economics, which argues that inflation stimulates economic growth and encourages investment. Keynesians believe that rising prices will lead to more borrowing and spending, which is essential for a healthy economy.

Austrian economists argue that falling prices encourage people to save, which is detrimental to the economy in the long run. However, Austrians believe that deflation can improve people's finances, making it more likely that they will spend and invest.

The Austrian school of economics emphasizes free markets, private property, and minimal central bank intervention. Austrian economists argue that government intervention in the economy does more harm than good. They believe that maintaining free markets and protecting the money supply are key to ensuring social progress and civil liberty.

Austrians support the idea of "sound money," which is convertible currency backed by gold or other hard assets. This makes it more challenging for the government to print more money. They argue that fiat money, which is not tied to any tangible asset, will always lead to inflation as governments cannot resist the temptation to print more money.

Merry Christmas in Austria: Unique Ways to Celebrate and Greet

You may want to see also

Keynesians believe in fiat currency, while Austrians believe in currency backed by gold or other hard assets

Austrian economics and Keynesian economics are two opposing theories of economic thought that are still popular today. Austrian economics, which emerged in the mid-1800s in the Austrian Empire, holds that the free market is the most efficient means of allocating resources. Keynesian economics, on the other hand, argues that government intervention is necessary to manage demand, maximize economic growth, and maintain stable prices.

One significant difference between these two schools of thought lies in their views on currency. Keynesians believe in fiat currency, which can be manipulated by central banks to adjust the money supply and stabilize the economy. They argue that the government should expand the money supply during economic downturns through expansionary fiscal policy, which can include implementing subsidies, increasing welfare entitlements, or cutting taxes.

Austrians, on the other hand, believe in "sound money," or currency that is backed by gold or other hard assets. They are critical of the use of fiat currency, arguing that it encourages governments to devalue currencies, destroy savings, and create inflation. Austrians prefer a more hands-off approach to the economy, with minimal central bank intervention, as they believe that economic recessions are caused by central banks keeping interest rates too low for too long.

These differing views on currency reflect the underlying philosophical disagreement between Keynesians and Austrians regarding the role of government in the economy. Keynesians see the government as a necessary stabilizer of the economy through strategic intervention, while Austrians argue that government intervention in economic processes typically does more harm than good.

Austria's Role in World War II

You may want to see also

Frequently asked questions

Austrian economics is based on the belief that the market will take care of itself and that there should be minimal government intervention. Austrian economists believe that society should have a set of reasonable laws and that people should adhere to them. They also believe in the importance of backing currency with gold or other precious metals to prevent inflation.

Keynesian economics advocates for more government intervention to stimulate the economy, especially during downturns. Keynesians believe that spending is the key to economic growth and that governments should implement policies to increase demand and promote more spending. They prioritize maximizing employment over minimizing inflation.

The main difference lies in their views on the role of government in the market. Austrian economists favour minimal government involvement, believing that the market will balance itself out over time. In contrast, Keynesians argue that markets are inefficient and require government intervention to stabilize them.